Faraday Future on the Brink: Is There Any Hope Left for Investors?

As Faraday Future's stock plunges amidst severe financial distress, the future looks increasingly bleak for this once-promising electric vehicle (EV) manufacturer. The company's recent warnings of potential bankruptcy due to a dire need for additional capital have shaken investor confidence to its core. With its premium EVs priced out of reach for most consumers, Faraday Future has struggled to find its footing in a competitive market dominated by more established players. The distress signals grew louder with the company's latest SEC filings, revealing that it managed to sell only four vehicles and lease six over the entire course of 2023, generating a meager $784,000 in automotive sales revenue. Investors and market spectators are now faced with the grim reality of Faraday's situation: a company that once aspired to revolutionize the EV market is on the verge of collapse unless a financial lifeline emerges. This article delves into the depths of Faraday Future's struggles, exploring whether there remains any flicker of hope for the company and its stakeholders.

What Does Faraday Future Intelligent Electric Do?

Founded in 2014, Faraday Future Intelligent Electric Inc. is a California-based firm specializing in the development and manufacturing of electric vehicles (EVs) and related products. The firm focuses on various aspects of the electric vehicle market, including the design, development, manufacture, engineering, sale, and distribution of EVs, striving to contribute to the evolving automotive landscape in the United States by integrating advanced technological solutions and sustainable practices into its business model.

Production and Supply Chain Challenges

Faraday Future has faced significant challenges in ramping up its production capabilities, which have severely impacted its ability to meet market demand and generate revenue. Despite achieving key milestones such as the production commencement of the FF 91 2.0 and its successful crash test completion, the company has struggled with lower-than-anticipated production volumes. This shortfall is primarily attributed to funding constraints that have hindered the company's ability to support its supply chain effectively. The complex nature of the electric vehicle (EV) manufacturing process requires substantial investment in production infrastructure and supply chain management, areas where Faraday Future has encountered persistent difficulties. The company's Robotic Body Shop and Paint Shop equipment, though commissioned, have not been able to scale operations to the desired throughput capabilities. Additionally, the integration and streamlining of vehicle assembly processes have not yielded the expected improvements in production efficiency. These operational bottlenecks, combined with financial limitations, have resulted in delays and a limited number of vehicles being delivered to customers, undermining the company's market position and contributing to its financial losses.

Financial Instability and Capital Constraints

Faraday Future's financial instability has been a critical factor in its struggles, with the company reporting significant losses and cash flow challenges. For fiscal year 2023, the company recorded a loss from operations of $286 million and a net loss of $432 million, despite a reduction in operating expenses compared to the previous year. This financial instability is exacerbated by the company's substantial accumulated deficit of approximately $4.0 billion as of December 31, 2023. The limited cash balance of $4 million, including restricted cash, further highlights the dire financial situation. The company's reliance on various forms of financing, such as convertible notes, equity lines of credit, and asset-based financing, has not been sufficient to stabilize its financial position. Moreover, the capital raised has primarily been used to cover operating expenses and production-related costs, leaving little room for investment in growth initiatives. The company's ability to generate revenue has been constrained by its limited production capacity, resulting in only $0.8 million in revenue for the entire fiscal year 2023. This financial instability has severely restricted Faraday Future's ability to scale its operations, invest in new technologies, and compete effectively in the rapidly evolving EV market.

Strategic Missteps and Market Misalignment

Faraday Future's strategic approach has also contributed to its difficulties, with several missteps and a lack of clear market alignment. The company's decision to enter the ultra-luxury and high-performance EV market has placed it in direct competition with well-established and financially stable competitors, such as Tesla and Lucid Motors. While the launch of the FF 91 2.0 and the aiHypercar+ aimed to position Faraday Future as a leader in innovation and technology, the company's limited production capabilities and financial constraints have undermined these efforts. Additionally, the focus on the U.S. and Chinese markets, while expanding into the Middle East, has spread the company's resources thin, leading to operational inefficiencies and missed market opportunities. The strategic cooperation agreements with entities in the Middle East, although promising, have not yet materialized into significant revenue streams or market penetration. Furthermore, the company's co-creation strategy, involving notable personalities and industry leaders, has not translated into substantial market traction or sales growth. This misalignment between the company's strategic initiatives and market realities has hindered its ability to achieve sustainable growth and profitability.

Final thoughts

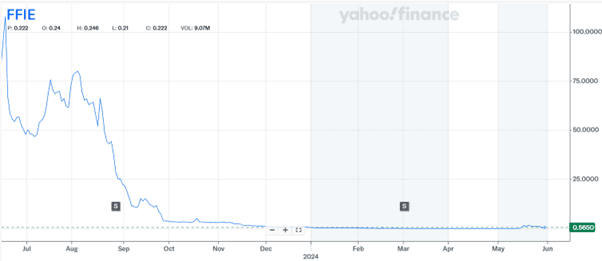

Source: Yahoo Finance

We can see how Faraday Future's stock has been decimated over the past year and has fallen below the $1 mark, becoming a penny stock. The financial strain of the company compounded by a significant drop in research and development spending—from nearly $300 million in 2022 to $132 million in 2023—highlighting a desperate attempt to cut costs amid financial turmoil. This cost-cutting is far from sufficient, however, as the company's operational and financial challenges have led to a delay in filing its latest quarterly results, pushing Faraday Future dangerously close to a Nasdaq delisting. Despite achieving key milestones and launching innovative products, the company's inability to scale production, secure stable financial footing, and align its strategic initiatives with market demands has resulted in substantial financial losses and erosion of investor confidence. Given these ongoing challenges and the uncertain outlook for recovery, investors are advised to avoid Faraday Future stock until the company demonstrates a clear and sustainable path to growth and profitability.