American Rebel: The Liberty Safe Controversy Could Well Be Bullish

We have extensively covered American Rebel (NASDAQ:AREB) in the past including its Champion Safe acquisition. It is a well-known fact that American Rebel stands out as a forerunner in the production of cutting-edge safes and vaults tailored for the contemporary American consumer. With its products reflecting a profound sense of American pride, the brand has always championed family protection. We are expecting an unprecedented bull run in the company's stock on account of the massive number of inquiries received by its Champion Safe subsidiary after the recent Liberty Safe controversy. The deluge of inquiries from safe dealers and consumers, particularly those seeking alternatives to products by Liberty Safe, is expected to result in a radically improved investor perception of the company. Let us have a closer look at American Rebel's business and how it could benefit from the Liberty Safe controversy.

Journey of American Rebel: More than Just Safes

American Rebel specializes in crafting top-tier safety and personal security merchandise. This includes not only vaults suitable for homes and offices but also personal safes, concealed carry bags, and attire like unisex vests, T-shirts, and jackets. Beyond safeguarding weapons, these vaults serve as sanctuaries for invaluable family heirlooms and memories. To cater to diverse needs, they also offer accessories such as light kits, moisture protectors, and rifle rod kits. Its products are offered under a variety of recognized brands, including American Rebel, Champion Safe, Superior Safe, and Safe Guard. The company has been dynamic, not only expanding its product range but also actively pursuing strategic growth. American Rebel's ethos is an embodiment of true American patriotism and underscores the brand alignment with customer values. Among key updates, the management recently announced the forthcoming launch of "American Rebel Beer" in 2024, reflecting the company's continuous endeavor to diversify while staying true to its patriotic roots. By constantly innovating, they aim to deliver premium features at reasonable price points, simultaneously boosting their brand value and demand.

Strategic Acquisition of Champion Safe

In a pivotal move in August 2022, American Rebel acquired Champion Safe Co., investing approximately $9.9 million. This astute acquisition is projected to enhance American Rebel’s revenues by nearly $20 million, ensuring robust profitability. Champion Safe's esteemed reputation in the safety domain synergizes perfectly with American Rebel's ethos. Notably, this union grants American Rebel the leverage of two factories and three top-of-the-line safe manufacturing lines. With Ray Crosby, Champion’s President and an industry stalwart, on board, American Rebel gains immensely in expertise and leadership. Additionally, given the burgeoning demand for unconventional safes like vault doors and vaults tailored for the cannabis industry, this collaboration allows American Rebel to tap into new avenues and expand their manufacturing capabilities.

What Is The Liberty Safe Controversy?

Liberty Safe, a prominent gun safe manufacturer in the United States, recently found itself ensnared in a whirlwind of controversy after complying with the FBI's request to provide access to one of its customer's safe codes. The customer in question, Nathan Hughes, was allegedly associated with the events of the January 6 Capitol riot and was under the purview of a legitimate search warrant. Liberty Safe was quick to clarify its stance, emphasizing its consistent policy: the company only releases access codes to law enforcement agencies when presented with a valid warrant. It stressed its ignorance concerning the investigation's specifics and mentioned previous instances where it had declined law enforcement requests in the absence of a warrant. However, these clarifications didn't appease many conservatives, who viewed the company's actions as a betrayal and an infringement on personal privacy. Vocal critics drew parallels between Liberty Safe and Bud Light, the latter having previously endured a conservative boycott due to its association with a transgender influencer. Some customers went as far as labeling Liberty Safe as "traitorous", with others considering cancelations or product returns.

Final Thoughts – How Does This Benefit American Rebel?

The Liberty Safe incident underscores the broader, ongoing debate concerning the equilibrium between individual privacy and societal security. Advocates for Liberty Safe's decision might argue that the company was dutifully abiding by legal requirements, aiding in the potential apprehension of a suspect. However, it is evident that the broader public perceives the company's decision as an egregious breach of customer trust, giving away private access without the owner's explicit consent. This could explain the huge number of inquiries for Champion Safe.

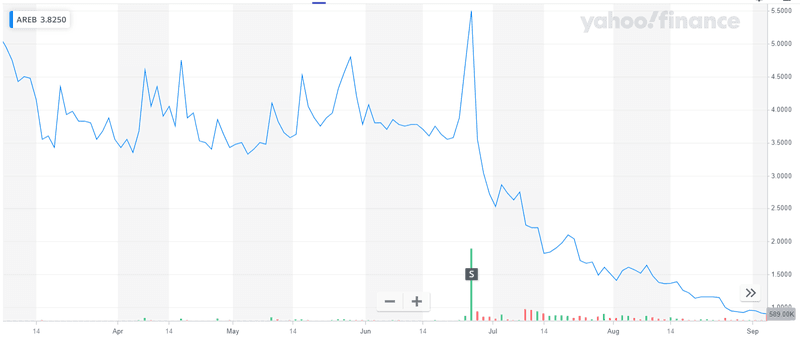

While American Rebel's stock price has been falling in the past 6 months, there was a staggering 42% rise post-market which isn’t shown in the chart above. Even if we factor in this spike, American Rebel’s stock offers significant potential for small-cap investors. This is evident from its valuation multiples. As of today, American Rebel is trading at an Enterprise Value/ Revenue multiple of 1.14x and a price-to-book valuation of 0.79x which are both ridiculously low. It is important to highlight that while it reported $8.45 million in revenues for the year ended 2022, American Rebel's trailing twelve-month revenue is already reported at $16.03 million and this revenue surge was taking place even before the Liberty Safe controversy. Given this background, we can safely re-emphasize our bullish sentiment on American Rebel as we believe that the company could be an excellent investment bet for our readers.