Investors are buzzing with excitement over Smartsheet Inc. (NYSE:SMAR) as the Bellevue-based software company finds itself at the center of acquisition interest from major buyout firms. According to a recent Reuters report, Smartsheet is in talks with investment bankers at Qatalyst Partners to assess various approaches from private equity firms keen on acquiring the innovative work management platform. Smartsheet, known for its robust collaboration and work management tools, has positioned itself as a formidable alternative to traditional spreadsheets like Microsoft Excel. The news of the potential acquisition comes on the heels of a strong financial performance in the first quarter of fiscal 2024. Smartsheet reported a 20% year-over-year increase in revenue, reaching $263 million. Let us take a closer look at Smartsheet’s business and evaluate the various factors that make it an attractive buyout target.

What does Smartsheet do?

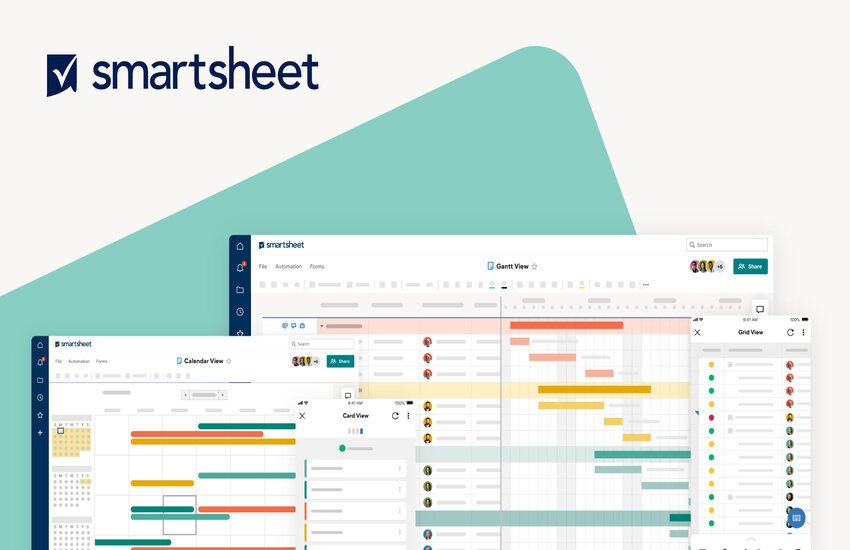

Smartsheet Inc. offers a comprehensive enterprise platform designed to plan, capture, manage, automate, and report on work for teams and organizations. Their product suite includes a range of tools such as Dashboards, Cardview, Grid, Reports, Projects, Calendar, Forms, Automation, and Integrations. The company also provides WorkApps, enabling customers to create user-friendly applications; Smartsheet Advance and Safeguard for enhanced capabilities and security; Connectors for embedded integrations with leading industry systems; Control Center for consistent work execution across organizations; and Dynamic View for secure collaboration with vendors. Additionally, Smartsheet offers Data Shuttle for seamless data transfer between Smartsheet and other systems; Bridge for building intelligent workflows and automating processes across platforms; Resource Management for efficient planning and allocation of resources; and Brandfolder, a digital asset management solution. Their app offerings also include Calendar, Pivot, and DataMesh for enhanced functionality. The company diverse sectors such as aerospace, automotive, biotechnology, consumer, e-commerce, education, finance, government, healthcare, IT and professional services, marketing, media, non-profit, publishing, software, technology, and travel.

Robust Customer Expansion

One of the primary drivers for potential acquirers taking an interest in Smartsheet is the robust expansion of its customer base. As detailed in the latest earnings call, Smartsheet has seen significant growth in its annualized recurring revenue (ARR), reaching $1.056 billion with over 14.7 million users. Notably, the company now boasts 72 customers with ARR exceeding $1 million, a 50% increase from the previous year. This growth extends not only to the quantity of users but also to different industries and geographic areas. For instance, a major global media and entertainment company has expanded its use of Smartsheet across multiple regions, including the U.S., Hong Kong, and Singapore. This company's adoption of premium features like Data Shuttle and Dynamic View has seen remarkable growth, doubling and tripling in use, respectively. Additionally, Smartsheet's success in securing large enterprise deals, such as with a prominent technology and consumer electronics company in EMEA, underscores its ability to cater to high-scale, data-intensive operations. The firm's partnerships with notable enterprises, including Nestlé Purina, Ross Stores, and Sephora, highlight its penetration into diverse sectors, further solidifying its market position. This expansive growth trajectory across various dimensions indicates a strong, sustained demand for Smartsheet's solutions, positioning it well for continued revenue and user base expansion.

Innovative Product Offerings

Smartsheet's innovative product offerings are another key factor responsible for the company fielding buyout interest. The company's continuous development and introduction of new features and tools demonstrate its commitment to enhancing user experience and meeting evolving business needs. The rollout of new capabilities like the Timeline View, which allows users to organize work visually on a horizontal timeline, and the upcoming Board View, a modern Kanban solution, are significant upgrades. These innovations are designed to provide superior visibility and ease of use, which are essential for agile work management. Furthermore, Smartsheet's AI-driven tools, such as the Smartsheet AI and Analyze Data, empower users to generate business logic and insights with simple prompts, significantly reducing manual effort and enhancing data-driven decision-making. The company's strategic enhancements in pricing and packaging, slated to be launched soon, aim to increase the accessibility of its comprehensive feature set to a broader user base while providing greater control and transparency to administrators. This shift from a paid creator model to a more inclusive approach is expected to drive higher virality and user engagement. Smartsheet's focus on continuous innovation and user-centric improvements ensures its platform remains competitive and attractive, fostering long-term customer loyalty and adoption.

Strategic Partnerships and Collaborations

Strategic partnerships and collaborations form a crucial driver for Smartsheet's potential acquisition. The company's collaboration with industry giants like KPMG exemplifies its ability to integrate deeply into enterprise workflows, enhancing client delivery experiences. This partnership has led to the development of a standardized service delivery solution, enabling KPMG and its clients to track and manage value realization on strategic business transformation projects. Additionally, Smartsheet's engagement with the International Olympic Committee for organizing the 2024 Paris Summer Olympics illustrates its capability to handle large-scale, complex events, positioning it as a reliable and scalable solution for major global organizations. The integration with Amazon Web Services (AWS) highlights Smartsheet's role in standardizing processes and creating a central source of information, thereby driving productivity and collaboration across teams. Furthermore, Smartsheet's active participation in industry events, such as the EMEA ENGAGE Customer Conference, where it showcased its role in enhancing collaboration with Bayer Crop Sciences, reinforces its influence and presence in the market. These strategic partnerships not only validate Smartsheet's platform capabilities but also expand its reach and impact across various sectors, ensuring sustained demand and adoption of its solutions. Such collaborations are instrumental in driving Smartsheet's growth, contributing to a stronger market position and increased investor confidence.

Final thoughts

Source: Yahoo Finance

We can see Smartsheet’s stock skyrocketing after the rumors of the company fielding buyout interest started spreading. While Smartsheet has not yet decided whether to pursue a sale or remain independent, the heightened interest from private equity firms reflects a broader trend of aggressive deal-making in the technology and services sectors. The company’s valuation with an LTM EV/ Revenue multiple of 6.05x appears to be steep especially given the fact that it has a negative EBITDA. Many would believe that for investors, this potential buyout could signal a lucrative opportunity but we see a lot of uncertainty around Smartsheet as the market speculates on the future trajectory of its stock. Given this backdrop, we believe that Smartsheet’s stock is best avoided at current levels.