Altimmune’s Strategic Moves Spark M&A Buzz: Is It The Hottest Player In Obesity & Liver Disease?

Altimmune (NASDAQ:ALT) has been making waves in the biotech space, particularly after recent developments surrounding its lead obesity and liver disease drug, pemvidutide. The company’s R&D Day provided critical updates, including the initiation of two Phase 2 trials targeting alcohol use disorder (AUD) and alcohol-related liver disease (ALD), both set to commence in Q2 and Q3 of this year. This comes after the FDA cleared pemvidutide for these additional indications in February. The excitement escalated further when Betaville, in an "uncooked" market alert, suggested that Altimmune may be undergoing a strategic review involving at least three large pharmaceutical companies. With its Phase 3-ready GLP-1/glucagon dual receptor agonist already showing promising efficacy in obesity and metabolic-associated steatohepatitis (MASH), Altimmune is positioning itself as a strong acquisition target for major pharma players looking to dominate the metabolic disease and obesity markets. The key question now is—who could be interested, and why?

Best-in-Class Liver Fat Reduction & Multi-Targeted Potential

One of the most compelling reasons for a large pharmaceutical company to acquire Altimmune is pemvidutide’s ability to deliver class-leading reductions in liver fat, a critical factor in treating obesity, MASH, and alcohol-related liver diseases. In clinical trials, pemvidutide achieved a 75% liver fat reduction within 24 weeks—exceeding reductions seen in leading competitors like Novo Nordisk’s (NYSE:NVO) semaglutide and Eli Lilly’s (NYSE:LLY) tirzepatide. Beyond MASH, Altimmune's expansion into AUD and ALD strengthens its positioning as a multi-indication drug platform. Given the increasing overlap between obesity, metabolic disorders, and alcohol-related liver conditions, a single drug addressing all these conditions could be highly attractive to pharma giants. Companies like Gilead Sciences (NASDAQ:GILD), which has been heavily invested in liver disease treatments, or Pfizer (NYSE:PFE), which has recently been expanding into metabolic disorders, could see pemvidutide as a valuable addition to their pipelines.

The Expanding Obesity Market & Competitive Differentiation

Obesity is a rapidly growing global epidemic, with estimates suggesting that nearly half of all Americans will be obese by 2030. The obesity drug market is currently dominated by GLP-1 receptor agonists like Wegovy (semaglutide) and Zepbound (tirzepatide). However, pemvidutide’s dual GLP-1/glucagon mechanism offers a competitive advantage by preserving lean mass and accelerating visceral fat loss while improving lipid profiles. Unlike existing drugs that can cause up to 40% lean mass loss, pemvidutide maintains lean mass at around 21.9%—a crucial differentiator that enhances long-term patient outcomes. This makes Altimmune’s drug a strong candidate for acquisition by companies like Novo Nordisk or Eli Lilly, which are actively seeking next-generation obesity treatments to sustain their market dominance.

A Phase 3-Ready Asset With A De-Risked Regulatory Pathway

Pharma companies looking for late-stage assets with clear regulatory paths often prioritize acquisitions that minimize development risk. Pemvidutide is already Phase 3-ready for obesity and advancing in a well-designed Phase 2b study for MASH, set to report data in Q2 2025. The company has engaged with the FDA, receiving clearance for direct Phase 2 trials in AUD and ALD, further de-risking its regulatory trajectory. A company like AstraZeneca (NASDAQ:AZN), which has a history of acquiring promising late-stage metabolic disease drugs, or Roche (OTCMKTS:RHHBY), which has expressed interest in expanding its metabolic disease portfolio, could see Altimmune as a strategic fit to bolster their therapeutic offerings.

Increasing Strategic Interest in Multi-Mechanism Metabolic Treatments

The pharmaceutical industry has been shifting toward multi-targeted drugs that address multiple metabolic pathways, a space where pemvidutide excels. By combining GLP-1 and glucagon receptor agonism, pemvidutide not only enhances weight loss but also improves metabolic markers such as liver fat, LDL cholesterol, and insulin sensitivity. Given the broader shift toward combination therapies, a company like Merck (NYSE:MRK), which has historically pursued innovative metabolic treatments, or Sanofi (NASDAQ:SNY), which has been looking for ways to reclaim a presence in the diabetes and obesity market, might find pemvidutide an attractive asset to integrate into their pipelines.

Conclusion: A Potential Buyout or Long-Term Play?

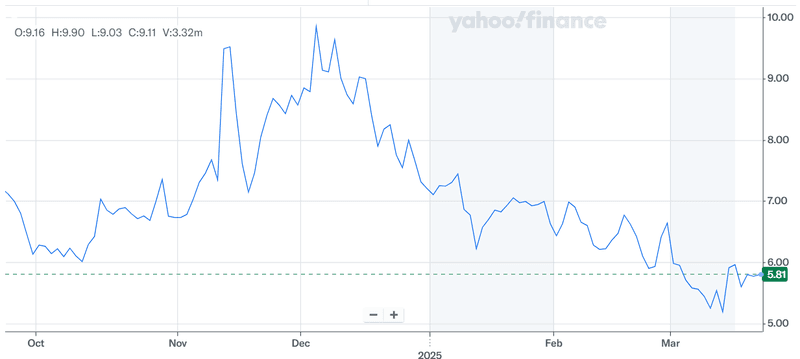

Source: Yahoo Finance

While Altimmune’s recent surge in stock price and speculation of acquisition interest suggest a potential deal in the making, investors must weigh both the upside and the risks. Pemvidutide’s strong clinical data, Phase 3 readiness, and multi-indication potential make Altimmune a valuable target, but execution risks remain, particularly in commercialization and regulatory approvals. The possibility of a buyout from a major pharma player could unlock significant value for shareholders, but if no deal materializes, Altimmune will need to prove its ability to bring pemvidutide successfully to market. As the obesity and metabolic disease market continues to heat up, we believe that Altimmune is a hot biotech stock to watch closely in the months ahead.