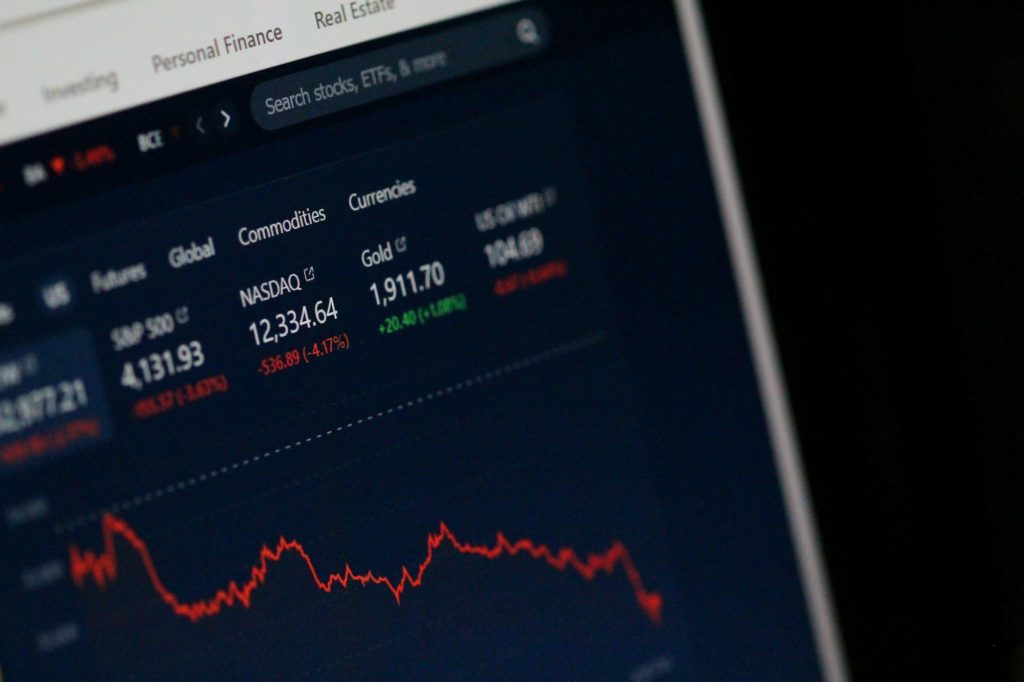

US stocks were lower on Thursday as investors digested fresh economic data that complicates the Federal Reserve’s path on interest rates. The Dow Jones Industrial Average (DJI) slipped 0.2%, the S&P 500 (GSPC) lost 0.4%, and the Nasdaq Composite (IXIC) dropped 0.5% by midday.

Markets are digesting a steep upward revision to second-quarter GDP and a surprise dip in jobless claims. While both signal resilience in the US economy, they also threaten to delay further Fed rate cuts, sparking renewed caution across equities.

Market Movers:

- Tesla (TSLA) fell nearly 3% after European sales slumped for the eighth straight month in August. EV registrations dropped more than 22% year-over-year, highlighting Tesla’s weakening position against rising Chinese competition and waning consumer sentiment toward Elon Musk’s brand in Europe.

- Costco (COST) dipped ahead of its earnings report due after the bell. Analysts expect strong same-store sales growth, but the wholesale retailer faces pressure from tariffs and heightened competition from rivals like Amazon and Walmart’s Sam’s Club, raising questions about its near-term performance.

- Lithium Americas (LAC) surged more than 16% as the Trump administration considers taking a stake in the company’s massive Nevada mining project. The proposed mine could become the largest lithium producer in the Western Hemisphere, a key resource for EVs, making the company a strategic target for US industrial policy.

- CoreWeave (CRVW) rebounded after announcing a $6.5 billion deal with OpenAI to provide additional cloud infrastructure. The agreement builds on earlier multibillion-dollar contracts and underscores the cloud provider’s critical role in powering next-generation AI systems.

- Intel (INTC) gained 7% on speculation of a potential investment by Apple. While analysts remain skeptical of a deep collaboration, investor optimism was buoyed by the prospect of Intel securing new partnerships following a $5 billion investment from Nvidia and a $9 billion injection from the US government.

- Oracle (ORCL) dropped nearly 5% after Rothschild & Co Redburn initiated coverage with a Sell rating. The analyst argued that expectations for Oracle’s cloud business are overly optimistic, warning the market is pricing in “a risky blue-sky scenario” unlikely to materialize.

Fed Divide Widens

Comments from Federal Reserve officials are keeping investors on edge. Chicago Fed President Austan Goolsbee and Kansas City’s Jeff Schmid both signaled unease about cutting rates further, citing inflation risks. Meanwhile, newly appointed Fed Governor Stephen Miran pushed for more aggressive easing, arguing that current rates remain too restrictive. The public rift underscores growing uncertainty about whether policymakers can deliver more than one additional cut this year.

Economy Shows Mixed Signals

Fresh data showed jobless claims unexpectedly fell to 218,000 last week, suggesting labor market strength despite ongoing recession fears. At the same time, US GDP for the second quarter was revised sharply higher to 3.8% from a 0.6% contraction in Q1. While both reports highlight resilience, they also complicate the Fed’s balancing act: too much growth could keep inflation sticky, delaying rate relief investors have been counting on.

Housing and Consumer Landscape

Housing remains under pressure as high prices and only modest mortgage rate relief keep buyers on the sidelines. August existing home sales slipped 0.2%, putting the market on pace for another year near three-decade lows. Meanwhile, Costco’s upcoming results will serve as a key barometer for consumer strength as shoppers hunt for value in an uncertain environment. Analysts expect solid sales growth, though Amazon’s aggressive expansion in same-day delivery is testing Costco’s edge.

Looking Ahead

Friday’s release of the August Personal Consumption Expenditures (PCE) index will be closely watched as the Fed’s preferred inflation gauge. A softer print could revive hopes for rate cuts later this year, while a hot reading might force policymakers to hold firm. Corporate earnings and fresh data on consumer spending will further guide markets as September trading winds down.