[ad_1]

As the stock market prepares to usher out 2018 on a gloomy be aware, the prevailing temper amongst Wall Street analysts seems to be cautious optimism, with strategists predicting stocks will bounce in 2019—though the trail greater may appear extra shrouded in uncertainty than ever.

On Friday, the Dow Jones Industrial Averages

DJIA, -1.81%

fell 414.23 factors, or 1.8%, to 22,445.37, whereas the S&P 500 index

SPX, -2.06%

fell 50.84 factors, or 2.1%, to 2,416.58. The Nasdaq Composite Index

COMP, -2.99%

COMP, -2.99%

traded down 195.41 factors, or 3% to 6,332.99, officially entering bear-market territory.

Even with the sturdy U.S. economic system as a constructive backdrop, worries that the Federal Reserve’s efforts to normalize rates of interest and wind down its stability sheet might proceed to weigh on stocks.

The consensus, for now a minimum of, factors to 2 extra will increase subsequent 12 months, somewhat than three, after a widely expected rate rise by the Fed on Wednesday. An acrimonious commerce warfare between the U.S. and China might additionally drag on stocks until Washington and Beijing attain a fast decision.

Read: Opinion: Who is right about 2019: the stock market or the Federal Reserve?

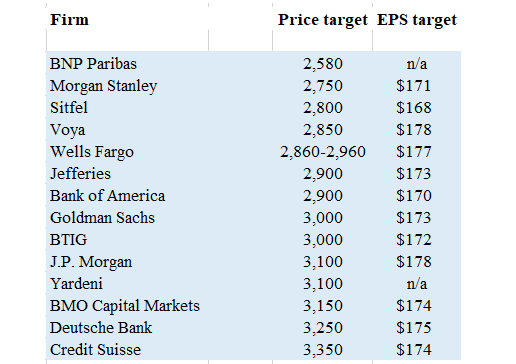

The stock market’s dismal efficiency in December, the truth is, has already prompted a minimum of one outstanding strategist—Jonathan Golub, chief U.S. fairness strategist, Credit Suisse Securities—to slash his 2019 S&P 500 goal to 2,925 from 3,350.

“We are keeping our EPS estimates for 2019 and 2020 unchanged at $174 and $185, implying 6.7% and 6.3% EPS growth,” he stated in a report. “The expected trajectory for EPS and the economy remain virtually unchanged during the recent market disruption. Our lower price target reflects recent volatility, rather than a change in fundamental backdrop.”

The Fed and China apart, there are different probably destabilizing occasions looming that might tank the market, together with Washington mayhem and political developments overseas.

S&P 500 forecasts for 2019

Here’s a snapshot of some Wall Street analysts’ 2019 preliminary outlooks:

Savita Subramanian, fairness and quant strategist at Bank of America Merrill Lynch

“Two themes ought to drive equities in 2019: 1) extra Fed tightening, the place we favor cash-generative investments over cash-users and 2) Higher volatility (seemingly by 2021), the place we count on top quality stocks to outperform.

We count on the market could peak round 3,000, the place still-supportive fundamentals, tepid fairness sentiment and cheap valuations maintain us near-term constructive. Alleviation of commerce tensions additionally would present upside threat.”

David Kostin, chief U.S. fairness strategist at Goldman Sachs

“A higher U.S. equity market, a lower recommended allocation to stocks, and a shift to higher quality companies summarizes our forecast for 2019. We forecast S&P 500 will generate a modest single-digit absolute return in 2019. The risk-adjusted return will be less than half the long-term average. Cash will represent a competitive asset class to stocks for the first time in many years.”

Dubravko Lakos-Bujas, head of U.S. fairness technique, J.P. Morgan

“Fundamentals ought to stay healthy, so far as earnings, funding spending, company stability sheets and leverage are involved. Even although earnings are anticipated to decelerate relative to 2018, they need to stay constructive and proceed to develop.

“Over the following 12 months, we might see greater than $1.5 trillion value of demand for U.S. equities by buybacks (about $800 billion), partial reinvestment of dividend revenue (about $250 billion), in addition to discretionary hedge fund and systematic flows (about $500 billion would take fairness positioning to about 50%-tile) as volatility normalizes.”

Binky Chadha, chief strategist, Deutsche Bank

“It will take a while for the market to regain its prior peak: once volatility gets elevated, [the] market recovers only slowly (6-7 months); concerns about peak earnings are unlikely to dissipate until there are clear signs growth is steadying, which we don’t expect until second quarter earnings.”

Karyn Cavanaugh, senior market strategist, Voya Investment Management

“In 2019 we expect, and prudent investors should prepare for, ‘the storm before the calm’ — tighter monetary conditions, uncertainty that includes a ‘disorderly Brexit’ and increasing tensions between China and the United States on multiple fronts. We expect a storm though, nothing more.”

Mike Wilson, fairness strategist, Morgan Stanley

“While issues would possibly look related on the index stage subsequent 12 months, the drivers must be a lot completely different than 2018’s strong earnings progress offset by a lot decrease valuations. Instead, 2019 is prone to be characterised by disappointing progress and a a lot narrower vary of valuation.

Holiday buying and selling subsequent week

Looking forward, U.S. stock and bond markets will see an abbreviated session on Monday, with U.S. stock markets ending at 1 p.m. Eastern Time, whereas bond markets are set for a 2 p.m. shut. Both stock markets on Wednesday might be closed for Christmas on Tuesday.

What knowledge are forward?

Monday

- Chicago Fed National lively index for November scheduled for 8:30 a.m.

Wednesday

- Case-Shiller residence costs for October due at 9 a.m.

Thursday

- Weekly jobless claims for the week ended Dec. 22 at 8:30 a.m.

- Consumer confidence index for December slated for 10 a.m.

- A studying of latest residence gross sales for November set for a similar time

Friday

- Advance commerce in items for November due at 8:30 a.m.

- Chicago PMI for December scheduled for 9:45 a.m.

- A report on pending residence gross sales for November set for 10 a.m.

Read: Here’s how a looming government shutdown could affect federal services — and stocks

Providing crucial info for the U.S. buying and selling day. Subscribe to MarketWatch’s free Need to Know publication. Sign up here.

[ad_2]