[ad_1]

In the ultimate parts of 2018, stock traders centered on earnings have confronted a turbulent trip. Most of the market basic dividend shares have fallen by the wayside, and share costs for AT&T (T) have dropped by 29.26% within the final 12 months. Rising debt ranges have led many analysts to query the viability of AT&T’s supreme dividend yield. These criticisms aren’t fully unreasonable, on condition that the corporate’s debt ranges proceed to hover close to the $180 million mark. But with an annualized dividend of $2.04 per share, AT&T’s payout ratio of 58% suggests a great measure of security for lengthy-time period traders which can be nonetheless holding the stock. AT&T generates sturdy ranges of free money move, and the stock has change into excessively low cost relative to its competitors (based mostly on ahead-earnings valuations). As a end result, traders centered on earnings era ought to proceed to search for alternatives to purchase the stock within the weeks forward.

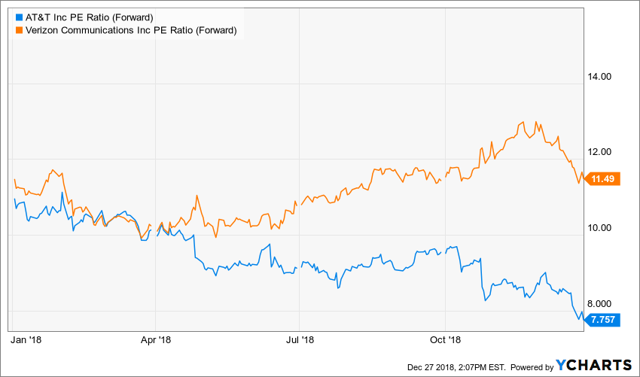

(Source: YCharts)

Recent declines in AT&T’s share costs have definitely put the stock in precarious territory. But these declines have made the corporate’s valuations extremely enticing for lengthy-time period traders. On a ahead worth-to-earnings foundation, AT&T is presently buying and selling at a 32.49% low cost relative to key business competitor Verizon Communications (VZ). These diverging tendencies in relative valuation started in April, and so they have reached extremes now that we’re coming to an in depth in 2018. In this case, a easy reversion to the imply could be greately useful for these holding T (when in comparison with these holding lengthy positios in VZ).

(Source: Bloomberg)

Of course, AT&T can not declare to reign supreme in all related areas. After the corporate’s acquisitions of Time Warner and DIRECTV and Time Warner, debt ranges have expanded in methods that may solely be described as problematic. Roughly $50 million of AT&T’s present debt load will change into due within the subsequent 5 years, so this can be a story which won’t be going away any time quickly. We should keep in mind that these debt funds will change into due as rate of interest ranges are rising, so there are sturdy components of medium-time period uncertainty that are tied to those points. At the identical time, we must always notice that Verizon’s debt ranges come to roughly $112 billion. So it isn’t as if AT&T is exclusive within the obstacles which will probably be seen throughout these durations.

(Source: Bloomberg)

Investors centered on earnings era might want to watch AT&T’s free money move figures, as this can be a important part in figuring out the corporate’s potential to keep up its excessive dividend payouts. On the premise of free money move, AT&T is presently buying and selling at a reduction of 38.83% when in comparison with Verizon. AT&T’s free money move figures are considerably above the figures generated by Verizon, and it will permit AT&T to keep up a strong margin of security in its dividend choices. As some extent of comparability, Verizon’s dividend yield presently stands at 4.48%. This is nicely above the 1.30% common dividend yield seen all through the expertise sector however nonetheless far beneath the 7.42% dividend yield captured by these holding positions in T.

(Source: Author)

All of that stated, the chart outlook for AT&T seems very dismal after falling by means of triple-backside assist ranges close to $31.80 per share. The bearish momentum has been vital, and this has made it troublesome for brand spanking new traders making an attempt to establish an acceptable level of entry. These sharp declines have been accompanied by rising buying and selling volumes, so these occasions shouldn’t be dismissed as merely short-term in nature. Long-term assist for the stock doesn’t emerge once more till we attain the decrease $20s, and the strength of the bearish momentum means that traders will in all probability discover continued alternatives over the following few weeks to purchase the stock at decrease ranges.

(Source: Zacks)

Ultimately, there’s nonetheless a large risk that this exercise will proceed till the following earnings catalyst enters the market. AT&T is scheduled to report earnings on 01/30/2019, with the analyst consensus indicating a quarterly EPS efficiency of $0.85. If realized, this might mark an EPS achieve of 8.97% relative to the identical interval final 12 months. Over the final 4 quarters, AT&T has crushed market expectations on solely two events (with a mean upside shock of 5.38% for your entire interval). This locations the present earnings estimates exterior of the corporate’s annual averages, and this might make it tougher for AT&T to ship an upside shock in earnings on the finish of January. As a end result, the stock needs to be considered as a maintain (fairly than a purchase) at present ranges, as traders searching for an opportunity to develop publicity to this heavy dividend-payer may even see higher worth stage alternatives within the weeks forward.

Thank you for studying.

Now, it is time to make your voice heard. Reader interplay is an important a part of the funding studying course of! Comments are extremely inspired. We stay up for studying your viewpoints on AT&T.

Disclosure: I’m/we’re lengthy T. I wrote this text myself, and it expresses my very own opinions. I’m not receiving compensation for it (apart from from Seeking Alpha). I’ve no enterprise relationship with any firm whose stock is talked about on this article.

[ad_2]