Better than Acorns? (Here are the facts) + bonus offer

[ad_1]

In this Stash app evaluate, I’ll provide you with all the stone chilly details and you’ll determined if it’s higher than Acorns. (read our full acorns review)

ALSO READ: Wealthsimple Review: No more worrying about your investments

Did that round one-third of Americans have nothing saved for retirement?

Everybody has the purpose of retiring sometime, however some folks haven’t begun working towards that purpose.

People haven’t started saving and investing as a result of it’s difficult for most individuals.

But why is that this?

This query is the identical one which Stash founders Ed Robinson and Brandon Krieg discovered themselves pondering.

Every new investor faces two obstacles:

- The price is simply too excessive

- The data is simply too sophisticated

With this in thoughts, Robinson and Krieg went to work, and Stash Invest was born.

The firm launched in October 2015 with the goal of simplifying the world of investing.

First-time buyers can use the firm’s platform to put money into a diversified portfolio with a small sum of money.

Today, Stash has helped hundreds with schooling, companies, and know-how to assist safe their consumer’s monetary futures.

Could Stash provide help to?

Let’s discover out.

Micro-Investing

Micro-investing is self-explanatory: an funding of a small sum of money.

Nowadays, firms are permitting buyers to purchase fractional shares (as an alternative of complete shares) to make investing extra reasonably priced for everybody.

Micro-investing removes the price barrier to investing…

…so now the price of investing can’t be too excessive.

Now, you don’t have any excuse to place off investing as a result of…

…Stash is a micro-investing platform that permits customers to take a position small quantities of cash at a time.

Rich, middle-class, or poor – you may get started saving immediately with Stash.

But earlier than you get started, let’s see what precisely this firm has to offer.

Stash Overview

Stash is an app that offers you the instruments, steering, and confidence to take a position and develop your wealth.

Instead of making an funding portfolio for you, the firm offers you the basis to construct your individual.

Stash is exclusive as a result of it isn’t a robo-advisor that chooses investments for customers. Instead, the firm empowers customers to take a position on their very own by way of schooling and varied instruments.

Because let’s face it – investing is usually a daunting job whenever you are simply beginning.

This firm could make the job much less daunting and even pleasant.

This is a vital step for brand spanking new buyers…

…even in case you can automate your investing, you must perceive your investments.

With Stash, you may:

- Invest as little as $5

- Learn the ins and outs of investing

All it takes is two minutes, 5 {dollars}, and a cellphone to start investing confidently.

Who Is Stash Best For

Stash is a wonderful choice for starting to intermediate buyers.

Users can even select customized investments (extra on that later) and acquire entry to a low-maintenance funding account.

So, actually – Stash might be helpful to any investor searching for these particular traits.

But newbie buyers stand to achieve the most from the Stash platform as a result of it is a wonderful studying device.

Stash Products

The app is easy and won’t overwhelm you with choices.

With Stash, you’ve two account choices:

- Taxable funding account

- Tax-advantaged retirement account: a standard or Roth IRA

You will make investments by way of the firm’s platform by depositing cash into your account.

But the distinctive factor about Stash is that it’ll not make investments or steadiness your portfolio for you.

How Stash Works

This part will take you from sign-up to creating your first funding with Stash.

Eligibility

Before you go any additional, let’s just remember to are eligible for an account.

You should meet three eligibility necessities to hitch Stash:

- Be a minimum of 18 years previous

- Be a resident of the United States

- Have an energetic checking account

Sign-up

You can sign-up free of charge in your desktop or obtain the Stash app to your cellphone.

To get started, simply enter your e-mail deal with and create a password.

New buyers can start an account with a free $5 investment.

Create your investor profile

After you are signed-up, you may start creating your profile by finishing a questionnaire that asks for data like your targets, age, monetary assets, and desired danger stage.

This data helps the firm consider your danger tolerance, present related funding recommendation, and provides customized funding recommendation.

Once your danger stage is decided, Stash offers you with an inventory of funding choices to decide on.

The three danger ranges are:

- Conservative

- Moderate

- Aggressive

Each danger stage relies upon your solutions to the questionnaire and has its personal really helpful investments.

The “aggressive” portfolio is a excessive risk-high reward proposition, and the “conservative” portfolio is a low risk-low reward proposition.

In common, in case you are extra risk-averse, you’ll be invested in additional conservative property (i.e., bonds) and vice versa.

These suggestions are much like what a robo-advisor does, however Stash gives much more funding choices.

You can’t manually change your danger stage – you will want to vary your private particulars or funding plan to do that.

Fund your account

You might want to fund your account by linking Stash to your checking account.

You can do that by:

- Entering your financial institution login and password

- Entering your account and routing numbers

Once your checking account is efficiently linked, it is possible for you to so as to add and subtract cash utilizing the Stash Deposit display screen.

There are no switch charges for deposits or withdrawals and shifting cash could be very straightforward.

Verify your identification

Verification could be very straightforward with Stash. The firm would require your social safety quantity to confirm your identification.

Once you’ve accomplished the verification, you are ready to start investing!

Choose your first funding

Once your account is set-up, you may select your first funding.

Fractional shares permit customers to start investing with as little as $5.

Stash will make funding strategies primarily based in your danger stage that apply to your monetary scenario.

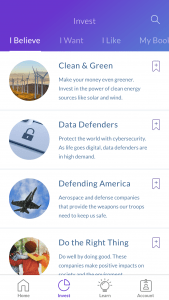

But as an alternative of selecting a stock or fund, you may select from ‘themed’ investments.

Stash renames every ETF in order that customers can get a common thought of what they are investing in.

These themed investments make investing extra easy, relatable, and presumably even enjoyable.

Each funding providing is damaged up into three classes:

- “I believe.” A selected trigger drives these investments. For instance, you may put money into different power or defending America.

Portfolios embrace: Clean & Green, Do the Right Thing, Equality Works

- “I want.” Your funding targets drive these investments. For instance, you may put money into treasured supplies, blue-chip shares, or conservative investments.

Portfolios embrace: Park My Cash and Aggressive Mix

- “I like.” Your hobbies and pursuits drive these investments. For instance, you may put money into retail, tech, and social media shares.

Portfolios embrace: Retail Therapy and Internet Titans

Each funding particulars danger stage, efficiency historical past, and the holdings. You can even see what the underlying funding is for any themed funding.

For instance, SPDR S&P 500 BioTech ETF is listed as ‘Modern Meds’ and the Vanguard Small-Cap ETF is known as ‘Small but Mighty.’

You even have the flexibility so as to add prompt ETFs into your portfolio.

However, one caveat to this investing (i.e., selecting “I like”) is that it might not be the finest funding in your given scenario.

Be positive to entry the instructional supplies and perceive what you are investing in beforehand.

Once you are prepared to take a position, there are quite a few investing tips and guides supplied by Stash to maintain you on the street to success.

Bonus Offer: Sign up immediately and get $5 deposited into your account free of charge. Click Here

* This offer received’t final

Stash App

Stash is primarily a cellular app. The app is suitable with iOS and Android units.

You can sign-up for an account on the Stash web site, however can solely make investments utilizing the cellular app.

The cellular app is the place Stash units itself aside with its useful and intuitive design. The shows are related and usually straightforward to grasp for various ranges of information.

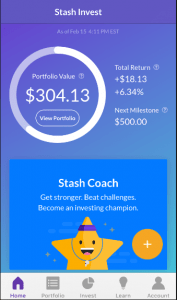

Here is a have a look at a few the tabs in the Stash app:

Home. Here you may view a abstract of your investments, portfolio efficiency, and milestone progress.

Learn. Here you may view totally different instructional articles primarily based on what you are trying to study. Materials are organized from newbie to extra in-depth upon getting started to get the dangle of issues.

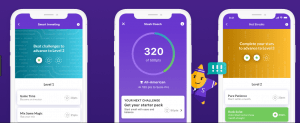

Another cool function in the app is “coaching” which inspires additional studying and helps you steadiness your portfolio.

The device offers you a rating primarily based in your mixture of property and varied challenges you’ve accomplished (i.e., studying sure instructional supplies).

Overall, we discovered the app to be intuitive and really straightforward to make use of.

Stash Invest Minimums and Fees

Stash doesn’t have minimal steadiness necessities.

Instead, you will want $5 to start investing in a taxable funding account and $15 to open a Roth or conventional IRA.

Stash prices customers two separate, flat charges:

- Users with much less than $5,000 invested pay $1/mo.

- Users with over $5,000 invested pay 0.25% of property below administration yearly.

For retirement accounts (Roth and Traditional IRA):

- Users with much less than $5,000 invested pay $2/mo.

- Users with over $5,000 invested pay 0.25% of property below administration yearly.

$1/mo. could appear low cost (and it might be low cost), however in case you are investing small quantities, it might be important.

Key Features

Stash is a hands-off funding platform for customers. Outside of suggestions and tips – you are in management.

Here are a few of the options that you ought to be conscious of earlier than signing up:

Electronically Traded Funds (ETFs)

The firm gives over 30 ETFs which is above-and-beyond what robo-advisors offer.

You can view an inventory of every ETFs holdings and the underlying securities of themed portfolios.

Individual Stocks

Stash additionally gives a restricted variety of particular person shares.

These shares embrace Amazon, Apple, Facebook, and General Electric.

Fractional Shares

Fractional shares permit customers to take a position small quantities.

This function implies that you should purchase a share of any stock for as little as $5.

Smart-Save

The Smart-Save function allows customers to avoid wasting extra money robotically.

Smart-Save analyzes consumer accounts to find out the place cash could be saved and robotically put the further money in your Stash account.

Stash Banking

The Stash Banking function helps customers handle their cash and gives FDIC-insured accounts with no minimal steadiness required.

Stash Retire

Stash Retire offers you the choice to put money into a standard or Roth IRA with simply $15.

Also, for these under-25, Stash gives no-fee retirement accounts. Investing free of charge is a GREAT incentive to start saving for retirement at a younger age.

Stash app Customer Service

Stash is simple to contact through their web site by way of the “Contact Us” link positioned at the backside of the dwelling web page.

Stash is obtainable for questions Monday by way of Friday from 8:30 a.m. to 6:30 p.m. ET, or on Saturday and Sunday from 11:00 a.m. to 5:00 p.m. ET.

Is Stash Safe?

Yes! Stash is a reputable firm with an A- score on Better Business Bureau.

What We Love About Stash

Educational alternatives

Stash is great for newbie buyers primarily due to the instructional supplies.

The firm tailors your instructional content material primarily based on the data that you just present when getting started.

The firm has categorized studying sources as follows:

- Teach Me

- Money News

- Money Talk

- Stash

Understanding your investments will set you as much as be a profitable investor over the long-term.

Stash does a wonderful job at slicing by way of sophisticated ideas and phrases making investing straightforward for anybody to grasp.

There are additionally query mark symbols all through the platform that launch fast definitions or explanations.

All of those function are necessary as a result of customers are the ones accountable for constructing their portfolio primarily based on strategies for Stash.

Savings help

The Smart-Save device helps customers create higher financial savings habits.

When the device identifies a chance to avoid wasting, it robotically strikes that cash into your Stash account.

Transfers are solely made when doable and won’t overdraft your checking account.

Low account minimal

There are no minimal steadiness necessities. No minimal steadiness necessities imply that your account won’t incur charges for going beneath a sure threshold.

You will want a minimum of $5 in your account to take a position which is an inexpensive minimal. The low-minimum funding is made doable by fractional shares.

Fractional shares

As talked about above, you should purchase fractional shares of stock.

This function offers buyers of all monetary conditions the alternative to take a position.

Stash purchases ETFs and shares and allocates every share amongst invsetors.

Custodial accounts

Custodial accounts let you give nieces, nephews, children, grandkids, and many others., the opportunity to invest.

You should be 18 years or older to open an account, so custodial accounts present an exception to that rule.

Stash is usually a nice choice to show children the way to make investments, as properly.

Themes

Instead of seeing random ETF names, you will notice themes you could select from.

Each theme gives particular person ETF choices. Themes make investing in ETFs simpler to grasp.

But make sure you view and perceive the underlying investments.

What We Don’t Love About Stash

Fees

The $1/mo. price charged on accounts with below $5,000 might not be value it for everybody.

For instance, in case you make investments $100 with Stash, you’ll lose $12 over the course of 1 yr.

It could be very tough in your funding to develop whereas paying that price.

ETF bills

The ETFs that Stash gives have a median expense ratio of 0.34%.

This quantity is excessive in comparison with robo-advisors.

However, that is a part of the price related to issues like investing in causes or firms that you just imagine in.

Is Stash App Review Summary. Is it proper For You?

Stash is an ideal choice for newbie buyers as a result of the firm removes the two most important boundaries:

- The price is simply too excessive

- The data is simply too sophisticated

Stash has confirmed to be an answer for those who do not need the cash or know-how to take a position.

The firm makes investing straightforward and might get you in your technique to constructing your monetary future in below 5 minutes.

Stash additionally has a singular method to funding schooling that may profit you lengthy after you’ve moved on from the firm.

Stash’s steering can even provide help to keep away from shedding cash attributable to expensive investing errors.

Additionally, the no-fee retirement accounts for customers’ under-25 is a good incentive for brand spanking new, younger buyers.

However, it’s essential to grasp that the charges charged by this firm are greater than you could possibly discover elsewhere.

This price could be notably dangerous to these with low account balances.

Despite this downfall…

…Stash does offer worth that justifies the month-to-month price and is undoubtedly a viable funding choice.

Overall, this is a wonderful app for faculty college students and newbie buyers.

So, what are you ready for – are you able to start investing?! Click here to open your account TODAY and Stash Invest gives you $5 free

Stash Invest

Pros

- Low minimal deposit and fractional shares make investing very reasonably priced

- Investment steering and schooling simplify the investing course of

- Themed funding classes let you put money into belongings you care about

- Free retirement accounts for customers under-25

Cons

- High price on small account balances

- Limited ETF funding choices

[ad_2]