[ad_1]

Saipem has many challenges

Saipem S.p.A. ADR (OTCPK:SAPMY) offers drilling providers, engineering, procurement, building and set up (or EPIC) of pipelines and complicated initiatives within the onshore and offshore vitality market. Saipem is going through weak point in practically all of its segments, aside from the Onshore Drilling section. There has additionally been a drop in worldwide E&P actions in a few of its worldwide geographies in current months. However, due to robust backlog, SAPMY’s outlook is predicted to recuperate within the subsequent two years. Given its dependence on the offshore market, a gentle revival of the deepwater initiatives could be the important thing to Saipem’s development. In 2018 up to now, SAPMY’s stock value has gone down by 21% in comparison with a 48% fall in VanEck Vectors Oil Services ETF (OIH). OIH represents the oilfield gear & providers (or OFS) business.

A deep-dive into Saipem’s segments

E&C Offshore

Lower vitality volumes within the Caspian and Central South America are affecting Saipem’s E&C offshore section. In the primary 9 months of FY2018, revenues decreased 8% in comparison with the primary 9 months of FY2017 — nonetheless, greater volumes registered within the Middle East offshore partially offset the autumn. Despite the autumn in revenues, its EBITDA margin elevated to 15% in comparison with 13% throughout the identical interval.

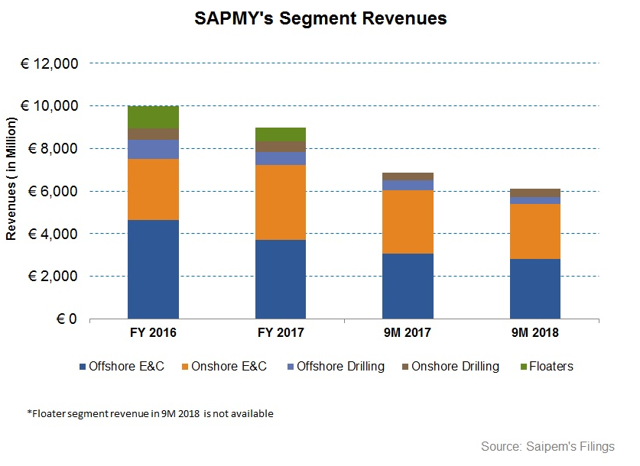

The crude oil value downturn in 2015 and early 2016 led to decreased revenue margins and an funding shake-out within the market. Hence, vitality operators have been pressured to pull back on future exploration spending. These producers additionally restructured or delayed drilling rig contracts. According to EIA, breakeven manufacturing within the North Sea and within the US Gulf of Mexico are right down to $25-40/barrel from $60-80/barrel a couple of years earlier as a consequence of elevated price effectivity. SAPMY’s Offshore E&C section revenues decreased 21% in FY2017 in comparison with FY2016. Investors might also be aware that in late-2016, Saipem initiated a 3-yr strategic plan for 2017-2020. The plan included a brand new organizational mannequin, improved effectivity, extra price cuts, and creation of a brand new entity for worth-added engineering actions.

In the previous couple of months, the Brent crude oil value has fallen considerably and is now hovering across the $50-level. While this stage can nonetheless be worthwhile for a lot of operators within the Gulf of Mexico, many worldwide operators can discover the present pricing setting not robust sufficient to extend or preserve the present manufacturing. If the offshore initiatives, which have been slowly transferring to see the sunshine of day, are shelved once more, it could impair the offshore vitality firm’s outlook. Due to traders’ skepticism on the offshore market restoration, Saipem’s stock value declined 35% prior to now two months.

E&C Onshore

In the E&C onshore section, SAPMY’s revenues fall was even greater than the offshore half (14% down) versus 9 months in 2017. This was due primarily to decrease exercise within the Middle East, Asia-Pacific, and West Africa. Onshore exercise in Latin America and the Caspian improved in 2018 in comparison with the earlier yr, thus offsetting among the hostile results on the income. In this section, too, SAPMY achieved a marginal enchancment within the EBITDA margin throughout the identical interval.

The crude oil value recovered strongly earlier than the current crash. By the top of FY2017, the WTI crude oil value elevated 12% in comparison with its value at the start of the yr. This led to a lot improved onshore vitality exercise, pushed by the great development within the U.S. unconventional shales. As a outcome, SAPMY’s Onshore E&C revenues elevated by 24% in FY2017 in comparison with the earlier yr. The Offshore E&C and the Onshore E&C segments collectively accounted for 88% of SAPMY’s revenues in 9M 2018.

Offshore Drilling

In the Offshore Drilling section, SAPMY’s revenues declined by 29% in 9M 2018 in comparison with 9M 2017. Investors might be aware that the corporate operates extremely-deep-water semi-submersible drilling rigs Scarabeo 5, Scarabeo 7, Scarabeo 8 and Scarabeo 9 and drillships Saipem 10000 and Saipem 12000 at depths in extra of 1,000 meters. Scarabeo 5 and Scarabeo 8 noticed much less exercise in 9M 2018 in comparison with the primary three quarters of FY2017. Scarabeo 9, in distinction, noticed greater motion in 2018, which led to greater rig utilization. The section EBITDA margin was resilient at 47% as a consequence of SAPMY’s price-saving initiatives. Also, lengthy-time period contracts have been re-negotiated at barely favorable charges because the offshore vitality market has started to recuperate from the 2014-16 crude oil value pushed crash.

Drilling section revenues are carefully tied to rig depend. According to Baker Hughes’s rig depend data, the rig depend in Latin America declined by 10% in November in comparison with the earlier month. This signifies a continued weak point within the Latin America area, which might drag down SAPMY’s efficiency in This fall.

Drilling Onshore

The Drilling Onshore section income was the one section which noticed greater 9M 2018 revenues in comparison with 9M 2017. The section-adjusted EBITDA improved by 21% yr-on-yr following price-saving initiatives in Latin America and environment friendly restoration in Middle East operations.

In FY 2017, the corporate’s Onshore Drilling section income declined by 10% over the earlier yr. Despite a restoration within the U.S. vitality market, steep reductions within the drilling exercise in Latin America triggered the section downfall. The section additionally noticed excessive start-up prices for brand new initiatives in Kuwait and Argentina.

Strong backlog in 2019 and 2020

Compared to the backlog disclosed by Saipem in July, the backlog has been revised up by EUR 0.7 billion in October based mostly on a contract awarded in 3 2018. However, its FY2019 and FY2020 backlogs are a lot greater in comparison with FY2018, which implies its FY2018 won’t get a lot traction from the backlog. In FY2019, Saipem’s backlog is 134% greater in comparison with FY 2018. Onshore E&C accounts for greater than 50% of the corporate’s whole backlog within the subsequent two years.

In Q3 2018, SAPMY obtained awards for 2 massive initiatives in E&C division, mixed with a number of different smaller orders, which add to a complete of EUR 2.1 billion in new orders coming into the backlog. One of its massive initiatives associated to ExxonMobil’s (XOM) Liza section 2 offshore undertaking in Guyana. SAPMY will provide EPCI (engineering, procurement, building, and set up providers) of risers, flowlines and subsea buildings, umbilicals and manifolds. It obtained one other XOM undertaking for the onshore West Qurna Development Project which entails debottlenecking actions to enhance manufacturing course of and capability within the current plan.

The firm bagged one other undertaking award from Saudi Aramco for 700 kilometers of pipeline as a part of a program to enhance the corporate’s sizeable onshore compression pipeline system. In Offshore E&C, SAPMY was awarded a couple of new initiatives price a mixed USD 400 million. This features a new contract by Total (TOT) in Azerbaijan for the event of the offshore subject within the Caspian Sea.

Will onshore utilization enhance?

In onshore drilling, the weighted common utilization price on the finish of Q3 2018 was ~ 66%, which was greater than the utilization price (63%) recorded in Q3 2017. In the Middle East, the fleet was absolutely utilized in Q3. However, the state of affairs remained difficult in sure international locations in Latin America. Despite that, SAPMY’s administration observes growing inquiries for drilling providers, together with in Argentina. Also, the longer term enterprise prospects in different areas comparable to North Africa and the Middle East are anticipated to contribute to the development within the fleet utilization price in mid-time period.

Which key consumer markets supply development for SAPMY?

SAPMY’s revenues from the upstream section have been down, regardless of essential contract awards in North Africa, the Middle East, and South America. The LNG section is rising on account of initiatives within the U.S. There was a major downturn within the firm’s pipeline enterprise which has lowered its significance in SAPMY’s portfolio. The refining section has strong development alternatives on account of awards obtained from the Middle East, North Africa, Asia-Pacific, and Russia-Central Asia. However, the petrochemical section lowered its quota as a result of lack of essential awards. The Infrastructure section continues to indicate constructive indicators of huge investments internationally each in conventional markets (Europe and USA) and in new markets (Egypt, Middle East, India, Russia).

The FY2018 administration steerage

In FY2018, Saipem’s administration expects revenues to lower 11% in comparison with FY2017. It expects adjusted EBITDA margin to remain above 10%. The FY2018 capex is predicted to almost double in comparison with the FY2017 capex.

SAPMY’s liquidity and money circulate

In the previous three quarters till Q3 2018, Saipem’s money circulate from operations (or CFO) elevated by 35% over the prior yr regardless of the income fall throughout this era. The money circulate enchancment displays an enchancment in working capital. Saipem’s money and money equivalents have been €1.7 billion on September 30, 2018. Saipem doesn’t pay a dividend or have any share repurchase plans. SAPMY’s capex was €365 million within the first 9 months of FY2018, which is an 84% rise over the earlier yr.

As of September 30, the corporate’s liquidity was €2.3 billion. It has undrawn dedicated money amenities totaling €1.3 billion. The majority of SAPMY’s debt compensation is due from 2021 via 2023. SAPMY’s debt-to-fairness ratio is 0.68. With no vital debt refunds due within the brief-time period, Saipem’s steadiness sheet is robust. However, if capex continues to extend sooner than the CFO development, Saipem’s free money circulate will decline. So, within the medium-to-long run, it could discover issue in assembly its monetary obligations except its money flows enhance within the subsequent two to 3 years.

What does SAPMY’s relative valuation say?

Saipem S.p.A. is at present buying and selling at an EV-to-adjusted EBITDA a number of of 4.7x. According to promote-aspect analysts’ estimates pulled from Thomson Reuters, Saipem’s ahead EV/EBITDA a number of is 5.2x. From FY2016 to FY2017, Profire’s common EV/EBITDA a number of was 10.2x. So, Saipem is at present buying and selling at a reduction to its previous two-yr common.

SAPMY’s ahead EV-to-EBITDA a number of is predicted to inflate versus its adjusted trailing twelve months EV/EBITDA. In distinction, the business friends’ common a number of is predicted to compress on this interval. This is as a result of promote-aspect analysts count on SAPMY’s EBITDA to deteriorate in comparison with the friends’ common rise in EBITDA within the subsequent 4 quarters. This would usually mirror in a decrease present EV/EBITDA a number of in comparison with the friends’ common. Saipem’s TTM EV/EBITDA a number of is decrease than its friends’ (WDGJF, FTI, and SBFFY) common of 9.4x.

What’s the tackle SAPMY?

Saipem has had a quiet yr in FY2018. The firm confronted headwinds in practically all of its segments, aside from the Onshore Drilling section. Lower onshore exercise within the Middle East, Asia-Pacific, and West Africa have mirrored in decrease rig depend in most of the worldwide geographies. The offshore vitality exercise has been below an uncertainty ever for the reason that crude oil value crash of 2014. The present weak point in value has as soon as once more put a query market on SAPMY’s offshore enterprise restoration.

However, SAPMY’s backlog reveals it’s anticipated to appreciate a lot greater revenues in FY2019 and FY2020. Also, regardless of the income drop, Saipem has been capable of forestall any vital margin erosion as a consequence of its price saving measures. The firm doesn’t have any main debt compensation obligation within the brief-time period, though its falling free money circulate can change into a priority over the extra prolonged interval. SAPMY might not present enough development alternative within the close to-time period. But given the scale and number of companies it’s concerned in, it presents safety from any sharp fall within the business.

Disclosure: I/we’ve got no positions in any shares talked about, and no plans to provoke any positions inside the subsequent 72 hours. I wrote this text myself, and it expresses my very own opinions. I’m not receiving compensation for it (apart from from Seeking Alpha). I’ve no enterprise relationship with any firm whose stock is talked about on this article.

Editor’s Note: This article discusses a number of securities that don’t commerce on a significant U.S. alternate. Please concentrate on the dangers related to these shares.

[ad_2]