[ad_1]

Adobe’s (ADBE) fourth-quarter and 2018 fiscal 12 months outcomes present there’s quite a bit to love in regards to the enterprise mannequin. Adobe is properly positioned for development through a extra engaging worth proposition to the present buyer base and attain to new clients segments. During the interval, the online new customers’ subscriptions improve throughout new segments and geographies. Recent acquisitions within the Experience section and the corporate’s profitable historical past of integrating new companies will proceed to help the sturdy outcomes momentum for Adobe.

We assume the outcomes spotlight Adobe’s positioning because the market chief in inventive and advertising software program options. We like Adobe’s excessive visibility income mannequin, ample development runway and publicity to secular tech development themes. As Adobe more and more shifts its put in base to a subscription software program mannequin, we don’t assume the transition might be as easy because the market expects. We additionally query the potential for incremental upside given the secular shift in print media and a historic incapability to monetize its developer base given the provision of cheaper options. At ~46x trailing PE, the stock instructions a hefty premium. We assume it higher to attend till valuations normalize earlier than contemplating a place.

Strong annual and quarterly gross sales

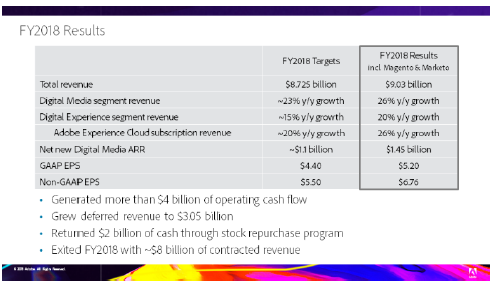

Adobe performed better than its targets on an annual and quarterly foundation in FY2018 and 4Q, excluding the outcomes of the just lately acquired Marketo. Annual gross sales elevated 24% yoy to USD 9.03 bn, resulting from good efficiency in each strategic segments – Digital Media and Digital Experience. On a quarterly foundation, gross sales grew by 23% yoy to USD 2.46 mn and had been 20 mn above targets (excl. Marketo).

(Source: Adobe)

The firm’s enterprise consists of three segments:

- Digital Media – presents options enabling clients to create, publish, promote and monetize digital content material. The firm is the market chief with its Creative Cloud providing for content material administration and Document Cloud providing offering answer for the alternate of digital paperwork. A key efficiency metric adopted by Adobe to measure leads to the Digital Media Segment is the Annualized Recurring Revenue (NYSE:ARR)

- Digital Experience section offers options for digital promoting. It consists of the sub-segments of Marketing, Analytics, and Advertising Clouds.

- Publishing – options for publishing wants

In 2018, the ARR within the Digital Media section grew to USD 6.83 bn and added USD 1.45 mn internet new ARR in the course of the 12 months. For the quarter, the corporate posted a internet new ARR of USD 430 mn, 45mn greater than the goal. Adobe’s inventive income elevated 28% yoy to USD 5.34 bn and Document income reached USD 982 mn (17% yoy). In the Digital Experience section, income elevated 20% yoy to USD 2.44 bn. On a quarterly foundation, Creative income grew by 26% yoy to USD 1.54 bn supported by good efficiency in all buyer teams and Document income was as much as USD 259 mn (10% yoy). The Digital Experience section elevated by 25% yoy to USD 690 mn.

The firm had roughly USD 8 bn of contracted income by the 12 months-finish comprising a USD 5 bn backlog of unbilled income and USD 3 bn of deferred income.

In FY 2018 Adobe, generated USD 4 bn in working money flows and returned USD 2 bn to shareholder by means of its share repurchase program.

Margins enchancment on an annual foundation and a few decline in 4Q partly as a result of acquisition of Marketo

On a yearly foundation, Adobe GAAP EBITDA elevated 27% yoy and margins improved by 84 bp to 35%. Company internet revenue grew 53% yoy to 2.59 bn and internet revenue margins improved from 23% in 2017 to 29%.

In 4Q Adobe’s EBITDA elevated by 13% yoy to 827 mn. However, margins declined to 34% vs. 36% in 4Q 2017 partly as a result of impact of Marketo acquisition.

The group posted annual diluted GAAP EPS of USD 5.20 (53% yoy development) and Non-GAAP EPS of 6.83. The quarterly GAAP EPS had been USD 1.37, and non-GAAP EPS reached USD1.83.

Raised expectations for 2019

Built on the sturdy momentum, Adobe offered steerage on 2019 anticipated outcomes to mirror: 1) the acquisition of Magento and Marketo (USD 75 mn write-down of deferred income) and 2) antagonistic modifications in world foreign money charges of roughly 35 mn.

Adobe’s targets had been primarily based on its present reporting customary ASC 605, however from 1Q 2019 reporting will transfer to ASC 606. The firm anticipated this may have a restricted constructive impact on earnings in 2019.

Adobe expects USD 11.15 bn in revenues (23% yoy development) with Digital Media posting 20% yoy development and the Digital Experience 34% yoy development. The internet new ARR is anticipated to succeed in USD 1.45 bn. The GAAP EPS is anticipated to succeed in USD 5.54 and USD 7.75 on a non-GAAP foundation

In the quarterly steerage Adobe forecasts revenues of USD 2.54 mn (22% development vs. 1Q 2018 and 3% development vs. 4Q 2018). The firm expects stronger development within the Experience section 31% yoy vs. 20% within the Media and internet new ARR for the interval of USD 330 mn. Expected GAAP and Non-GAAP EPS are USD 1.14 and USD 1.60 respectively.

Recent acquisitions to help Adobe’s attain in Digital Experience

In June 2018 Adobe added the commerce platform Magento to the Digital Experience section and in October 2018, Marketo – the chief in B2B advertising engagement was acquired. Without the impact of the current acquisition, annual gross sales elevated 22% yoy, nonetheless forward of the set targets (Marketo introduced USD 21 mn to gross sales in 4Q for one month). Adobe’s administration is targeted on the combination of the 2 just lately acquired corporations. Given the small share of Marketo within the group’s revenues, no substantial impact on margins from the acquisition is anticipated in 2019.

Conclusion

Adobe has a secure enterprise mannequin with main market positions in its strategic segments – Creative Cloud and Document Cloud. The firm is clearly, properly positioned to broaden its worth proposition and buyer base and supply sustainable lengthy-time period outcomes. However, the stock is costly at EV/EBITDA of 35.8x and Trailing P/E of 45.8x.

We see dangers on the horizon as properly – 1) Potential resistance to the shift towards a subscription software program mannequin, and 2) Headwinds in print media, its core vertical, and 3) Challenges in monetizing its developer base given the provision of cheaper options. We assume it higher to attend till valuations normalize earlier than contemplating a place.

Disclosure: I/we have now no positions in any shares talked about, and no plans to provoke any positions inside the subsequent 72 hours. I wrote this text myself, and it expresses my very own opinions. I’m not receiving compensation for it (aside from from Seeking Alpha). I’ve no enterprise relationship with any firm whose stock is talked about on this article.

[ad_2]