Elutia’s Game-Changing Tech Has Boston Scientific’s Full Attention— Is A Bigger Deal Coming Next?

In the med-tech sector, mergers and acquisitions have long been a defining feature of the competitive landscape, with larger players routinely snapping up innovative small-cap companies to bolster pipelines, enter new markets, or gain technological edge. When a smaller firm is able to command the attention of a global heavyweight—especially through the sale of a key business segment—it often signals more than just a financial transaction; it hints at deeper strategic interest. That’s precisely what has transpired with Elutia (NASDAQ:ELUT), which announced on September 9, 2025, that it would sell its EluPro and CanGaroo bioenvelope assets to Boston Scientific (NYSE:BSX) for $88 million in cash. While framed as a product-line divestiture, the deal allows Elutia to wipe out its debt, resolve legacy litigation, and fully fund its high-priority pipeline product, NXT-41. Meanwhile, Boston Scientific's increasing involvement in EluPro’s commercialization raises a more intriguing question: could this transaction be a precursor to a full-scale acquisition?.

Elupro's Rapid Commercial Momentum Creates A Scalable Revenue Engine

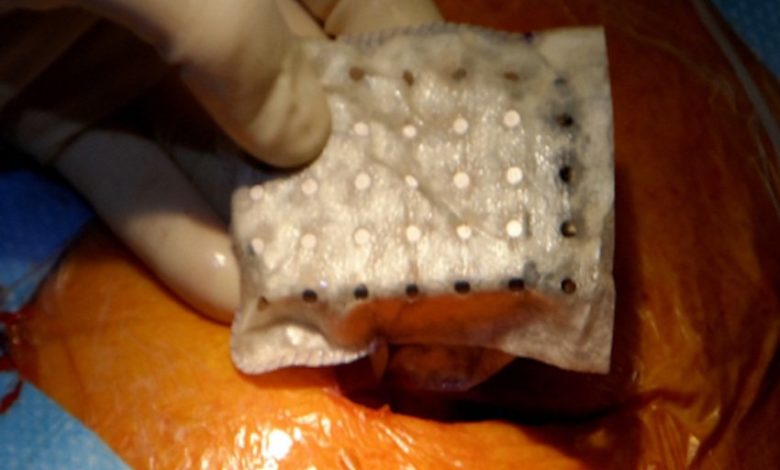

EluPro has quickly emerged as a dominant product in the implantable device envelope space, registering 49% quarter-over-quarter revenue growth and accounting for 68% of Elutia’s BioEnvelope revenue. This rapid uptake is a function of strong hospital VAC (Value Analysis Committee) penetration—Elutia has already secured 161 hospitals with active ordering relationships, representing roughly 10% of its 1,600-hospital addressable U.S. pacemaker market. This is no small feat in the tightly regulated hospital ecosystem, where the VAC approval process averages six months. EluPro's higher efficacy and utilization compared to its predecessor, CanGaroo—driven by its antibiotic-eluting biologic matrix—are contributing to 130% higher revenue per account. The product’s scaling trajectory is further underpinned by robust GPO (Group Purchasing Organization) coverage, including contracts with Premier, S3P, and Advantus. Boston Scientific has played a material role in this growth, facilitating sales at 98 hospitals and participating in 30% of EluPro's procedures. This shared go-to-market success validates the synergy potential of a deeper integration and positions EluPro as a $150 million U.S.-only market opportunity in pacemakers, with a similarly sized upside in the neurostimulation market. For Boston Scientific, which operates broadly in CRM (cardiac rhythm management) and neuromodulation, acquiring full control of this expanding revenue engine—alongside its proprietary biologic platform—could deliver long-term strategic advantage.

NXT-41 Platform Could Be A Gateway Into The $1.5B Reconstruction Market

Elutia’s next pipeline innovation, the NXT-41 biologic matrix, represents a natural extension of its drug-eluting platform into a $1.5 billion breast reconstruction market that remains biologics-heavy yet clinically underserved. With 151,000 mastectomies annually in the U.S.—and 65% of implant costs tied to biologics—this is an addressable market where complications like infections, capsular contracture, and implant loss remain highly prevalent. Elutia’s NXT-41X, a fully engineered porcine-derived matrix with embedded antibiotics, directly targets this unmet need. It also builds on the same rifampin and minocycline drug-eluting model validated by EluPro. The company plans a staggered regulatory approach, launching the base matrix in 2H 2026 and the drug-eluting version in 1H 2027. This approach derisks market entry while enabling simultaneous real-world clinical validation. The platform is not a repurposed version of Elutia’s SimpliDerm but a newly engineered matrix with optimized biological incorporation and consistent performance. Boston Scientific’s historic reluctance to enter biologics-heavy applications may be offset by NXT-41's differentiated mode of action, which not only addresses infection but may offer regenerative benefits. NXT-41 opens up strategic adjacency in women’s health and surgical reconstruction, two segments where Boston Scientific has limited current exposure but meaningful distribution synergies.

Litigation Resolution & Debt Elimination De-Risk The Balance Sheet

One of the less visible yet highly strategic benefits for any acquirer is Elutia’s substantially de-risked balance sheet following the $88 million divestiture to Boston Scientific. As disclosed in the Q2 2025 earnings call, Elutia has resolved 97 out of 110 legacy lawsuits stemming from a product recall related to its now-divested Orthobiologics unit. The remaining 13 cases are isolated and expected to be resolved on favorable terms due to the lack of coordinated legal exposure. This cleanup effort removes a longstanding overhang that previously deterred strategic interest. More importantly, the sale proceeds will also eliminate all of Elutia’s outstanding debt, cutting financial burn significantly and positioning the company for a self-sustaining growth trajectory. With an adjusted EBITDA loss of $3.8 million in Q2 2025—against a $14 million BioEnvelope revenue run-rate and improving gross margins (62.4% in Q2)—Elutia is approaching breakeven, especially with cardiovascular patch products generating over 80% margins. This fiscal transformation improves acquisition visibility and attractiveness, particularly for a large-cap acquirer like Boston Scientific that prizes earnings accretion, balance sheet cleanliness, and manageable integration risk in its M&A playbook.

Strategic Fit & Embedded Operational Synergies With Boston Scientific

The most compelling rationale for a potential full acquisition is the existing integration between Elutia and Boston Scientific across commercial, operational, and clinical domains. Boston Scientific is already deeply embedded in EluPro’s distribution strategy, co-selling the product in nearly 100 hospitals and participating in nearly one-third of active procedures. This partnership has yielded demonstrable market share gains, driven by Boston’s reach and Elutia’s innovation. If Boston were to acquire Elutia outright, it could unlock vertical integration benefits—streamlining procurement, accelerating VAC approvals using its national account infrastructure, and potentially driving margin uplift by eliminating duplication in sales and manufacturing. Further, Boston's CRM and neuromodulation franchises would benefit from the in-house control of a differentiated drug-eluting biologic envelope, which has proven superior uptake versus legacy options. On the innovation front, Boston could scale the NXT-41 platform using its broader clinical trial and reimbursement apparatus, accelerating time-to-market and market penetration. Additionally, the IP portfolio and experienced R&D leadership at Elutia—especially under Dr. Michelle Williams—could complement Boston’s ambitions in biologic device convergence. This level of embedded operational synergy makes a full acquisition both technically feasible and strategically aligned, should Boston Scientific seek to expand its biologics and drug-delivery footprint.

Final Thoughts

Source: Yahoo Finance

Elutia’s stock price has been on the decline off late as the company remains unprofitable, with a recent adjusted EBITDA loss of $3.8 million. Its stock trades at a trailing EV/Revenue multiple of 3.27x and EV/EBITDA of (4.05x), reflecting both high growth potential and inherent execution risks. A full acquisition would imply Boston Scientific sees not only product-level value but long-term strategic potential in biologics-integrated medical devices—a space it has only selectively entered. The strategic and operational alignment between the two companies is evident, particularly given Boston Scientific’s existing role in selling EluPro and its synergies with CRM and neuromodulation and we believe that there is a very good chance of the med-tech behemoth going through with the complete acquisition in the coming months.