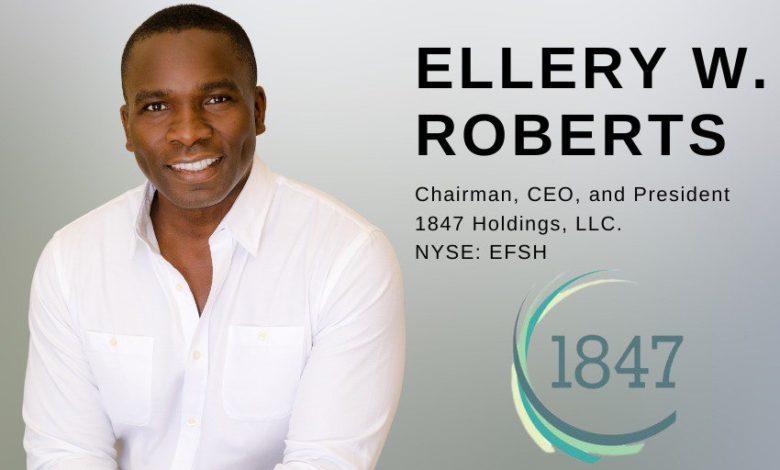

Mr. Roberts has been our Chairman, Chief Executive Officer, and President since our inception on January 22, 2013. Mr. Roberts brings over 20 years of private equity investing experience to us. In July 2011, Mr. Roberts formed the 1847 Companies LLC, a company that is no longer active, where he began investing his own personal capital and capital of high-net-worth individuals in select transactions. Before forming the 1847 Companies LLC, Mr. Roberts was the co-founder and was co-managing principal from October 2009 to June 2011 of RW Capital Partners LLC, the recipient of a "Green Light" letter from the U.S. Small Business Administration permitting RW Capital Partners LLC to raise capital in pursuit of the Small Business Investment Company license with the preliminary support of the Small Business Administration. Mr. Roberts was a founding member of Parallel Investment Partners, LP (formerly SKM Growth Investors, LP), a Dallas-based private equity fund focused on re-capitalizations, buyouts, and growth capital investments in lower middle market companies throughout the United States. Previously, Mr. Roberts served as Principal with Lazard Group LLC (LAZ), a Senior Financial Analyst at Colony Capital, Inc., and a Financial Analyst with the Corporate Finance Division of Smith Barney Inc. (now known as Morgan Stanley Smith Barney LLC). Mr. Roberts has also served as the chairman of the board of 1847 Goedeker (GOED) since April 2019 and has also been a director of Western Capital Resources, Inc. (WCRS) since May 2010. Mr. Roberts received his B.A. degree in English from Stanford University.

Full Interview:

Thank you for taking the time to answer my questions about 1847 Holdings LLC (EFSH). For our readers who may be unfamiliar, can you briefly describe the Company and its focus? Thank you for the opportunity to connect with your readers.

1847 Holdings LLC is a holding company formed with the expressed purpose of acquiring, owning, and potentially selling small businesses, headquartered in the U.S, that we believe offer an opportunity to generate attractive returns due to internal and external growth opportunities identified in the pre-diligence and due diligence conducted before acquisition. These growth opportunities are realized through investments in people, processes, and systems made by 1847 Holdings in our operating subsidiaries. Although we are built to own all of our subsidiaries in perpetuity, we may from time to time sell operating subsidiaries when we believe we can generate an above-average return for our investors.

1847 Holdings operates in the lower-middle market. Why do you believe this space offers hidden gems for investors, and how does your approach differ from traditional private equity firms?

Given that (i) a 2019 SBA report found that small businesses accounted for 44% of U.S. economic activity, (ii) only a di minimus number of small businesses eclipse $100 million in sales, and (iii) the overwhelming majority of institutional capital is focused on investing in businesses with sales of less than $100 million, we believe there has been and there will continue to be far more mature businesses looking for capital than there are pools of institutional or sophisticated capital seeking to invest in this sector. Our approach is different from a traditional private equity firm due to our structure as a holding company without a finite life to our investment vehicle. This allows us to take a more patient approach to investing versus a private equity fund wherein an investment can only be held for a definitive number of years.

How does EFSH identify potential acquisition targets, and what criteria do you look for in businesses?

Given the supply of businesses available for sale far outnumbers buyers with the capacity to acquire such businesses, we have the luxury of culling through businesses shown to us by investment bankers, business brokers, and other intermediaries to find businesses wherein we can apply our experience in industries where we have invested successfully in the past. Our criteria are evolving as our business matures but currently, we are interested in businesses with minimum earnings before payments for interest, taxes, depreciation, or amortization (“EBITDA”) of $2.0 million and minimum Revenues of $20 million. We would like the businesses to have a recent track record of stability in terms of revenues and EBITDA, with a clearly defined reason to exist and an opportunity to make 3x or higher return on investment over a 3 horizon.

With a focus on both selling businesses at higher valuations and holding them for consistent cash flow, how does 1847 Holdings strike a balance between these two paths to create value for shareholders?

Maintaining our balance between buying for consistent cash flow and selling to generate an above-average return isn’t very hard to do. Generally, we believe if we focus on buying solid businesses, with stable cash flow that we can improve over time, the selling of a business will take care of itself. We recently announced that due to unsolicited offers to buy certain operating subsidiaries we own we have engaged bankers to formally help us evaluate the value of these subsidiaries, as they may be farther ahead of schedule in terms of value creation than we thought. This is an example of why we focus on buying the right businesses and working to improve the business’s operations without a specific exit in mind but focusing on annual operating goals.

We realize that if we bought the right business and improved it, sellers would find us. As a public company that operates with a much higher degree of transparency than most private equity firms, our operating subsidiaries are public as well, and as such, they provide quarterly and annual updates through our 10Qs and 10Ks, which can lead to interested buyers reaching out to us versus us reaching out to them. However, we do review annually each subsidiary to assess whether additional capital should be allocated or reinvested as we seek to improve operations or whether an opportunity exists to invest or reinvest capital in a new platform or one of our other operating subsidiaries.

ICU Eyewear brings a strong brand presence and diverse product lines. How do you plan to leverage their expertise and capabilities across the 1847 Holdings portfolio?

ICU is unique because it services some of the largest, most sophisticated retailers in the U.S., as well as significantly smaller retailers. We believe ICU’s diverse points of distribution will impact not only consumer product companies that we already own like Wolo but also help us better diligence other consumer product companies we may screen for acquisition. These are some of the tangential benefits of buying a broad array of businesses.

With two potential catalysts for growth: balance sheet optimization and the upcoming spinoff of 1847 Cabinets, can you delve into the potential timelines and outcomes of these initiatives?

As a public entity, we have to respect the rules of disclosure, so although we do have a timeline internally, we have not shared it publicly. What I can say is we are dedicated to optimizing the balance of debt and equity, minimizing any future dilution from convertible securities through amortization or refinancings, and adding larger more sophisticated subsidiaries to accelerate our growth.

What are some exciting new developments or trends you see emerging in the lower-middle market that could benefit EFSH?

I often talk about the “graying of America” during conversations with investors. I think what we will years in the next decade is a sustained turnover of ownership as we see one of the largest generation of entrepreneurs moving from active engagement in businesses they founded decades ago to retiring. This sustained transition is what excites me more than any trend because it means unless there is a dramatic change in the capital markets, our universe of businesses to buy should expand exponentially over time while the universe of buyers will fail to keep pace.

How does EFSH intend to leverage its operational expertise to continue unlocking hidden value and driving growth within its portfolio companies?

We have two members of our team who are expressly tasked with scouring our subsidiaries for hidden value and driving growth. Those individuals are Eric Vandam, our Chief Operating Officer, and Glyn Milburn, our Vice president of Operations. Eric and Glyn speak to operators daily and are seamlessly integrated into the internal conversations of the subsidiary executive teams. This integration allows them to think about ways in which subsidiaries can collaborate on opportunities or share best practices. Eric and Glyn have done a particularly good job integrating our cabinet operations under one umbrella and have fostered a collaboration between ICU and Wolo.

What are your long-term goals for EFSH, and how do you envision the company evolving in the next few years?

My long-term goals for EFSH are (i) to continue building an entity premised on improving the fundamentals of the businesses we acquire and own first and foremost, (ii) to build platforms around subsidiaries similar to what we have been able to do with the creation of 1847 Cabinet Inc., and (iii) have several successful exits to cement in the minds of investors a coherent perspective on what 1847 is and can be in perpetuity. In the near term, we are focused on expanding our capital relationships, to make sure we are less reliant on expensive senior capital to enhance returns on our equity.

Thank you for your time.