Century Casinos Launches Strategic Review, Weighs Asset Sales—Or A Full Sale

Century Casinos (NASDAQ:CNTY) has formally launched a strategic review to evaluate a full spectrum of corporate options, from individual asset sales to strategic partnerships, mergers, or even a potential sale of the entire company. The decision follows a surge of unsolicited interest from potential buyers and partners in recent months, prompting management to engage Macquarie Capital as financial advisor and Faegre Drinker Biddle & Reath as legal counsel. The review comes at a pivotal time: the company has just delivered record second-quarter revenue of $150.8 million and adjusted EBITDAR of $30.3 million, driven by strong performance in Missouri, Canada, and Poland. With $85.5 million in cash, improving leverage metrics, and no debt maturities until 2029, Century Casinos enters this process from a position of operational momentum. While no decisions have been made, the structured evaluation is designed to determine the most effective path to enhance shareholder value in an evolving gaming landscape.

Broad-Based Operational Momentum Strengthening Strategic Position

Century Casinos’ recent operating performance provides a strong backdrop for initiating a strategic review. In Q2 2025, adjusted EBITDAR rose 50% sequentially and 10% year-over-year, supported by gains across nearly all regions except Nevada. Missouri was a key growth driver, with the new $51.9 million Caruthersville Casino and Hotel delivering a 30% EBITDA increase thanks to higher visitor counts, an expanded geographic reach, and a strong showing from high-value customers. Cape Girardeau’s Riverview Hotel continued to lift gaming and non-gaming revenue despite weather disruptions, with comped guests generating an average of $556 in gaming spend. Colorado operations benefited from cost efficiencies after removing live table games, with Cripple Creek achieving a 23% comparable EBITDA increase and the new electronic table games lounge attracting consistent play. West Virginia’s Mountaineer Casino grew EBITDAR 12% on stronger iGaming, and Canadian properties posted gains after targeted renovations. Poland rebounded sharply, with revenue up 23% and EBITDAR up over 300% on license renewals and property openings. This consistent, diversified performance positions Century Casinos as an attractive partner or acquisition target, demonstrating that its portfolio can generate returns across varied regulatory environments and market conditions.

Non-Core Asset Monetization Potential, Led By Poland

The planned divestment of Polish operations is a central element in the strategic review. Century Casinos expects to sign a letter of intent with an Eastern European gaming group imminently, entering an exclusivity period. Poland’s Q2 rebound—driven by license reinstatements, property reopenings, and customer redirection from a closed Warsaw venue—produced a meaningful EBITDA lift, yet management sees greater long-term value in redeploying proceeds to higher-return markets or balance sheet improvement. The review also allows for assessment of other non-core asset sales, whether domestic or international, particularly where competitive dynamics, regulatory constraints, or capital intensity limit optimal returns. The company’s mix of wholly owned assets, leased properties under agreements with VICI, and geographically diverse operations provides flexibility in structuring transactions. Selling select properties could free significant capital to fund debt reduction, expand in high-growth markets like Missouri and Colorado, or return cash to shareholders. By aligning asset sales with long-term strategy, Century Casinos can strengthen operational focus while improving its financial profile.

Capital Structure Realignment & Leverage Reduction Opportunities

Century Casinos enters the review with improving leverage metrics and no near-term refinancing pressure. At quarter-end, the company had $338.1 million in total debt, $252.5 million in net debt, and a net debt-to-EBITDA ratio of 6.2x—down from 6.9x in Q1. Lease-adjusted leverage improved to 7.3x, and no debt maturities are due until 2029, allowing management to prioritize debt reduction when strategically advantageous. Management has indicated that larger debt repurchases—potentially in the $10–$30 million range—would likely follow major asset sales such as the Poland divestment. Century Casinos has already returned capital via share buybacks, repurchasing 428,734 shares at an average price of $2.12 during Q2 under a 10b5-1 plan. With interest rates and economic sentiment influencing lower-tier and retail customer segments, the ability to flexibly allocate capital between debt reduction, shareholder returns, and targeted growth investments will be a critical factor in maximizing valuation. The strategic review provides an opportunity to recalibrate the capital structure to better balance growth ambitions with financial resilience.

Readiness For Strategic Partnerships Or Corporate Transactions

The diversity and scale of Century Casinos’ operations make it a viable candidate for strategic partnerships, market consolidation plays, or acquisition by larger operators or private equity. Its U.S. portfolio spans multiple states, supported by international holdings in Canada and Poland, and includes both regional casinos and integrated resorts. The upcoming launch of online and retail sports betting in Missouri through a BetMGM partnership adds a new growth vector, with contributions expected in 2026. Competitive positioning in markets like Colorado, where Cripple Creek benefits from spillover demand from a new competitor, underscores the portfolio’s adaptability. The company’s ability to drive consistent performance across properties, coupled with operational enhancements and property upgrades, offers multiple transaction structures: joint ventures in emerging markets, asset swaps to optimize geographic reach, or full corporate sales to strategic buyers seeking expansion. By initiating a formal process, Century Casinos can create competitive bidding scenarios, potentially improving terms and valuations for any deal pursued.

Final Thoughts

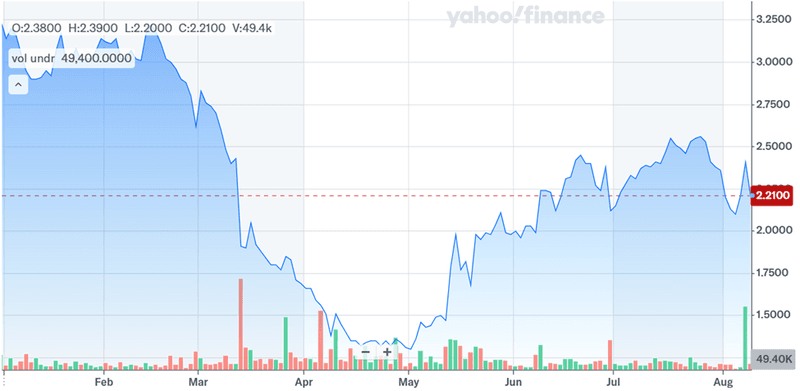

Source: Yahoo Finance

Century Casinos’ strategic review reflects a calculated response to inbound interest and the company’s desire to fully explore its value creation options. Recent operational gains across key markets, supported by targeted capital investments, position the company well for negotiations. The potential divestment of Poland and other non-core assets could fund debt reduction, strengthen the balance sheet, and refocus growth on higher-return markets. At the same time, leverage remains elevated, and competitive or weather-related pressures can impact results in certain regions. From a valuation standpoint, Century Casinos trades at an LTM EV/EBITDA multiple of 11.58x and an LTM Price/Sales ratio of 0.12x, levels that reflect both the capital-intensive nature of the business and market caution toward regional gaming operators. The strategic review process offers a platform to test market appetite, evaluate partnership opportunities, and determine whether the greatest value lies in operational independence or a transformative transaction.