US stocks fell on Monday as Wall Street entered a pivotal week dominated largely by expectations for a Federal Reserve rate cut. After notching gains to close out last week, markets opened this week on shakier footing, with sentiment shaped by caution.

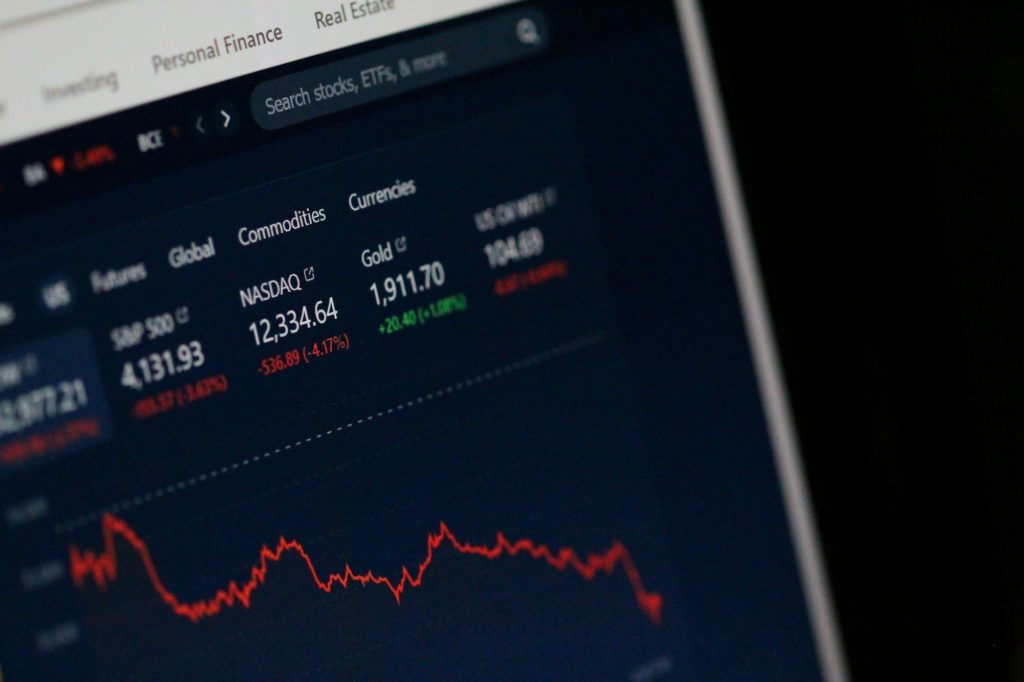

The Dow Jones Industrial Average fell roughly 0.5%, the S&P 500 slid 0.3%, and the Nasdaq Composite hovered near flat. The pullback came as investors positioned themselves ahead of Wednesday’s decision, with market participants weighing softer inflation data, mixed labor indicators, and growing debate over the Fed’s longer-term policy path.

Market Movers:

- Wave Life Sciences (WVE) +86% – Shares skyrocketed after the company unveiled encouraging Phase 1 data for its obesity therapy WVE-007. Investors were particularly bullish on early evidence of durable fat reduction and muscle preservation, supporting hopes for infrequent dosing and strong differentiation from existing GLP-1 treatments.

- Confluent (CFLT) +29% – Stock surged on reports from The Wall Street Journal that IBM is in advanced talks to acquire the data-streaming platform for roughly $11 billion. The deal would enhance IBM’s hybrid cloud and AI ecosystem by securing real-time data infrastructure critical to modern enterprise computing.

- Carvana (CVNA) +8% and CRH (CRH) +5% – Both companies gained after being added to the S&P 500 index, effective Dec. 22. The inclusion reflects rising investor confidence and typically prompts buying from index funds that track the benchmark.

- Warner Bros. Discovery (WBD) +6% – Shares rallied after Paramount launched a $108 billion hostile takeover bid, offering a massive premium over Warner Bros.’ undisturbed trading level. The move complicates Netflix’s competing acquisition agreement and injects fresh uncertainty into the media consolidation landscape.

- Marvell Technology (MRVL) -7% – Shares slid after a downgrade from Benchmark, which argued the company has likely lost key next-generation Trainium chip design wins at Amazon to rival Alchip. Analysts said this undermines Marvell’s 2026 growth trajectory despite management’s assurances.

- Unilever (UL) -7% – The stock dropped after the company completed the spinoff of its ice-cream division into the newly formed Magnum Ice Cream Company. The demerger structure shifted shares directly to Unilever investors, sparking volatility as markets reassessed the company’s slimmed-down profile.

- CoreWeave (CRWV) -6% – Shares dipped after the Nvidia-backed cloud provider announced a $2 billion private convertible-note offering, raising concerns about future dilution. The company plans to offset share-pressure through capped call transactions, but the size of the issuance still rattled investors.

Fed Week Dominates Market Psychology

With the Fed’s final policy meeting of the year beginning Tuesday, traders have largely concluded that Wednesday will deliver a 25-basis-point cut — the third reduction of 2025. According to CME FedWatch, the probability of a cut now stands near 88%, up sharply from a month ago as softer inflation and incremental labor-market weakness filtered into forecasts.

Still, policymakers remain divided. Some Fed officials emphasize lingering risks around inflation that remains above target, while others argue that labor-market cooling warrants additional easing. The tone of the Fed’s statement and updated economic projections may ultimately matter more for markets than the cut itself.

Labor Market and Inflation Data Back in Focus

Tuesday’s long-delayed October JOLTS report will provide new insight into job openings, layoffs, and worker quit rates — information that has been missing since the government shutdown disrupted data releases. Investors are watching closely for signs that hiring continues to cool without tipping into outright contraction.

Friday’s PCE inflation update, the Fed’s preferred gauge, remains the week’s other major event. Last month’s soft reading helped fuel the current rate-cut conviction, but any upward surprise could challenge the prevailing market narrative.

Corporate Headlines Drive Individual Moves

Merger intrigue took center stage in the media sector after Paramount launched a surprise hostile takeover bid for Warner Bros. Discovery, aiming to outmaneuver Netflix’s tentative acquisition. Meanwhile, Carvana’s S&P 500 inclusion underscored its dramatic turnaround, and eyes are on Oracle and Adobe earnings later this week for clues about enterprise software spending.

Looking Ahead

Markets now enter a stretch where clarity from the Fed may dictate whether the recent rally continues or stalls. A widely expected rate cut won’t surprise investors — but the committee’s forward guidance, economic projections, and tone will shape expectations for 2026 and determine how risk assets finish the year. The week’s data flow, from JOLTS to PCE, will either reinforce confidence in a soft-landing narrative or reignite fears of persistent inflation. With volatility likely to rise around Wednesday’s announcement, traders are preparing for a pivotal few days that could reset the market’s direction heading into the new year.