[ad_1]

Introduction

I’m on the lookout for corporations in a number of sectors to stability my portfolio. This 12 months was very risky, and my sector allocation is a little bit out of stability. I’m on the lookout for corporations within the client staples, industrials, and knowledge expertise sectors. I’m on the lookout for stable dividend progress corporations that can be capable to enhance their funds over time.

In my final articles, I centered on the buyer staples sector and acquired shares in Archer Daniels Midland (ADM). I additionally centered on overseas corporations, as they’re many occasions ignored by American buyers. In this text, I will probably be taking a look at BAE Systems (OTCPK:BAESY) which is from the industrials sectors.

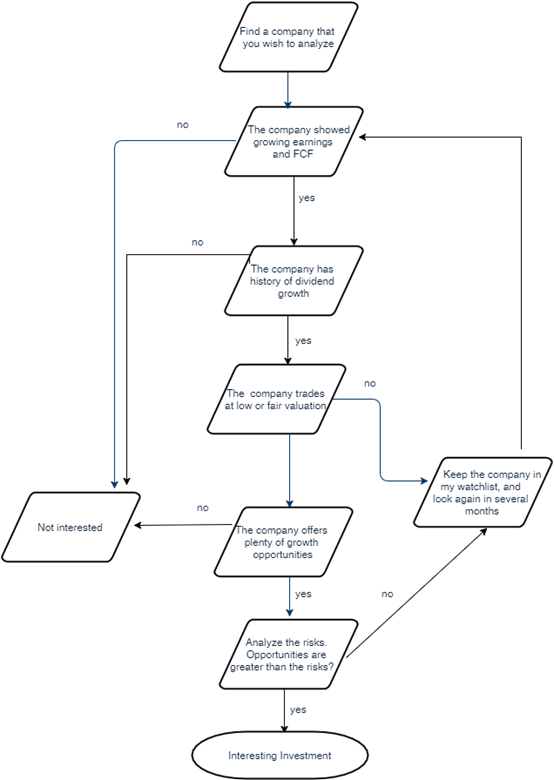

I analyzed the corporate utilizing my methodology as described within the graph under. I appeared on the fundamentals, valuation progress alternatives, and dangers. I discovered a really stable firm which gives excessive dividend yield but additionally excessive payout ratio. In my opinion, it’s an fascinating dividend progress possibility for buyers who search for publicity to foreign currency.

(Source: Created by creator)

BAE Systems operates as a protection, aerospace, and safety firm worldwide. It operates by means of a number of segments: Electronic Systems, Cyber & Intelligence, and Platforms & Services. BAE Systems plc was integrated in 1979 and relies in London, the United Kingdom.

(Source: baesystems.com)

Fundamentals

BAE Systems managed to attain low high-line progress over the previous a number of years. When we take a look at the numbers in GBP, since that is the foreign money utilized by the corporate, we see that, over the previous 4 years, the corporate managed to attain a compound annual progress fee of 2% in its high line. This could not look too spectacular, however the administration believes that it will possibly obtain increased progress fee going into the longer term.

The EPS over the identical interval confirmed some extra spectacular progress. The compound annual progress fee of the EPS previously three years was 4.5%, and whereas this isn’t sturdy, the administration believes that it’s going to keep low to mid-single-digit EPS progress within the quick time period. In the medium time period, the administration has confidence that its spectacular backlog and progress prospects will permit the EPS to develop at a quicker tempo.

I take a look at the dividend in GBP as properly. The firm has raised its annual funds yearly for the previous 13 years, and it’s a precedence for the administration. The present yield is 4.75%, and this can be a distinctive determine on this sector and trade. The motive for that’s partially the excessive payout ratio that stands at 81%. The firm is subsequently growing the dividend by solely 2% yearly, because it makes an attempt to decrease its payout ratio. Due to the low dividend progress fee, if you happen to obtain your dividends in USD, it might appear to be a dividend discount as a result of weak point of the GBP.

Due to the excessive payout ratio, BAE Systems has no important share repurchase plan, however it greater than compensates for it with the present dividend coverage. I consider that administration ought to attempt to decrease the payout ratio, and when it believes the share worth is enticing, use a buyback plan. In the meantime, it is vital that shareholders do not get diluted for no motive.

Valuation

When I take a look at the valuation, I desire to have a look at the quantity is GBP as properly. While the corporate seems to be extra attractively valued in USD, consistency, when analyzing an organization, is a key. The present P/E ratio is 17. This is an inexpensive determine for an organization that could be a market chief, has secure shoppers, and grows its earnings by nearly 5% yearly.

The graph from Fastgraphs.com reveals the same story. BAE Systems trades for decrease valuation in comparison with its historic valuation. Therefore, the corporate could also be undervalued. The fluctuations within the alternate charges between the greenback and the pound are the rationale for the volatility in earnings.

(Source: F.A.S.T. Graphs – Fundamentals Analyzer Software Tool)

BAE Systems supply stable fundamentals and excessive dividend yield that touches the 5% mark. On the opposite hand, it gives gradual dividend progress and excessive payout ratio that will make some buyers uncomfortable. It additionally gives a good valuation with some margin of security that matches the present progress fee. If the corporate has some progress prospects in its future, and manageable dangers, it is going to be a sexy possibility.

Opportunities

The first progress alternative for the corporate is the expansion within the army spending within the United States. The United States accounts for 41% of the corporate’s gross sales, and with the rise in protection spending, BAE Systems, as one of many largest protection corporations on the earth anticipate to get pleasure from from a few of this funds enhance.

Moreover, the corporate additionally seems to be at Europe for some progress alternatives. Not solely that the United Kingdom accounts for 25% of the gross sales, the mistrust between the United States and the European Union could result in progress in European army spending. Emmanuel Macron, the president of France, already acknowledged that Europe ought to take into account constructing its personal military. European military will almost definitely be constructed utilizing European corporations.

Another catalyst for elevated army spending is the rise of Russia and China. In current years, each nations made bigger effort to achieve affect on the earth. They do it utilizing their financial strength but additionally utilizing army strength. This progress in world rigidity can function a catalyst for elevated army spending.

Risks

The first threat is the excessive payout ratio. Right now, the payout ratio is increased than typical, and each main decline in earnings could harm the dividend protection to a degree the place it will not be coated by earnings. Moreover, whereas the present valuation gives some margin of security, the dividend seems to be a little bit fragile to me. Luckily, a lot of the shoppers are governments of secure nations.

Another threat is the weak execution by the corporate. Over the previous a number of years, a few of the firm’s friends confirmed some phenomenal progress in high and backside line. At the identical time, BAE Systems is struggling a little bit bit to compete with its friends, and their execution was considerably disappointing.

Another threat is the foreign money. The firm pays dividends in GBP, and American buyers skilled dividend discount attributable to that. The firm can be situated within the United Kingdom, and when the Brexit remains to be a thriller, it is rather arduous to find out the way it will have an effect on its enterprise and the GBP. Economists consider that the consequences will probably be damaging, and the uncertainty is certainly a threat.

Conclusions

BAE Systems is likely one of the 5 largest corporations within the trade. It is situated within the United Kingdom and gives buyers a chance to spend money on corporations exterior the United States. The firm gives sturdy fundamentals and an amazing dividend. It additionally gives truthful valuation and a technique to capitalize from the world rigidity.

The dangers have to be taken under consideration, however I consider that the reward is well worth the threat. Investors who need publicity to the British Pound ought to provoke a place in BAE Systems. The firm is able to ship returns and assist its house owners generate earnings.

Disclosure: I’m/we’re lengthy ADM. I wrote this text myself, and it expresses my very own opinions. I’m not receiving compensation for it (apart from from Seeking Alpha). I’ve no enterprise relationship with any firm whose stock is talked about on this article.

[ad_2]