2018’s Stock Market Volatility | Seeking Alpha

The fourth quarter spike in fairness market volatility is primarily the results of the US-China commerce negotiations throughout a multi-year rate of interest normalization program designed to reverse the unprecedented central financial institution lodging from 2008 to 2016. In addition, secondary components together with slowing overseas economies, Brexit, the US Government shutdown and a very tight Federal Reserve have created a volatility occasion in December which High Frequency Traders1 “HFT” have exacerbated leading to a monetary panic. The US fairness markets started the yr in a equally risky trend with rising rates of interest prompting a dramatic February fairness market rout. The early 2018 stock market pullback was slowly reversed by larger earnings from decrease company taxes, earlier than the fourth quarter’s 14% decline.

The exceptionally sharp fourth quarter decline is a “volatility event” the place technical [read-computer driven and HFT] components amplify momentary fears which can show immaterial to the markets’ health six months later. We don’t count on the US slipping right into a recession, a commerce conflict with China, extreme tightening by the Federal Reserve, Brexit or the US authorities shutdown to meaningfully influence international development.

If the US-China commerce relationship is restructured to cease China’s mental property theft and compelled know-how transfers, the outcomes will stimulate international development and trigger international markets to rebound. President Trump and President Xi’s G-20 summit resulted in an settlement to halt extra tariff will increase and work towards a extra everlasting commerce deal over the subsequent 90 days ending March 2. Equity markets will proceed to consolidate and rebound as these negotiations transfer towards settlement. We imagine that the world’s two largest nations perceive that it’s of their mutual greatest curiosity to resolve their dispute. This uncomfortable perspective relies on the extra horrifying precedent of Mutually Assured Destruction “MAD” which has stored the United States and Russia from utilizing nuclear arms to destroy one another. In each circumstances, failure to resolve variations can be so disastrous {that a} decision is crucial.

US Equity Markets Are Attractively Priced:

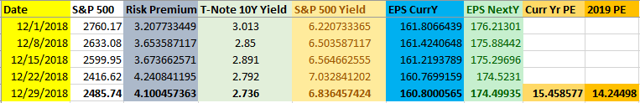

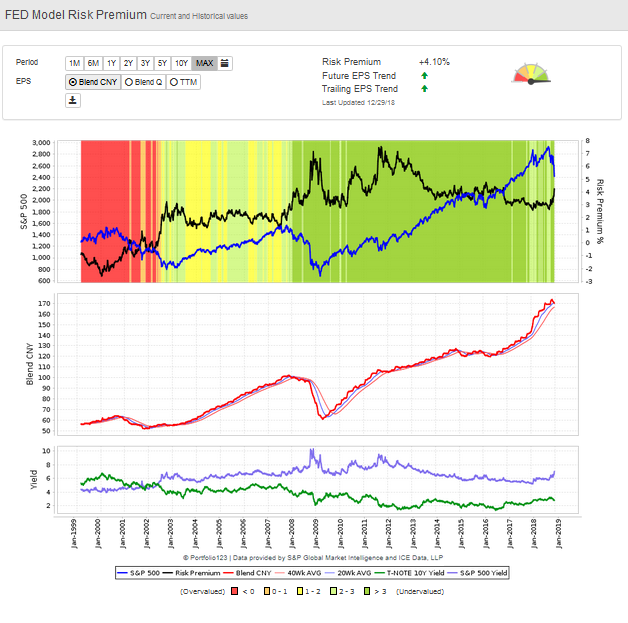

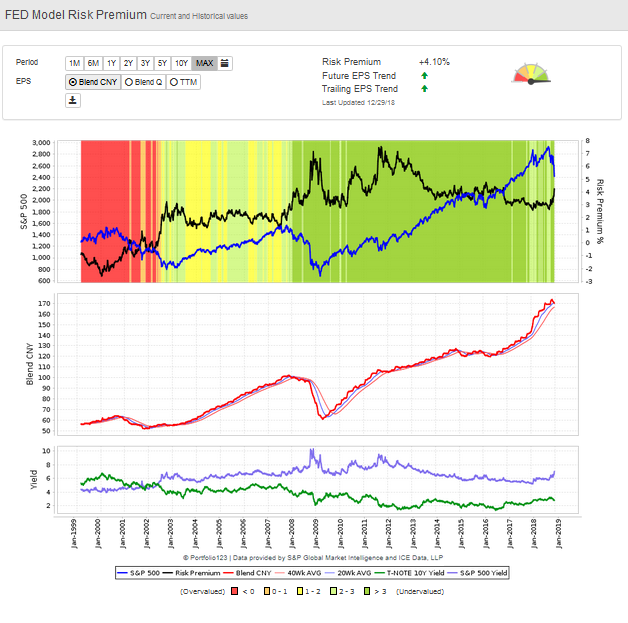

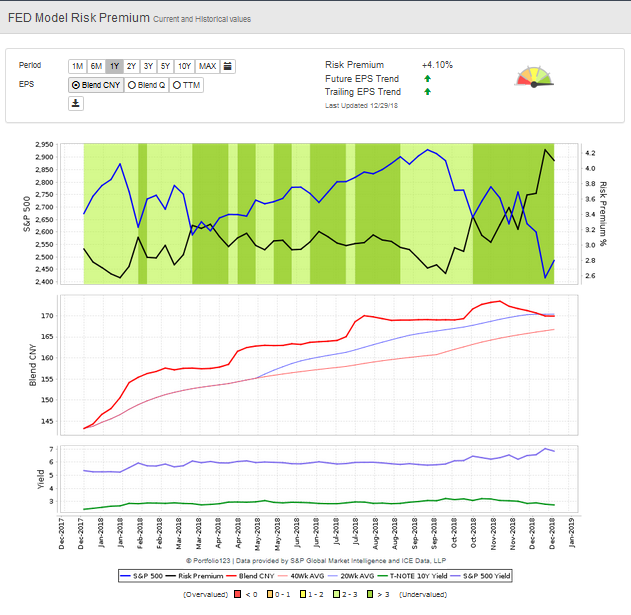

The desk under exhibits the S&P 500 earnings yield is 6.86% and the 10-year Treasury observe yields 2.736%, reflecting a better earnings yield for shares than bonds. The Fed Model’s Risk Premium2 is kind of engaging at 4.1%. Further, the S&P 500 PE is 15.45 occasions 2018 S&P 500 earnings and 14.24 occasions 2019 earnings. According to Jeremy Seigel, for the final 65 years the S&P 500 has traded at a mean trailing a number of of 17 with a lot larger rates of interest.

Source: Portfolio123.com and Income Growth Advisors, LLC

The longer-term FED Model Risk Premium chart under exhibits earnings rising all through 2018 whereas the stock market has been consolidating these beneficial properties. Below the S&P 500’s earnings yield (6.83%) exceeds the 10-year Treasury Note yield (2.73%) by 4.1%–“The Risk Premium”. The Risk Premium is within the higher half of its 20-year vary, and the one actual danger can be if earnings flip down like they did in 2008.

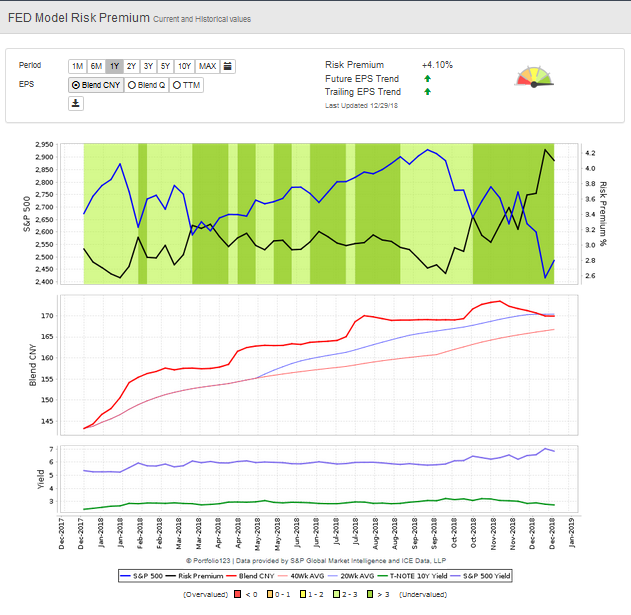

The one-year chart under exhibits the chance premium rising quickly within the prime graph because the earnings yield rose with declining stock costs and rates of interest declined as proven within the backside graph.

Source:Portfolio123.com

Buy Panic:

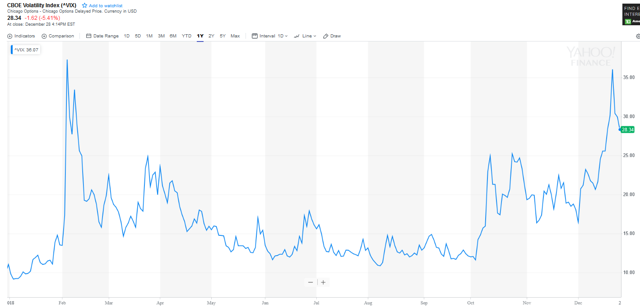

The chart under of the VIX Index exhibits that volatility has spiked to the highs of earlier this yr and seems to be in retreat. Since volatility spikes replicate a disproportionate funding in put choices, it’s a helpful goal measure of panic, which traditionally marks a pretty entry level for buyers. Of course, we assume that financial situations should not about to meaningfully deteriorate.

Source Yahoo Finance CBOE Volatility Index

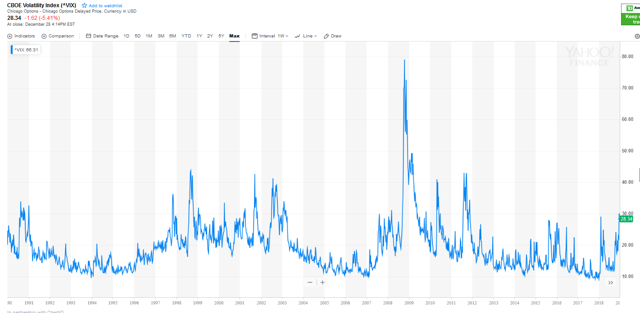

The long-term chart of volatility under exhibits that the present spike is within the higher vary of volatility ranges suggesting this was among the many bigger spikes within the final three a long time. We imagine the present volatility spike, like volatility occasions in 1990, 1998, 2010 and 2011, will be purchased as a result of the worrisome information of the day will show a non-event in six months.

Source: Yahoo Finance

Master Limited Partnerships:

MLPs have carried out poorly since 2014 when oil costs collapsed from $107 to $26. The oil market collapse pressured MLPs to de-lever, restructure and turn out to be self-funding throughout 2016-2018. During this later interval, MLPs distribution development dropped from their traditionally spectacular mid-to-high single-digit ranges to zero. Today, the US power markets have recovered. Natural gasoline and oil manufacturing has expanded to make them rising export markets. With monetary restructuring largely behind it, MLPs now provide a tax advantaged yield of 9.21% (AMZX) and may see a resumption of distribution development. As famous by Barclays “After two years of growth and balance sheet repair, 2018 will be the first year since 2015 that our coverage universe did not on the whole see dividends/distributions decline. We see 2018 at +0.8% for income and think 2019 could see 4.5%, through a combination of increases and repeatable buybacks is what will likely draw in retail.”

Because the return profile of MLPs traditionally is the sum of the present distribution yield plus the distribution development price, by including the present 9.21% yield plus a distribution development price of 4.5%, we forecast anticipated returns within the 13.7% vary. There has been 4 years of MLP underperformance in comparison with the S&P 500, however now the elemental case for MLPs once more seems strong.

However, for these anxious a couple of main stock market prime following a ten-year bull market in shares, there’s one other compelling argument for MLPs. Historically, MLPs have been negatively correlated to the foremost indexes when MLPs working fundamentals are constructive and the S&P 500 is in a bear market. This is as a result of momentum cash reallocates into protected havens like bonds and excessive yielding securities like MLPs, when capital beneficial properties are not simply present in index investing.

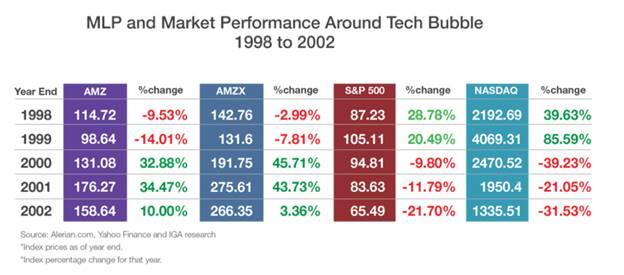

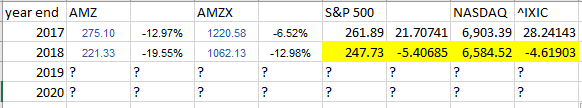

The desk under exhibits when the 2000 know-how and stock market bubble matured and reversed, MLPs had been inversely correlated to the S&P 500 and NASDAQ. In 1998 and 1999, complete returns for the S&P 500 rose 28.8% and 20.5% and the NASDAQ rose 39.6% and 85.6%, respectively. MLPs’ complete returns had been -3.0% and -7.8%, respectively.

When the stock market peaked and collapsed in 2000, 2001 and 2002 the S&P 500 and NASDAQ declined 9.8%, 11.8% and 21.7% and 39.2%, 21.1% and 31.53%, respectively. In sharp distinction, MLPs’ complete returns rose 45.7%, 43.7% and 3.36%, offering a rewarding hedge and return in that publish bubble market.

Is The Past Prologue?

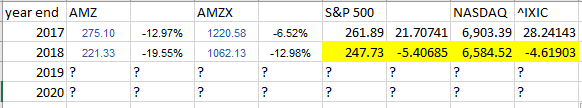

The chart under exhibits that in 2017 and 2018, MLPs had been underperforming whereas the S&P 500 and NASDAQ had been topping. Like the 2000 peak, the MLP sector is in good elementary form whereas prospects for the S&P 500 and NASDAQ seem much less sure. While we stay sanguine in regards to the S&P 500 and NASDAQ, we can’t be sure that the foremost indices will proceed their bull markets. By distinction, it seems the MLP sector has made a cyclical backside and at a minimal ought to see strength just by advantage of their outsized yields. As such, including to MLPs as a complete return and hedging funding is wise.

Source: Portfolio 123.com and Income Growth Advisors.com

We have been shopping for Kayne Anderson MLP/Midstream Investment Company (KYN) a closed finish MLP fund managed by Kayne Anderson. KYN 11.3% yield mixed with a diversified portfolio of top quality MLPs is a pretty automobile for MLP buyers.

While we stay deeply troubled by American Midstream’s distribution reduce and subsequent conduct by its General Partner (American Midstream GP, LLC) and ArcLight Capital, American Midstream Partners (AMID) simply bought its refined merchandise terminal and continues to de-lever its steadiness sheet. Further, its December 31 announcement of a debt covenant modification chopping the 4th quarter distribution to zero till the “Consolidated Total Leverage Ratio” is lower than 5.00:1.00 solely accelerates the corporate’s steadiness sheet restore. With ArcLight shopping for stock and bidding $6.10 a share, tax loss promoting abating, renewed panicked investor promoting from its curiously timed December 31 momentary distribution reduce and AMID’s closing worth of $2.99/share, a return on the order of 100% may very well be achieved within the coming 6-9 months.

Clients have misplaced badly believing AMID CEO Lynn Bourdon’s commentary3 and its shares are down 75% in 2018. More disturbing is ArcLight’s bid following the July distribution reduce, AMID’s unwillingness to take quarterly convention name questions or actually have a convention name to elucidate AMID’s 75% distribution reduce and new enterprise technique, when MLP buyers are sometimes retired fastened earnings buyers not centered on rigorously studying regulatory disclosures. So whereas we agree with Recurrent Advisors’4 and our purchasers’ disgust with administration’s conduct, we imagine AMID’s models are considerably undervalued and exactly why ArcLight is shopping for AMID.

We want you a healthy and affluent New Year.

Sincerely,

Tyson Halsey, CFA

References:

- High Frequency Traders have had sure brief sale exemptions which we imagine exacerbate the promoting and rapidity of the market’s latest sharp declines. Uptick Rule

- The Risk Premium is the measure by which the S&P 500 earnings yield exceeds the 10-year US treasury observe yield. Its 4.1% yield suggests the market is paying markets a sturdy premium to purchase shares and that they’re an particularly engaging danger in comparison with 10-year US Treasury bond notes.

- CEO Lynn Bourdon November 8 2017 AMID stock closed $13.15/unit.

- “These accomplishments underscore the support that we have had and can expect from our sponsor ArcLight Capital Partners, as we move forward.”

- “Quite frankly folks, this train is leaving the station. I hope as investors, you are as excited as we are about our future and if you stay with us or you get on board quick, because we have an exciting and successful journey ahead of us, and we’re not waiting around.” CEO Lynn Bourdon November 8, 2017 AMID stock closed $13.15/unit.

- As reported on October 10, 2018 by Bloomberg’s Rachel Adams-Heard, AMID and ArcLight’s actions seem self-interested and “egregious”.

- ESG Investopedia – Environmental, Social and Governance (ESG) Criteria

Disclosure: I’m/we’re lengthy AMID KYN. I wrote this text myself, and it expresses my very own opinions. I’m not receiving compensation for it. I’ve no enterprise relationship with any firm whose stock is talked about on this article.