Amgen’s Obesity Moonshot: Could MariTide Be The Billion-Dollar Game-Changer?

Amgen (NASDAQ:AMGN) is stepping into one of the most lucrative and fiercely competitive pharmaceutical arenas: obesity treatment. As the global demand for weight-loss drugs skyrockets, the company has unveiled a strategic push into the space with its once-monthly injectable candidate, MariTide. Early data from Phase II trials suggest weight loss rates comparable to or exceeding those from existing GLP-1 therapies like Novo Nordisk’s Wegovy and Eli Lilly’s Mounjaro. With full 52-week Phase II results due at the ADA meeting in June and Phase III trials now underway, Amgen is signaling its intent to secure a solid foothold in a market that analysts estimate could surpass $100 billion by 2030. Simultaneously, Amgen’s existing product portfolio continues to generate steady cash flows, with strong performances across cardiovascular, rare disease, oncology, and biosimilars. However, it is MariTide and its potential role in reshaping Amgen’s long-term growth profile that has become the focal point for both analysts and investors.

MariTide Phase III Acceleration & Differentiated Dosing Approach

Amgen’s lead obesity candidate, MariTide, is advancing rapidly through clinical development, with two Phase III trials already initiated. These studies are targeting 3,500 patients with obesity or overweight without Type 2 diabetes, and another 999 patients with comorbid Type 2 diabetes. Both trials will assess weight change at 72 weeks across three dose levels (low, medium, high) and use a titration scheme to mitigate side effects, a common hurdle in GLP-1 class drugs. MariTide’s formulation leverages an immunoglobulin backbone, allowing for stable pharmacokinetics and enabling monthly, every-other-month, and even quarterly dosing, as observed in earlier trials. This potentially superior dosing convenience could be a significant edge in a market dominated by weekly injectables, where patient adherence drops dramatically over time. Data from Phase II already showed 20% weight loss in non-diabetic patients and 17% in those with diabetes. Additionally, the tolerability profile has improved markedly with dose titration, cutting nausea and vomiting incidence nearly in half compared to earlier stages. With high patient persistence (90% opted for the second year of treatment), Amgen’s long-term vision hinges on MariTide offering not just initial weight loss but sustained adherence and real-world outcomes, all of which are being tested in its robust Phase III program.

Strategic Manufacturing Investments To Support Future Biologic Volume

As Amgen gears up for large-scale commercialization of MariTide, it is simultaneously expanding its manufacturing infrastructure. The company has already invested over $1.5 billion in its North Carolina biologics plant, which is expected to come online by 2026 and support a broad range of products, including obesity drugs. A second portion of the facility has already undergone ribbon cutting, with ground-breaking soon to follow. These facilities are being developed alongside the Ohio packaging site, which is currently handling established drugs like Repatha and Prolia and is expected to support future biologics like MariTide. By investing ahead of demand, Amgen aims to de-risk manufacturing bottlenecks that have plagued peers in the GLP-1 space. Having this infrastructure in place may not only support regulatory timelines but also secure long-term supply stability. Given the chronic nature of obesity treatment and its global prevalence, operational scalability could become a critical differentiator, especially as competition intensifies and pricing pressures rise. Furthermore, Amgen’s emphasis on a high-yield, reliable drug supply aligns with its company-wide mantra of delivering for “every patient, every time,” and could support broader uptake post-approval.

Portfolio Strength Provides Financial Cushion For MariTide Ramp-Up

While MariTide garners the spotlight, Amgen’s existing portfolio continues to deliver solid growth and provides a financial cushion to support its obesity ambitions. In Q4 2024, Amgen posted $9.1 billion in sales, up 11% year over year, with 21 products achieving record annual sales and 10 products growing at double-digit rates. Drugs like Repatha (cholesterol) and EVENITY (osteoporosis) posted growth rates of 36% and 35%, respectively. In rare diseases, TEPEZZA, UPLIZNA, and TEZSPIRE also drove meaningful revenue increases, with biosimilars contributing $2.2 billion in 2024—up 60% year over year. Management expects to double biosimilar sales to over $4 billion by 2030. Importantly, Amgen guided for stable revenue growth each quarter in 2025 and a full-year non-GAAP operating margin of 46%, indicating strong financial discipline. This healthy margin structure, paired with the historical trend of beating earnings in 18 of the last 20 quarters, positions Amgen to aggressively pursue long-term growth opportunities like MariTide without compromising its existing operations or shareholder returns. With legacy products nearing patent expiry, MariTide could offer a timely offset to revenue erosion, supported by the company’s diversified cash-generating assets.

Addressable Market Size & Unmet Needs Create a Large Runway

Global obesity prevalence continues to rise, with estimates suggesting over 1 billion people may be affected by obesity or overweight conditions. Current market leaders like Eli Lilly and Novo Nordisk have built multi-billion-dollar franchises around weekly GLP-1-based treatments. However, real-world adherence remains poor, with roughly 65% of patients dropping off treatment within a year, according to published data. This exposes a critical unmet need that MariTide is specifically aiming to address—sustained weight loss with fewer injections. Amgen believes that fewer doses could dramatically improve patient experience, long-term efficacy, and market penetration. Additionally, MariTide is being tested not just for obesity, but for obesity-related conditions such as heart failure, sleep apnea, and atherosclerosis, expanding its potential label and revenue streams. Analysts estimate that even capturing a modest market share could yield multi-billion-dollar annual sales, with some projections reaching $10 billion by 2030. While current consensus estimates peg MariTide’s revenue closer to $2.5 billion (risk-adjusted), this figure could rise as Phase III data matures and regulatory milestones are met. Amgen’s strategic positioning in both non-diabetic and diabetic obesity populations, combined with its investment in manufacturing, points to a multi-indication, global commercial strategy that aims to unlock durable long-term value.

Final Thoughts

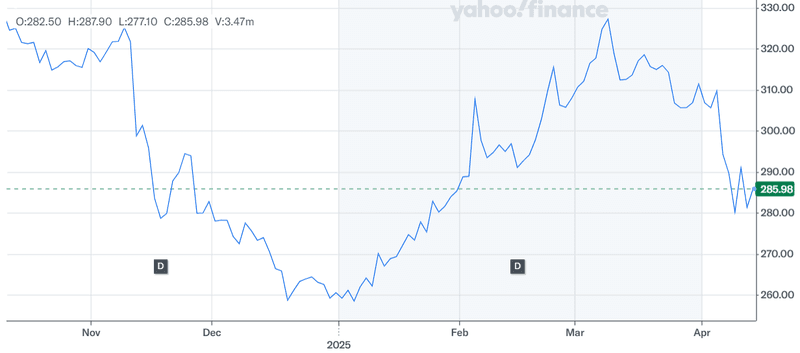

Source: Yahoo Finance

Amgen’s stock trajectory has been highly volatile over the past few weeks but that can also be attributed to the uncertainty in global markets because of Trump’s tariffs. We believe the company’s foray into the obesity treatment landscape with MariTide comes at a pivotal time for itself and the broader pharmaceutical industry. While the GLP-1 market is already crowded, Amgen’s differentiated dosing, strong Phase II results, and manufacturing readiness present a credible case for long-term participation in a high-growth category. Its diversified portfolio, consistent earnings delivery, and cautious yet methodical development strategy offer further confidence in execution. However, competitive pressures, especially from the likes of Eli Lilly and Novo Nordisk, coupled with regulatory hurdles, and pricing uncertainties remain key risks. We see a strong upside potential from MariTide and we have faith in the broader durability of Amgen’s pipeline and commercial portfolio which is why we see the company as a compelling investment opportunity at current levels.