Datavault AI Surges On Push Into High Value Tech Infrastructure—Is A Breakout Coming?

Datavault AI (NASDAQ:DVLT) shares surged after the company unveiled a comprehensive strategic expansion plan that signals a major push into high-value technology infrastructure. The expansion includes the relocation of its headquarters from Beaverton, Oregon to downtown Philadelphia, the launch of a Center for AI and Quantum Computing Excellence in Sandy Springs, Georgia, and a new European presence through its Quantum Computing & Digital Twin Embassy in London’s Knightsbridge. Alongside these geographic moves, the company is ramping up hiring for AI engineers, blockchain specialists, and systems integration experts, as it continues scaling its proprietary technology platform for tokenization, data monetization, and exchange infrastructure. This wave of activity follows Datavault’s Q2 performance, which showed 467% year-over-year growth and a significant $2.5 million licensing deal with Nyiax tied to the NASDAQ financial framework. These developments come as the company deepens its integration with IBM as a Platinum Partner, extending its AI and blockchain reach across North America, Europe, and Asia.

Opening New AI & Quantum Centers Is A Big Deal

Let’s start with something exciting—Datavault just opened a new Center for AI and Quantum Computing Excellence in Sandy Springs, Georgia, and set up a Quantum Computing & Digital Twin Embassy in London’s Knightsbridge. That’s a mouthful, but here’s what it means: they’re investing big in technology that lets companies turn data into real money. These new hubs will power platforms like Datavault Bank, VerifyU, and DataScore—all built to help people and organizations make their data work harder (and smarter) for them. They’re doing this with IBM’s AI tools, giving them serious horsepower to scale fast. And the move to downtown Philadelphia? That’s not just a change of address—it gives them better access to financial markets and talent. Plus, their expansion into Europe helps them stay on top of regulations around crypto and data privacy, which is a must if you're playing globally. They’re hiring too—bringing in top tech talent to build these platforms out. All of this gives Datavault a strong edge and shows they’re serious about becoming a global player in AI, blockchain, and data monetization.

Big Acquisitions & Licensing Deals Are Pushing Them Forward

Datavault isn’t just growing through tech—they’re growing by buying and partnering smart. This year, they acquired a company called CSI, and now they’re about to wrap up another deal with API Media. That second one’s especially interesting because it could give them access to some major public events, where their tech can be front and center. On top of that, they inked a $2.5 million licensing deal with a company called Nyiax, giving them access to NASDAQ’s tech infrastructure. That’s a big deal—it means they can now launch their own exchanges, like the Elements Exchange (for trading real-world stuff like metals or carbon credits), the NIL Exchange (for college athletes to monetize their name/image), and even a Political Exchange. They're all powered by IBM’s AI and built to be super secure and fully compliant. And there’s more—they’re rolling out a platform called VerifyU that helps verify credentials, like whether a military veteran is eligible for healthcare benefits, or if a college athlete qualifies for sponsorships. These tools are patent-backed and built to work in industries ranging from healthcare to education to government. With everything coming together, Datavault is building a solid moat with technology that others just can’t copy—and partners like IBM and Dolby are helping them go even further.

Timing Issues Could Mess With Their Revenue Picture

Now, let’s talk about what could trip them up. One of the biggest risks Datavault faces is timing—specifically, when they can actually recognize the revenue from all these deals. For example, they announced a big $2.5 million licensing agreement with Nyiax, but they couldn’t count it as revenue in Q2 because the payment wasn’t finalized. That kind of delay might not seem like a big deal, but it can throw off financial reports and create uncertainty for investors trying to gauge how fast the company’s really growing. And don’t forget, they’re juggling a lot right now. They’re merging two companies (CSI and API Media), integrating new systems, and launching brand-new exchanges. If something slips—whether it’s a delayed payment, a slow integration, or a hiccup in a new product rollout—it could mess with their cash flow or slow their momentum. They say they’re managing costs carefully and using smart legal strategies to protect their tech without draining cash. But let’s be real: the more complex the business gets, the more chances there are for something to go sideways. That’s just part of scaling fast. Still, for investors, it means you’ve got to keep a close eye on how and when Datavault actually turns bookings into bankable revenue.

Valuation Disconnect Highlights Market Skepticism

Datavault AI’s valuation metrics suggest a wide disconnect between investor expectations and the company’s strategic ambitions. As of October 23, 2025, the company trades at a trailing 12-month EV/Revenue multiple of 103.36x and an LTM Price/Sales ratio of 94.73x—figures far exceeding those of most high-growth software peers. Even more concerning are the negative profitability metrics: LTM EV/EBITDA stands at -16.03x, EV/EBIT at -13.71x, and P/E at -1.10x. The steep negative free cash flow metrics—such as a Market Cap/FCF multiple of -14.35x and a levered FCF yield of -7.0%—highlight the firm’s heavy cash burn and underline the risk embedded in its current model. While investors have priced in high revenue growth and upside from its tokenomics platforms, the speculative nature of its business model—centered on emerging AI-driven exchanges and patent-based monetization—leaves little room for error. The valuation surge also reflects high expectations from partnerships like IBM and Dolby, which, while credible, are not guarantees of commercialization or long-term margin expansion. These multiples suggest the stock is being valued on narrative rather than fundamentals, and until the company delivers consistent revenue recognition and operating leverage, market skepticism is likely to persist. This could hinder further capital raising or partnership development, especially in volatile macro environments where investors seek clearer paths to profitability. As such, the current valuation embeds significant execution risk and limited margin for disappointment, which long-term investors must weigh carefully.

Final Thoughts

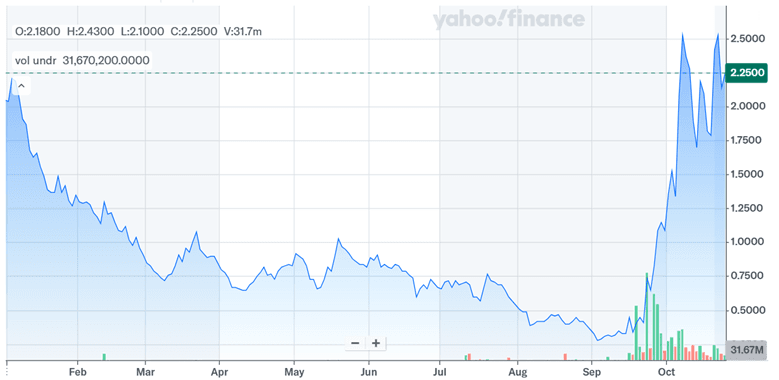

Source: Yahoo Finance

Datavault’s stock has been on a dream run off late given its strategic expansions—anchored by its new AI & quantum centers, international footprint, and licensing breakthroughs. And investors are paying attention, as seen in that 9% stock pop. But while the momentum is strong, the numbers tell a more cautious story. With trailing valuation multiples like 103x EV/Revenue and 94x Price/Sales, Datavault is priced for perfection. And yet, cash flow is negative, profitability is still out of reach, and revenue timing issues could add volatility. Overall, we believe that the company’s strategy is bold, the tech is impressive, but the path to sustainable growth is still under construction.