Alphabet’s AI Revolution Is Happening Now — Here’s What Wall Street Isn’t Telling You!

Alphabet Inc. (NASDAQ:GOOGL) is intensifying its efforts in artificial intelligence, revealing a wave of innovations that could reshape not only its core services but also its competitive standing in the tech landscape. At its recent I/O developer conference, Alphabet unveiled the Gemini 2.5 family of models, including Gemini 2.5 Pro and Gemini 2.5 Flash, which promise significant advances in reasoning, coding, and multimodal processing. Gemini is already being integrated across Alphabet's major products, with all 15 platforms having over 0.5 billion users now powered by the models. Search is evolving through AI Overviews and AI Mode, features designed to deliver nuanced, conversational answers, while YouTube has embraced AI in everything from Shorts monetization to podcast recommendations. These shifts are pivotal, but they also come with challenges, such as interface friction, monetization parity, and rising infrastructure costs. Investors must examine whether Alphabet’s aggressive AI strategy will sustain long-term growth or strain operational leverage.

Full-Stack AI Integration Across Core Products

Alphabet's recent rollout of Gemini 2.5 Pro and Gemini 2.5 Flash marks a significant leap in its efforts to embed AI capabilities across its product ecosystem. The models are now powering Search, Android, YouTube, Google Workspace, and Google Cloud, demonstrating the company’s full-stack approach to AI. Gemini 2.5 Pro leads in benchmark performance in areas such as science, coding, and complex reasoning, while Gemini 2.5 Flash provides a cost-effective and high-quality option for developers. The broad deployment of Gemini models underlines Alphabet's strategy to reinforce its AI footprint at the infrastructure, platform, and application levels. However, scaling this integration introduces complexity. For instance, AI Mode requires an additional user action, which may reduce adoption compared to more seamless experiences offered by newer AI-native competitors like Perplexity or ChatGPT. Nonetheless, Alphabet's reach across billions of users via Android, Search, and YouTube provides an inherent advantage in distributing AI-powered features. The long-term implications hinge on user engagement and monetization effectiveness. Alphabet has begun seeing positive feedback on Gemini-powered features such as “Circle to Search,” Lens, and Gemini Live, but the challenge remains in aligning AI performance with intuitive UX. Moreover, Gemini's integration with the Gemini App, Android OS, and enterprise applications through Google Cloud highlights Alphabet’s aim to become a default AI provider in both consumer and corporate environments. Yet, the sheer scope of deployment, model upgrades, and branding fragmentation (e.g., Gemma, Veo, Imagen, Gemini) may create user confusion and diluted product recall. These factors will determine if Alphabet’s AI stack can deliver sustained adoption and revenue uplift.

Evolution Of Search Through AI Overviews & AI Mode

AI is reshaping Google Search, Alphabet’s most profitable business, through the deployment of AI Overviews and the experimental AI Mode. AI Overviews, now available to over 1.5 billion users monthly across 140 countries and 15 languages, offer synthesized answers to queries by integrating Gemini’s multimodal reasoning capabilities. According to Alphabet’s leadership, commercial queries are increasing in volume as a result, with monetization staying at roughly the same level as traditional search. AI Mode, currently being tested in Google Labs, takes this evolution further by handling longer, more complex queries and supporting follow-up interactions. While these developments represent Alphabet’s attempt to fend off rising competition from AI-native search engines, they introduce a new set of risks. The core challenge lies in preserving the simplicity and familiarity of the traditional search interface while introducing fundamentally new behavior. Requiring users to click into AI Mode adds friction, potentially limiting engagement. Moreover, the shift in query patterns—towards more nuanced, multi-sentence queries—alters the way Google must structure and sell ads, which could impact monetization if not handled effectively. On the upside, the company reported that ads in AI Overviews are monetizing at parity with traditional formats and will be expanded to mobile and desktop platforms in more countries. Additionally, early feedback on AI Mode points to positive user reception, especially in complex product comparisons and trip planning tasks. How effectively Alphabet balances user expectations, ad revenue optimization, and AI experience design will critically influence the future of Search, the engine of Alphabet’s financial model.

YouTube's AI-Led Growth Across Shorts, Podcasts & CTV

YouTube, celebrating its 20th anniversary, is a centerpiece of Alphabet’s AI push, especially in driving user engagement and monetization. The platform has surpassed 125 million Music and Premium subscribers and now boasts over 1 billion monthly podcast users. Shorts, YouTube’s response to TikTok, continues to grow, with engaged views rising over 20% year-over-year. Alphabet has deployed Gemini across Shorts to improve recommendation algorithms, creator tools, and monetization through AI-enhanced ad formats. The use of multitrack audio for language translation and DreamScreen for video generation enables creators to produce and localize content faster, widening global reach. In terms of monetization, Alphabet claims that in some markets, Shorts’ revenue per watch hour has reached parity with traditional in-stream video. This marks a crucial milestone in transforming a previously under-monetized format into a viable revenue stream. YouTube’s Connected TV (CTV) leadership further strengthens its AI-backed growth, with over 1 billion hours of watch time logged on living room devices. New ad formats such as QR-enabled shoppable TV, pause ads, and reservation-based brand sponsorships—many AI-optimized—are improving click-through and conversion rates. However, challenges remain. The intense competition for creator loyalty from rival platforms like TikTok and Instagram means Alphabet must continually evolve its creator support and monetization tools. Meanwhile, heavy investments in content acquisition, creator payouts, and CTV infrastructure will continue to weigh on margins. Whether YouTube’s AI-driven growth can offset rising costs and fend off platform competition will be critical in Alphabet’s long-term valuation.

AI Infrastructure Investment & Cloud Monetization Strategy

Alphabet’s infrastructure investments in AI are unprecedented, with $75 billion in CapEx expected in 2025 alone—primarily allocated to data centers, servers, and specialized chips. The rollout of Ironwood TPUs, optimized for AI inference, and early adoption of NVIDIA’s Blackwell GPUs are designed to keep Google Cloud competitive. Cloud revenue grew 28% in Q1 2025, with operating margins expanding to 17.8%. Gemini models and third-party AI tools like Llama 4 and Anthropic are now available through Vertex AI, positioning Google Cloud as a key player in enterprise AI services. Alphabet also introduced tools such as Agent Development Kit and Agent Designer, targeting the next wave of enterprise adoption through customizable AI agents. These tools are already deployed at global firms like KPMG for internal knowledge retrieval and workflow automation. However, profitability pressures are mounting. Depreciation from infrastructure investments rose 31% in Q1 and will continue to accelerate through 2025. Alphabet has acknowledged a tight demand-supply environment, meaning revenue pacing may fluctuate depending on how fast new capacity comes online. There are also competitive risks from AWS and Microsoft Azure, who are investing aggressively in similar AI capabilities. Another key risk is customer acquisition friction—Google Cloud’s tools must balance performance and accessibility for developers of varying skill levels. The stakes are high, as Alphabet aims to capture high-margin enterprise workloads without compromising its capital efficiency. The trajectory of Cloud profitability will depend on how well it monetizes these investments while keeping pace with client expectations and technological shifts.

Regulatory Scrutiny & Competitive Risk From AI Expansion

Alphabet’s rapid AI expansion has attracted increasing scrutiny from regulators. The U.S. Department of Justice is reportedly investigating Alphabet’s partnership with Character.AI to assess whether it was structured to avoid formal merger reviews, signaling renewed antitrust concerns. This comes on the heels of court rulings finding Alphabet guilty of monopolistic practices in both search and advertising. While Alphabet has stated that Character.AI remains a separate company and that the partnership is non-exclusive, the regulatory risk tied to talent acquisition and tech licensing remains. Additionally, as AI models begin to generate content, answer complex queries, and replace third-party websites in Search results, there’s a growing risk that Alphabet’s dominance could extend to new digital verticals—prompting calls for tighter oversight. From a competitive perspective, Alphabet’s interface challenges—like the extra click required to access AI Mode—make it vulnerable to more fluid experiences offered by OpenAI, Microsoft, and emerging players like Perplexity. Furthermore, while Gemini models have received strong developer feedback and lead in certain benchmarks, Alphabet still lags OpenAI in daily active usage of its standalone app, with internal documents revealing Gemini’s DAUs at 35 million compared to ChatGPT’s significantly higher base. Brand fragmentation (Gemini, Imagen, Veo, Gemma, etc.) may also impede user recognition and cross-product synergy. These competitive and regulatory pressures may cap Alphabet’s AI-driven upside or introduce compliance costs and product constraints, especially in high-stakes areas like advertising, health AI, and data sovereignty.

Final Thoughts

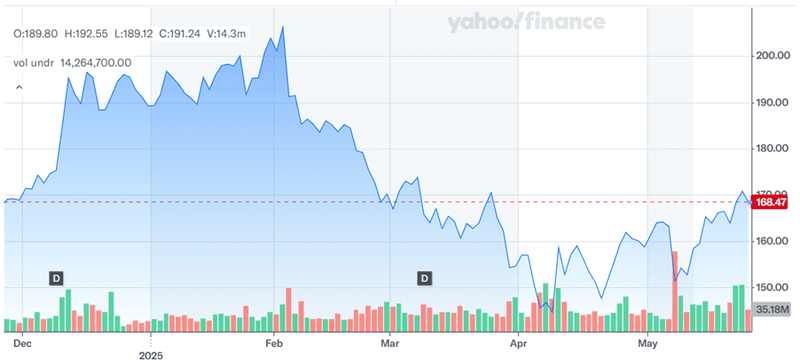

Source: Yahoo Finance

We can see that the market’s perception of Alphabet’s aggressive AI rollout has been rather tepid. One of the biggest reasons for the same is the fierce competition it faces from other AI giants. However, this move marks a pivotal shift in the company’s strategic direction, deeply integrating Gemini and related technologies across its core products, ad platforms, cloud infrastructure, and consumer experiences. The potential for long-term transformation is evident, from reshaping Search and YouTube to redefining enterprise productivity and creative workflows. However, investors must not ignore the significant challenges that persist, including monetization risks, user friction, competitive pressure, and regulatory oversight. It will be interesting to see how Alphabet navigates these dual forces of innovation and constraint. The long-term impact on the stock will depend not only on AI’s technological efficacy but also on Alphabet’s ability to convert AI engagement into scalable, profitable growth.