[ad_1]

A New Way Forward

In my portfolio introduction in May 2018, I launched the primary part of my portfolio constructing plan which started in February 2017. This “base” included excessive yield REITs which equipped me with round $5,000 in money dividends per yr. I contributed $65,000 to this part, choosing some high-risk, small-cap names (e.g., City Office REIT (CIO), Easterly Government Properties (DEA)), some high-risk, speculative names (e.g., CBL & Associates Properties (CBL), VEREIT (VER), Ladder Capital Corp. (LADR)), and usually a minimum of what I thought of best-in-breed names (e.g., Omega Healthcare Investors (OHI), STAG Industrial (STAG), Apple Hospitality REIT (APLE), American Campus Communities (ACC)).

With this $65,000 base down, I regarded for tactics to increase and develop my portfolio outdoors of the REIT sector. I started to wrestle with a query that I think about most buyers face sooner or later: what number of particular person securities can I realistically maintain at any given time and nonetheless preserve the extent of due diligence that I really feel is required?

One of my said hopes from the portfolio is that someday it generates $150,000 in annualized dividends. I started doing basic math, and assuming a weighted dividend yield of 5% (which is being beneficiant), that will imply $3,000,000 value of stock. My common price foundation is $5,000 which might imply managing a portfolio of 600 shares. That doesn’t sound enjoyable or sensible.

This realization in the end led me to query the right way to handle this portfolio not simply within the brief time period however in the long run as nicely. While I admittedly was arduous on myself for not pondering of this “problem” sooner, I’ve by no means been one to ruminate too lengthy when I’ve the self-awareness to repair the issue. Ultimately, this led me to the choice to make routine contributions into low-cost index funds. That would give me the most effective of each worlds: some actively managed stock choosing and a passive investing part of the portfolio that can develop over time with the market.

While the considered managing too many shares was the rationale I ended up wanting into establishing a base of index funds, I nonetheless had the time and curiosity to develop the person stock portion of the portfolio as nicely. Given my bias in the direction of revenue era, promoting put choices to get into shares of curiosity and promoting coated calls as soon as in them felt like a pure part for me to discover. I turned extraordinarily as I started to do extra analysis, as this opened my eyes to the flexibility commerce into higher-risk development shares I had beforehand averted. I started to increase my analysis horizons and constructed out my watchlist. I’ll overview my 4Q 2018 choices motion later.

The Index Fund Section

Time Horizon: 35+ years (My age: 31, My spouse’s age: 28)

Risk Tolerance: High

Target Portfolio

US Equities: 70-80%

International Equities: 20-25%

Bonds: 5-10%

Portfolio as of 12-31-2018

US Equities: 72.87%

International Equities: 19.86%

Bonds: 7.27%

Because this text will function an introduction to this part, I’ll break it down a bit greater than I’ll in future updates.

The Building Phase

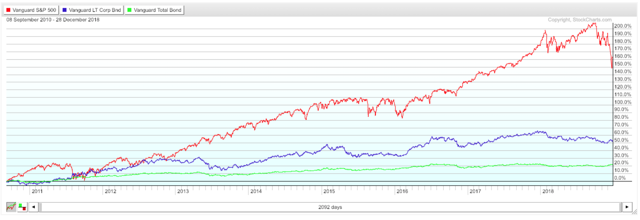

Building the index fund part took much more work than I believed, as there have been many extra choices on the market than I spotted. I briefly thought of 100% equities, however in the end discovered a bond index fund that I appreciated within the Vanguard Long-Term Corporate Bond Index ETF (VCLT).

VCLT: The fund holds long-term investment-grade company bonds at a 0.07% expense ratio and distributes a month-to-month dividend. I ended up choosing VCLT over a extra generic bond alternative just like the Vanguard Total Bond Market ETF (BND) as a result of it correlates extra positively with the general market (8-year chart proven under). Because the fund holds company bonds, drops within the market can affect VCLT extra so than a typical bond fund. For the long run, I view VCLT as a pleasant 4.5% month-to-month participant that may make up 5-10% of this portion of the portfolio. I count on to purchase 2 shares of the fund a month going ahead.

(Source: StockCharts.com)

US Equities: I ended up choosing the the Vanguard S&P 500 ETF (VOO), Invesco QQQ ETF (QQQ), and the iShares Core S&P Small-Cap ETF (IJR) because the funds to make up this portion.

VOO: Needs no introduction. For the novice in me, I nonetheless researched if there was a “correct” S&P 500 fund to get into. Aside from choosing VOO/IVV over SPY, it appears every little thing else is equal. I ended up going with Vanguard’s VOO as I picked different Vanguard funds.

QQQ: Having a heavy expertise publicity is one thing I would like for the following 35 years. Apple (AAPL), Microsoft (MSFT), and Amazon (AMZN) make up roughly 32% of the QQQ, whereas they solely make up 10% of VOO. QQQ in the end beat out the Direxion NASDAQ-100 Equal Weighted Index Shares ETF (QQQE) and the First Trust Nasdaq-100 Ex-Tech Sector Index ETF (QQXT), because it was market cap-weighted quite than equal cap-weighted. The 10-year annualized return for all was additionally a consideration. For these questioning, 19.20% for QQQ, 17.65% for QQQE, and 15.70% for QQXT. All percentages are primarily based on 12/28/2018 closing.

IJR: This fund tracks a market cap-weighted index of small-cap US shares. The 600 shares that make up the fund symbolize about 3% of the accessible market. I picked IJR over the SPDR S&P 600 Small Cap ETF (SLY) and the Vanguard S&P Small-Cap 600 ETF (VIOO) as a result of it was the identical actual factor with a decrease expense ratio. The actual determination appeared to be IJR versus IWM. IJR tracks shares which can be ranked 901-1500 in market cap, whereas IWM tracks shares which can be ranked 1001-3000 (also called Russell 2000). The thought course of right here was merely that IJR had extra established firms within the pool, and I wasn’t certain if the extra firms inside IWM was value the additional danger. I did some analysis and located that IJR has outperformed IWM on the 3-year (8.22% to 6.28%), 5-year (5.95% to 4.16%), and 10-year (13.89% to 12.35%) benchmarks. All percentages are primarily based on 12/28/2018 closing.

(Source: StockCharts.com)

International Equities: I ended up choosing the Vanguard FTSE Developed Markets ETF (VEA), the Vanguard FTSE Emerging Markets ETF (VWO), and the Franklin FTSE China ETF (FLCH) because the funds to make up this portion.

VEA and VWO appeared seemingly fairly customary choices to achieve publicity to developed and rising markets, respectively. As appeared to at all times be the case, there have been 3-4 others that did the very same factor however charged extra and had worse efficiency. EFA (Blackrock’s Developed Markets Fund) had a 0.32% expense ratio in comparison with 0.07% for Vanguard, whereas additionally underperforming the 10-year benchmark, 6.20% – 6.41%. All percentages are primarily based on 12/28/2018 closing.

I did discover myself questioning if worldwide publicity was actually wanted and/or useful. Take a take a look at the final eight years of VOO, QQQ, IJR, VEA, and VWO:

(Source: StockCharts.com)

I did some additional analysis past this chart and discovered that from 2005 to 2008’s peak, VWO went up 125%, in comparison with SPY’s 25% return in the identical time interval. So, there have been instances when worldwide markets have drastically outperformed. I additionally discovered enhanced yield in VEA (3.37%) and VWO (2.90%) in comparison with VOO (2.08%), QQQ (0.92%), and IJR (1.59%). I might like to have a dialogue within the feedback about how others deal (or don’t) with worldwide publicity, because it was one thing I went backwards and forwards on.

Finally, FLCH. I needed long-term publicity to the Chinese market that has fallen 30% this yr. I’m extraordinarily bullish on Tencent (OTCPK:TCEHY) and Alibaba (BABA), and thought of shopping for particular person positions in October. Rather than go in that course, FLCH stood out as a brand new (lower than 1-year-old) ETF with a particularly low expense ratio (0.19%) to offer me publicity to each shares and the Chinese market basically. Tencent and Alibaba make up roughly 27% of FLCH. 38% of the fund is in expertise and 30% is in financials. I should be extra aware of this ETF, since it’s so new. The quantity in FLCH is gentle, which ends up in awkward shopping for at instances.

Accumulating Positions

Thanks to Robinhood, I’ve been capable of purchase into these ETFs slowly quite than leap in . This allowed me to cost-average in throughout the slumps in October, November, and December. Here is the place the index fund portfolio stands as of now:

(Source: Author’s Chart)

The Individual Stock Selection

Time Horizon: For REITs, 5+ years. For non-REIT shares, lower than 5 years. While each are topic to altering fundamentals and efficiency, that is the final expectation.

My objective when beginning this part was merely including REITs that paid a excessive dividend (which I took in money) which I believed have been sustainable for the long run. When I first started, I didn’t think about the corporate’s observe file in rising the dividend almost as a lot I ought to have. If I do find yourself rebalancing the REIT portion, I’ll search for dividend stability and development.

In This fall, I started promoting places and calls on non-REIT shares to department away from being so targeted on one sector. While I’ve enjoyed promoting places and coated calls, it does imply that my time horizon for a number of the shares may very well be shorter, which has made me assume more durable about exit costs. Thus, basically, I might stamp the REIT “base” as a steady, long-term dedication, whereas my different positions you will notice under might find yourself being short-term or long-term relying on my entry/exit methods.

This can be why I’ve stamped the portfolio because the “triple threat” (e.g., index funds, REIT base, and put/name choices). Everyone wants a cool portfolio identify.

Portfolio Buy/Sell Action Since Last Update (08/17/2018)

(Source: Author’s Chart)

Apollo Commercial Real Estate Finance (ARI) Scorecard

Bought 285 ARI at $17.54 on 02/07/2017

Sold 285 ARI at $18.50 on 10/25/2018

Brokerage Fees: $13.95

Realized Gain/Loss: +$259.65 (+5.18%)

Cash Dividends Collected: +$786.60

Total Gain/Loss: +$1046.25 (+20.87% // 11.80% annualized)

Transocean (RIG) Scorecard

Entry: $0.10 Put Option ($7) on 12/21/2018

Exit: $0.08 Covered Call Option ($7) on 12/28/2018

Brokerage Fees: $0

Realized Gain/Loss: $18 (+2.57% // 134% Annualized – distorted, 7-day commerce)

Selling out of ARI got here all the way down to the truth that I additionally personal LADR, so I used to be awkwardly hanging on to an excessive amount of business actual property publicity. Yes, I notice the irony of claiming that given all the portfolio (was) REITs. LADR and different ARI opponents (Blackstone Mortgage Trust (BXMT)) are additionally delivering thrilling quarter after thrilling quarter, elevating the dividend, and giving freely particular dividends. I used to be rising more and more involved that ARI might quickly lower the dividend, as administration mentioned in June 2018 they have been “going to look at it closely” within the months forward. All this in a yr they’ve file mortgage originations. I’m additionally very bearish on New York actual property (the place ARI is predominantly situated) over the following three years.

Overall, I took in a 20.87% achieve (together with the dividends) in a bit beneath 2 years. While I by no means thought of monitoring my stock efficiency in opposition to the S&P 500 after I started in 2017, it’s one thing that I perceive a bit extra about now. Using my trusty S&P 500 calculator, from February 2017 by October 2018, the S&P 500 with reinvested dividends was up 24.53%. So, whereas a achieve in ARI, a slight underperformance there.

RIG was a short-term commerce, as I continued to discover choices buying and selling (extra on that shortly).

Let’s pivot and try the present holdings of this portfolio and test in on them.

The Current Stock Portfolio

(Source: Author’s Chart)

Prior Divs = Dividends acquired previous to 2018.

I’ll present commentary on the non-REIT additions within the subsequent part.

December 15th was the day the underside fell out for almost all of this portfolio. One day prior, the portfolio was a sea of inexperienced, up 2.5% and hanging on to good points for the yr. REITs and utilities ended up being the final sectors to fall on December 15th, turning the spreadsheet an unsightly crimson shade on a day all the portfolio dropped by $4,000.

Regarding particular securities, CBL continues to massively disappoint. I’ve touched on my determination to carry it in my last update in order to not spend an excessive amount of time on it right here. Perhaps this funding is exposing a serious weak spot I’ve – not realizing when to promote a stock deep within the crimson. There is part of me that also feels the decline right here is grossly overdone. It will sit right here for now. I think about a large chunk of my $1088 dividends in CBL this yr is coming again to me as a return of capital for tax functions, and that can cut back my total price foundation. CBL offered a small return of capital final yr.

LADR continues to impress me. Management actually appears to be taking all the fitting steps to compete in a competitive house. Twice this yr, the corporate has raised capital by issuing new fairness, misplaced 3-4%, and twice the stock recovered inside 4-5 buying and selling days. I proceed to be bullish on LADR shifting into 2019.

OHI has additionally continued to be a large celebrity. I’m most , with tenant points seemingly resolved if the corporate will resume bettering the dividend because it did for therefore lengthy (I purchased OHI the quarter earlier than it paused the dividend hikes.)

Here is a snapshot of how all of the REIT shares have carried out since my final replace on August 17th:

(Source: Author’s Chart)

The Options Section

Time Horizon: In normal, lower than 5 years.

Initial Funding: $20,000

Targeted Allocation: Roughly 50% on 3+% dividend payers. Roughly 50% on riskier names I see development potential in.

I’ve experimented with promoting put and name choices at numerous lengths starting from one week to seven weeks. While the one-week choices have been useful throughout a unstable 4Q and made attainable by Robinhood, I feel 3-4-week time horizons might be extra my velocity going ahead simply from my very own time availability. Here are my put/name choices pointers I’ve for the portfolio, in addition to some real-life examples from this previous quarter:

Dividend Stocks

Entry: 3-4% decrease than the place it at present trades, with a 1-2% premium acquired (12-24% annualized).

Higher Risk, Growth Stocks

Entry: 7-10% decrease than the place it at present trades, with a 1-2% premium acquired (12-24% annualized).

To be clear, I’m not simply throwing a dart at shares and attempting to get in at a low worth. After doing a little due diligence on General Mills (GIS), I picked $40 as an entry worth as a result of that represented a 4.9% dividend yield and a stock that traded at 12x ahead earnings.

Here are some instance trades to showcase the rules set above:

11/26/2018, GIS was buying and selling at $42.38. I bought a $40 put for $0.50 expiring on 12/21/2018.

5.61% draw back safety for 1.25% return (18.26% annualized)

12/11/2018, ROKU was buying and selling at $37.19. I bought a $34 put for $0.34 expiring on 12/14/2018.

8.57% draw back safety for 1.00% return (annualized determine distorted – solely 4 days)

My choices trades since October have included a wide range of names in a wide range of industries.

Among the 3%+ dividend gamers: Altria (MO), GIS, AMC Entertainment Holdings (AMC), Macy’s (M), and Enbridge (ENB).

Among the “riskier” names: Sirius XM Holdings (SIRI), Symantec (SYMC), General Electric (GE), Roku (ROKU), Twitter (TWTR), Huya Broadcasting (HUYA), Advanced Micro Devices (AMD), Marvell Technology Group (MRVL), and RIG.

SYMC and SIRI have been assigned to me after the downturn in October. MO was assigned to me at $60, after it dropped like a rock from $65 to $53 on the back of some news from the FDA. GIS dropped from $44 to $37 throughout December. ROKU additionally fell to me throughout the December downturn. To respect everybody’s time, I’ll at all times discuss much less in regards to the choices that expired and a bit extra in regards to the exercised shares by giving a fast funding thesis and worth goal.

SIRI: I’m bullish on the Pandora merger. I imagine the stock is undervalued at my entry at $6. It has misplaced a Pandora’s value of market cap since asserting the merger. My goal worth for the stock is $7.75. I’ll promote coated calls at $6.50 / $7.00 for some further premium. I’ve added $70 in coated calls since proudly owning the stock. The highest analyst estimate on the Street is $8.00.

SYMC: I’m bullish on the expertise safety sector basically. I imagine SYMC is best-in-breed in that sector. I used to be barely involved about their lack of cell presence however was glad to be taught in regards to the acquisition of a company that does just that. I feel the drop from $29 to $19 in a day on an audit investigation was crazy. My goal worth for the stock is $30. I’ll promote coated calls at $23+ for some further premium. I’ve added $36 in coated calls since proudly owning the stock.

MO: I’m bullish on the corporate administration. I needed so as to add firms to the portfolio I felt have been undervalued and prepared for the following recession. MO ended up being one of many main names I appreciated for that. The stock has fallen arduous on FDA information and hefty acquisition costs. While I’ve been promoting coated calls on SIRI and SYMC, I’m much less seemingly to do this right here, as MO’s dividend development has been nice and (extra importantly) it’s up to now under my entry worth, it’s not value it till it recovers nearer to my entry.

GIS: Recession-proof with a 5% yield at my entry worth. The firm’s debt load appears manageable primarily based on free money movement. While I do assume it overpaid for Blue Buffalo, I respect its efforts to develop. Based on forecasts from administration, I feel the dividend ought to resume development in 2020. I’ll promote month-to-month coated calls on this in 2019 beginning at $42.50-45.

ROKU: The riskiest of the names. Simply put, I imagine it’s the way forward for TV. While I’m aware that my beliefs in regards to the future don’t essentially justify a great stock, I feel firm administration has actually delivered each quarter since coming public. Going to $77 was manner too far, too quick, and I’m glad to have gotten it the place I did. I do plan to promote month-to-month calls on this identify. Because of its excessive development potential, I can get a a lot larger strike worth for my desired 1% premium. ROKU at present trades round $31, and the January 25th $40.5 name is at present going for $0.40. I’ll most likely look to execute that on the primary buying and selling day of 2019.

The Overall Portfolio

Three ultimate tables to summarize every little thing. First, the general efficiency damaged down by yr:

(Source: Author’s Chart)

Dividends and choices premiums in 4Q propelled the portfolio to outperform the S&P 500 with dividends reinvested (-3.78% to -4.38%), though that is hardly a victory lap. I proceed to be taught lots about myself and my very own biases two years into investing. I’m excited for 2019.

Second, the dividend and choices 2018 recap:

(Source: Author’s Chart)

Red: Stock bought.

Gray: Did not personal the stock these months.

And lastly, the anticipated dividend outlook in 2019:

(Source: Author’s Chart)

2019 Outlook

While I’m “in the red” my first two years within the market, I’ve discovered lots. Losing 5.39% in 2017 (a yr through which the S&P 500 gained 21.83%) was my very own inexperience, as I acquired my ft moist. I imagine I solely owned 6 shares in whole, with $10,000 / $35,000 being given to CBL. In 2018, the portfolio misplaced 3.78% (with dividends and choices premiums) and the S&P misplaced 4.38% (adjusted for dividends)

For 2019, I’m carrying $8,300 in money into the brand new yr. I might count on one other $11,000 in contributions in 2019 from my “side gigs”, which can take the portfolio contributions to $100,000. The $4600 in anticipated dividends will stay within the account. My sport plan in the mean time is to construct the index funds portion as much as a way more substantial and significant portion of the portfolio.

One factor I’m being aware of is just not being caught flat-footed in a hypothetical full-fledged bear market with no money to place to work. I nonetheless assume the S&P 500 ends 2019 nearer to 2700 (+8% from the shut of this yr). 2350 is a stage that values the S&P 500 at a 14.5 a number of with 0% development in 2019. That’s a “worst-case scenario” valuation, in my eyes. I feel China-US tensions will get resolved in a smaller deal than POTUS needed however will nonetheless permit him to say “victory”. That, in and of itself, ought to push the market larger.

I’m nonetheless curious as to how others deal with “cash” for attainable bear market downturns. I might think about some of us making ready for a bear market however then it does not come.

Finally, my spouse and I are planning on shopping for our first home, and now we have been stockpiling money for a 40% down cost. So, the contributions to the account in 2019 are more likely to be a lot lower than in 2018 and 2017.

Tracking My Portfolio Progress

Here are all of my portfolio updates so far within the occasion anybody is interested by how the portfolio has been formed over time. I’ll (in time) ultimately go away the final 8 quarters right here.

2018: 1Q // 2Q // 3Q and 4Q (this text)

Disclosure: I’m/we’re lengthy VOO, QQQ, IJR, VEA, VWO, FLCH, VCLT, OHI, LADR, STAG, MO, ACC, CIO, ARCC, VER, IRM, APLE, DEA, GIS, ROKU, SIRI, CBL, SYMC. I wrote this text myself, and it expresses my very own opinions. I’m not receiving compensation for it (apart from from Seeking Alpha). I’ve no enterprise relationship with any firm whose stock is talked about on this article.

[ad_2]