Avadel Pharma Under Activist Pressure: Can A Potential Buyout Unlock Massive Value For Investors?

Avadel Pharmaceuticals (NASDAQ:AVDL) surged after ASL Strategic Value Fund publicly called on the company to pursue strategic alternatives—including a potential sale. The activist investor, led by Steve Braverman, demanded that Avadel immediately hire an investment bank to explore all options. Braverman argues that the commercial launch of LUMRYZ, Avadel's once-nightly oxybate for narcolepsy, has underwhelmed and failed to deliver value to shareholders. He further proposed distributing a contingent value right (CVR) to shareholders tied to the outcomes of the company’s ongoing litigation against Jazz Pharmaceuticals. While the board continues to tout the long-term promise of LUMRYZ, the recent earnings highlighted management’s effort to reignite launch momentum through expanded commercial investment, a revamped sales strategy, and signs of operational cash flow generation. With strategic litigation milestones and new market indications on the horizon, investors are watching closely to see whether a sale becomes the next logical step.

A Unique & Clinically Differentiated Product In LUMRYZ

LUMRYZ is the only once-at-bedtime extended-release oxybate on the market, positioning it as a potentially superior alternative to first-generation twice-nightly treatments for narcolepsy. Since its June 2023 launch, LUMRYZ has captured nearly 75% of the total patient adds in the oxybate category, reaching over 2,500 net patients. Its key value proposition lies in eliminating the need to wake up in the middle of the night to take a second dose, an issue the FDA has described as “antithetical to improving sleep.” Clinical feedback underscores strong physician and patient interest in the convenience and efficacy of LUMRYZ. This has led to adoption by more than 2,200 unique prescribers, including over 200 who had never previously written a prescription for an oxybate. Moreover, early 2025 trends indicate the beginning of a reversal in the declining switch-patient trend from late 2024. Importantly, Avadel has already expanded its sales force by 15%, doubled its field and nursing support teams, and ramped up patient education campaigns through direct-to-consumer initiatives. These strategic investments are expected to drive further market penetration and strengthen brand loyalty among both new and existing patients. With broader commercial insurance coverage exceeding 90% and improvements in Medicare access, LUMRYZ’s footprint continues to grow in a market estimated to be worth over $1 billion. This first-mover advantage, combined with strong intellectual property protections extending into 2042, makes LUMRYZ a highly attractive asset for any potential acquirer.

Strategic Legal Battles Could Yield Substantial Non-Operating Upside

Avadel’s legal positioning—particularly its ongoing litigation against Jazz Pharmaceuticals—offers another layer of potential value. The company is involved in multiple legal proceedings, including a pending appellate decision regarding an injunction, a patent infringement case, and a high-stakes antitrust lawsuit scheduled for jury trial in November 2025. The antitrust case accuses Jazz of anti-competitive practices in the oxybate market and, if successful, could yield a significant cash settlement or damages. Activist investor ASL Strategic Value Fund has called for the creation of a Contingent Value Right (CVR) to let shareholders benefit directly from any potential recovery in these suits. While legal outcomes are inherently uncertain, the presence of multiple cases and the gravity of the antitrust suit create optionality for investors and potential acquirers. A buyer might factor in the upside from these legal claims into its valuation, especially since Avadel has already incurred certain litigation-related expenses and accrued for a royalty obligation conservatively in its books. Moreover, any favorable legal ruling would not only offer cash flow benefits but could also enhance Avadel’s competitive positioning by removing market barriers or discrediting rivals. Importantly, the litigation highlights the protective moat Avadel believes it holds around its once-at-bedtime formulation—one that the company continues to defend vigorously through patent enforcement and court action. These legal tailwinds, though non-core, offer asymmetric upside and are worth consideration in any strategic evaluation of the company.

Pipeline & Expansion Potential In Idiopathic Hypersomnia & Beyond

Beyond narcolepsy, Avadel is actively developing LUMRYZ for Idiopathic Hypersomnia (IH), a rare and poorly served neurological disorder characterized by excessive daytime sleepiness and sleep inertia. The Phase III REVITALYZ trial is currently enrolling and remains on track to deliver topline results in early 2026, with a potential NDA filing to follow shortly thereafter. There are roughly 42,000 diagnosed IH patients under physician care, yet fewer than 10% are treated with the only FDA-approved option today. LUMRYZ’s once-nightly profile is particularly compelling for IH patients, who often struggle with the burden of waking up mid-sleep due to their already disrupted sleep cycles. Physician feedback suggests LUMRYZ could provide even more value in IH than in narcolepsy. Avadel is also working on a no or low-sodium formulation of LUMRYZ to cater to additional patient subgroups, potentially expanding its reach and reducing cardiovascular risks often associated with sodium intake. This life cycle management strategy, if successful, could give the company a broader competitive edge and help establish it as a leader in sleep medicine beyond narcolepsy. For acquirers, the pipeline presents an opportunity to leverage existing commercial infrastructure to expand into new indications without materially increasing costs. Importantly, this pipeline is not speculative: it’s rooted in real-world insights from current LUMRYZ patients and aligned with the company’s long-term goal to expand the oxybate market. With the IH trial progressing and supportive market dynamics in place, the company offers more than just a single-product story.

Final Thoughts

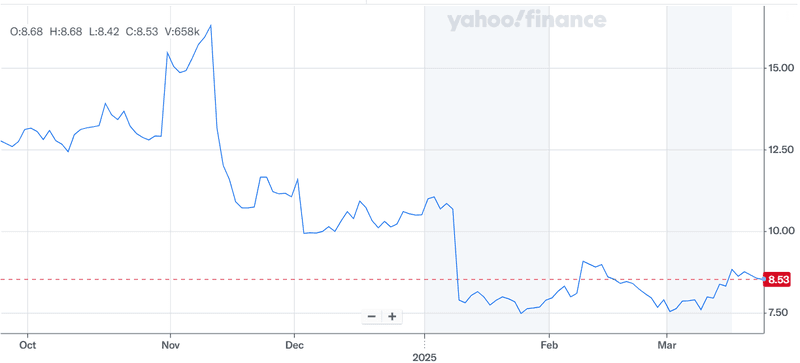

Source: Yahoo Finance

As we can see in the above chart, Avadel Pharmaceuticals’ stock has taken a beating over the past 6 months. The company is trading at an LTM EV/ Revenue multiple of 4.67x and is loss-making at EBITDA level. Despite these drawbacks, its clinically differentiated asset, strong commercial execution, growing revenue base, and promising pipeline make it a potential acquisition target. However, the recent activist pressure, pending litigation outcomes, and the need for sustained commercial momentum introduce a degree of uncertainty. The litigation against Jazz and the possible strategic review process may either catalyze value creation or merely highlight structural challenges. Either way, we believe that a wait-and-watch approach is most suited for investors with respect to this stock and they should not consider this as an investment opportunity at least until Avadel shows some tangible signs of financial improvement and operating profitability.