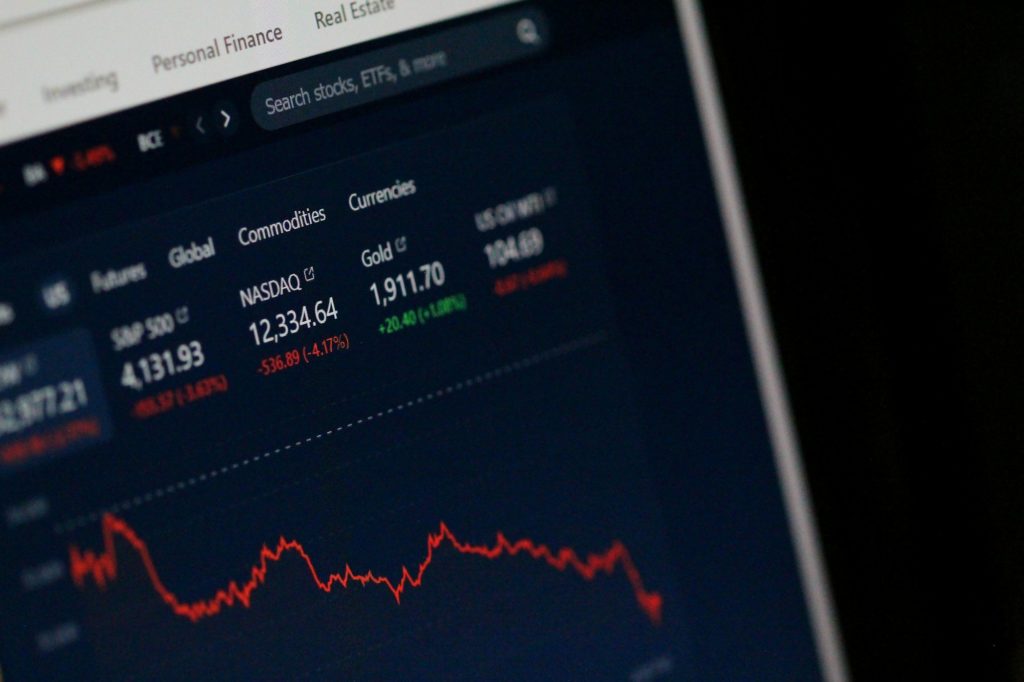

U.S. stocks slipped on Wednesday as technology shares continued to face selling pressure, leaving the Nasdaq Composite down. The Dow Jones Industrial Average (DJI) was mostly flat, while the S&P 500 (GSPC) fell roughly 0.4%. The tech-heavy Nasdaq (IXIC) dipped 0.9%, reflecting growing investor caution around questions about the sustainability of the AI-driven rally.

After strong gains in prior sessions, traders are reassessing risk exposure, rotating away from high-growth tech names toward sectors considered safer, while awaiting upcoming Federal Reserve minutes for clues on interest-rate policy. Retail earnings reports are also keeping the market on edge, as investors monitor the impact of tariffs and trends in consumer spending.

Market Movers:

- Palantir (PLTR): -3.41%: Palantir continued its decline following steep losses the previous day. Investor concerns center on the company’s growth trajectory and the ability to maintain momentum in government and enterprise contracts. Analysts are watching to see whether the recent pullback represents a buying opportunity or a deeper correction in the tech sector.

- Nvidia (NVDA): -1.19%: The AI chipmaker dipped slightly amid a broader tech sell-off. While demand for Nvidia’s GPUs remains strong, rising competition and concerns over profit sustainability prompted some investors to trim positions.

- Broadcom (AVGO): -1.82%: Broadcom shares fell as investors weighed global economic uncertainties against strong demand for networking and semiconductor products. The company’s performance is being closely watched for indications of how tariffs and geopolitical tensions could impact tech supply chains.

- Target (TGT): -7.19%: Target reported a slight profit beat but warned that tariffs and pressure on consumer spending may weigh on future quarters. The announcement highlights ongoing challenges in retail and contributed to a significant drop in its stock.

Retail Earnings Spotlight

Retailers have taken center stage in market movements this week. Target’s cautious commentary illustrates the pressures of tariffs and rising costs, while Walmart’s results on Thursday will provide additional data points on how major chains are managing inventory, labor, and consumer behavior. Analysts are looking for signs of whether the U.S. consumer is starting to pull back or if spending will remain resilient despite macroeconomic headwinds.

Fed Watch: Market Eyes Policy Signals

Investors are also focused on the Federal Reserve, with the upcoming release of minutes likely to influence market direction. After recent economic data tempered expectations for aggressive rate cuts, traders are hoping for clarity on the Fed’s approach to interest rates. Any signals regarding inflation management or adjustments to monetary policy could trigger further market swings, especially in the tech sector.

Geopolitical and Economic Drivers

Additional factors contributing to market volatility include trade policy developments and ongoing tariff considerations. Investors are evaluating the broader economic impact of tariffs on both technology companies and retailers. These concerns, combined with mixed economic data, are adding complexity to portfolio management strategies in the current environment.

Looking Ahead

Markets are likely to remain sensitive in the coming sessions as traders balance retail earnings, tech sector movements, and Fed signals. While tech stocks face short-term pressure, defensive sectors may attract attention for stability. Investors will continue monitoring corporate guidance, economic indicators, and policy developments for direction through the rest of the week.