Disney Trades Down ESPN Stake To Secure NFL Network & Redzone—Can It Surpass Netflix’s Live-Sports Ambitions?

Disney’s (NYSE:DIS) sports-media empire is undergoing seismic shifts this summer. First, the company agreed to swap a 10 percent stake in ESPN for full control of NFL Network and RedZone—a deal worth $2.5–3 billion that reduces Disney’s ownership from 80 percent to 72 percent and Hearst’s from 20 percent to 18 percent. Almost in tandem, ESPN inked a five-year, $1.6 billion pact to stream WWE’s marquee events, including WrestleMania and SummerSlam, beginning in 2026. Both agreements feed directly into Disney’s standalone ESPN streaming service, slated to launch this fall at $29.99 per month. As Netflix pushes into live soccer and boxing, and Amazon bids aggressively for NFL rights, Disney’s dual play for football and wrestling content seeks to cement its leading edge in live programming. Yet these blockbuster deals invite antitrust scrutiny and risk rights-fee inflation. Let us take a closer look at the biggest factors propelling Disney’s sports-revenue engine—and the one looming risk that could undercut its ambitions.

NFL Network & RedZone Integration: Strengthening Football’s Stronghold

By exchanging a 10 percent ESPN equity slice for NFL Network and RedZone, Disney solidifies ESPN’s position as the unrivaled home of American football. NFL Network contributes seven exclusive regular-season games, premium studio shows, and year-round league coverage, while RedZone’s eight-hour Sunday whip-around of every scoring play has become essential for fantasy aficionados and super-fans alike. Bringing these assets in-house empowers ESPN to curate cohesive linear bundles and deep-integration streaming packages, driving subscription spikes during high-impact weekends and Monday Night Football. Under Disney’s control, RedZone—currently in under 10 million homes—can leverage ESPN’s carriage agreements to triple its reach, unlocking substantial affiliate-fee revenue. Disney gains negotiating leverage for future NFL rights rounds by aligning incentives: the NFL secures marketing firepower and guaranteed distribution, while Disney locks in long-term content supply and participates directly in league profits. Operational synergies enable ESPN to optimize scheduling, cross-promote football-themed studio events across ABC and Disney+, and integrate interactive features—real-time stats, betting odds, and fantasy tools—into its apps. In an era when live football remains the most resilient content against cord-cutting, this consolidation solidifies football as the linchpin of Disney’s broader sports-streaming flywheel.

WWE Rights Acquisition: Capitalizing On Spectacle & Fandom

ESPN’s five-year, $1.6 billion deal for exclusive U.S. streaming rights to WWE’s flagship events—from WrestleMania to SummerSlam—marks a deliberate extension of Disney’s live-event portfolio. Beginning in 2026, these spectacle-driven productions will headline ESPN’s direct-to-consumer service, simulcast on cable to maintain broad visibility. The agreement almost doubles the value of WWE rights compared to Peacock’s current $900 million, underscoring ESPN’s confidence in wrestling’s passionate global fanbase. WWE events reliably deliver appointment viewing, social-media buzz, and steep viewership spikes—metrics that translate into valuable ad impressions and upsell opportunities for subscription tiers. Disney can integrate WWE’s weekly Raw and SmackDown recaps, backstage specials, and Hall of Fame ceremonies into its streaming ecosystem, enriching the content mix and boosting engagement on non-game days. Cross-promotion leverages Disney’s theme-park channels and merchandise networks to create immersive WWE experiences—from in-park meet-and-greets to limited-edition collectibles—amplifying ancillary revenue. Furthermore, WWE’s demographic, spanning millennials to Gen Z, dovetails with Disney+ and Hulu audiences, facilitating cross-sell and reducing churn across platforms. By owning premium WWE inventory alongside NFL content, Disney positions ESPN as the definitive destination for high-octane sports entertainment, capitalizing on wrestling’s fusion of theater, storytelling, and athletic spectacle.

Direct-to-Consumer Synergies: Elevating Bundles & Engagement

The fusion of NFL and WWE assets into Disney’s streaming architecture unlocks potent subscriber-growth and engagement levers. With ESPN’s standalone tier launching at $29.99 per month this fall, Disney can market an integrated package—spanning blockbuster films on Disney+, original series on Hulu, and every live NFL game and WWE event on ESPN—in a single user interface. This “all-in” bundle simplifies choice, reduces churn, and maximizes lifetime value by catering to diverse interests. Advanced ad-tech capabilities—dynamic ad insertion during live events, targeted overlays, and interactive sponsorships—enable Disney to command premium CPMs from Auto, Tech, and CPG brands eager to reach concentrated audiences. First-party data flows from theme-park visits, Disney+ viewing patterns, and ESPN app interactions, fueling machine-learning models that optimize content recommendations, pricing promotions, and ad placements in real time. Push notifications for injury updates, fantasy matchups, or event reminders drive habitual daily engagement, transforming streaming from a passive pastime into an active sports hub. Cross-platform promotions—such as discounted park tickets bundled with a season subscription—amplify the “flywheel” effect, while in-app fantasy and betting integrations deepen user immersion. As Netflix and Amazon chase fragmented sports rights, Disney’s unified sports bundle, backed by exclusive league partnerships, offers a defensible moat in the battle for direct-to-consumer supremacy.

Regulatory Scrutiny & Competitive Encroachment

Disney’s aggressive play for live-sports supremacy invites heightened regulatory scrutiny and exposure to skyrocketing rights costs—both of which threaten to erode projected upside. Antitrust authorities are expected to probe the NFL equity-for-ESPN-stake swap for potential anticompetitive conduct, examining whether ESPN will receive preferential scheduling, promotional advantages, or discounted carriage terms. Any adverse finding could delay deal closures, compel divestitures, or impose operational restrictions, undermining Disney’s strategic calculus. Meanwhile, Netflix’s entrenchment in global soccer and boxing, coupled with Amazon’s escalating bids for Thursday Night Football, has ignited a bidding war that risks driving rights fees beyond sustainable levels. Rising content costs may outpace ARPU growth on ESPN+, even within bundled offerings, compelling Disney to raise subscription prices and risking subscriber attrition. Operational integration hurdles—unifying billing systems, harmonizing UX across Disney+, Hulu, and ESPN apps, and preserving ESPN’s journalistic integrity—pose additional execution risks. Data-privacy regulations could curtail personalization and ad-targeting features, shrinking ad-tech revenues. In a high-stakes environment where consumer tolerance for premium bundles is tested and pure-play streamers vie aggressively for must-see content, Disney’s expansive rights footprint may become a liability if regulatory or cost pressures intensify.

Final Thoughts

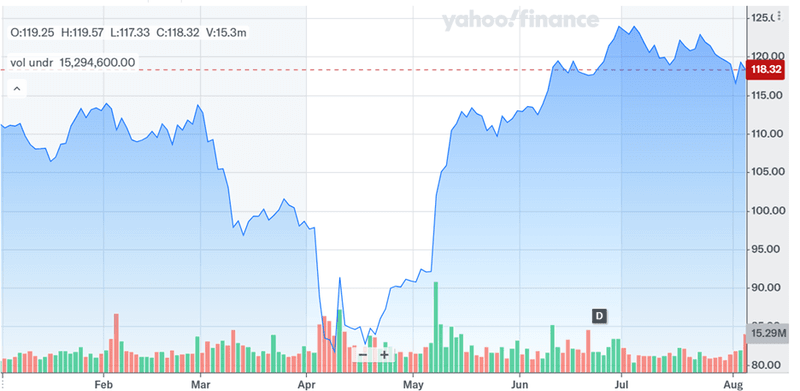

Source: Yahoo Finance

Disney’s stock has been flat over the past couple of months as the market awaits its upcoming earnings. Trading at approximately 2.70x LTM EV/Revenue, 13.29x EV/EBITDA, and 24.15x P/E, the company’s LTM valuation multiples reflect balanced expectations amid capital-intensive content expansions and margin pressures. Disney’s twin maneuvers—exchanging ESPN equity for NFL Network and RedZone rights and securing exclusive WWE streaming rights—underscore a bold pivot toward live-sports leadership designed to supercharge its streaming business, advertising yields, and subscriber engagement. These deals promise to deepen content differentiation and monetize fandom across multiple channels. Yet they also introduce formidable antitrust risks, exposure to escalating rights fees, and executional complexities in platform integration. There will also be the aspect of competitive counter-bids from Netflix and Amazon, and technical integration challenges. Overall, we believe that the ultimate impact of Disney’s sports-media strategy will hinge on balancing exclusive content depth against sustainable economics and preserving brand equity in an ever-evolving media landscape.Bottom of Form