Disney And Fox – Buy The Post Deal Dip – The Walt Disney Company (NYSE:DIS)

The Walt Disney Company (DIS) has lastly accomplished the acquisition of the vast majority of the previous Twenty-First Century Fox Inc.’s belongings (FOX) (FOXA) creating a chance for buyers to leap into both stock as arbitragers and shareholders exit the newly created positions within the new corporations that they do not wish to maintain any longer. The completion of the deal implies that Disney’s share value collar has been eliminated permitting the shares to maneuver up or down on account of firm efficiency and sentiment going ahead as an alternative of being locked right into a predetermined stock vary based mostly on the acquisition’s contractual agreements and ratios. Disney’s newfound freedom might permit it to simply discover new all-time highs because it has traded largely sideways over the previous 3 years whereas the S&P 500 has had a pleasant run. With Disney properly-positioned to make a significant impression within the upcoming streaming wars in opposition to the likes of Netflix Inc. (NFLX), AT&T Inc. (T), Apple Inc. (AAPL), and others, a successful content material portfolio might produce exemplary rewards for a stock that trades at a present unbelievable worth. Meanwhile, Fox itself appears to be like to be a money cow with a premium content material lineup of its personal that would additionally simply obtain a future M&A premium.

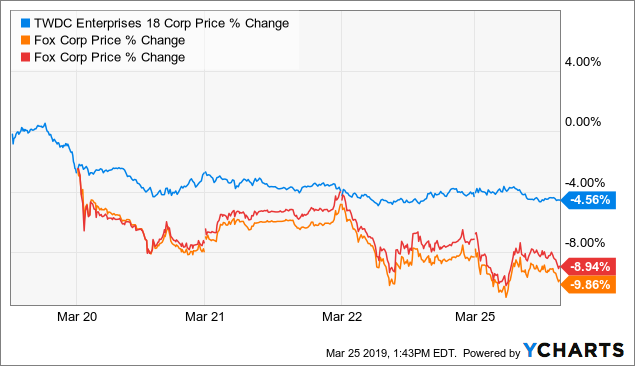

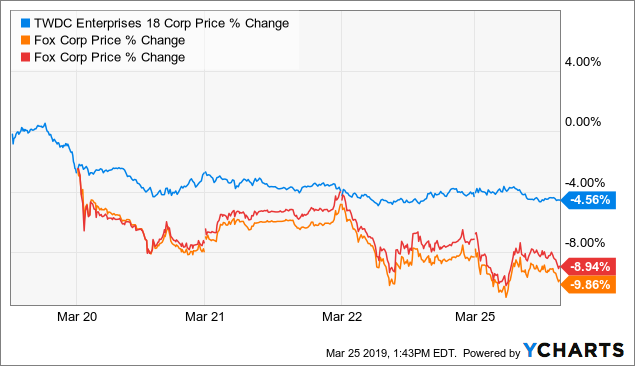

Disney not too long ago closed on its $71B Fox deal reshaping each corporations for future development of their respective industries. The preliminary Disney/Fox deal was anticipated to be around $60B in December of 2017, however Comcast Corporation (CMCSA) determined to leap into the motion with bids of its personal leading to a drawn-out battle for almost all of Fox’s belongings earlier than Disney ultimately gained and received final regulatory approval from Mexico’s IFT. The drawn-out course of implies that a variety of shareholders considering arbitrage conditions and the ensuing new corporations like I used to be when I sold my Disney shares to buy Fox shares have been ready patiently for the conclusion of the deal. Investors ready over a 12 months for the deal to shut now have the possibility to promote the ensuing positions that they do not need anymore and transfer on to different alternatives. This has meant a pleasant publish deal selloff for each corporations (Disney ~ 4.5% and Fox near 9%) that would simply show to be wonderful shopping for alternatives.

Data by YCharts

Data by YCharts

The conclusion of the deal additionally implies that the collar on Disney stock has additionally been eliminated permitting each Disney and Fox stock to maneuver freely. According to the merger paperwork, this collar was based mostly on trade ratios that helped maintain Disney’s stock between a excessive of $114.32 and a low of $93.53 in the course of the acquisition proceedings. The elimination of this collar might assist Disney start transferring towards new all-time highs as its stock has traded largely sideways over the previous 3 years, considerably underperforming the S&P 500, particularly over the previous two years when the Fox deal was being formulated and put into motion.

Data by YCharts

Data by YCharts

Now that Disney and Fox are free to commerce as separate corporations once more, buyers are in an incredible place to purchase into the long run development and money move alternatives that these corporations look to supply within the coming years.

Disney is rising an ecosystem for its content material and companies that features double-digit price hikes at lots of its theme parks based mostly on the anticipated elevated demand for its latest Star Wars points of interest. With the Fox acquisition within the bag, it has a fair higher pool of hit motion pictures to construct round together with future Avatar characteristic points of interest as Disney rolls out 4 Avatar sequels within the coming years. Disney additionally has yearly blockbuster hits from its superhero franchises, which nearly appear endless, together with lesser-identified characters resembling the newest Captain Marvel, Aquaman, and Black Panther motion pictures.

Disney has already entered the streaming world with the launch of ESPN Plus in April of 2018, which has already grown to over 2 million subscribers, double the quantity from 5 months in the past in keeping with Disney’s latest conference call, together with acquiring exclusive UFC rights. ESPN Plus works off of Disney’s BAMTech platform, which ought to have loads of time to work out any kinks in service earlier than Disney launches Disney Plus on the finish of 2019. With Disney’s investor day webcast upcoming in April, shareholders will not have to attend lengthy to get a essential replace on Disney’s plans transferring ahead together with its content material plans in addition to perhaps extra data on pricing. Disney has hinted at a pricing technique beneath what it sees as its foremost competitors in Netflix, so maybe $4.99-6.99 a month with perhaps a bundle possibility with ESPN Plus down the road. Disney hopes to develop its streaming ecosystem quickly whereas it lays off greater than 3,000 jobs within the newly mixed firm. It additionally plans on quickly paying off parts of its newly acquired debt over the subsequent 12 months or two, with the sale of its regional sports activities networks over the subsequent few months and powerful money flows, to regain its conservative funding-grade credit standing.

Fox has its investor conference scheduled for May of 2019 the place buyers will discover out much more about the way it desires to handle its appreciable money flows together with its premium content material in reside sports activities and information together with its broadcast community and regional TV protection. Fox ought to have few debt considerations after the Disney deal and can as an alternative have the ability to concentrate on its engaging development prospects in addition to hopefully a lovely dividend for buyers. Both Disney and Fox have obtained a number of purchase upgrades after the offers closed, however many buyers will wait on the sidelines for a few months earlier than getting extra of the info transferring ahead at every of the corporate’s upcoming investor days.

The conclusion of the lengthy-anticipated Disney/Fox deal permits each shares to commerce freely as soon as once more because the contractual collar has been eliminated and each corporations are free to discover development alternatives of their respective fields. The publish-acquisition selloff needs to be ending up permitting buyers an incredible alternative to get into the shares earlier than the corporate’s attempt to construct pleasure and momentum at their respective upcoming investor days. I offered my Disney on the finish of 2017 to purchase Fox and now personal each new Disney and new Fox as I feel the potential alternatives for each are intriguing. Best of luck.

Disclosure: SmallcapsDaily.com is not receiving compensation for the publication of this text. We don’t have any enterprise relationship with any firm whose stock is talked about on this article.