High cholesterol was twice as prevalent among American Indian teens and young adults

[ad_1]

Research Highlights:

- A study of more than 1,400 people in U.S. tribal communities found that high cholesterol was twice as prevalent among American Indian adolescents and young adults compared to the overall U.S. population.

- The study also noted that few study participants with high cholesterol sought or received treatment during the study period.

(NewMediaWire) – March 08, 2024 – DALLAS — Young American Indians, ages 15-39, had cholesterol levels more than two times higher than the general U.S. population, according to new research published in the Journal of the American Heart Association, an open access, peer-reviewed journal of the American Heart Association.

(NewMediaWire) – March 08, 2024 – DALLAS — Young American Indians, ages 15-39, had cholesterol levels more than two times higher than the general U.S. population, according to new research published in the Journal of the American Heart Association, an open access, peer-reviewed journal of the American Heart Association.

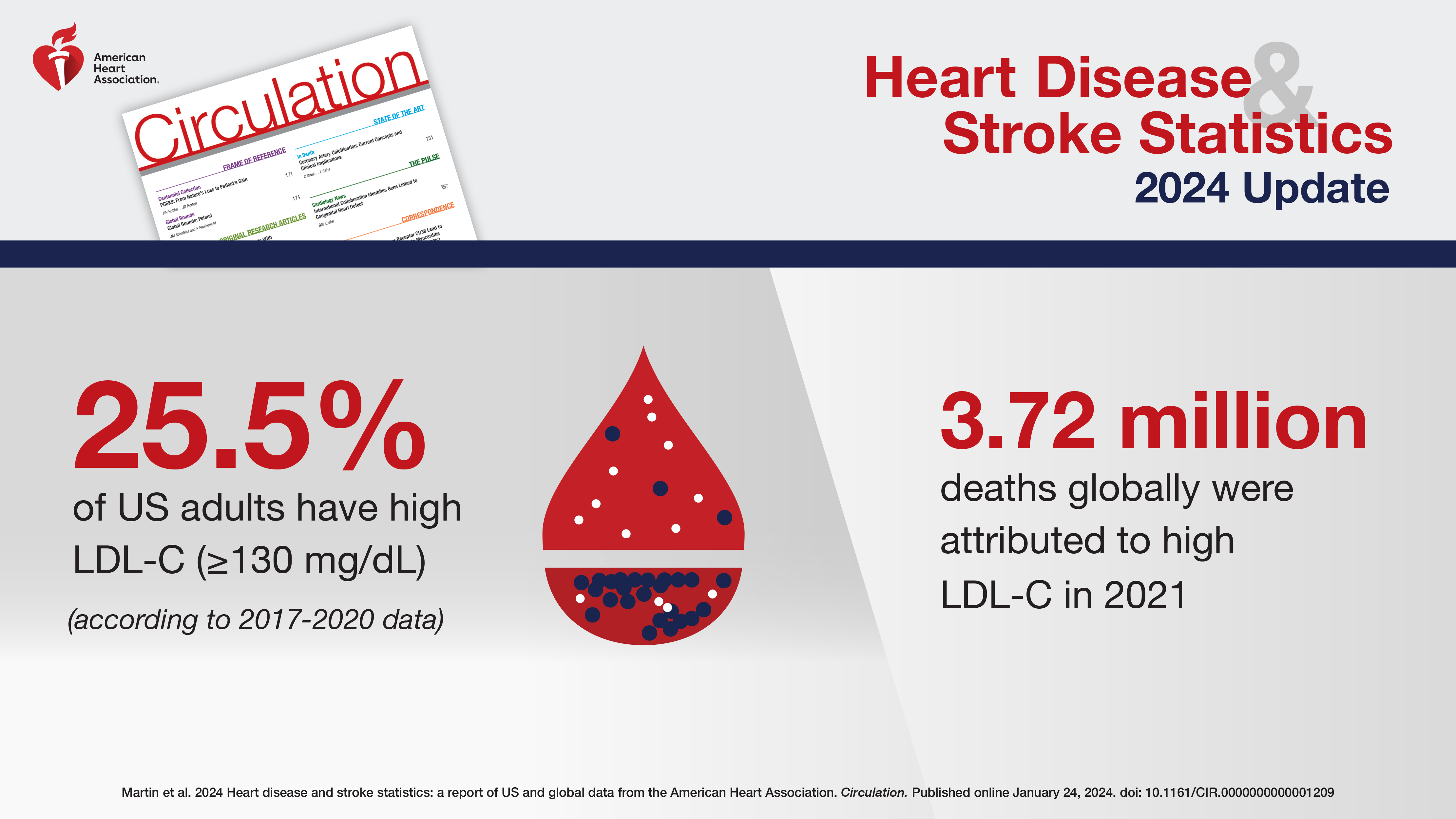

The researchers noted that previous research has estimated that approximately 25% of adolescents and approximately 30% of young adults in the U.S. have high cholesterol.

“This is the first study of total cholesterol levels in American Indian adolescents and young adults, and we were surprised by the levels of high cholesterol, especially in adolescents,” said principal investigator Ying Zhang, M.D., Ph.D., an associate professor of biostatistics and director of the Center for American Indian Health Research at the University of Oklahoma Health Sciences Center in Oklahoma City. “The high cholesterol in this population will likely lead to subtle damage in blood vessels and to premature heart disease. There is a need for care including early screening and treatment for high cholesterol levels.”

Researchers reviewed data from the Strong Heart Family Study — a study of risk factors for cardiovascular diseases among tribal communities in central Arizona, southwest Oklahoma, North Dakota and South Dakota. High cholesterol and its role in the development of heart disease and stroke was assessed among 1,440 American Indian teens and adults in the study.

The analysis found:

- The prevalence of high cholesterol was 55.2% for American Indian adolescents, ages 15-19; 73.6% for American Indian young adults, ages 20-29; and 78% for American Indian adults, ages 30-39 years old.

- Roughly 2.8% of all study participants had LDL-C, also known as “bad cholesterol,” higher than 160 mg/dL, which is above the recommended threshold for adults ages 20-39 years old.

- During the follow-up examination in 2006-2009, 9.9% of participants had arterial plaque, 11% had plaque progression, and 9% had cardiovascular disease events. Arterial plaque are fatty deposits that accumulate on the inside of arteries, narrowing the vessels, which increase the risk of a number of health conditions, including peripheral artery disease, coronary heart disease and chronic kidney disease.

- Participants with total cholesterol higher than 200 mg/dL had more than twice the risk of arterial plaque compared to participants with cholesterol lower than 200 mg/DL, as well as greater plaque buildup.

- Despite the high prevalence of an imbalance of blood lipid levels (dyslipidemia) and the recommended cholesterol thresholds for intervention, none of the participants who were younger than age 20 were taking lipid-lowering medication during the study’s initial examination or 6-8 years later at the follow-up examination. (Dyslipidemia is an imbalance of blood lipid levels that can include high levels of low-density lipoproteins (“bad” cholesterol) or triglycerides (the most common type of fat in the body) or low levels of high-density lipoproteins (“good” cholesterol).)

- 1.8% of the participants were taking lipid-lowering medications during the baseline exam, from 2001-2003. The use of lipid-lowering medication remained low at the follow-up examination, from 2006-2009, with 8% of participants taking medication to help lower cholesterol.

“It is our hope that our study’s results attract attention within the health care community,” Zhang said. “It would be beneficial for American Indian youth and young adults to get recommendations from their physicians about regularly checking cholesterol levels and following the AHA’s Life’s Essential 8 to help improve their cardiovascular health and prevent heart disease and stroke.”

Study details, background or design:

- The Strong Heart Study is focused on genetic and conventional cardiovascular risk factors among American Indians.

- The study was conducted between 2001-2003 through 2020 and included American Indian teens and adults ages 15-39 at the time of enrollment. Roughly 57% of the study’s participants self-identified as female, and 43% of participants self-identified as male.

- Cardiovascular events were identified through 2020, with a median follow-up of 18.5 years.

- Cholesterol levels were measured once, after a 12-hour fast at a follow-up exam.

- Ultrasounds of the carotid artery were used to detect arterial plaque at enrollment and follow-up, with median follow-up of 5.5 years.

Study limitations include that the results may only be generalizable to other populations with a high prevalence of cardiometabolic risk factors, such as Type 2 diabetes, prediabetes, high cholesterol and abdominal obesity, similar to American Indian populations.

According to the Association’s 2020 scientific statement, Cardiovascular Health in American Indians and Alaska Natives, heart disease rates are noted as approximately 50% higher among the 5.2 million Americans who self-identify as American Indian and/or Alaska Native, compared to white Americans. In addition, Type 2 diabetes affects American Indian and Alaska Native adults at three times the rate of white adults in the U.S., and American Indian and Alaska Native adults develop cardiovascular diseases at younger ages in comparison to white adults.

Co-authors, disclosures and funding sources are listed in the manuscript. The Strong Heart Study has been funded by the National Heart, Lung, and Blood Institute, a division of the National Institutes of Health, for more than three decades.

Studies published in the American Heart Association’s scientific journals are peer-reviewed. The statements and conclusions in each manuscript are solely those of the study authors and do not necessarily reflect the Association’s policy or position. The Association makes no representation or guarantee as to their accuracy or reliability. The Association receives funding primarily from individuals; foundations and corporations (including pharmaceutical, device manufacturers and other companies) also make donations and fund specific Association programs and events. The Association has strict policies to prevent these relationships from influencing the science content. Revenues from pharmaceutical and biotech companies, device manufacturers and health insurance providers and the Association’s overall financial information are available here.

Additional Resources:

About the American Heart Association

The American Heart Association is a relentless force for a world of longer, healthier lives. We are dedicated to ensuring equitable health in all communities. Through collaboration with numerous organizations, and powered by millions of volunteers, we fund innovative research, advocate for the public’s health and share lifesaving resources. The Dallas-based organization has been a leading source of health information for a century. During 2024 – our Centennial year – we celebrate our rich 100-year history and accomplishments. As we forge ahead into our second century of bold discovery and impact, our vision is to advance health and hope for everyone, everywhere. Connect with us on heart.org, Facebook, X or by calling 1-800-AHA-USA1.

###

For Media Inquiries and AHA/ASA Expert Perspective: 214-706-1173

John Arnst: 214-706-1060; John.Arnst@heart.org

For Public Inquiries: 1-800-AHA-USA1 (242-8721)

heart.org and stroke.org

[ad_2]