Apple’s Survival Plan: Panic Buyers, Streaming Discounts & A Manufacturing Meltdown!

Over the past two weeks, Apple (NASDAQ:AAPL) has faced one of its most volatile periods in recent memory, with its stock shedding over $700 billion in market value and investor sentiment rattled by a wave of geopolitical and policy shifts. At the heart of the crisis lies President Donald Trump’s decision to impose sweeping new tariffs on China and other countries, including a 125% duty on Chinese goods that directly impacts Apple’s China-centric supply chain. The move has triggered consumer panic, with Apple stores witnessing holiday-season-like traffic as buyers rush to avoid expected price hikes on iPhones. Apple has scrambled to respond, flying multiple planeloads of iPhones from India to the US in a bid to beat the tariff deadlines. Meanwhile, the company's streaming division attempted to distract with a deep discount on Apple TV+, but that did little to cushion the blow from the broader stock market carnage. With increased scrutiny over where and how its devices are made, Apple is now confronting a new era of political risk, supply chain fragility, and pricing pressures—all while the threat of being forced to “make iPhones in America” looms large.

The Tariff Tsunami & Its Stock Market Fallout

Apple has become one of the most high-profile casualties of President Trump’s aggressive tariff strategy, losing about 23% of its market capitalization in less than two weeks and ceding its position as the most valuable U.S. company to Microsoft. The White House has made it clear that Apple will not receive any exemptions, a stark departure from the 2018 trade war when the company was shielded. With tariffs on Chinese goods jumping to 125%, and retaliatory tariffs from China hitting 84% on U.S. exports, the impact on Apple’s bottom line is expected to be significant. Analysts from Needham project a potential 28% decline in Apple’s fiscal 2025 earnings if exemptions are not secured. The broader market reacted accordingly: Apple’s shares dropped 6.5% following the latest comments from Press Secretary Karoline Leavitt confirming the administration’s belief that iPhones can be built in the U.S. Panic buying at Apple stores ensued, but this short-term demand spike is unlikely to offset longer-term supply chain cost pressures. While there was a temporary stock rebound—Apple jumped 10% on hopes of a policy pause for other countries—the gain was not enough to reverse the damage from the prior week. Rosenblatt Securities even warned that the tariffs could “blow up” Apple’s stock, and Wedbush, a long-time Apple bull, slashed its price target, calling the situation a potential “disaster.” With no relief in sight and the tariff timeline already underway, investors are now grappling with a highly unpredictable trade and regulatory environment that directly threatens Apple’s cost structure and pricing strategy.

The iPhone Manufacturing Conundrum: Why 'Made in America' Is a Costly Illusion

Trump’s insistence that Apple shift iPhone manufacturing to the U.S. has raised alarms across the investment community, not only because of the logistical complexity involved but due to the staggering cost implications. Bank of America analysts estimate that iPhone production costs would rise 25% solely due to higher U.S. labor costs, and up to 90% or more if Apple is forced to pay tariffs on the imported parts and subassemblies that would still originate in Asia. Apple outsources manufacturing to partners like Foxconn, Pegatron, and Luxshare, which operate largely in China and Taiwan. A full domestic shift would require Apple to either internalize its supply chain or replicate a decades-old ecosystem built with billions of dollars of investment—neither of which is realistic in the near term. Morgan Stanley estimates it would take three years and $30 billion just to move 10% of the supply chain to the U.S. Furthermore, TechInsights notes that the iPhone 16 requires over 387 individual components, most of which are not manufactured in the U.S., creating additional exposure to tariffs even if final assembly occurs domestically. While Apple has committed to investing $500 billion in the U.S. and hiring 20,000 staff over four years—including a new AI server facility in Texas—this does little to solve the immediate challenge. The company still assembles roughly 80% of its smartphones in China, and any forced shift to American manufacturing would result in extreme pricing pressure or a sharp hit to margins.

Temporary Relief From India: Strategic Diversification Or Stopgap?

In response to the escalating trade war, Apple has rapidly increased its reliance on India, flying in at least 10 cargo flights from Chennai in the days following Trump’s “Liberation Day” tariff announcement. While this move helped Apple avoid immediate penalties and meet demand surges in the U.S., it highlights the fragile state of the company’s global logistics network. Currently, India handles only a fraction of Apple’s total iPhone production. Bank of America estimates that reserving India’s entire iPhone output would cover approximately 30 million out of the 50 million units shipped annually to the U.S., indicating that this is not a sustainable long-term solution. Moreover, India has itself been hit with a 27% reciprocal tariff, although negotiations are underway to reduce this burden through a bilateral trade agreement. While Indian officials have confirmed Apple’s plans to expand manufacturing locally, including supplier discussions with Tamil Nadu’s government, capacity limitations persist. Tata is scaling up operations, and Jabil has signed an MoU for facility expansion, but these changes will take time. Apple’s diversification into India, Vietnam, and Brazil appears to be a prudent step, but the current crisis reveals that these markets still lack the infrastructure and scale to fully absorb the shock of a disrupted China supply chain. This makes Apple vulnerable to further geopolitical friction, as any manufacturing realignment takes years—not weeks—to implement effectively.

Streaming Discounts & Services Growth: A Diversion From Hardware Risks?

As the tariff drama played out in the hardware space, Apple took a highly visible step to attract consumer goodwill by slashing the price of Apple TV+ by 70% for a limited time—offering subscriptions at $2.99 per month for three months. The move coincided with the release of a new Jon Hamm-led series and followed a similar content giveaway earlier this year. However, while Services revenue continues to grow—up to $26.34 billion last quarter from $23.11 billion year-over-year—Apple TV+ itself remains a loss-making segment with annual deficits around $1 billion, according to analysts. With a subscriber base estimated at 45 million, the platform faces steep competition from entrenched players like Netflix and Amazon Prime Video. The price cut appears to be a tactical move aimed at customer retention during a turbulent news cycle, but it does little to offset concerns in the core hardware business that drives the majority of Apple’s revenue. The services strategy may provide a long-term hedge, yet it cannot immediately compensate for margin compression, supply chain volatility, or the cost inflation stemming from new tariffs. While diversification into services is part of Apple’s long-term plan, the company remains acutely dependent on hardware—and particularly the iPhone—for profitability. This creates a mismatch in investor expectations during times of macroeconomic stress, especially when the iPhone business is facing historic headwinds.

Final Thoughts

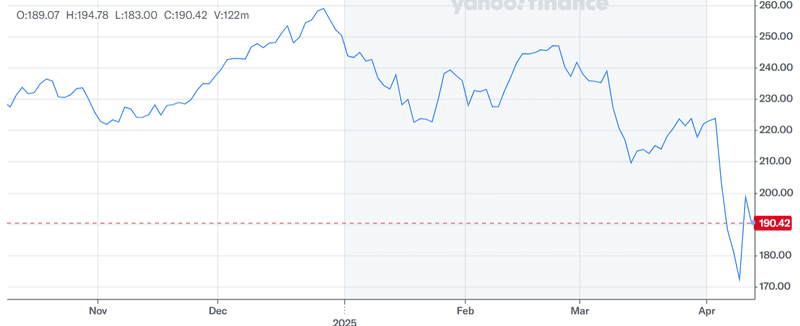

Source: Yahoo Finance

We can see the wild volatility in Apple’s stock price in the above chart. It is evident that the company is currently navigating one of the most complex operating environments in its modern history, driven by escalating tariffs, calls for domestic manufacturing, reliance on fragile global supply chains, and heightened investor volatility. While Apple’s management has taken short-term steps such as ramping up shipments from India and pushing promotions on its streaming service, these measures do not resolve the underlying structural risks. The possibility of price hikes, margin erosion, or longer-term supply disruptions cannot be dismissed. At the same time, Apple’s brand loyalty, diversified product portfolio, and large cash reserves provide a cushion against short-term turbulence. We believe that the current situation presents both threats and strategic inflection points, and its resolution will likely shape Apple’s business model for years to come.