Boeing’s $33 Billion Comeback? A Surprise Win Over Lockheed & Korean Air’s Mega Order Could Change Everything!

After years of turbulence, Boeing (NYSE:BA) appears to be regaining altitude. The aerospace and defense behemoth has seen its stock rally on multiple positive catalysts in recent weeks. Most notably, Boeing secured a major $33 billion aircraft and engine deal with Korean Air following its merger with Asiana Airlines, reinforcing its presence in Asia's booming aviation market. Additionally, Boeing delivered a surprising blow to Lockheed Martin by winning the Air Force’s next-generation F-47 fighter jet contract—a move that lifted its stock and stunned much of Wall Street. Operationally, Boeing is reporting progress across its commercial production lines, with strong momentum in both the 737 and 787 programs, and its CFO recently reaffirmed that Q1 is tracking in line with expectations. While the company is still dealing with the aftermath of past issues, including the 737 MAX crashes and production delays, the tide seems to be turning, making Boeing a company that’s hard to ignore in 2025.

The F-47 Jet Fighter Win Over Lockheed Martin

In one of the most unexpected defense contract outcomes in recent years, Boeing managed to beat Lockheed Martin for the U.S. Air Force’s sixth-generation F-47 fighter jet program. This decision, publicly announced by President Donald Trump, stunned the defense sector and reintroduced Boeing as a serious contender in high-stakes military aviation. The F-47 will eventually replace the Air Force’s existing fleet of F-22s, with the aircraft expected to cost hundreds of millions to produce and maintain across its multi-decade service life. Analysts estimate that the F-47 program could bring in $120 billion to $150 billion in revenue for Boeing. The company’s shares surged on the news, gaining over 3% on announcement day and continuing to rise thereafter. This victory holds strategic value as well—it challenges Lockheed’s dominance in the fighter jet space and signals a potential resurgence for Boeing Defense, which has struggled in recent years with losses tied to fixed-price contracts and inflation. Notably, Lockheed was widely expected to win the contract, and its stock reflected the blow, dropping around 7% since the announcement. While Lockheed still retains the more entrenched F-35 program, analysts like Richard Safran of Seaport Global noted that the scale and symbolism of Boeing’s win could open the door for more defense opportunities down the line. Moreover, Boeing is also in contention for the Navy’s upcoming sixth-generation fighter jet program, although this time it faces off against Northrop Grumman. Winning both contracts is seen as unlikely by analysts, but even a split win allows Boeing to assert a stronger presence in next-gen defense technologies.

The $33 Billion Korean Air Order & Global Aviation Backlog

In a formal move that cemented previously announced plans, Korean Air signed a $24.9 billion contract with Boeing to purchase 50 new jets, alongside a $7.8 billion deal with General Electric for associated engines and services. The Boeing deal includes 20 777-9 and 20 787-10 aircraft, to be delivered by 2033. This order gains strategic significance following Korean Air’s completed merger with Asiana Airlines, which has propelled the company into the world’s top ten airlines by capacity and made it Asia’s second-largest carrier. The order also supports Boeing’s long-term commercial aviation strategy by adding momentum to its widebody programs, which were severely affected by the pandemic and subsequent production issues. Furthermore, this contract highlights Boeing's robust backlog, now estimated at over $0.5 trillion, giving the company flexibility to navigate geopolitical and supply chain disruptions. Boeing CFO Brian West has emphasized the role of this backlog in offsetting near-term risks, including potential tariffs or customer-specific constraints. From a policy perspective, the Korean Air deal was also celebrated by U.S. and South Korean trade officials as a reinforcement of economic ties, especially as political rhetoric around tariffs intensifies. Given that this order supports production of key aircraft models where Boeing is attempting to scale up—such as the 787, which is targeted to reach 7 units per month—this deal serves both as a financial win and an operational catalyst. Moreover, it signals that global demand for widebody jets is recovering, with airlines expanding fleets in anticipation of long-term growth in international travel.

Commercial Production Stabilization & Inventory Wind-Down

After years of disruptions, Boeing’s commercial aircraft production appears to be stabilizing. The company is targeting a production rate of 38 aircraft per month for the 737 program and 7 per month for the 787 program by year-end. Boeing CFO Brian West recently noted during the Bank of America Global Industrials Conference that the company is already cycling all three Renton 737 assembly lines and that both fuselage and engine availability are not constraints at this point. For the 787, heat exchanger and seat shortages that plagued earlier months have been resolved, and production is now steady at 5 per month, with expectations to increase. Boeing is also winding down its “shadow factories,” where older inventory aircraft were being reworked, and reassigning labor to fresh production. This transition signals that Boeing is confident in its quality control systems, including the six FAA-monitored KPIs for stability like rework rates, supplier shortages, and training metrics. Notably, elevated inventory—which has acted as a buffer against supply shocks—will now serve as a source of cash as it is converted into deliveries. Management expects this inventory wind-down to improve cash flow in the coming quarters. For Q1, Boeing is forecasting lower-than-expected working capital drag, with free cash flow potentially outperforming guidance by hundreds of millions. While Boeing is not projecting a near-term return to full profitability, these operational improvements indicate that it is moving toward a normalized production cadence—an essential condition for financial recovery.

Reintegration Of Spirit AeroSystems & Strategic Restructuring

Boeing’s plan to reacquire Spirit AeroSystems is advancing toward a mid-2025 closing and is viewed internally as a critical move to enhance operational control and long-term efficiency. Spirit, which supplies major fuselage components, has shown improved operational consistency from its Wichita facility, according to Brian West. Boeing believes bringing Spirit back in-house will improve safety, quality, and stability across its production lines by enabling tighter integration and reducing bureaucratic inefficiencies. The transaction is being accompanied by detailed integration planning and cultural onboarding, with the aim of treating Spirit personnel as if “they never left,” per West’s comments. While Boeing does not plan a massive portfolio overhaul, it is undertaking a “pruning” exercise to shed non-core assets, supplement liquidity, and streamline focus. For instance, Jeppesen, a digital aviation service, is reportedly being evaluated for divestiture. On the other hand, Boeing is retaining its investment in Wisk, an autonomous air mobility venture, due to its long-term innovation value. These strategic moves signal a sharpening of Boeing’s corporate focus under new leadership. CEO Kelly has also launched a culture reset, embedding new values and performance expectations across teams. Meanwhile, aircraft certification timelines for the 737-7, 737-10, and 777X remain unchanged, with ongoing collaboration with the FAA. The 777X has already entered the second phase of flight testing, with over 3,700 flight hours completed. Together, the Spirit deal, cultural transformation, selective divestitures, and stable certification programs represent Boeing’s broader effort to de-risk its business and reestablish its industrial and strategic credibility.

Final Thoughts

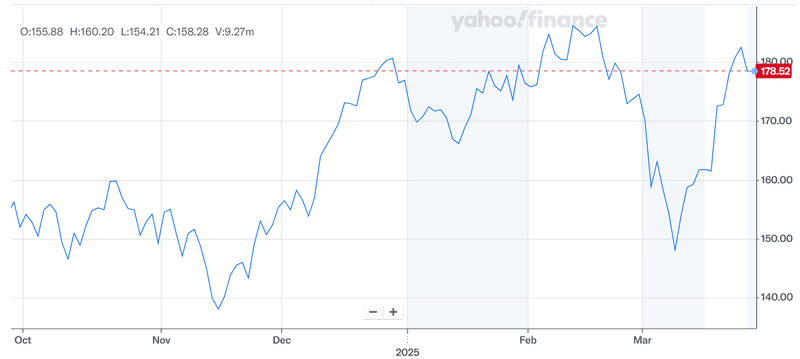

Source: Yahoo Finance

Boeing’s recent developments have not gone unnoticed by the market and the company’s stock is trading close to a 6-month high. However, its multiples continue to be low as it is trading at an LTM EV/ Revenue of 2.47x which is lower than its aerospace peers. There is little doubt that the company has seen meaningful progress on multiple fronts—from its surprise win over Lockheed Martin for the F-47 fighter program to the significant Korean Air order and improving commercial production metrics. The planned reintegration of Spirit AeroSystems and renewed focus on operational and cultural discipline reflect a deliberate approach to long-term recovery. However, investors should remain mindful of lingering risks, including regulatory oversight, defense program uncertainties, and execution challenges in certification and production ramp-ups. As Boeing attempts to rebuild its reputation and financial footing, it may seem like a solid bottom-fishing candidate but given its past history, the stock is certainly not for the risk-averse or the faint-hearted investors.