Applied UV: Entering The African Market With A Bang

We have covered disinfection technology player, Applied UV (NASDAQ:AUVI) extensively in the past few months. The company has made excellent technological advancements with respect to both surface disinfection as well as air purification and has highly pertinent offerings for the current global crisis. With the world being hyper-focused on cleanliness and hygiene after battling a life-threatening pandemic, the company’s various disinfection technologies are in huge demand across a wide variety of sectors such as healthcare, hospitality, manufacturing, and even residential markets. Applied UV has been on track to grow the distribution of Airocide and recently announced a new partnership with 3Sixty Biopharmaceuticals expanding its horizons to the African. We believe that the company is poised for growth going forward and may provide exceptional returns to investors.

Partnership with 3Sixty Biopharmaceuticals

In May 2021, Applied UV made a huge breakthrough by signing an exclusive distribution agreement with 3Sixty Biopharmaceuticals Ltd. for the distribution of the Airocide consumer and commercial air purification systems within the continent of Africa. This comes in line with management’s plans to take on new distribution agreements and sales wins in the near term. 3Sixty is a South African healthcare player focused on the development and commercialization of South African intellectual property and operates at different stages of launching and bringing to market, new technologies that respond to some of mankind’s most challenging diseases. As per the agreement, 3Sixty has made an upfront binding purchase commitment of a minimum of $3.5 million of Airocide systems over the initial one-year term of the agreement. After the initial collaboration, both parties have agreed to assess opportunities to expand the product line to include the SteriLumen platform of connected UVC devices for infection control in and around high-traffic areas. With this partnership, the company gets exposure to the scale, infrastructure, and reputation that 3Sixty holds and an interesting opportunity to make the Airocide system a market leader in Africa. The continued distribution efforts made by the company may lead to long-term relationships and will indeed positively impact its revenue in the years to come.

Other key developments

After delivering a robust financial result in the first quarter of 2021, Applied UV completed the acquisition of all of the relevant assets of Akida, including all of the rights to manufacture and sell the patented Airocide air purification technology. Airocide products have seen broad adoption across all major markets amid the pandemic. The FDA has issued guidance for air Purifiers and disinfectants which states that they may reduce the risk of viral exposure to the Covid-19 by keeping aerosol concentration levels low. This could provide a major boost to Applied UV’s business.

Another major development announced by the company was its partnership with Boston Red Sox to install the Airocide System at Fenway Park and JetBlue Park. The Airocide Air Purifiers are being installed in all player areas, including weight rooms and both the home and visitors’ locker rooms. Apart from this, the company recently appointed a new chief financial officer, Mike Riccio, who brings extensive financial experience to the table, including a background with global public companies in corporate finance and corporate merger and acquisition planning and integration. It is also worth mentioning that during the first quarter, the company saw an improvement in the demand from its hospitality customers given the economic recovery. As a result, its Munn Works revenues are returning to normal pre-Covid levels. With various new opportunities opening up after the Airocide acquisition, Applied UV’s addressable market has expanded significantly and we should see many such updates in the coming future.

Key takeaways

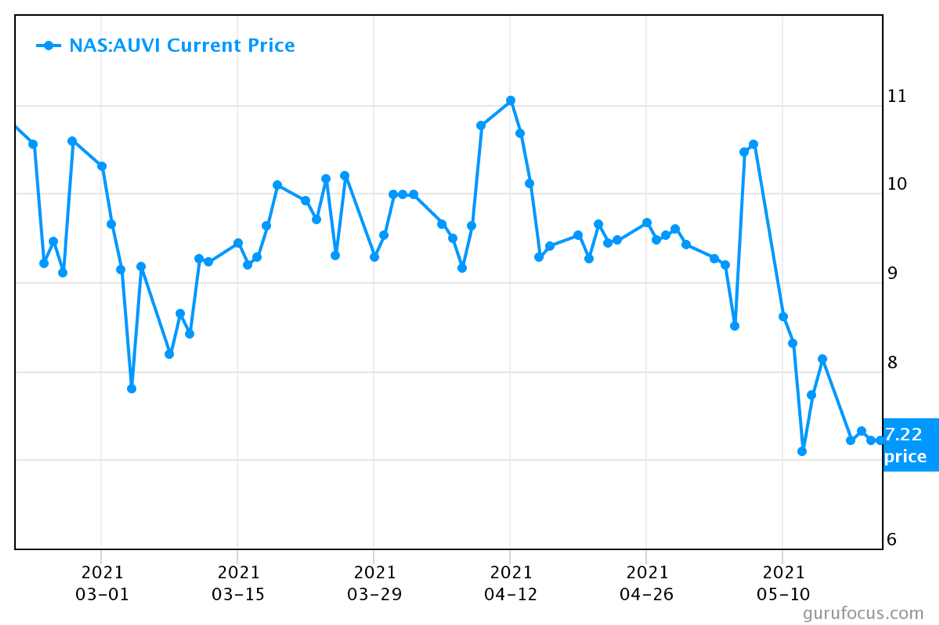

The stock price of Applied UV has not witnessed any significant movement after the previous acquisition-related spike after the Airocide announcement. This can be largely attributed to the pandemic-induced woes that led to the headwinds faced by the company’s MunnWorks subsidiary which primarily caters to the hospitality industry that had been on a low on account of the Covid-19. However, there has definitely been a sharp recovery in sales which was demonstrated in the triple-digit sales growth of Applied UV in Q1 2021. We believe that the stock should gain a lot of momentum by the end of 2021 which is when MunnWorks will be operating at full capacity given the recovery in hotel chains across the globe. The company has sufficient growth capital and liquidity as indicated by its excellent cash-to-debt ratio of 9.2. To sum up, we believe that Applied UV has a highly compelling value proposition and is trading at a ridiculously low price making it an excellent investment opportunity for our readers at SmallCapsDaily.