ADT fined by SEC for skirting reporting guidelines

[ad_1]

Residential and industrial safety firm ADT Inc. has earned the wrath of the Securities and Exchange Commission — and a $100,000 nice — over its failure to present equal prominence to monetary measures reported below the trade commonplace as below nonstandard ones.

In accordance with SEC guidelines, corporations are obliged to report below Generally Accepted Accounting Principles, or GAAP, when presenting quarterly, annual or present monetary numbers. They are allowed to complement these numbers with sure non-GAAP metrics, however they have to give the GAAP numbers equal or higher prominence of their reporting.

ADT

ADT, -2.07%

failed to try this when it reported monetary outcomes for its fourth quarter and for fiscal 2017 on March 15, and once more when reporting first-quarter numbers for 2018, based on the SEC, as MarketWatch’s Francine McKenna and Tomi Kilgore wrote at the time.

“When including a non-GAAP financial measure in a filing with the Commission, (companies) must include a presentation, with equal or greater prominence, of the most directly comparable financial measure or measures calculated and presented in accordance with GAAP,” the SEC mentioned in an enforcement announcement ordering the corporate to stop and desist from the apply and outlining the penalty.

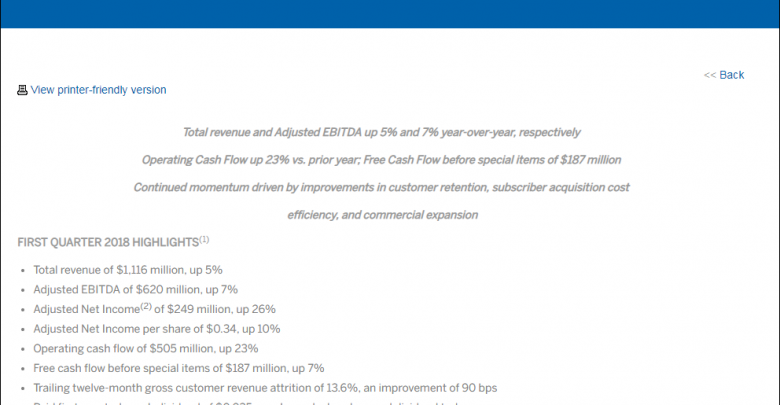

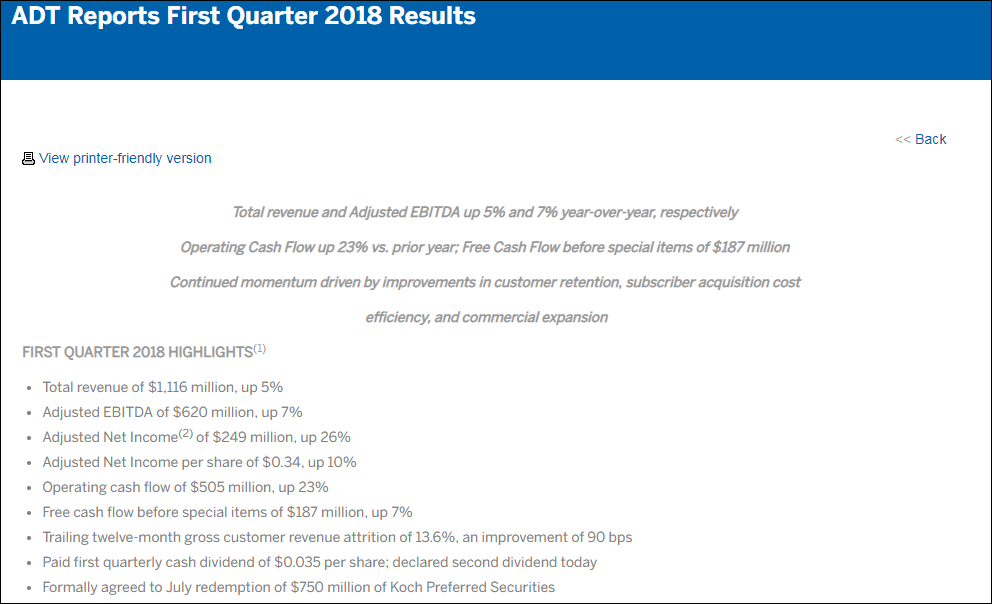

The releases in query benefit higher scrutiny, as a result of they reveal precisely why the SEC is irked by ADT’s disclosures. In the primary quarter of 2018, for instance, the preliminary numbers, described as highlights, embrace adjusted EBITDA (earnings earlier than curiosity, taxes, depreciation and amortization), adjusted internet revenue and adjusted internet revenue per share — all nonstandard metrics.

See additionally: Security company ADT’s stock slips after quarterly loss disappoints investors

Since the GAAP numbers weren’t provided on the similar time, it’s solely when readers get six paragraphs deeper into the discharge that they see the corporate really had a internet loss — of $157 million — wider than the year-earlier loss of $141 million.

“To the untrained and uncynical eye, those HIGHLIGHTS do look good,” mentioned monetary knowledge supplier Calcbench, in a weblog submit.

Concerns concerning the widespread use of non-GAAP metrics peaked in 2016 after the SEC issued guidelines reminding corporations of the foundations, as MarketWatch has reported. But most corporations proceed to offer them, alongside their GAAP numbers.

In case you missed it: Here’s how investors are duped each earnings season

Related: Investors who paid attention to GE’s accounting saw trouble coming

“The three crucial reporting principles are that a company: (a) explain why it believes its non-GAAP metric is worth including; (b) also reconcile that non-GAAP metric to the closest GAAP metric; and (c) give both GAAP and non-GAAP disclosures equal prominence in the earnings release,” because the Calcbench weblog submit explains.

ADT returned to the general public markets in January 2018 after having been taken non-public in 2016 by Apollo Global Management

APO, -0.08%

Despite posting losses and carrying a debt burden near $10 billion, analysts polled by FactSet stay bullish on ADT shares. The common ranking on the stock is purchase, with a mean worth goal of $12.83, or roughly double the present buying and selling degree.

Read now: Analysts are swooning over ADT — with one exception

ADT’s stock was down 3% Thursday and has misplaced 35% within the final three months, whereas the S&P

SPX, +0.86%

has fallen 17% and the Dow Jones Industrial Average

DJIA, +1.14%

is down 15%.

[ad_2]