Alphabet Just Unloaded Its CrowdStrike Stake—Is Wiz The New Security King?

Alphabet’s (NASDAQ:GOOG) CapitalG fund completed its exit from CrowdStrike (NASDAQ:CRWD), selling its remaining 74,230 shares after an earlier trim in Q1. This decisive move comes a few months after Google Cloud’s $1.9 billion acquisition of Wiz, positioning Wiz’s cloud-native vulnerability-management platform at the heart of Alphabet’s security ambitions. Rather than maintaining a passive investment in CrowdStrike, Alphabet is doubling down on in-house innovation, embedding Wiz’s agentless, AI-driven scanning directly into its AI-optimized data centers and multi-cloud tooling. But why this strong pivot towards cloud security and this urgent need to accelerate threat detection, automate remediation, and unify policy enforcement? Let us try and understand Alphabet’s clear bet on proactive, AI-first defenses that align with broader cloud-security trends.

Strategic Focus On Embedded Cloud Security

Alphabet’s sale of CrowdStrike shares and its acquisition of Wiz underscores a strategic shift toward embedding advanced security directly into its cloud stack, rather than relying on third-party integrations. By fully owning Wiz’s agentless vulnerability-management platform, Alphabet can integrate its deep telemetry capabilities—covering configuration, identity, network and workload data—into Google Cloud’s AI-optimized infrastructure. This enables real-time risk scoring and contextual prioritization, automating the identification and remediation of critical vulnerabilities before they can be exploited. Embedding Wiz at the kernel of Google Cloud also aligns with enterprise demands for “security by design,” reducing friction for developers who can now invoke security scans directly within CI/CD pipelines, Kubernetes clusters and Cloud Build workflows without additional agents or licensing complexities. The risk, however, lies in ensuring that Wiz’s platform scales reliably to meet global SLAs and matches or exceeds the feature maturity of established players like CrowdStrike, whose detection-and-response capabilities remain industry benchmarks. Alphabet must also balance internal R&D investment against potential market pushback from customers wary of vendor lock-in. Nevertheless, possessing Wiz’s IP outright gives Alphabet unparalleled control over its security roadmap, potentially accelerating feature rollouts and driving a more cohesive, end-to-end cloud security experience that differentiates Google Cloud in a crowded market.

AI-Driven Synergies Between Wiz & Google’s Infrastructure

Integrating Wiz’s vulnerability-management technology with Google’s AI stack unlocks powerful synergies, leveraging Gemini models and TPU acceleration to deliver proactive, large-scale threat analysis. Wiz collects comprehensive environmental data across hybrid and multi-cloud deployments, feeding it into AI algorithms that can predict risk exposure and recommend prioritized remediations. Running these analyses on Google’s global network of AI-optimized data centers—and using its full spectrum of TPU and GPU offerings—ensures low-latency, high-throughput inference that adapts dynamically to shifting workloads. This deep integration also enables AI-powered security assistants embedded within developer tools, automatically surfacing code misconfigurations and infrastructure drifts during the build process. Potential architectural challenges include maintaining data residency and sovereignty across geographies, ensuring that telemetry pipelines are both secure and performant, and harmonizing identity management between GCP and other public clouds. Furthermore, Alphabet must manage the balance between open-ecosystem integrations and prioritizing Wiz in its native cloud, so as not to alienate ISVs who depend on more agnostic security solutions. Even so, the combined force of Wiz’s specialized risk intelligence and Google’s AI research—processing nearly one trillion tokens monthly across products—positions Google Cloud to offer one of the most comprehensive, AI-first security platforms available today.

Competitive Differentiation & Enterprise Adoption Risks

Alphabet’s pivot from CrowdStrike equity to direct ownership of Wiz sharpens its competitive differentiation in cloud security, but also carries significant enterprise adoption risks. By embedding Wiz deeply into Google Cloud, Alphabet can offer a unified security suite that spans vulnerability management, compliance reporting and automated remediation—features that many enterprises still stitch together from multiple vendors. This all-in-one proposition can accelerate sales cycles and increase average deal sizes for GCP, especially as Wiz’s SaaS-native model aligns with modern DevSecOps practices. However, concentrating security capabilities within Google Cloud risks amplifying concerns around vendor lock-in. Customers committed to multi-cloud resilience may hesitate to adopt deeply integrated Wiz features if they perceive that moving workloads to other providers could degrade their security posture. Moreover, with Wiz now an in-house platform, any platform instability—false positives, service outages or performance bottlenecks—would directly impact Google’s reputation, whereas a diversified vendor ecosystem might diffuse such risks. To mitigate these concerns, Alphabet will need to maintain robust multi-cloud compatibility, transparent SLAs, and a clear migration path for customers who require flexibility. If it succeeds, Google Cloud could capture a larger share of the estimated $50 billion cloud-security market by bundling Wiz with its existing compute and AI offerings.

Final Thoughts

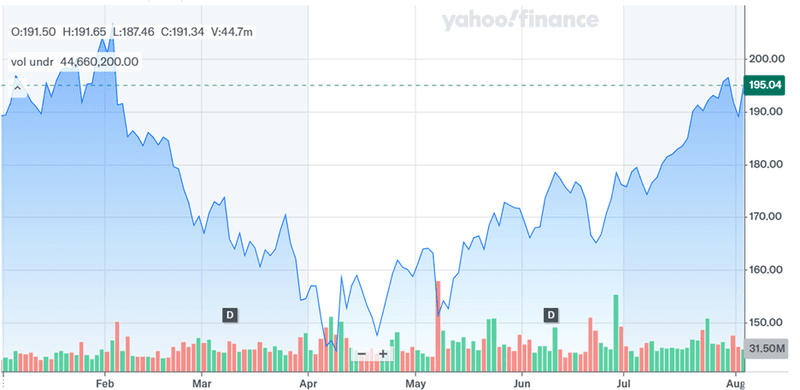

Source: Yahoo Finance

Alphabet’s stock has performed well after a solid set of earnings in the recent quarter. The company’s full exit from CrowdStrike and its focus on integrating Wiz into Google Cloud reflect a coherent effort to internalize security innovation and differentiate its cloud offerings. In terms of valuation, Alphabet’s forward NTM Price/Sales stands at 5.69x and NTM TEV/EBITDA at 12.07x, while its trailing LTM TEV/EBITDA is 16.40x and LTM P/E is 20.79x. Divesting its remaining CrowdStrike stake—approximately $30 million of proceeds—enables Alphabet to reallocate capital toward Wiz integration without altering its 2025 CapEx forecast of $85 billion for data-center expansion. This strategy promises tighter product integration, faster feature rollouts and a stronger AI-first security posture that could drive higher-margin cloud growth. Overall we believe that the cybersecurity repositioning represents a calculated bet: one that leans into Alphabet’s AI and cloud strengths but must overcome execution hurdles and market apprehension to fully validate its premium valuation.