Energy Recap: Quick Hits – Energy News For The Week Ended Jan. 4, 2019 – BP p.l.c. (NYSE:BP)

Welcome to the newest version of the Energy Recap. Here are this week’s “quick hits” from the power sector – i.e., transient bits of latest information, together with some recommendations for additional studying on every matter. Let us know what you assume within the feedback part under.

Quick Hits – Energy News

As reported by MarketWatch on Monday, Jan. 3, “the American Petroleum Institute reported … that U.S. crude supplies fell by 4.5 million barrels for the week ended Dec. 28 … They also reportedly showed that gasoline stockpiles climbed by 8 million barrels, while distillate inventories rose by 4 million barrels.” Further studying: “Where Is Oil Headed In 2019? Just Watch What The Saudis Want Closely“

As reported by The Wall Street Journal on Monday, Jan. 3, “thousands of shale wells drilled in the last five years are pumping less oil and gas than their owners forecast to investors, raising questions about the strength and profitability of the fracking boom that turned the U.S. into an oil superpower. … Two-thirds of projections made by the fracking companies between 2014 and 2017 in America’s four hottest drilling regions appear to have been overly optimistic, according to the analysis of some 16,000 wells operated by 29 of the biggest producers in oil basins in Texas and North Dakota. Collectively, the companies that made projections are on track to pump nearly 10% less oil and gas than they forecast for those areas, according to the analysis of data from Rystad Energy AS, an energy consulting firm.” Further studying: “Will Oil Prices Rise In 2019?“

As reported by CNBC on Monday, Jan. 3, “oil and gas business activity in Texas and neighboring states plunged in the fourth quarter, according to the Dallas Federal Reserve. The survey from the Fed’s 11th District also showed company sentiment turned negative for the first time in nearly two years and executives don’t expect much of an oil price recovery in 2019. The insight is from the Dallas Fed’s latest quarterly Energy Survey, which comes on the heels of a nearly 40 percent plunge in U.S. crude oil prices to about $45 a barrel in the final quarter of 2018. The oil market has been hammered by fears of growing oversupply and slowing economic growth that could weigh on fuel demand. One of the key findings in the survey shows that oil executives think U.S. crude prices will end 2019 at $59.97 on average. That would mark a fairly moderate recovery…” Further studying: “The WTI Crude Oil Price In 2019“

Energy Articles of Note

“Andrew Hecht Positions For 2019 – Buy Those Dips In The VIX” by Andrew Hecht

“Jennifer Warren Positions For 2019: Energy, Opportunities, And Acceptable Risk” by Jennifer Warren

“BP: Investing For A Clean Energy Future” by Fluidsdoc

Energy Sector IPOs for the Week Ended Jan. 4, 2019

Here’s a listing of the newest preliminary public choices within the power sector:

– None.

Feel free so as to add any that we would have missed within the feedback part under.

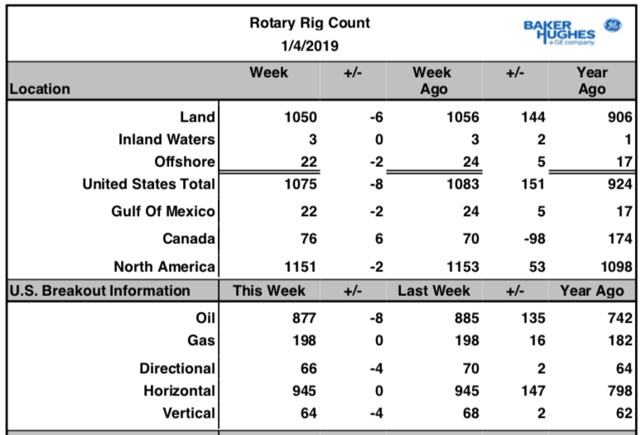

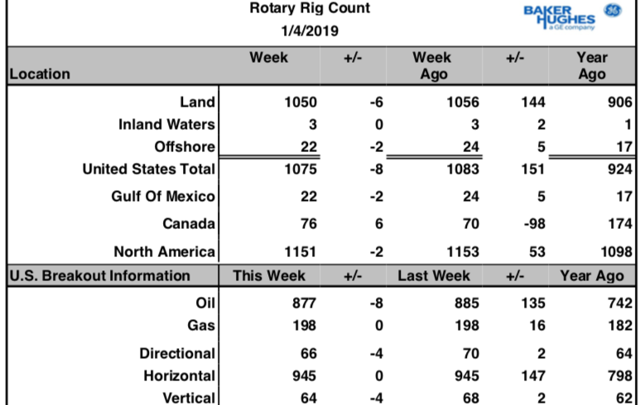

U.S. Oil Rig Count

As per Baker Hughes, the variety of energetic U.S. oil drilling rigs declined this week.

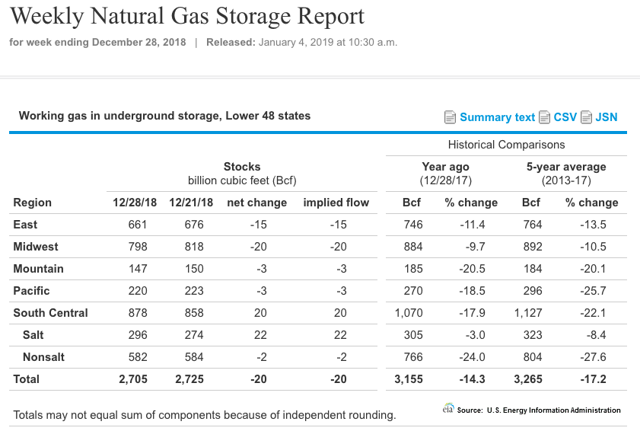

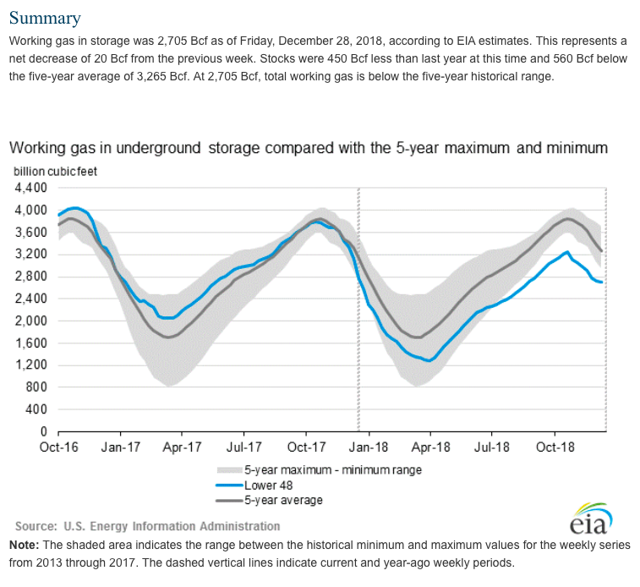

Weekly Natural Gas Storage Report and Summary

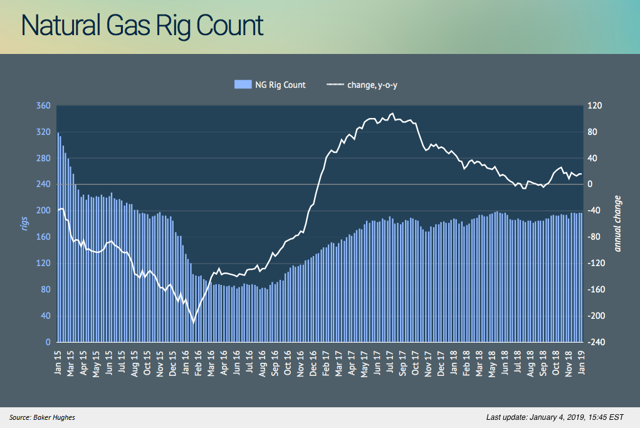

Natural Gas Rig Count

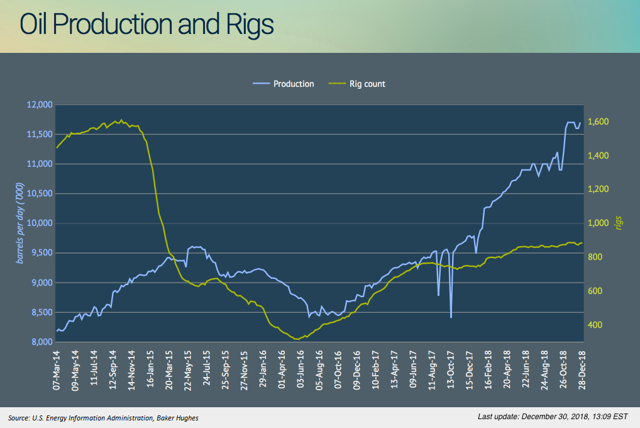

Oil Production

As at all times, we encourage you to submit your personal article by clicking here, if you have not already completed so.

Disclosure: I/we now have no positions in any shares talked about, and no plans to provoke any positions throughout the subsequent 72 hours. I wrote this text myself, and it expresses my very own opinions. I’m not receiving compensation for it (aside from from Seeking Alpha). I’ve no enterprise relationship with any firm whose stock is talked about on this article.