Facebook’s Network Shows No Signs Of Cracking – Facebook (NASDAQ:FB)

[ad_1]

Good investments typically hinge on one key query. That query is sort of a fulcrum the stock teeters over. As opinion wavers, so does the stock. This volatility is worth traders’ alternative.

Facebook’s (NASDAQ:FB) stock is down almost 40% from its all-time excessive. The market is clearly grappling with uncertainty. You cannot go far with out listening to a couple of new Facebook scandal or rage over its privateness coverage.

There have been so many who the Tech Republic put together a handy timeline to catch you up on them.

It’s straightforward to lose sight of the sign amidst a lot noise. I’m not right here to dismiss these scandals or play down their significance. Instead, I’m right here to argue that for lengthy-time period traders, an important query to ask is whether or not Facebook’s community will stay intact.

My opinion is that it actually will and that Facebook is a lovely funding at immediately’s value.

The Great Salad Oil Swindle

In Dear Chairman, Jeff Gramm writes:

In June 1960, an nameless tipster referred to as American Express to reveal a large fraud at Allied Crude Vegetable Oil Refining Corporation. At the time, Allied was the biggest buyer of American Express’s area warehousing subsidiary, which was within the unenviable place of getting assured tens of millions of {dollars}’ value of Allied’s soybean oil stock.

The tipster, whom American Express staff referred to as “the Voice,” mentioned he labored the night time shift at Allied’s facility in Bayonne, New Jersey. He challenged American Express staff to examine Tank No. 6006, one of many largest tanks on the property. He defined that there was a slender steel chamber crammed with oil positioned instantly beneath the measuring hatch. Everything else within the tank was seawater.

Allied Crude Vegetable Oil was alleged to have 1.8 billion kilos of oil as collateral in opposition to loans, however solely had 110 million kilos. American Express’ (NYSE:AXP) stock dropped 40% and misplaced $125 million in market worth (source). The market did not assume American Express may make good on the loans and anticipated it to exit of enterprise.

In The Snowball, Alice Schroeder writes:

“So every trust department in the United States panicked,” remembers Buffett. “I remember the Continental Bank held over 5 percent of the company, and all of a sudden not only do they see that the trust accounts were going to have stock worth zero, but they could get assessed. The stock just poured out, of course, and the market got slightly inefficient for a short period of time.”

While traders targeted on the scandal and panicked, Warren Buffett regarded for the sign amidst the noise. He knew American Express was a beautiful enterprise: it earned excessive returns on its capital and will reinvest massive quantities at equally excessive charges. American Express was the prototypical “compounding machine.”

Although the press was crucifying American Express, Buffett seen that folks did not cease utilizing their playing cards at eating places or in shops. Many anticipated customers to desert their American Express cost playing cards. But this wasn’t taking place.

Buffett’s key perception was that as long as customers continued to think about their cost playing cards, the corporate would survive. American Express would take a one-time monetary blow to settle its excellent claims, however this is able to shortly change into a blip on the radar as soon as AXP resumed compounding.

Buffett put 40% of his funding partnership in American Express at $35 per share. American Express ultimately settled with the salad oil claimants for $32 million and three years later the stock stood at $70 per share (source).

American Express made errors and so did Facebook. Its person knowledge was compromised, and traders concern customers will stroll away from the platform. But this is not taking place.

Like American Express, Facebook is a “compounding machine.” It earns excessive returns on its capital, advantages from working leverage, and might reinvest at excessive charges. Facebook additionally has deep pockets – a money and securities place of over $41 billion ($14 per share). To borrow a phrase from Charlie Munger, the corporate is “drowning in cash.”

I am unable to pinpoint what the implications of Facebook’s scandals will probably be. FB might pay fines, it could pay greater taxes, and it will likely be topic to extra laws. But Facebook’s enterprise mannequin is so highly effective and so efficient that so long as its community stays intact, the stock will proceed to compound.

Evaluating Facebook’s Network

A community impact happens when a services or products positive factors worth as extra individuals use it. Facebook suits this definition completely.

The extra of your actual world family and friends have Facebook accounts, the extra precious it’s so that you can be a part of the community. This will increase worth on your pals in a constructive suggestions loop.

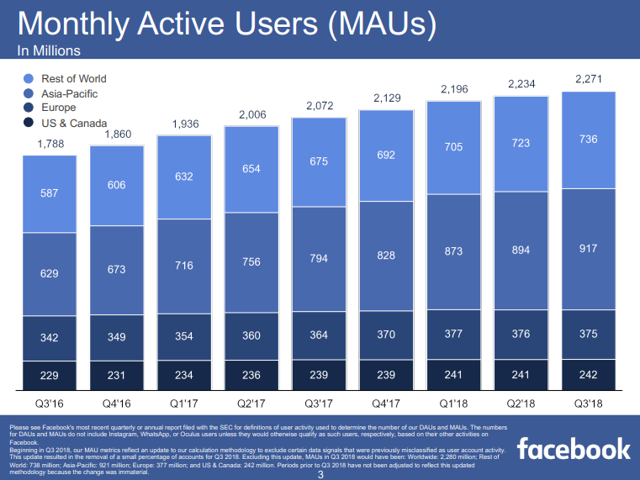

A easy barometer of Facebook’s health is the dimensions of its person base. Facebook makes use of Monthly Active Users (MAUs) as a proxy for this.

Source: Facebook’s 2018-Q3 Earnings Slides

MAUs the world over have been up 1.7% final quarter and 9.6% over the past yr. Europe was the one geography to indicate a decline, which was a modest 0.5% since its 2018 Q1 peak.

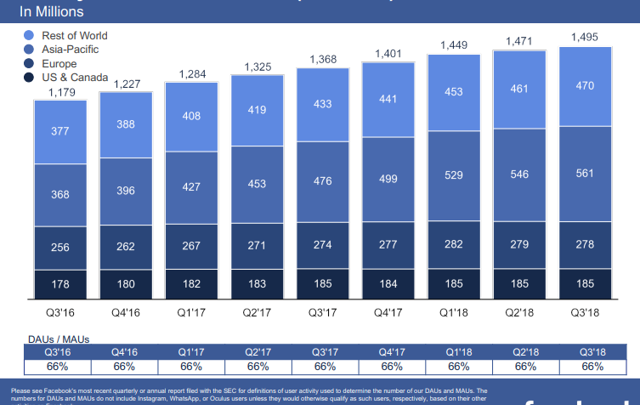

Facebook attracts customers who need to work together with different customers, and advertisers who pay for the privilege to work together with customers. The extra interplay Facebook has on its platform, the extra enticing advertisers discover it. Facebook makes use of the ratio of Daily Active Users (DAUs) to MAUs as a proxy for person engagement.

Source: Facebook’s 2018-Q3 Earnings Slides

User engagement has been regular for the final eight quarters at 66% whereas DAUs have continued to extend worldwide. Europe is once more the lone exception, exhibiting a 1.4% decline in DAUs over the previous two quarters.

What’s Going On In Europe?

In Q2, Europe’s General Data Protection Regulation (GDPR) went into impact. GDPR requires customers to explicitly choose-in to proceed utilizing Facebook and explains the loss of some customers.

Zuckerberg commented on the Q2 earnings name:

GDPR was an necessary second for our business. We did see a decline in month-to-month actives in Europe – down by about 1 million individuals consequently. At the identical time, it was encouraging to see the overwhelming majority of individuals affirm that they need us to make use of context – together with from web sites they go to – to make their adverts extra related and enhance their total product expertise.

That the overwhelming majority of customers explicitly opted in to Facebook is a powerful vote of confidence within the community’s worth.

A recent study aimed to look at precisely how a lot individuals worth Facebook. Since the service is free, placing a greenback worth on the service is troublesome. The researchers used actual auctions to find out the value at which somebody can be prepared to deactivate their Facebook account for one yr. The outcomes revealed customers would need greater than $1,000 to surrender Facebook for a yr. This speaks to the stickiness and worth of Facebook’s community.

The dip in European DAUs will not be with out precedent, both. Facebook noticed its DAUs dip as soon as earlier than in North America. They have been rapidly recovered the subsequent quarter. Some noticed this as the start of a decline, and extrapolated the pattern out. Instead, imply-reversion took over and restored the customers.

Jason Zweig has argued that imply-reversion, not extrapolation, is probably the most highly effective drive in finance:

“From financial history and from my own experience, I long ago concluded that regression to the mean is the most powerful law in financial physics: Periods of above-average performance are inevitably followed by below-average returns, and bad times inevitably set the stage for surprisingly good performance.”

The level is that Facebook’s person base does fluctuate, and it is nothing to panic over. The overwhelming majority of Facebook’s customers explicitly opted into the service, which is a powerful vote of confidence within the community’s worth.

There isn’t any quantitative motive to imagine Facebook is failing to take care of and entice customers.

Multi-tenanting

Multi-tenanting is properly described by Li Jin and D’Arcy Coolican of Andreessen Horowitz of their article 16 Ways to Measure Network Effects:

We’ve typically noticed that if an organization is ready to replicate a community, it could additionally layer on performance that may obviate the necessity for one more product. Even if it would not wipe out the goal firm, such multi-tenanting can scale back utilization and compress margins for all opponents. A market for canine walkers and pet house owners, for instance, has the chance to maneuver into pet health or food or different adjoining merchandise, given it has constructed a community of pet house owners from the core enterprise. Facebook developed ephemeral Stories and added this function into their varied apps, together with Instagram, in flip stymying the expansion of Snapchat.

In a nutshell, when the customers of two networks overlap, the bigger can replicate the smaller and provide its customers one-cease procuring.

Facebook is the biggest social community on the earth (source) and due to this fact has probably the most potential to learn from this.

Currently Facebook is including Stories, which has similarities to Snapchat (NYSE:SNAP). IGTV is taking over YouTube (NASDAQ:GOOG) (NASDAQ:GOOGL), and Facebook Dating will tackle Tinder. Snap and Match Group (NASDAQ:MTCH) have a mixed market cap of over $17 billion, to ballpark the dimensions of the potential alternative.

These are low-threat, excessive-reward bets for Facebook to make. I do not count on all of them to be house runs, however do count on them so as to add worth.

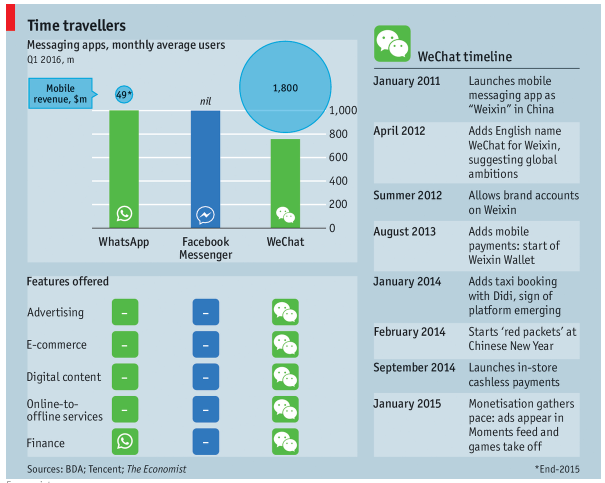

The poster youngster of multi-tenanting is Tencent’s (OTCPK:TCEHY) WeChat.

Source: The Economist

In China, WeChat combines a messenger, like WhatsApp, with a social community, trip-sharing platform, funds, and gaming, amongst others. The graphic above exhibits what number of options WeChat has in comparison with Facebook and the way a lot it is ready to monetize options Facebook has but to. I’m not predicting that Facebook turns into the American WeChat. I present it as an example Facebook’s potential.

Investing For The Future

After Buffett purchased his stake in American Express, he pushed the corporate to allocate its capital in the direction of liberally compensating the defrauded events. The different shareholders opposed him. They regarded for a authorized loophole to dodge accountability. This may need saved American Express a few bucks within the brief run, however who would belief American Express’s assure the subsequent time?

The lengthy-run worth of American Express lay within the belief customers had in its franchise. American Express may compound capital at such excessive charges that defending this model was value tens of millions of {dollars}.

The similar could be mentioned of Facebook.

Facebook should do all the things it could to take care of its customers’ belief. Sheryl Sandberg’s latest mea culpa exhibits the corporate understands this.

Without customers’ belief, its community and enterprise will unravel. There are not any indicators of this taking place but, however Facebook can not afford to take any probabilities.

Mark Zuckerberg has probably the most to realize and lose from Facebook. He owns over 400 million shares, or 14% of the corporate, and holds 78.9% of the voting energy (source). Zuckerberg has the biggest incentive of all to maintain Facebook in tip-prime form. He additionally has the ability to do no matter is important to proper the ship.

In his Q2 earnings name, Zuckerberg mentioned:

Looking forward, we’ll proceed to speculate closely in safety and privateness as a result of we have now a accountability to maintain individuals protected. But as I’ve mentioned on previous calls, we’re investing a lot in safety that it’s going to considerably impression our profitability. We’re beginning to see that this quarter. But along with this we even have a accountability to maintain constructing companies that deliver individuals nearer collectively in new methods as properly. In gentle of elevated funding in safety, we may select to lower our funding in new product areas, however we’re not going to — as a result of that would not be the appropriate method to serve our neighborhood and since we run this firm for the long run, not for the subsequent quarter.

The market did not like this (the stock fell 19% that day), however that is as a result of brief-time period considering. Facebook expects its working margin will decline to 35% in 2019 as a result of its spending will improve quicker than its revenues.

Facebook is spending on AI that can assist to fight faux information and unhealthy actors. It’s additionally investing in higher safety and privateness methods. And it continues to construct out knowledge middle capability to remain forward of demand.

This spending hurts within the brief time period however strengthens Facebook for the long run. Not solely does it construct a extra reliable community, but it surely additionally creates a barrier to entry.

Facebook spent $6.7 billion in capital investments in 2017, and can spend much more in 2018 and 2019. Users and regulators now demand these up-entrance investments in safety, and Facebook is fortunate that it is able to make them. Competitors and upstarts is not going to be so fortunate. How may a start-up, with a smaller income base, afford to sink billions into safety methods on day one?

GDPR is more likely to be the start of information laws, not the tip. Regulations are more likely to entrench Facebook and Google in a duopoly since nobody else may have the assets to adjust to the laws.

Facebook can be taking motion to make sure social media has a constructive impact on customers’ temper and self-esteem. In Q2 Zuckerberg mentioned:

And the analysis there may be very clear, that when persons are utilizing the Internet and — together with our companies — to work together with different individuals, that is related to all of the constructive components of properly-being that you simply’d count on — feeling extra linked, feeling much less lonely, feeling happier, and lengthy-time period measures of health. But if you’re merely utilizing the Internet to passively devour content material, that is not essentially related to constructive enhancements to properly-being. Both due to the suggestions that we have been getting and the analysis, we felt like this was actually the appropriate course to go in.

Facebook is re-prioritizing interplay with pals, household, and teams, on the expense of video and different types of passive content material. This might harm revenues within the brief time period, however is more likely to make the Facebook neighborhood nearer, stickier, and extra interactive over the long term.

Facebook is not abandoning video altogether both. It’s transferring it to new locations on the platform the place it doesn’t compete instantly with interactions. Facebook launched Stories on Instagram, Facebook, and WhatsApp with nice success.

Untapped Pricing Power

One of probably the most precious qualities a enterprise can possess is untapped pricing energy. That is, the power to boost costs quicker than prices with out sacrificing quantity.

Facebook’s advert costs are set by an public sale course of. In The Psychology of Human Misjudgement, Charlie Munger writes:

Well the open-outcry public sale is simply made to show the mind into mush: you have obtained social proof, the opposite man is bidding, you get reciprocation tendency, you get deprival tremendous-response syndrome, the factor goes away… I imply it simply completely is designed to control individuals into idiotic habits.

Then there may be the Warren Buffett rule for open-outcry auctions: do not go.

The consequence is a lollapalooza impact that ends in what’s generally known as the winner’s curse. According to Wikipedia:

The winner’s curse is a phenomenon which will happen in widespread worth auctions, whereby the winner will are likely to overpay as a result of emotional causes or incomplete data.

The system is designed to get the highest value, and costs have been going up. Advertisers are pushed by ROI – the extra they make from an advert, the extra they may spend. Facebook’s distinctive potential to serve properly-focused adverts makes its adverts precious to advertisers.

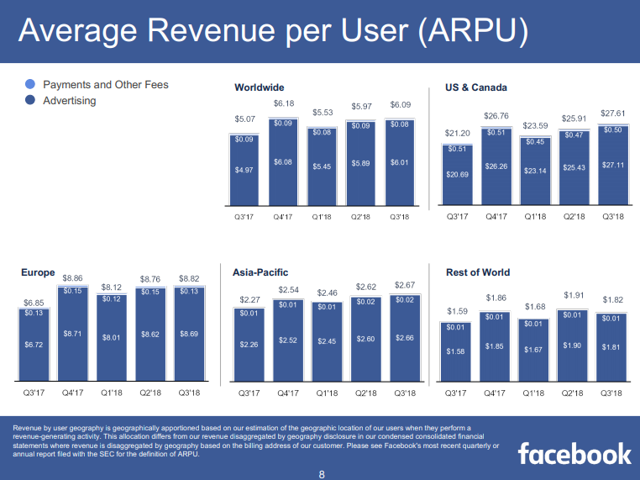

Source: Facebook’s 2018-Q3 Earnings Slides

Other than the seasonally robust fourth quarter, Facebook’s ARPU exhibits regular progress over the past yr.

The ARPU knowledge above exhibits a big distinction between the worth of a person within the US and Canada and the remainder of the world. The US and Canada are mature markets for Facebook: penetration, as a % of the inhabitants, is regular at 65%. But ARPU has continued to extend.

I count on ARPU to proceed to climb as a result of Facebook continues to learn from a number of tailwinds.

At probably the most primary degree, the world’s inhabitants is rising. Meanwhile, an rising % of the world’s inhabitants is linked to the web. Today, solely 55% of the world’s inhabitants is on the web (source).

User penetration (as a % of the whole inhabitants) has plateaued within the US and Canada at 65%. The world’s inhabitants immediately is 7.7 billion, and it is rising at 1.1% yearly (source).

If the remainder of the world reached the identical 65% penetration fee because the US and Canada, Facebook would add 2.734 billion customers. Facebook’s ARPU for customers exterior of the US and Canada is $14.18, which means these customers are value $38.8 billion yearly. Facebook’s marginal value of manufacturing is close to zero, so this is able to be principally revenue.

In addition to web penetration and inhabitants progress, FB advantages from an rising advert market. Ad {dollars} are likely to develop in tandem with GDP, and will conceivably rise barely quicker as small companies acquire entry they beforehand did not have (source).

As Facebook positive factors newly linked web customers in rising markets, it is going to additionally acquire advertisers in these markets. That is, Facebook is more likely to acquire market share of the promoting market in rising markets. This will drive ARPU greater whereas MAUs additionally develop.

Together, these forces imply Facebook has a few years of above-GDP progress left in it.

The remaining issue to debate is Facebook’s advert load. I do not count on Facebook to materially alter its advert load on its flagship properties – Facebook Feed, and Instagram. But Facebook has room to monetize Stories (Facebook, Instagram, WhatsApp), in addition to WhatsApp and Messenger.

Stories might find yourself cannibalizing a few of the adverts beforehand destined for Feed, however all in all Facebook ought to be capable to improve its variety of adverts served by monetizing its different properties.

High Return On Incremental Invested Capital

Facebook will not be a capital intensive enterprise. The firm’s main prices are engineers and knowledge facilities. Its value of sustaining these is minimal.

Facebook does spend lots on progress initiatives. These have confirmed to be profitable, and present no signal of exhaustion.

Between 2010 and 2017, FB’s complete capital invested grew from $2,433 million to $54,242, a change of $51,809. I outline complete capital invested as shareholders’ fairness plus debt and capitalized leases minus goodwill and intangible property.

Over the identical interval, the corporate produced cumulative working money flows of $62,461 and retained nearly all of it.

What was the results of this reinvestment? Facebook’s working money circulation grew $23,518: from $698 million in 2010 to $24,216 in 2017. This means return on funding was 45% (23,518 / 51,809).

Buybacks & Capital Allocation

Facebook is drowning in money and desires a method to spend it. Historically, the corporate has invested in itself and made acquisitions (notably Instagram, WhatsApp, and Oculus).

Today Facebook’s TTM working money circulation stands at $28 billion. There’s a restrict to what number of knowledge facilities and engineers Facebook wants. It’s unlikely to have the ability to reinvest in itself on the similar fee because it has traditionally.

The firm can be unlikely to make one other main acquisition due to antitrust issues.

That leaves returning the capital to shareholders by dividends or share repurchases. So far, Facebook actions point out that it prefers repurchases.

FB has at present licensed $15 billion of repurchases, a few of which has already been spent. Given its massive web money and securities place ($41 billion) and its robust free money circulation ($16 billion over the previous 12 months), I would not be stunned to see much more repurchases sooner or later.

Valuation

When I make investments, I observe a simple checklist:

1. Untapped pricing energy

2. Anti-fragile capital construction

3. Management with pores and skin within the recreation

4. A value which affords a margin of security.

So far, I’ve addressed the primary three factors. Now, I’ll deal with the fourth.

Facebook’s trailing 12-month EPS is $6.76, and the stock at present trades at $136 per share. It has about $14 of extra money and securities that are not used for operations, which implies the enterprise (excluding money and securities) trades for $122 per share for a P/E ratio of 18.

The S&P 500 at present sports activities a 20x P/E ratio (source). Even for those who imagine that Facebook is simply a mean firm, then it seems to be barely undervalued immediately.

But FB is not simply a mean enterprise, it is a phenomenal enterprise. It has a powerful steadiness sheet, pricing energy, ample progress prospects, and the power to reinvest at excessive charges of return.

Compared to the S&P 500, Facebook seems low cost: it is an above-common enterprise promoting for a beneath-common value.

Facebook additionally compares properly in opposition to its major competitor, Google. Net of money, Google’s shares commerce for 33x earnings. If Facebook have been to commerce right here, it would be value $237 per share or 74% extra.

There’s no telling if Google is priced appropriately, nevertheless. Maybe Google ought to be buying and selling for Facebook’s a number of and is overvalued at present.

After all, Facebook did information for its working margin to contract to about 35%. Facebook’s TTM working margin was 47%. If we assume that Facebook’s working and web margins contract 12 factors every, then Facebook would have a 25% web margin.

At a 25% web margin, FB would earn about $4.50 per primary share and have a 27x P/E (excluding money and securities). This continues to be cheaper than Google, although a major premium to the S&P 500.

These valuations are simplistic and take a look at Facebook as an image, frozen within the present. But what concerning the firm’s future?

Facebook has plenty of levers to tug for progress:

-

Increasing ARPU, as a result of elevated advert spending (which is because of an rising market share of all advert {dollars}, plus an advert market that grows at a GDP-like fee).

-

Increasing customers, primarily from rising markets.

-

Monetizing new and present properties (equivalent to produced by multi-tenanting).

Facebook’s progress is extraordinarily precious as a result of it doesn’t include commensurate prices. In 2010, its working margin was 34% on $777 million income. In 2017, it was 50% on $40,653 million income.

If Facebook continues to develop, it’s more likely to proceed to expertise working leverage. The subsequent few years might buck this pattern as Facebook makes “catch-up” investments in privateness and safety.

Even if a 35% working margin (and 25% web margin) was the brand new regular going ahead, FB would “only” must develop revenues 43% with the intention to keep its present EPS. I say “only 43%” solely as a result of Facebook has grown revenues at a 75% CAGR since 2010. And it grew revenues 47% from 2016 to 2017. When analysts fret about slowing progress, they’re speaking about decelerating progress – the second by-product.

Facebook is kind of more likely to proceed rising and at a quick clip by most requirements.

The Bottom Line

When Buffett purchased American Express, he regarded previous the information and targeted on what mattered most: have been individuals nonetheless utilizing their cost playing cards? If the community remained intact, the corporate would ultimately proper itself.

Facebook is in the identical state of affairs immediately. So far, there isn’t a proof that Facebook is having hassle sustaining or attracting customers, and that is what issues most over the long term.

Facebook is a superb enterprise, and as long as its community stays robust, it is going to proceed to compound for a few years. FB stands to learn from person progress, market share progress, pricing progress, and working leverage.

The market is not pricing Facebook like that is the case although. FB’s P/E a number of is 10%, decrease than the S&P 500’s, which implies the market expects Facebook to develop slower than common.

Facebook is laying the inspiration for its future by investing rising quantities immediately, on the expense of tomorrow’s earnings. It is taking initiatives to make its platform safer, safer, and extra interactive.

Sometimes issues worsen earlier than they get higher. There’s by no means only one cockroach within the kitchen, and Facebook will not be out of the woods but. For traders who can afford to take a protracted-time period view, nevertheless, that is exactly the sort of pessimism you need to purchase into.

Disclosure: I/we have now no positions in any shares talked about, however might provoke a protracted place in FB over the subsequent 72 hours. I wrote this text myself, and it expresses my very own opinions. I’m not receiving compensation for it (apart from from Seeking Alpha). I’ve no enterprise relationship with any firm whose stock is talked about on this article.

[ad_2]