Comerica Sparks Bidding War: PNC, Fifth Third & Huntington Could Be Interested!

Comerica Inc. (NYSE:CMA) has recently found itself at the center of M&A speculation following a public push from HoldCo Asset Management to initiate a sales process. The investment firm, holding a $155 million stake in Comerica, released a presentation urging the Dallas-based regional lender to hire an investment banker and solicit bids. Notably, HoldCo has identified PNC Financial Services, Fifth Third Bancorp, and Huntington Bancshares as potential acquirers. This development comes on the heels of Comerica’s stronger-than-expected Q2 2025 results, where earnings per share increased to $1.42 and robust loan growth offset deposit pressure. Despite ongoing concerns around deposit pricing and efficiency ratios, Comerica’s CET1 ratio stood at a healthy 11.94%, significantly above its 10% target, and the bank returned $193 million to shareholders through dividends and buybacks. With M&A chatter heating up across the banking industry amid regulatory softening, it is interesting to analyze what exactly makes Comerica a compelling potential target.

Strategic Geographic & Business Overlap For Buyers

PNC, Fifth Third, and Huntington each have expansive commercial and retail banking operations in regions that overlap meaningfully with Comerica’s footprint in Texas, California, and Michigan. Acquiring Comerica could allow these potential buyers to deepen penetration in growth markets like Dallas and Houston while simultaneously enhancing scale in mature markets such as Detroit. Comerica’s client base includes middle-market businesses and industry verticals like energy, environmental services, and private equity fund lending. The existing overlap would enable quick integration with limited branch redundancy while offering cross-sell synergies. For instance, PNC or Fifth Third could scale their treasury and payments operations through Comerica’s upgraded digital solutions, which recently saw the rollout of real-time payments and embedded finance products. Meanwhile, Huntington, having previously expanded into Texas through smaller acquisitions, could leapfrog to a major statewide presence. These synergies not only provide cost rationalization opportunities but also open revenue streams through broader product distribution and harmonized service models. Additionally, Comerica’s deep relationships with long-standing customers provide a base for enhanced fee income, particularly in wealth management, small business lending, and commercial deposits.

Strong Capital & Credit Metrics Reduce Integration Risk

One of Comerica’s most attractive qualities for a buyer is its strong capital foundation and disciplined credit approach. As of Q2 2025, Comerica maintained a CET1 ratio of 11.94%, comfortably exceeding its 10% target, even after executing $100 million in share buybacks and redeeming preferred stock to avoid punitive coupon resets. The tangible common equity ratio also improved 22 basis points quarter-over-quarter, supported by reductions in AOCI losses. Credit quality remained stable, with net charge-offs at 22 basis points—well within management’s 20–40 basis point target—and nonperforming loans fell to their lowest level in four quarters. These metrics offer a safety net for acquirers wary of taking on underperforming loan books or capital deficiencies. For acquirers like Fifth Third or PNC, known for their conservative balance sheet management, Comerica’s risk profile would make integration smoother and reduce the likelihood of post-deal write-downs or capital charges. Furthermore, Comerica’s well-monitored and diversified loan book, with growing commitments in environmental services and improved private equity deal flow, aligns with the underwriting standards of these larger institutions. Importantly, the bank’s conservative provisioning strategy has already anticipated economic uncertainties, reducing the risk of credit surprises in a merger scenario.

Revenue Upside From Embedded Payments & Fee Income

Comerica’s recent strategic focus on modernizing its payments and deposits business introduces new revenue upside for a potential acquirer. In Q2 2025, the bank unveiled two real-time payment solutions and continued investing in digital enhancements, aiming to grow fee income and deepen client relationships. Noninterest income rose by $20 million quarter-over-quarter, supported by higher capital markets revenue from syndication and FX fees. Capital markets and fee-based businesses are strategic growth areas for banks like PNC and Fifth Third, which have built capabilities in treasury services and digital banking. Comerica’s product suite, especially its traction with embedded finance and interest rate derivatives, could be quickly leveraged across a broader client base. The focus on stable fee income and digital channels also offers long-term benefit as banks pivot away from net interest income reliance in a low-rate or volatile rate environment. Moreover, with fiduciary income and deferred compensation flows rebounding, Comerica’s noninterest revenue stream provides a buffer against cyclical swings in lending. Given the trajectory, a buyer could not only unlock synergies from scale but also integrate high-margin services into their broader offering. The timing aligns with rising demand for digital-first financial solutions, giving a combined entity an edge in client retention and onboarding, particularly in commercial banking.

Comerica’s Favorable Valuation As A Compelling Entry Point

Forward multiples further suggest room for operational leverage: the NTM P/E is 13.51x and the NTM P/S 2.64x, based on normalized earnings of $5.16 per share. With forward NII growth guided at 5–7% and a projected 2% rise in noninterest income, Comerica’s earnings trajectory remains solid. Additionally, its strategic investments in growth platforms such as business banking, small business services, and digital payments provide latent value not yet fully reflected in its valuation. For a well-capitalized buyer, acquiring Comerica at these levels could offer immediate EPS accretion if cost synergies are realized, and meaningful long-term ROE uplift if revenue synergies from payments and commercial banking scale are captured. Moreover, Comerica’s relatively low leverage and high-quality deposit base (38% noninterest-bearing) could enhance the buyer’s funding profile. However, integration costs, rising deposit betas, and legacy systems may pose challenges that need to be priced into any offer.

Final Thoughts

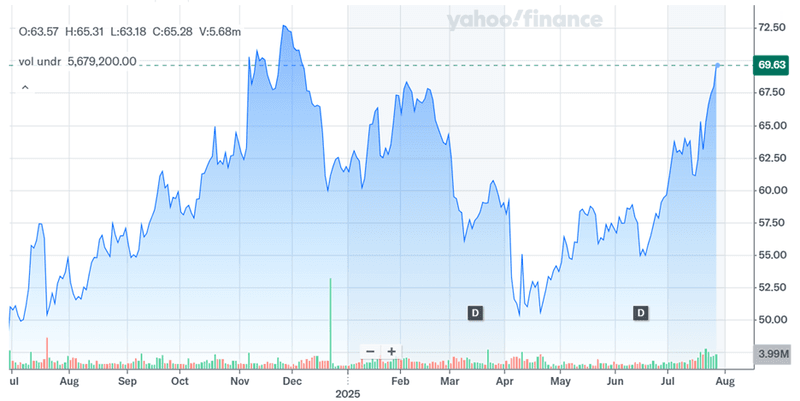

Source: Yahoo Finance

Comerica trades at modest valuation multiples relative to peers, making it an attractive financial target in an M&A scenario. As of July 28, 2025, Comerica’s LTM P/E stood at 13.37x, and LTM P/S at 2.81x. Its LTM price to tangible book value was 1.45x, which, while slightly elevated from earlier in the year, remains within a manageable acquisition range, particularly considering its 4.1% LTM dividend yield. Compared to industry benchmarks, these figures indicate neither a distressed nor a premium valuation, offering potential buyers a balanced entry point.

Overall, we believe that Comerica’s potential as an acquisition target hinges on several converging factors: a geographically attractive footprint, an improving performance trajectory, and a core funding base that supports lending growth. For suitors like PNC Financial Services, Fifth Third Bancorp, and Huntington Bancshares, the ability to extract operational and strategic synergies from Comerica’s deposit franchise, commercial lending capabilities, and digital payments platform is evident. At the same time, Comerica’s high efficiency ratio and expense base may present integration challenges that would require careful planning and execution. While HoldCo Asset Management’s call for a sale introduces pressure, the timing and likelihood of a deal will depend on strategic fit, regulatory alignment, and board consensus. Whether Comerica remains independent or not, the M&A calculus will continue to hinge on financial prudence and strategic merit.