Cool Company In The Crosshairs: EPS Ventures Eyes Full Takeover In $9.65/Share Deal

Cool Company Ltd. (NYSE:CLCO), a small-cap LNG shipping firm, has officially confirmed it is in advanced discussions with EPS Ventures regarding a potential acquisition that could see EPS acquire all outstanding shares of CoolCo not already under its control. The proposed transaction, announced on September 24, 2025, would value each CoolCo share at $9.65 in cash—a 26% premium over its last closing price and 38% above the 90-day volume-weighted average. EPS Ventures already holds a 59.3% stake and plans to enter a support agreement to vote its shares in favor of the merger. The deal comes at a pivotal moment for CoolCo, which is navigating a recovery in LNG shipping rates, a tightening supply of older vessels, and long-term charter protection amidst a challenging spot market. Let us dive deeper into this news and analyze why CoolCo comes across as such a strategically valuable investment for EPS Ventures.

Backlog Stability Anchors Earnings Amid Spot Market Volatility

One of CoolCo’s defining strengths—and a likely core attraction for EPS Ventures—is its robust charter backlog that shields earnings during cyclical downturns in the spot market. In Q2 2025, CoolCo reported adjusted EBITDA of $56.5 million on $85.5 million in revenue, despite average time-charter equivalent (TCE) rates falling to $69,900/day from $70,600/day in Q1. This performance was largely underpinned by fixed and floating-rate charter contracts, which offer visibility and insulation from current rate softness. Over 50% of CoolCo’s available days are covered through 2027, creating a foundation of predictable cash flows that derisks the investment thesis for an acquirer. This long-term charter coverage is particularly valuable in an LNG shipping sector plagued by a supply overhang of newbuilds and idling of older steam turbine vessels. By acquiring CoolCo outright, EPS can capture the full benefit of this recurring revenue base without minority shareholder leakage and deploy its own capital discipline and trading expertise to optimize vessel deployment. Furthermore, the company has already demonstrated a successful strategy of redeploying vessels into the spot market when charters end—often at unsatisfactory rates but ensuring high utilization. The presence of variable-rate contracts with upside-sharing provisions, such as the LNG-E upgrade-linked charters, adds an embedded optionality to earnings that EPS could monetize more effectively as sole owner. For a small-cap shipping asset, this degree of backlog protection offers a rare balance of stability and flexibility in a volatile macro environment.

LNG-E Upgrades Offer Hidden Asset Value & Fuel Efficiency Premiums

A second compelling reason for EPS Ventures’ interest likely lies in CoolCo’s recent capital upgrades, specifically the LNG-E enhancements applied to several of its vessels. These subcooler-based retrofits—costing approximately $10 million per vessel—have improved fuel efficiency and reduced boil-off, translating to operating savings and environmental benefits. Notably, vessels with these upgrades have secured spot fixtures at a $5,000/day premium relative to standard 160,000 cbm TFDE ships, with total savings value estimated at $10,000/day when including charterer benefits. Four out of five LNG-E upgrades have been completed, with the final one scheduled in Q4 2025, meaning EPS could acquire these improved vessels just as their enhanced economics begin to materialize. For a sponsor like EPS Ventures, which already has a controlling stake, this presents an opportunity to fully internalize the IRR from the CapEx investment—returns that are currently being shared with third-party shareholders. Moreover, the fuel savings and emissions reductions are not merely commercial features; they align with long-term regulatory trends and charterer preferences, potentially giving CoolCo’s fleet a competitive edge in securing new charters in a tightening compliance regime. In a broader M&A context, these asset upgrades make CoolCo’s fleet more attractive on a standalone basis and more synergistic when integrated into a larger shipping platform. EPS Ventures, with greater scale and financing capabilities, may be able to leverage the fleet’s upgraded status to target higher-tier charters or enter into longer-term fixed contracts at favorable rates, capturing upside not yet fully reflected in CoolCo’s current market valuation.

Market Dislocation & Aging Fleet Dynamics Create Timely Entry Point

CoolCo operates in an LNG shipping market currently experiencing a paradox: while long-term fundamentals are improving, near-term spot rates remain depressed due to a glut of newbuilds and the presence of older steam turbine vessels. This dislocation has capped upside for small-cap shipping names like CoolCo, which despite strong operating performance, trade at discounted valuations. As of September 25, 2025, CoolCo's trailing EV/EBITDA multiple stood at just 8.1x, with a P/E of 8.9x and Price/Sales of 1.51x—all below sector norms for LNG carriers with secured backlog. For EPS Ventures, this presents a timely opportunity to consolidate a strategically positioned fleet at a discount to intrinsic value. Importantly, a structural supply-side shift is underway. Over 50 steam turbine LNG vessels have already been idled, and many more are nearing the end of their initial charters. CoolCo’s fleet is more modern and upgraded, giving it staying power in a market where obsolete tonnage is being rationalized. This backdrop increases the relative value of CoolCo’s assets and adds urgency for a strategic buyer to act before the market rebalances and valuations reset. EPS Ventures could not only lock in undervalued tonnage, but also potentially achieve better pricing in future refinancings or equity raises by absorbing the small-cap entity into a larger private platform with superior capital access. The ability to capitalize on this timing advantage—buying at low public multiples while monetizing assets in a recovering market—is a classic private equity playbook that fits squarely with the current LNG cycle.

Strong Liquidity, Hedging Discipline, & Share Buybacks Enhance Financial Appeal

From a balance sheet perspective, CoolCo presents a well-managed, low-risk profile that enhances its appeal as a bolt-on acquisition for EPS Ventures. As of Q2 2025, the company reported $226 million in available liquidity—$109 million in cash and $117 million in undrawn revolver capacity—providing ample room for operating flexibility and opportunistic investments. More significantly, management has proactively hedged 75% of its notional debt and 82% of its net debt, locking in an average interest cost of 5.6% and reducing exposure to rate volatility. This kind of financial predictability is particularly valuable to acquirers seeking to optimize cash flows and debt servicing in leveraged buyouts. CoolCo has also demonstrated shareholder-friendly capital allocation via its buyback program, repurchasing over 850,000 shares at an average of $5.77—well below its net asset value per share—reducing the share count by 1.6%. These actions not only show disciplined capital deployment but also signal management’s own view of undervaluation, which could have triggered EPS Ventures’ decision to move toward full ownership before further rerating occurs. For a small-cap shipping firm, such financial discipline is not always guaranteed and thus adds an extra layer of defensibility to the investment thesis. With limited CapEx obligations going forward—only two more drydocks are scheduled—and operating cost per vessel already trending down to $15,900/day, CoolCo offers a streamlined, cash-generating asset base. EPS Ventures may see in CoolCo a ready-to-integrate platform that doesn’t require financial triage, allowing them to focus on strategic optimization and asset scaling.

Final Thoughts

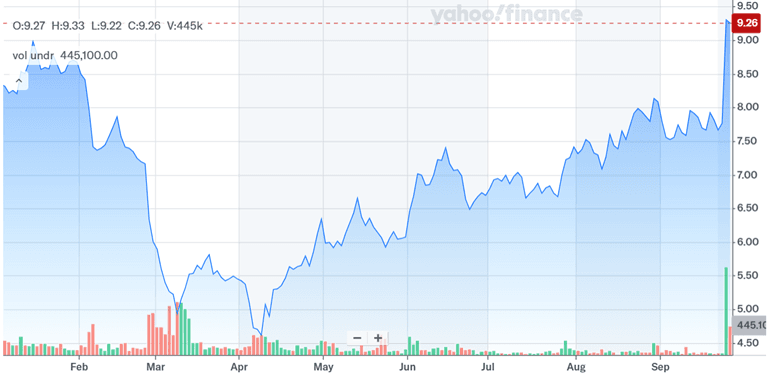

Source: Yahoo Finance

We can see the Cool Company stock climbing to $9.26 levels already and is a mere 39 cents below the expected acquisition price. Its valuation presents a very interesting picture. While CoolCo's LTM valuation of 8.1x EV/EBITDA and 1.51x P/S reflects operational progress, it also embeds market skepticism about the pace of rate recovery and vessel utilization. For EPS Ventures, the proposed $9.65/share offer may reflect an attempt to acquire these assets before public markets rerate the name—or before smaller shareholders begin demanding a premium closer to NAV. Moreover, its deep charter backlog, LNG-E upgrade program, and disciplined financial management make it a stable, earnings-generating platform with real optionality for a controlling shareholder like EPS Ventures. The ongoing rationalization of older LNG vessels and resurgence in liquefaction FIDs support a more constructive long-term outlook for LNG shipping. Overall, we believe that this acquisition could work out very well for EPS ventures in the long run.