Currency Market Outlook: Dump The Dollar

[ad_1]

We are presenting our 2019 Market Outlook in 4 elements:

I. 2018 Market Review and Economic Outlook

III. Currency and Commodity Forecasts (under)

IV. Equity Market Strategy for 2019 (forthcoming)

Currency Market Outlook

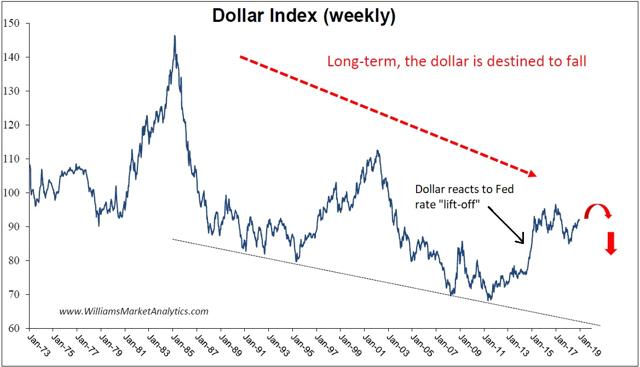

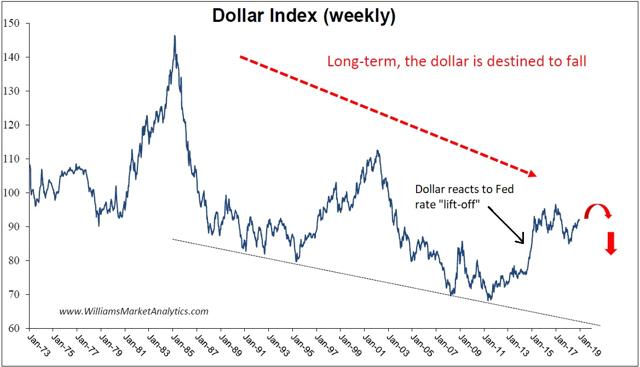

This part of our 2019 Outlook presents our forex market outlook. In sum, we’re bearish on the greenback as Fed coverage tightening has gotten too far forward of different world central banks, which stay dovish. The Fed can be pressured to cease Quantitative Tightening in 2019. The long-term greenback down-trend will lastly resume in 2019. This influences our fairness allocation decisions, which we are going to present within the closing version of our Outlook.

We have a desire for under-valued currencies going into 2019. It is feasible that the dying of the U.S. momentum commerce on fairness markets might carry over to the forex market. If U.S. equities underperform within the subsequent stock market cycle, the long-term down-trend within the Dollar Index ought to resume.

supply: eodhistoricaldata.com

supply: eodhistoricaldata.com

The Fed’s tightening cycle is properly is advance of these of different world central banks. The Dollar Index displays this financial coverage lead. For the Dollar to proceed to rise, we’ll must see the Fed carry although with no less than two fee hikes in 2019, the U.S. economic system carry out higher than anticipated (and different developed nations have disappointing development), and international central banks keep on with their crisis-level financial insurance policies. This is an excessive amount of to ask for. We are Dollar bears.

Among developed currencies, we just like the Japanese Yen. The Yen may obtain tailwinds because the Bank of Japan (BoJ) will get much less dovish. Moreover, Yen sentiment is overly unfavourable and excessive ranges of brief Yen positions should be unwound ought to the risk-off commerce decide up stream. Remember that the Yen is a risk-off forex. In the chart under, a falling curve signifies Yen strength (fewer Yen to purchase $1).

supply: eodhistoricaldata.com

supply: eodhistoricaldata.com

We are mildly bullish on the euro, which seems undervalued at these ranges and will obtain assist because the enhancing financial indicators in Europe will permit the European Central Bank to maneuver away from disaster financial coverage charges. Sterling is a wild card. GBP will swing wildly as Brexit negotiations advance.

Our desire stays for Emerging Market currencies, which have underperformed with different EM belongings throughout a lot of the enlargement which started in 2009.

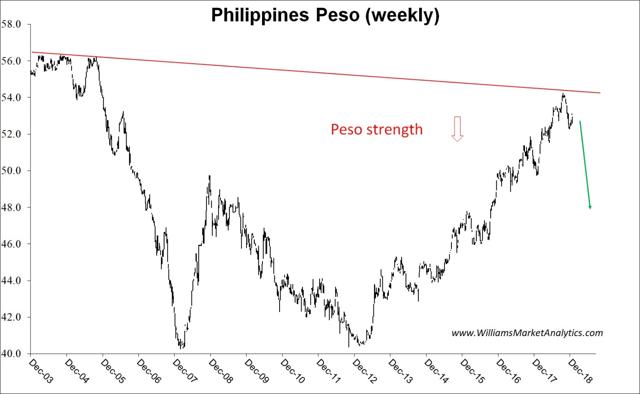

The first forex we like is the Philippines Peso. The Philippines GDP development remained at a strong 6.1% in Q3 2018 and has held about 5% every quarter since 2011. Underperformance of the Peso appears unrelated to the nation’s financial fundamentals (manufacturing PMI exhibiting sturdy enlargement at 54.2, Building Permits at 18-year excessive, exports are increasing strongly). When political dangers fade, nationwide currencies have a tendency to understand shortly.

The chart of the Peso under additionally appears to be like engaging, because the forex traded all the way down to 2005 lows this previous quarter towards the greenback. Again, a falling curve signifies Peso strength (fewer Pesos to purchase $1). We can’t make sure that 2019 will see a significant rally within the Peso, however after a -35% fall since 2013, threat is clearly to the upside.

supply: eodhistoricaldata.com

supply: eodhistoricaldata.com

Staying within the Southeast Asian area, we additionally just like the Malaysian Ringgit and the Indonesian Rupiah, each buying and selling close to cycle lows.

The Ringgit rallied to highs of MYR 2.9 following the Financial Crisis. However, since 2013, it has been ugly (Ringgit down round -50%). Growth has been first rate (GDP in 4.5% to 6.5% vary on this enlargement) however the forex has been harm by the excessive international possession of Malaysia’s authorities bond market, which leaves the nation extraordinarily weak to capital outflows. In addition, the central financial institution’s latest transfer to clamp down on forex speculators most likely rattled international traders additional in 2016. All these causes are previous information. We see a forex buying and selling not removed from cycle lows, extra uncovered to optimistic surprises than further unfavourable occasions. For traders seeking to diversify a bit out of the U.S. greenback, we suggest allocating a bit to MYR. In the chart under, a falling curve signifies Ringgit strength (fewer Ringgit to purchase $1).

supply: eodhistoricaldata.com

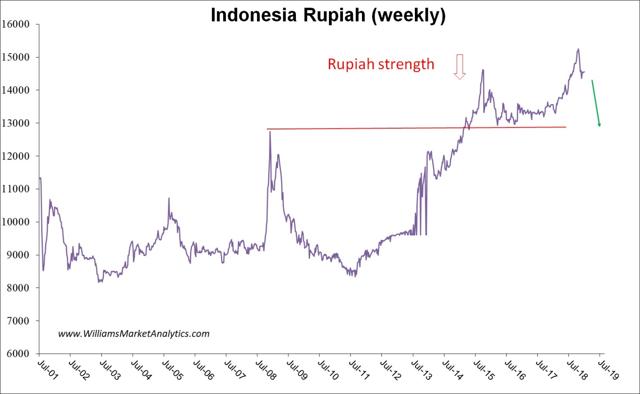

The Indonesian Rupiah has suffered from the nation’s excessive present account deficit. The excessive foreign-ownership of bonds coupled with Indonesian corporates’ elevated USD debt are additionally rendered the Rupiah liable to weak point. Like the Ringgit, our guess on the Rupiah is that the unhealthy information has been priced in and any optimistic information can kick off a return-to-the-mean commerce. In the chart under, a falling curve signifies Rupiah strength (fewer Rupiah to purchase $1).

supply: eodhistoricaldata.com

supply: eodhistoricaldata.com

Among Latin American currencies, we just like the Brazilian Real. Brazil is transferring in the direction of financial enchancment. Jair Bolsonaro, the brand new Brazilian president, will start his time period on January 1. He is pro-market and can attempt to sort out the mounting debt load in Brazil (debt-to-GDP hovering close to 75%). Unlike his socialist predecessors, he’s open to privatization. The Real halted its down-trend on information of Bolsonaro’s election.

The chart of the Real is greater than compelling. With the Real buying and selling once more all the way down to BRL 4.0 / USD in 2018, the forex is placing in a doubtlessly main, multi-year double backside (or, because the chart under exhibits, a double high for the U.S. Dollar vs the Real).

supply: eodhistoricaldata.com

supply: eodhistoricaldata.com

Finally, we’ve got been taking part in the Turkish Lira because the forex crashed in August. A return to rising development assist from 2015-2017, now round TRY 2.25, appears possible in 2019 as some type of normalcy returns. That’s one other +20% upside for the Lira. In the chart under, a falling curve signifies Lira strength (fewer Lira to purchase $1).

supply: eodhistoricaldata.com

supply: eodhistoricaldata.com

Commodities Markets Perspectives

We have written in size in regards to the Commodity commerce (see “ The Commodity Super Cycle”). In sum, our arguments are as follows:

Commodities (oil and metals costs) needs to be at their candy spot within the late financial cycle. Inflation tends to choose up because the economic system begins to overheat. And commodity costs are usually among the best inflation hedges. Relative under-performance of arduous belongings in comparison with shares has reached a 20-year excessive. The pendulum will swing again within the course of arduous belongings, simply as we’ve got noticed all through historical past. Commodity shares are unloved and under-owned. The weight of Energy throughout the S&P 500 is under 5% – an all-time low. When sentiment will get this bitter, it is best to be contrarian.

The latest collapse in oil costs doesn’t change our pondering, because the drop in crude oil doesn’t mirror fundamentals however fairly (1) extreme hypothesis over a worldwide financial slowdown and (2) a speedy unwinding of lengthy crude/brief Nat Gas trades placed on by massive hedge funds. We belief OPEC will handle provide to maintain oil costs at steady ranges, larger than ranges prevailing at this time. As for world oil demand, this largely is determined by the economic system of China and the financial insurance policies of the People’s Bank of China. Commodity traders needs to be notably attentive to a Chinese economic system arduous or tender touchdown.

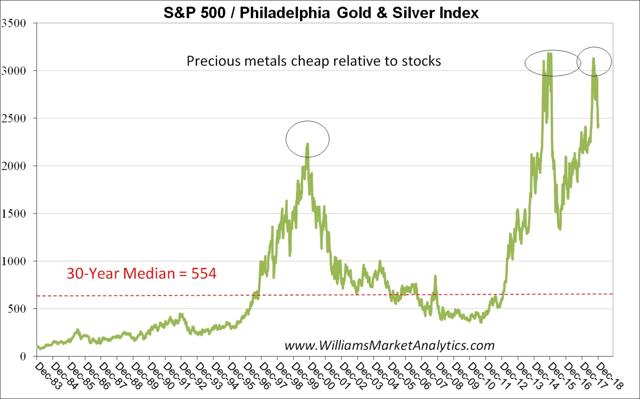

Looking on the S&P 500 relative to the Philadelphia Gold & Silver Index, we see that valuable metals are traditionally very low-cost in comparison with shares. An allocation to Gold (NYSEARCA:GLD) and the Gold Miners (NYSEARCA:GDX) additionally is sensible for 2019 as a hedge towards a Fed financial coverage error, Dollar weak point, and late enlargement inflationary pressures.

Summary

Summary

We imagine it is time to get bullish once more on non-U.S. monetary belongings, together with foreign currency. Safe-haven developed currencies (Yen, Swiss franc) ought to do properly if markets stay unstable. Emerging currencies are engaging for a long-term purchase and maintain. There is blood on the streets in lots of commodities, notably crude oil. Barring an distinctive world financial depression, crude oil is a robust purchase at present depressed ranges.

Disclosure: I/we’ve got no positions in any shares talked about, and no plans to provoke any positions throughout the subsequent 72 hours. I wrote this text myself, and it expresses my very own opinions. I’m not receiving compensation for it (apart from from Seeking Alpha). I’ve no enterprise relationship with any firm whose stock is talked about on this article.

[ad_2]