[ad_1]

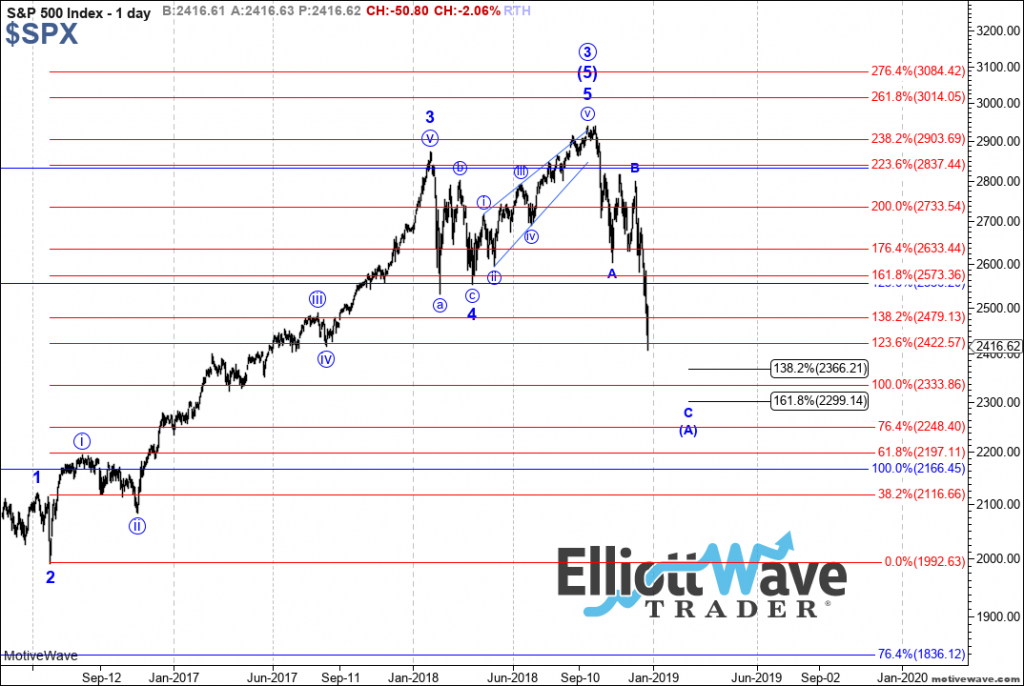

I do know of no different evaluation methodology that gives higher context to understanding the market than Elliott Wave evaluation. Back within the 1930s, R. N. Elliott theorized that markets transfer by 5 waves in a main pattern, and three waves in a corrective pattern. So, when a five-wave construction is nearing completion, you’ve the context throughout the market to have the ability to put together for a reversal of the pattern.

When the S&P 500

SPX, -1.06%

approached the 2,900 area as we moved into the autumn of 2018, we started to put together our subscribers for what to anticipate as soon as this third wave off the 2009 low completes. In truth, for the month earlier than we topped, I added a warning on the finish of each weekend replace about how shut we have been getting to the highest of wave 3 off the 2009 lows, with our expectation to drop to the 2,100-2,200 area for the fourth-wave correction we anticipated to see as soon as the third wave accomplished. And, as soon as the 2,880 area broke as assist, I famous that the dangers have been usually not well worth the rewards for any additional rally to new highs within the market, as the larger goal resided decrease.

So, now that the Nasdaq index

COMP, -0.62%

has dropped greater than 20% off its highs, everyone seems to be speaking in regards to the “bear market” of 2018. But, I’ve at all times discovered it to be fairly ineffective to label a 20% decline as a bear market. Labeling it as such solely makes individuals extra bearish than they need to be. In truth, we are actually nearer to the tip of the “bear market” than the start. Therefore, labeling it a “bear market” presently is actually counterproductive. But I digress.

Based upon the motion now we have seen this previous week, I don’t suppose the a-wave now we have been monitoring is but accomplished, and we possible nonetheless have decrease to go. At a minimal, I would wish to see one other fourth and fifth wave develop earlier than I may even contemplate a bottom being struck within the a-wave of wave 4. And, as you possibly can see from the attached 5-minute chart, we are able to even see two extra fourth and fifth waves earlier than a bottom is struck on this a-wave off the all-time market highs. This suggests a goal of 2,250-2,335 for the bottom of the a-wave.

As the market has dropped down towards the targets now we have had for this decline, we’ll proceed to monitor the construction by the usage of our Fibonacci Pinball methodology of Elliott Wave evaluation. Most particularly, because the market strikes down, we’ll proceed to decrease the market pivot, which maintains a cap on the market for corrective rallies.

I’m now additional decreasing S&P resistance to the 2,470-2,530 area. As lengthy because the market maintains beneath that resistance on its subsequent “bounce,” I’m trying for the market to drop down to the 2,335 area, which might mark the conclusion of this a-wave of the larger-degree fourth wave.

Should the S&P proceed down to the 2,335 area, resistance can be lowered to the 2,470 area, and will decide if we drop additional towards the 2,250-2,300 area for a deeper a-wave, or if the a-wave has accomplished. Once the a-wave does full, I might be trying for a rally again up towards a minimum of the 2,700 area, however extra possible pointing us again up towards the 2,800 area, and probably even increased.

I additionally need to point out the potential situation whereby we’re already within the c-wave down within the market, as offered in yellow on the daily chart. I went by this potential intimately final week, so I don’t have to handle the small print once more this time. But, if the market drops immediately to the 2,200-2,250 area within the coming weeks, this can turn into a a lot stronger various.

As you possibly can see from the daily chart, we are actually only some hundred factors from the highest of our long-term fourth-wave goal we set even earlier than this correction started. So, now isn’t the time to “begin” getting bearish. Rather, now could be the time we must always start trying for “bottoming” indicators within the coming weeks. While my choice is for that bottoming to be an a-wave inside wave 4, I’m sustaining an alternate that we could full this fourth wave sooner than I had initially anticipated, as outlined by the yellow various on the daily chart. Price motion would be the determinative issue, as defined final weekend.

As we strategy our bottoming goal, I’m going to be trying for clear bottoming indications within the technicals as we type yet one more 4-5, and probably two extra 4-5’s into this bottoming goal (offered in purple). In different phrases, the fourth-wave bounces outlined on the five-minute S&P chart ought to start to develop constructive divergence setups within the MACD on a minimum of the 60-minute chart, and ideally even on the daily chart. When the technicals line up with our sample right into a bottoming goal, that can be what we’d like to see within the coming weeks to alert us to an impending change of pattern within the market for a possible b-wave rally of 400+ factors. Until such time, the market can proceed to prolong decrease.

The worse-case quick situation means that the S&P will get turned down on the 2,470 area twice within the coming months, and completes all the c-wave of wave 4 sooner moderately than later down into the 2,100-2,200 area. This would full wave 4, and kick off the fifth-wave rally to 3,200+ (offered on the attached monthly chart) by the second quarter of 2019. For now, my choice stays bottoming within the a-wave between 2,250 and 2,335 on the S&P, and rallying again to a minimum of the 2,700 area. But, as I famous, the market has to start offering us with bottoming indicators to assist this angle within the coming weeks.

In conclusion, now we have to always remind ourselves that fourth waves are essentially the most variable inside Elliott’s 5-wave construction, and present us with a really treacherous setting. So whereas I can be trying for one other bounce within the coming week primarily based upon the proposed path famous on the five-minute SPX chart, the commonality of patterns recommend that our “bottoming” goal resides between the 2,250-2,335SPX area within the coming weeks. The foremost higher resistance proper now could be at 2,520-30, and will drop down to the 2,470 area as soon as we strike 2,335.

With the market getting nearer to our long-term goal for this fourth wave, and as the remainder of the market begins to acknowledge and embrace a “bear market,” I’m going to start trying for robust indications of bottoming as we strategy the 2,250-2,335SPX area. But, till the market makes it clear that the a-wave will bottom inside our best goal zone, or till it breaks out by our market pivot, strain will stay down, and the lengthy aspect will proceed to stay harmful.

I need to take this chance to want you and your households a really pleased, healthy and secure vacation season.

See detailed charts illustrating the wave counts on the S&P 500.

Avi Gilburt is a broadly adopted Elliott Wave technical analyst and founding father of ElliottWaveTrader.net, a stay Trading Room that includes intraday market evaluation on U.S. indexes, shares, treasured metals, power, foreign exchange, and extra, together with an interactive member-analyst discussion board and detailed library of Elliott Wave schooling.

[ad_2]