Burlington Offers Growth At A Reasonable Price – Burlington Stores, Inc (NYSE:BURL)

[ad_1]

2018 has been large

Burlington Stores (BURL) has had a unprecedented 12 months in 2018. During a time when the broad market is unstable and retailers, significantly smaller ones, have been hammered, Burlington has carried on doing what it does finest. The stock has rewarded shareholders immensely as soon as once more this 12 months because it trades roughly 30% greater than it did when the 12 months started. I’ve been bullish on Burlington over the previous couple of years and that bullishness has actually been rewarded. Indeed, I used to be out in September with a name that mentioned the stock would make new highs. While the stock did technically make a brand new excessive in November, I’m hardly claiming victory. However, I believe the latest selloff is an opportunity for traders that wish to personal Burlington to get an opportunity to take action after one other stellar earnings report.

Q3 outcomes spotlight Burlington’s operational excellence

Burlington’s Q3 report was not solely excellent, however included a lift to full-12 months steerage as effectively. Total income was up 13.7% in Q3 on a comparable gross sales acquire of 4.4%, which accounts for a shift within the retail calendar in opposition to final 12 months. The remainder of the gross sales acquire got here from new and in any other case non-comparable shops’ income, which totaled $128 million in incremental income in Q3. In addition, the 4.4% comparable gross sales acquire got here on high of a 3.1% acquire in final 12 months’s Q3, producing a two-12 months stacked comparable gross sales acquire of a whopping 7.5%. Burlington has been producing robust gross sales beneficial properties for a while and given the outcomes we noticed in Q3, it actually seems these beneficial properties are set to proceed.

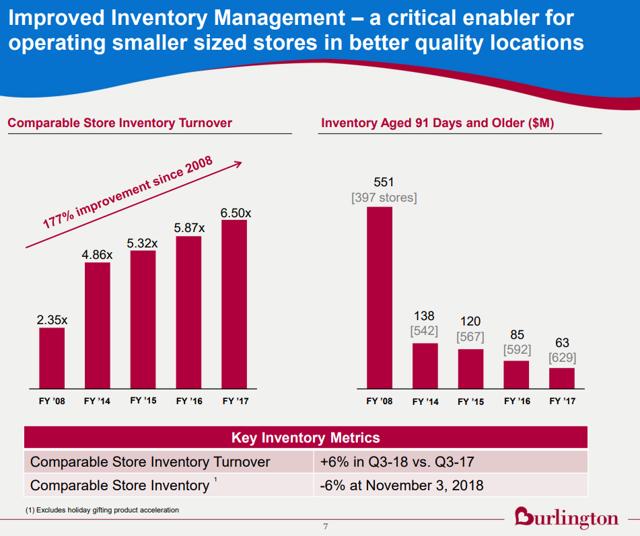

Gross margins additionally continued their trek greater, including 20bps to final 12 months’s Q3 for a complete of 42.4%. Higher freight prices eliminated 20bps from gross margins however a 40bps acquire in merchandise margin greater than offset the upper freight expense. Burlington was in a position to enhance merchandise margins as a result of it has stronger pricing energy due to its superior shopping for and stock turnover. Burlington’s merchandising technique hinges upon comparatively small shops with very quick stock turnover charges, as seen under.

Source: Investor presentation, page 7

This slide exhibits some large stats on simply how productive Burlington has been in recent times with its stock. Any retailer has to handle its stock as a result of when the corporate buys one thing, its money is tied up in that merchandise till the merchandise is bought. Regardless of how robust margins are on a product, if it sits for a really very long time earlier than being bought, the retailer gained’t be significantly worthwhile. On the opposite finish we discover Burlington, an organization that has large turnover charges, which implies it spends much less time holding merchandise, which ends up in higher pricing energy by means of decrease markdowns, which then boosts margins.

Indeed, comparable gross sales stock turnover was 2.35X in 2008, which isn’t a foul quantity. However, the corporate has since boosted that quantity to an astounding 6.50X. In addition, its aged stock – which is the margin-killing product that needs to be marked right down to be bought – is down to only $100Ok per retailer from $1.4 million per retailer in 2008. The transformation Burlington has made with respect to its stock practices is nothing in need of astonishing, proving it’s a finest-in-class retailer.

Continuing the margin dialogue, Burlington managed to scale back SG&A prices by 60bps in Q3, pushed by expense leverage on greater gross sales. Burlington continues to give attention to working prices in order that when it does produce gross sales development, it sees significant working leverage. In whole, working margins rose 80bps in Q3 and earnings-per-share had been up 73% on an adjusted foundation to $1.21. Management noticed match to spice up steerage for the complete-12 months to a midpoint of $6.35 in opposition to a previous midpoint of $6.17. Overall, Q3 was large, persevering with a protracted streak of robust experiences from Burlington.

A brilliant future awaits

We’ve established that Burlington has been terrific previously at boosting earnings, however what about wanting ahead? There are some things I believe will proceed this story for a very long time to come back, together with the superior stock administration we’ve already mentioned, in addition to comparable gross sales development. In addition to that, I see retailer growth as a key driver of lengthy-time period development.

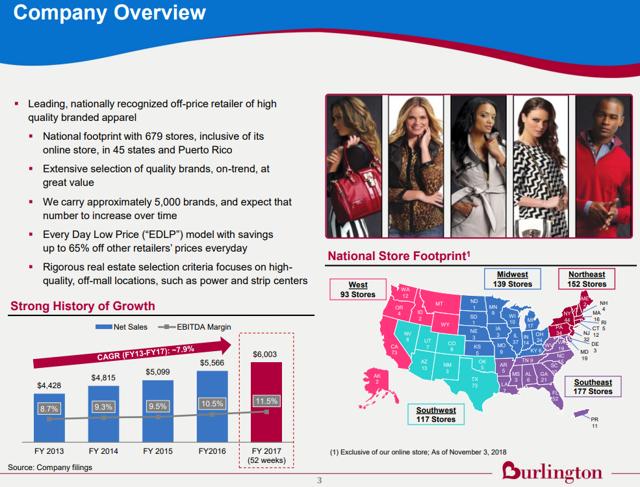

Source: Investor presentation, page 3

Burlington has 679 shops right this moment in 45 states, so its footprint is numerous in geographical phrases. That’s fascinating provided that, significantly for an attire retailer, totally different components of the nation have totally different style developments and climate patterns that affect gross sales. However, it additionally implies that Burlington has ample room to proceed to increase its footprint by including shops in markets the place it maybe has one retailer, or in fully new markets, of which there are lots. Burlington has confirmed this mannequin works nearly in all places, so I anticipate we’ll proceed to see increasingly more shops for a very long time to come back. Indeed, it appears Burlington is inquisitive about some previous Sears shops as a strategy to get into some new places extra cheaply.

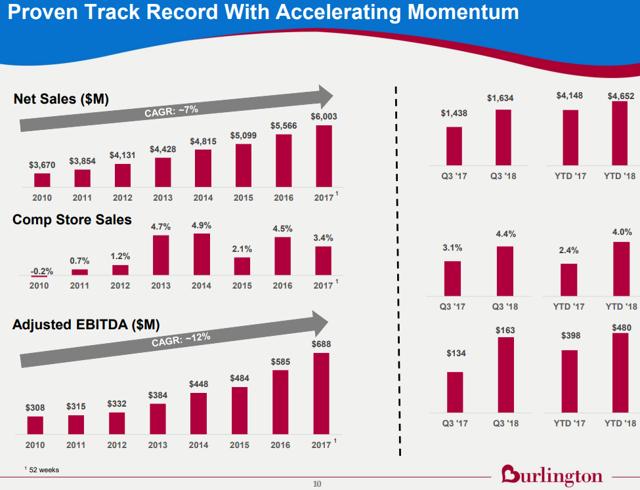

Burlington has a confirmed observe report in terms of producing development and, importantly, it isn’t displaying any indicators of letting up.

Source: Investor presentation, page 10

Total gross sales have grown previously a number of years at a CAGR of 7%, thanks partially to robust comparable gross sales beneficial properties, together with 4.5% and 3.4%, respectively, previously two years. That, mixed with margin enhancements due to its superior sourcing technique and execution, has led to 12% annual development in working earnings. Analysts, and yours really, anticipate the great occasions will proceed to roll within the coming years as Burlington continues to execute on its method of low costs and large stock administration.

Growth at an inexpensive value makes it a purchase

The stock has been resilient at a time when the retail sector hasn’t, so it isn’t practically as low cost as a few of its counterparts. Shares commerce for 25 occasions this 12 months’s EPS midpoint of $6.35, as guided by administration, and 22 occasions subsequent 12 months’s estimate of $7.09. This valuation is kind of corresponding to the place it has traded in recent times, so the stock seems to be pretty priced to me in the intervening time. That’s about nearly as good as one can anticipate for a famous person sector chief like Burlington, so for those who imagine there’s nonetheless development available – I imagine the weight of the proof suggests there unequivocally is a few left – the stock seems enticing. Thus, I’m reiterating my purchase advice on Burlington because the story continues to unfold as anticipated, so I nonetheless imagine shares will transfer a lot greater within the coming years.

Disclosure: I’m/we’re lengthy BURL. I wrote this text myself, and it expresses my very own opinions. I’m not receiving compensation for it (apart from from Seeking Alpha). I’ve no enterprise relationship with any firm whose stock is talked about on this article.

[ad_2]