Decoded: Why Did Johnson & Johnson Spend $2 billion To Acquire Ambrx Biopharma?

Ambrx Biopharma (NASDAQ:AMAM) is a biotech small-cap that has been at the forefront of innovation, specializing in the development of antibody-drug conjugates (ADC), a cutting-edge class of cancer drugs. In a groundbreaking move, pharmaceutical giant Johnson & Johnson (NYSE:JNJ) has set the stage for a significant leap forward in cancer treatment with its recent $2 billion acquisition of this small player. The announcement sent shockwaves through the market, propelling Ambrx’s stock price and making it witness a triple-digit growth. This acquisition comes on the heels of significant industry shifts, with Pfizer's recent $42 billion acquisition of Seagen and AbbVie's impending $10 billion acquisition of ImmunoGen. Let us take a closer look at Ambrx Biopharma and evaluate the rationale behind JNJ’s $ billion acquisition.

What Does Ambrx Biopharma Do?

Ambrx Biopharma Inc., a clinical-stage biopharmaceutical company headquartered in La Jolla, California, is dedicated to the discovery and development of advanced therapies, primarily focusing on antibody-drug conjugates (ADCs) and other engineered solutions to modulate the immune system. At the core of its mission is a portfolio comprising clinical and preclinical programs meticulously designed to enhance efficacy and safety across various cancer indications. Notably, Ambrx is actively advancing its proprietary ADCs, such as ARX517, directed at the prostate-specific membrane antigen (PSMA), and ARX788, a distinctive ADC targeting HER2. Since its inception in 2003, the company has fostered both preclinical and clinical collaborations with multiple partners, leveraging its innovative technology in the development of promising drug candidates. With a commitment to pioneering advancements in cancer therapeutics, Ambrx Biopharma stands poised at the forefront of the biopharmaceutical landscape.

Advanced Antibody-Drug Conjugate (ADC) Technology

Ambrx Biopharma’s utilization of advanced ADC technology represents a key driver for JNJ’s future success. The company focuses on the development of ADCs, which consist of an antibody linked to a cytotoxic payload. This innovative approach allows for targeted delivery of the drug to the tumor cells while minimizing the exposure of healthy tissues, thereby reducing side effects. The effectiveness of an ADC depends on several factors: the selection of a suitable target antigen, the stability of the ADC in the bloodstream, precise binding to the tumor antigen, successful internalization into the tumor cells, and efficient release of the payload at the target site. Ambrx’s ADCs have been designed to address these critical aspects, showing potential to deliver more effective and safer treatments for patients. The company's focus on improving ADC stability, targeting efficiency, and payload delivery demonstrates its commitment to advancing cancer therapy, which could significantly impact JNJ’s stock value in the coming years. The success of these ADCs in clinical trials and their subsequent commercialization could establish JNJ as a leader in this innovative therapeutic area, potentially driving significant growth for the company.

Enhanced Tumor Targeting & Payload Delivery

Ambrx Biopharma’s ADCs are uniquely designed for enhanced tumor targeting and payload delivery, which is crucial for effective cancer treatment. The company's ADCs are engineered to bind precisely to tumor antigens, ensuring that the cytotoxic payload is delivered directly to cancer cells. This targeted approach minimizes the impact on healthy cells, reducing the risk of off-tumor toxicities. Ambrx’s ADCs are designed to be stable in circulation, preventing premature release of the payload, which could otherwise lead to side effects. This stability is achieved through a robust conjugation process, ensuring that the payload remains attached to the antibody until it reaches the tumor site. Once at the tumor, the ADC is internalized, and the payload is released within the cancer cells, causing their destruction. This process requires precise synchronization of multiple biological mechanisms, which Ambrx has optimized in its ADCs. The successful implementation of this technology could result in superior efficacy and safety profiles for its cancer treatments, potentially leading to significant clinical advantages over existing therapies. The achievement of these clinical milestones could act as a catalyst for the JNJ stock, attracting investor interest and driving future growth.

Diverse Oncology Pipeline

Ambrx Biopharma's diverse oncology pipeline, encompassing multiple therapeutic areas and targets, is a critical driver for JNJ’s future performance. The company is developing treatments for various types of cancer, utilizing its ADC technology to target different antigens expressed on tumor cells. This diversity allows Ambrx to address a wide range of unmet medical needs in oncology. The success of any of these candidates in clinical development and subsequent approval would not only benefit patients but also significantly impact Ambrx's market position and financial performance. The broad oncology pipeline increases the likelihood of clinical success, as it reduces the company's dependence on a single product or indication. Additionally, a diverse pipeline allows Ambrx to explore strategic partnerships and licensing opportunities, potentially providing additional revenue streams and collaborative advantages. As these programs progress through clinical trials and reach commercialization, they could significantly contribute to the company's revenue growth and enhance its stock value.

Key Takeaways

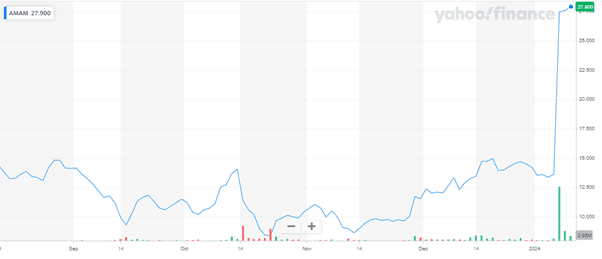

Source: Yahoo Finance

We see a massive spike in Ambrx Biopharma’s stock price post the JNJ acquisition. This acquisition not only positions Johnson & Johnson to expand its pipeline but also underscores the growing importance of ADCs in the pharmaceutical landscape. The collaboration aims to fast-track the ongoing Phase 1/2 APEX-01 study which could become a solid contributor to JNJ’s top-line. It is important to note that Ambrx’s acquisition price per share is $28 and the stock is already at $27.9 which means there is very little premium for M&A arbitrageurs. However, the deal does present an interesting acquisition case study in the world of biotechnology.