Ahead Of The Curve: OLB Group to Facilitate Crypto Payments

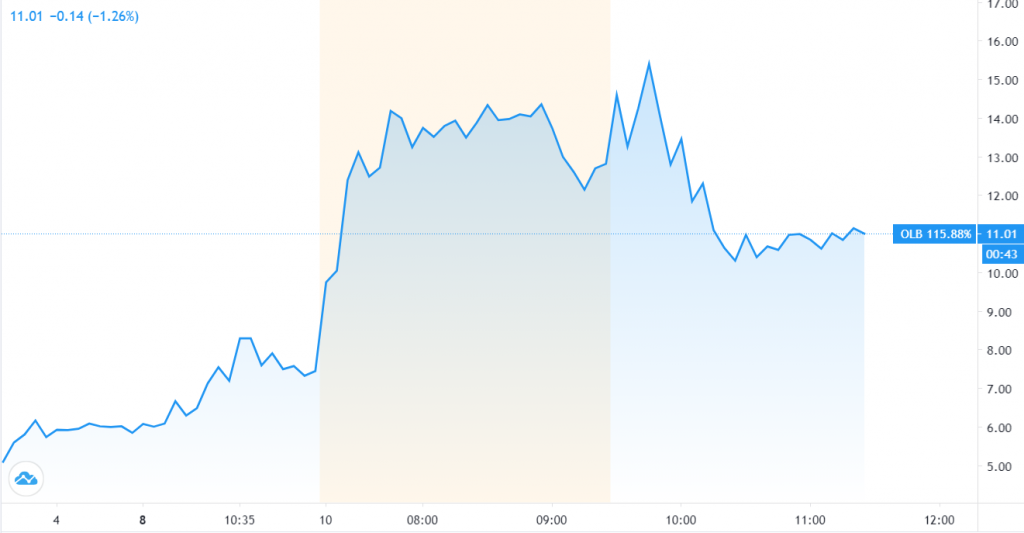

It has been a rather eventful session for investors holding the OLB Group (NASDAQ:OLB) stock. The company came out with a press release this morning announcing the adoption of cryptocurrencies onto its platform and this led to a frenzy in the market. The number of “Buy” orders for OLB’s stock surged and its stock price nearly doubled in the morning. Despite some profit-booking, the stock remains above the $10 resistance point. It is important for us to understand the update from OLB Group and what implications it has on the future of the company as well as the payment processing industry as a whole.

OLB Group’s Business – A Quick Recap

The OLB Group is a fintech company that operates a payment ecosystem for the merchant community which includes electronic payment processing, cloud-based multi-channel commerce platform solutions and crowdfunding services. It offers a variety of products and acts as a payment facilitator and commerce service provider for small and medium sized businesses. The company also provides other facilities such as order fulfillment, customer service, outbound marketing, sales reporting, and fundraising through its proprietary crowdfunding platform. It operates through 3 subsidiaries – eVance, Omnisoft.io and CrowdPay.us. The company also operates an omnichannel platform known as ShopFast which follows the Shopify business model.

OLB’s Cryptocurrency Adoption

OLB’s big cryptocurrency announcement shifted the eyes of investor community towards the stock. The management announced that it has upgraded its SecurePay payment gateway system to support a wide variety of cryptocurrencies including Bitcoin, Ethereum, USDC and DAI across all merchant platforms. This would imply that all merchants using OLB’s SecurePay gateway service or its cloud-based business management platform, Omnisoft, shall instantly have the option to accept any of these cryptocurrencies as alternative modes of contactless payment methods without bringing about any change in their existing payment acceptance hardware. OLB has made sure that its systems are wallet-agnostic and have a significant ease of integration with third-party software. This makes it very easy for customers to seamlessly pay using cryptocurrency wallets such as MetaMask, Coinbase Wallet, Crypto.com and Trust Wallets.

There is a strong underlying benefit associated with receiving crypto payments from clients. It results in an instant settlement of the transaction through the wallet and provides much more flexibility to merchants in their functioning. They can easily use SecurePay which is compatible with their mobile phones, tablet devices and other cloud-based infrastructure and is already integrated into the merchant’s existing payment ecosystems. Enabling the option to accept cryptocurrency is as simple as setting up an account on https://cryptoaccept.com. The number of merchant accounts in crypto are also expected to grow rapidly given the strong macroeconomic environment for these currencies.

Strong Macro For Institutional Crypto Adoption

Adoption of cryptocurrencies has become the new norm for large fintech giants. Square has invested heavily (close to $50 million) in Bitcoin whereas PayPal is offering the option of trading in Bitcoin, Bitcoin Cash, Ethereum, and Litecoin to its 350+ million users. This is why OLB integrating crypto into its offerings gives a highly positive message to the market that the company is advancing along the same lines as its larger fintech counterparts and this led to value being unlocked in the stock price.

It is worth highlighting that institutional adoption of cryptocurrency has extended far beyond fintech as companies like Tesla and MicroStrategy have invested heavily in crypto assets. In fact, MicroStrategy was recently in the news for converting $425 million of its cash reserves into Bitcoin as it acts as a better store of value. The total number of Bitcoins being issued has also halved resulting in a greater demand and a huge price runup. The same goes for many other cryptocurrencies. Given this background, everyday consumers having crypto wallets is expected to become very common. In fact, Fortune Business Insights data indicates that there are close to 66 million users of cryptocurrency wallets today and this number could easily double in the coming years particularly given the price appreciation and the institutional adoption of these cryptocurrencies.

Why OLB’s Bull Run Is Here To Stay?

While OLB Group’s offerings are similar to those of fintech giants like Square and Shopify, its market positioning is drastically different. OLB offers its platforms to smaller merchants such as bars, restaurants, retailers etc. that are well below the average client size of Square. It has been in the process of acquiring such merchant portfolios ever since its fundraising last year. While the average transaction size and volume of these merchants is lower than those of Square, OLB’s offering is basically taking cryptocurrency acceptance to the grassroot levels. It is also creating a solid and a viable alternative for the larger merchants to actually switch from their existing payment facilitators to OLB’s platform given this new added flexibility.

We can see that the OLB stock has doubled in the past 5 days with a large spike today after the big announcement. Needless to mention, OLB’s revenues are directly correlated to the number of merchants onboarded as well as the size and volume of transactions taking place. Adding the crypto feature is an automatic jump in these figures which is why the market perception with respect to the value of OLB changed which is what caused such a huge spike in the stock price. However, it is worth mentioning that the OLB management has been clear about its intention to acquire new and upcoming fintech technologies. Thus, it is safe to say that we can expect many such big updates from the company in the coming future.