Axogen In Play? Here’s Why A Buyout Makes Sense At $18 Per Share

Axogen, Inc (NASDAQ:AXGN) saw its stock climb nearly 4% after reports emerged that the company is entertaining a possible acquisition. According to a report by StreetInsider, an unnamed strategic buyer has offered $18 per share for the company, prompting Axogen to engage Centerview Partners to evaluate the proposal and potentially explore interest from other bidders. While the company has not publicly confirmed any details and the process remains in early stages, the offer has sparked market speculation. Axogen's unique positioning in the nerve repair space, its nearing biologics license approval for its Avance Nerve Graft, and its accelerating commercial traction make it a logical target for acquisition. The implied premium of the offer suggests that the bidder values Axogen's clinical and regulatory advances, robust hospital network presence, and potential in emerging surgical verticals. As such, the market is watching closely to see if a formal offer materializes.

Dominant Position In Nerve Repair With BLA-Backed Exclusivity

Axogen's core product, the Avance Nerve Graft, is on the cusp of a major regulatory milestone with a Biologics License Application (BLA) expected to be approved by the FDA in September 2025. The approval would confer 12 years of market exclusivity, establishing Avance as the only implantable biologic specifically indicated for peripheral nerve repair. This regulatory exclusivity significantly reduces competitive risk and enhances the commercial value of the product. The product already benefits from an established CPT code (64912), and management does not expect the BLA transition to affect hospital access or reimbursement pathways. Importantly, the company has completed key FDA inspections, including both clinical trial site and sponsor-level reviews under the Bioresearch Monitoring Program, which derisks the regulatory path. For an acquirer, the timing of a deal just before final BLA approval presents an opportunity to secure a defensible asset with minimal incremental development risk. The biologic classification would also strengthen Axogen’s pricing power and sales continuity, making it an accretive bolt-on to any surgical or biologics portfolio. This rare regulatory asset positions Axogen as a defensible leader in its niche, making the timing of a takeover strategically attractive.

Deep Penetration In High-Potential Hospital Accounts

Axogen's commercial success is driven by a focused go-to-market model centered around 780 high-potential accounts, including major trauma centers and academic institutions. In Q1 2025, 566 of these accounts were active, contributing 66% of company growth and generating a 24% year-over-year increase in average productivity per account. This level of account productivity and procedural repeatability indicates a strong base of trained microsurgeons and hospital administrators who routinely choose Axogen's nerve repair solutions. The company is scaling its sales infrastructure, aiming to add 20 new sales territories by year-end, expanding coverage across extremities, breast resensation, and oral/maxillofacial markets. In parallel, Axogen is investing in surgeon education, professional society engagement, and coverage advocacy to entrench its clinical algorithm across specialties. An acquirer with a broader sales force or adjacent product offerings could accelerate these efforts, leveraging Axogen’s clinical credibility and embedded customer base to drive faster adoption. The strategic discipline in targeting only high-opportunity accounts also makes Axogen's commercial engine relatively efficient, a positive for any buyer looking for scalable, margin-accretive growth.

High-Growth Adjacent Markets With Expansion Headroom

Axogen is actively cultivating high-growth adjacent surgical markets with tangible commercial traction. The Breast Resensation program has expanded to 229 active accounts and 254 surgeons performing procedures, growing 16% year-over-year. In oral/maxillofacial and head and neck surgery, the company is establishing a stronghold in mandible reconstruction and neck dissection procedures. Further, Axogen has initiated its entry into the urology space via robotic-assisted radical prostatectomies. The company has confirmed three clinical pilot sites for prostate nerve preservation and is targeting ten by year-end. While revenue contributions from prostate procedures are not included in 2025 guidance, the segment lays groundwork for long-term revenue diversification. These verticals offer a synergistic fit for acquirers operating in breast reconstruction, oral surgery, or urology. The ability to cross-sell, bundle, or integrate Axogen's solutions into existing surgical platforms could generate operational leverage and broaden the acquirer's value proposition. By investing in clinical studies, professional education, and KOL relationships, Axogen is not only penetrating these verticals but also shaping standard-of-care expectations—an attractive attribute for strategic buyers seeking growth through category leadership.

Operating Leverage & Predictable Revenue Model Post-BLA

Axogen’s earnings model is transitioning toward predictability and operational leverage. In Q1 2025, the company delivered $48.6 million in revenue, a 17.4% increase from the prior year, alongside $2.9 million in adjusted EBITDA. While gross margin declined to 71.9% due to inventory reserves and elevated cost of goods sold from the new Dayton facility, management projects margin normalization to 73%-75% by year-end. Notably, margin pressure is expected to ease post-BLA approval when manufacturing and quality systems can undergo planned improvements. Once classified as a biologic, Avance Nerve Graft’s recurring sales profile—based on procedural volume and repeat surgeon use—will be further entrenched. Moreover, Axogen’s cost base is positioned to benefit from economies of scale and quality system optimization post-approval. These dynamics create a path to enhanced profitability and cash generation, which would be more readily achieved if integrated into a larger corporate infrastructure. A buyer with manufacturing, regulatory, or administrative scale could unlock synergies, accelerate cost rationalization, and boost EBITDA margins. For a potential acquirer, the near-term earnings accretion and longer-term operational improvements provide a multi-layered return profile.

Final Thoughts

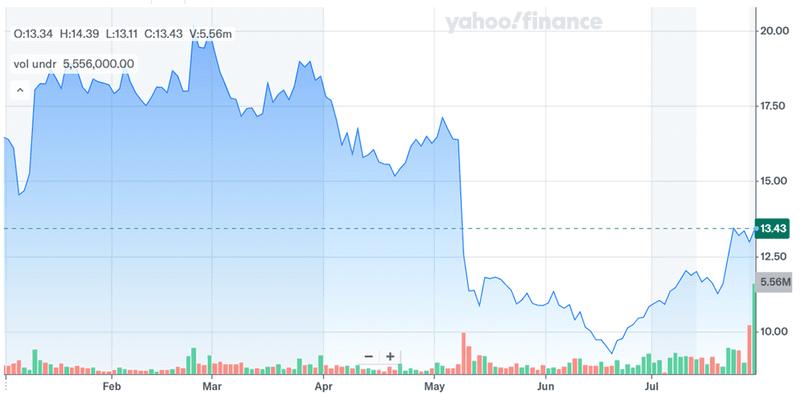

Source: Yahoo Finance

As we can see in the above chart, Axogen's stock price has witnessed a slight spike but is far away from the $18 mark, leaving some room for M&A speculators to profit. In terms of valuation, Axogen currently trades at an LTM EV/Sales of 3.4x and EV/Gross Profit of 4.58x, with an LTM EV/EBITDA of 100.71x reflecting near-term margin compression. The $18 per share offer reflects a forward-looking premium that assumes operational improvements post-BLA and synergy realization. Moreover, the company’s asset base, regulatory trajectory, and commercial footprint align well with the strategic interests of potential acquirers in the biologics or surgical solutions space. The impending BLA approval for Avance Nerve Graft could serve as a catalyst for sustainable revenue growth and margin expansion, supported by a focused sales strategy and expansion into adjacent procedures. Overall, we believe that while the company is a logical strategic fit, a deal outcome will depend on risk appetite, integration capabilities, and capital allocation priorities of the interested buyer.