Chevron’s $53 Billion Triumph Over Exxon: The Hess Acquisition Can Truly Reshape Big Oil!

Chevron (NYSE:CVX) has finally emerged victorious in a pivotal arbitration battle with ExxonMobil (NYSE:XOM), clearing the path for its long-delayed $53 billion acquisition of Hess Corporation. The ruling by a panel of international arbitrators brings an end to a high-stakes dispute that revolved around Exxon's right of first refusal for Hess's stake in Guyana’s prolific Stabroek oil block. With the panel siding with Chevron and Hess, Chevron immediately closed the acquisition and is now firmly entrenched in one of the most lucrative oil discoveries in recent memory. The deal grants Chevron a 30% stake in the Guyana project, which is projected to produce 1.2 million barrels of oil per day by 2027. This acquisition not only rejuvenates Chevron’s long-term portfolio—which had been under scrutiny by investors—but also positions the company more competitively against Exxon, which previously enjoyed a dominant presence in Guyana. Let us analyze this big win in detail and figure out if it truly alleviates growth concerns around Chevron and whether it will truly help the company achieve its global upstream ambitions.

Arbitration Clarity Unlocks Chevron’s Strategic Path Forward

The arbitration dispute between ExxonMobil, Hess, and Chevron had cast a long shadow over the latter’s biggest deal in decades. Exxon, which operates the Guyana project, argued that its joint operating agreement gave it the right of first refusal on Hess's 30% stake. This contention, if upheld, would have either blocked Chevron’s entry or forced a bidding war. However, international arbitrators rejected Exxon’s claim, validating Chevron’s acquisition strategy and removing a significant legal overhang. The dispute had put Chevron’s stock under pressure and stalled investor confidence, as the viability of the Hess acquisition—and its valuable Guyana asset—remained uncertain for nearly two years. The resolution immediately allowed Chevron to finalize the transaction and nominate John Hess to its board, adding further stability and alignment. This ruling also helped Chevron mitigate the reputational and financial risks associated with an aborted acquisition and provided the company with much-needed clarity to chart its long-term portfolio trajectory. With the arbitration behind it, Chevron not only regains credibility in executing transformative deals but also neutralizes one of its biggest legal threats. This clarity provides operational flexibility and allows Chevron to focus on executing its post-acquisition integration and portfolio optimization. Additionally, it strengthens Chevron’s precedent in handling complex cross-border M&A cases, which could prove valuable as the energy sector continues to consolidate amid geopolitical and market volatility.

Access To Guyana’s Oil Bonanza Levels The Playing Field With Exxon

The acquisition of Hess hands Chevron a 30% non-operating stake in Guyana’s Stabroek Block—one of the most consequential oil discoveries of this century. The project, which already produces about 650,000 barrels per day, is projected to exceed 1.2 million barrels per day by 2027. Previously, Exxon held a clear strategic advantage with a 45% stake and operatorship in this region, while China’s CNOOC holds the remaining 25%. Chevron’s entry significantly narrows the resource gap and long-term production growth outlook between the two U.S. energy giants. Prior to this deal, analysts and investors voiced concerns that Chevron’s portfolio lacked high-growth, high-margin assets beyond 2030, unlike Exxon which was increasingly seen as the leader in global upstream expansion. The Guyana stake immediately addresses this criticism, giving Chevron not only resource scale but also long-term revenue visibility. Moreover, the economics of the Stabroek Block are favorable—low breakeven costs, rapid development timelines, and high margins make it a crown jewel in any portfolio. While Chevron won’t operate the asset, its passive stake ensures strong free cash flow contributions without the burden of day-to-day operations. In addition, Guyana’s geopolitical stability and investor-friendly policies enhance the asset’s attractiveness. This access to long-term oil volumes helps Chevron hedge against production plateauing in mature assets like the Permian and secures a place in one of the last major conventional oil frontiers. With this, Chevron is no longer perceived as lagging in the global upstream race and can now present a more balanced growth story to shareholders.

Strengthened Capital Efficiency & Portfolio Diversification

With the integration of Hess, Chevron adds not only a lucrative asset but also reinforces its strategy of capital discipline and portfolio diversification. The company has recently committed to lowering its 2025 CapEx by $2 billion versus last year and is targeting structural cost savings of $2–3 billion by the end of next year. The Hess acquisition fits neatly within this financial framework. Chevron expects the addition of Hess to lower its corporate breakeven oil price to below $50 per barrel next year, improving its ability to sustain dividends and buybacks even in lower-price environments. Simultaneously, it continues to optimize its asset base, with recent divestitures in East Texas gas assets and other non-core regions freeing up cash and operational bandwidth. Additionally, Chevron is expanding its global footprint—building projects in the Gulf of Mexico, Kazakhstan (TCO), and Argentina’s Vaca Muerta shale basin. It is also investing in energy infrastructure for U.S. data centers through its gigawatt-scale power solutions venture. These diversified efforts ensure Chevron is not overly reliant on a single region or asset type for cash flows. By broadening its base of conventional and unconventional resources while maintaining financial discipline, Chevron increases its resilience across commodity cycles. This multi-pronged strategy of acquiring high-return assets, divesting non-core properties, and enhancing capital flexibility positions the company well for a balanced and efficient growth trajectory over the coming decade.

Long-Term Growth Visibility Restored Amid Operational Momentum

Chevron’s victory in arbitration and the addition of Guyana volumes come at a time when its long-term growth narrative needed renewed credibility. The company had faced recent headwinds, including cost overruns in Kazakhstan, production challenges in the Permian, and regulatory friction in Venezuela and California. This raised questions about whether Chevron could continue to grow organically. However, the current momentum in operational performance, when combined with the Hess acquisition, offers a more robust outlook. The Future Growth Project at TCO in Kazakhstan hit nameplate capacity within 30 days of start-up—ahead of schedule. In the Gulf of Mexico, Chevron has begun production at Ballymore, one of its most prolific projects to date, and continues ramping up Anchor and Whale. The Permian Basin is expected to return to 1 million barrels per day of production soon, supported by higher frac activity. Moreover, Chevron’s downstream and chemicals arms, including CPChem, continue to progress with capital-efficient projects. In the Eastern Mediterranean, the Aphrodite gas field in Cyprus has reached the pre-FEED stage, aiming to deliver 800 million cubic feet per day to Egypt. Collectively, these developments show Chevron is now executing effectively across geographies and segments. The Hess deal enhances this picture by plugging a significant long-term resource gap and fortifying the portfolio with a low-cost, high-growth asset. With a solid balance sheet and net debt ratio at 14%, Chevron retains financial firepower to sustain operations, absorb volatility, and possibly pursue further strategic investments.

Final Thoughts

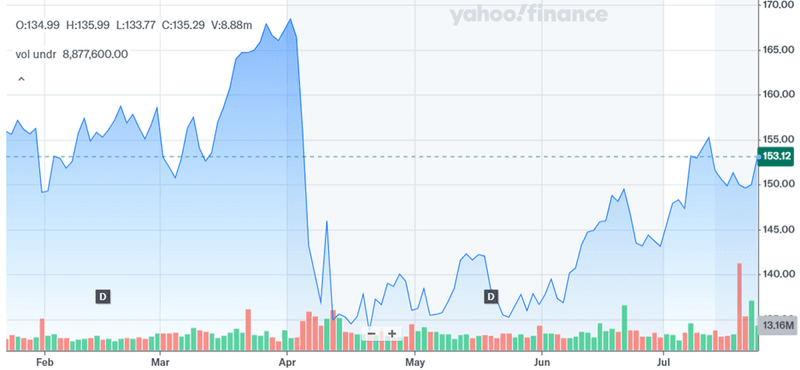

Source: Yahoo Finance

Chevron’s stock trajectory has been extremely volatile over the past 6 months and it is hard to comment on whether the stock is a good investment opportunity or not. However, there is no doubt about the fact that this arbitration win over Exxon and the successful $53 billion acquisition of Hess mark a turning point for the company. It eliminates legal ambiguity, gives access to a generational oil asset in Guyana, and addresses investor concerns about its post-2030 growth pipeline. However, it is also important to see the other side of the coin. Exxon continues to hold the majority stake and operatorship in Guyana, potentially retaining leverage over project direction. Chevron must also navigate regulatory headwinds in regions like California and Venezuela, as well as macro risks such as sustained low oil prices. Overall, we believe that despite all the challenges, Chevron’s portfolio is more robust than it was two years ago and this deal significantly reduces strategic uncertainty and places Chevron in a stronger position to compete in the global oil and gas market over the next decade.