Buyout Buzz: Is Victoria’s Secret About To Be Acquired? Here’s What Investors Need To Know!

Victoria’s Secret (NYSE:VSCO) is making headlines once again, but this time, it’s not just about its latest collections or fashion show revamps. The lingerie powerhouse has reportedly attracted takeover interest, sparking a rapid 5% surge in its stock price. According to traders citing a Betaville "uncooked" alert, the company has engaged advisors to explore a potential sale. This development raises questions about who the potential buyers could be and why Victoria’s Secret has suddenly become a prime acquisition target. Let us dig deeper and find out why the company could be a hot ticket in the M&A space.

Strong Market Position & Brand Equity

Victoria’s Secret remains the dominant force in the intimate apparel industry, boasting approximately 20% market share in North America. The company has a vast customer base with 25 million active customers and 38 million loyalty members. Additionally, its digital presence is formidable, with over 88 million Instagram followers, making it the second most-followed brand globally in its sector. This level of brand recognition provides an immediate advantage to any acquirer looking to capitalize on a well-established name with deep consumer engagement. The company has successfully transitioned from a legacy brand to one that resonates with modern audiences by embracing inclusivity, expanding its product range, and adjusting marketing strategies to align with evolving consumer expectations. Recent strategic efforts to refine product assortments, reduce excessive promotional activity, and invest in higher-margin categories like beauty and athleisure further enhance its market appeal. Any strategic buyer with an interest in retail, e-commerce, or direct-to-consumer brands would find this brand equity invaluable, as it drastically lowers customer acquisition costs while offering immense scalability. Furthermore, the company's ability to outperform the broader North American intimates market despite sector-wide headwinds highlights its resilience and growth potential.

Robust International Expansion Strategy

Victoria’s Secret is not just thriving in North America; its international business is experiencing double-digit growth, driven by strong retail sales, joint ventures, and franchise partnerships. The company’s expansion into emerging markets like China, the Middle East, and Latin America has positioned it as a global brand with multiple revenue streams. In Q4, the company reported strong performance in its China and U.K. joint ventures, as well as an increase in travel retail sales—an area where many retailers have struggled post-pandemic. Additionally, Victoria’s Secret is actively investing in supply chain efficiencies, including the establishment of a European distribution center in the Netherlands, which will improve delivery speed and reduce costs for international markets. This level of strategic expansion makes the company an attractive target for a global fashion conglomerate or a private equity firm looking to tap into fast-growing international markets. By leveraging its well-known brand, an acquirer could accelerate global penetration and drive significant topline growth without requiring substantial rebranding efforts. Given the company's success in adapting product offerings to regional tastes and cultural preferences, a buyer could further amplify these efforts to deepen market share in regions with rising disposable incomes and a growing appetite for premium lingerie and beauty products.

Diversified Revenue Streams Beyond Lingerie

Victoria’s Secret is no longer just about lingerie; it has transformed into a lifestyle brand with strong growth in beauty, swimwear, and sportswear. The company’s beauty segment, featuring its iconic Bombshell fragrance and an expanded range of higher AUR (Average Unit Retail) products, has outperformed expectations and continues to be a growth engine. Swimwear, which was once a major category for the brand, has seen a strong resurgence, driven by strategic collaborations such as PINK by Frankie, which resonated well with Gen Z consumers. Additionally, the company has aggressively expanded into the activewear segment with VSX, a move that aligns with broader industry trends favoring athleisure and comfort-driven fashion. The ability to diversify beyond its core lingerie business mitigates category-specific risks and enhances its overall investment appeal. For financial sponsors seeking an asset with multiple high-margin revenue streams, Victoria’s Secret presents a compelling opportunity. The company’s push into lifestyle categories aligns with changing consumer habits, where lingerie shoppers are looking for a one-stop destination for beauty, loungewear, and activewear. The growing success of these adjacent categories ensures that an acquirer wouldn’t be betting solely on the lingerie market but rather on a diversified, evolving fashion and beauty powerhouse.

Operational Improvements & Cost Optimization

In addition to revenue growth, Victoria’s Secret has been focused on strengthening its operational efficiencies and optimizing costs. The company has been reducing promotional dependency, streamlining its supply chain, and implementing a more customer-centric merchandising approach. The leadership team has already made notable progress in cost savings, having achieved nearly $200 million in efficiencies in 2024, ahead of its initial three-year plan. This operational discipline has resulted in healthier margins, with fewer markdowns and a stronger focus on full-price selling, demonstrating financial discipline that would be attractive to potential buyers. Additionally, Victoria’s Secret is implementing a "store of the future" concept, modernizing its retail footprint to enhance customer experience and improve sales productivity. With 95% of its top 100 stores expected to be converted by year-end, this strategy aligns with the broader retail trend of experiential and tech-enabled shopping. From a private equity perspective, these operational enhancements indicate a clear path to value creation through further efficiency gains, digital transformation, and potential synergies with other portfolio brands. The ability to drive bottom-line growth through improved supply chain logistics, store renovations, and a disciplined pricing strategy adds another layer of attractiveness to a potential transaction.

Conclusion: A Buyout On The Horizon?

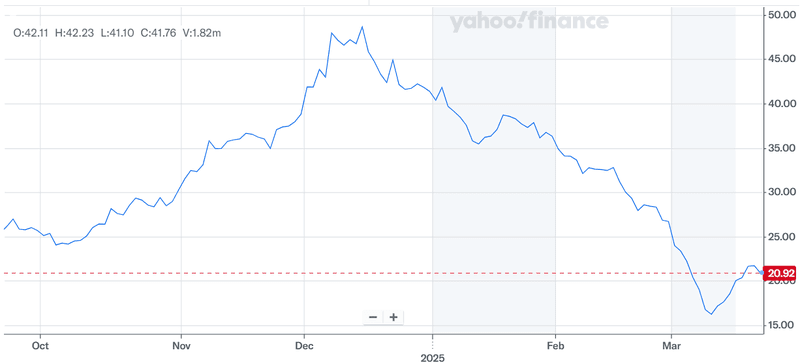

Source: Yahoo Finance

We can clearly see the stock trajectory of Victoria’s Secret and also how it has ended up becoming a cheaply valued stock. The company is currently trading at an LTM EV/ EBITDA of 7.91x which is significantly below its peer group despite having decent profitability. Over and above the cheap valuation, Victoria’s Secret’s dominant brand equity, expanding international footprint, diversified revenue streams, and disciplined cost structure position it as a valuable asset for both strategic acquirers and private equity firms. Given these factors, we see a significant chance of an acquisition taking place in the coming months. Overall, we believe that whether a deal materializes or not, Victoria’s Secret’s recent transformation makes it a brand to watch in the evolving retail landscape.