Gigacloud’s $18 Million Bet: Can The New Classic Deal Supercharge Its Global Marketplace?

Gigacloud Technology Inc. (NASDAQ: GCT), the small-cap e-commerce infrastructure company specializing in large-parcel logistics and supplier fulfillment, is once again in the spotlight following its latest acquisition announcement. On October 24, 2025, the company entered a binding term sheet to acquire 100% of the outstanding equity in New Classic Home Furnishing for $18 million, with the transaction expected to close on January 1, 2026. Funded entirely through existing cash reserves, the deal marks Gigacloud’s continued push to expand and diversify its sourcing network amid a volatile global trade environment and shifting tariff policies. New Classic—a California-based furniture distributor generating roughly $70 million in annual revenues from over 1,000 retail customers—offers a diversified supply base across Southeast Asia and the U.S., with minimal exposure to China. For Gigacloud, this acquisition could deepen its marketplace ecosystem but the big question is how? And what could be the underlying synergies that could propel this small-cap? Let us find out!

Strengthening Supply Chain Resilience & Geographic Diversification

The acquisition of New Classic Home Furnishing provides Gigacloud a valuable opportunity to reduce its dependency on any single sourcing geography—particularly China—and mitigate the volatility created by the shifting global tariff landscape. As the small-cap company highlighted in its most recent quarterly call, recent tariff hikes in Vietnam, China, and Malaysia disrupted supply chains and temporarily slowed shipping activity as partners paused shipments to reassess policy risks. New Classic’s sourcing footprint, which draws less than 3% from China and relies more heavily on suppliers across Southeast Asia and the U.S., creates an immediate hedge against future trade policy shocks. By integrating New Classic’s procurement infrastructure into its Supplier Fulfilled Retailing (SFR) model, Gigacloud could achieve faster re-routing of inventory and better alignment of supply with demand, enhancing the platform’s agility during disruptions. The company’s ability to pivot sourcing dynamically is central to its business model, and the addition of New Classic’s existing supplier relationships could expand that flexibility substantially. Furthermore, this acquisition complements Gigacloud’s growing European presence—where gross merchandise volume (GMV) surged 59% year-over-year—and allows for smoother cross-border coordination among regional suppliers. As the SFR ecosystem evolves, combining New Classic’s distributed sourcing with Gigacloud’s digital logistics network may improve cost stability, safeguard margins from tariff-driven shocks, and strengthen the reliability of product availability across continents. The result could be a more resilient, multi-origin supply chain that supports sustainable growth across both its 1P and 3P segments.

Expanding Retail Distribution Channels & Product Reach

New Classic’s established relationships with over 1,000 retailer customers give Gigacloud immediate access to a downstream network that could complement its marketplace-driven B2B model. While Gigacloud’s core operations have traditionally focused on connecting global suppliers and resellers in an asset-light, digital-first format, the acquisition brings a legacy physical distribution platform with an extensive catalog exceeding 2,000 active SKUs. Integrating these assets allows Gigacloud to test hybrid retail strategies that combine its online marketplace reach with direct channel access through New Classic’s customer base. For furniture and home goods—a category heavily dependent on logistics efficiency, fulfillment speed, and design assortment—this vertical integration offers significant advantages. By leveraging New Classic’s established showroom and retailer relationships, Gigacloud could accelerate adoption of its proprietary marketplace solutions among small and mid-sized U.S. retailers who have yet to digitize procurement. Moreover, this acquisition could provide a launchpad for expanding its 1P portfolio and improving SKU velocity, particularly after the successful integration of Noble House, whose rationalized portfolio now contributes approximately one-quarter of Gigacloud’s global product sales. New Classic’s diverse and active product mix may also fill SKU gaps within Gigacloud’s existing lineup, offering synergy between legacy Noble House inventory and newer SFR-based supplier offerings. Over time, this alignment could reduce customer acquisition costs and increase wallet share among repeat buyers. While execution risk remains in merging physical retail operations with a digital-first business model, the complementary nature of both networks points toward potential operational synergies in customer reach and product lifecycle management.

Enhancing Scale & Margin Efficiency Through SKU Optimization

One of Gigacloud’s central strategic themes over the past year has been SKU rationalization, which aims to streamline product offerings by eliminating low-margin inventory and reallocating resources toward high-performing SKUs. The company’s management reported that it has already retired 3,800 underperforming SKUs, introduced approximately 1,200 new ones, and expects the portfolio to stabilize by mid-2026. The integration of New Classic’s 2,000+ active SKUs could accelerate this initiative by adding a robust and well-performing catalog that aligns with existing demand trends in home furnishings. Unlike the distressed Noble House portfolio acquired from bankruptcy, New Classic’s active product base requires less turnaround and could immediately contribute to margin accretion. In Gigacloud’s most recent quarter, product margins improved by 174 basis points sequentially to 29.2%, largely driven by portfolio optimization and marketplace efficiencies. Adding New Classic’s profitable SKUs to this framework could drive further improvement in gross margin mix and operational leverage. Additionally, New Classic’s U.S.-based sourcing and distribution capabilities allow Gigacloud to capture higher-value logistics margins domestically while reducing freight exposure—a factor that temporarily weighed on its service margins due to lower ocean spot rates. By integrating fulfillment planning and inventory analytics, Gigacloud can better allocate capacity across its 11.2 million square feet of global warehouse space, including its newly expanded German fulfillment centers. In short, New Classic’s SKU structure provides a strong foundation for Gigacloud to scale profitably by balancing product diversity with disciplined margin control, strengthening its competitiveness in a fragmented global marketplace.

Accelerating International Expansion & Marketplace Monetization

Gigacloud’s European operations have rapidly evolved into one of its most dynamic growth pillars, accounting for roughly one-quarter of global revenue and growing 59% year-over-year. The addition of New Classic’s sourcing network, which already spans multiple non-China regions, could accelerate this international push by improving supply-side readiness for European demand. Management has emphasized that the company’s strategy follows a “go first, prove, then scale” approach—entering new markets via 1P operations before opening them to 3P sellers. The New Classic acquisition could enhance this playbook by providing ready-to-deploy supplier and product infrastructure, enabling faster onboarding of 3P sellers in new regions. Furthermore, integrating New Classic’s domestic logistics expertise with Gigacloud’s SFR model may strengthen the company’s monetization engine across both freight and service segments, particularly as GMV from third-party sellers reached $758 million on a trailing 12-month basis. As European and international 3P activity scales, New Classic’s established fulfillment and product-handling capabilities could help mitigate the onboarding friction for new suppliers entering unfamiliar markets. The acquisition also adds strategic optionality for Gigacloud to diversify its currency exposure and stabilize revenue flows, given that tariff shifts have recently disrupted shipment volumes and ocean freight rates. By extending marketplace services into new geographies supported by localized sourcing and warehousing, Gigacloud enhances both the top-line scalability and the monetization potential of its platform. The combination of digital marketplace depth and physical operational infrastructure could therefore serve as a catalyst for higher GMV per active seller while reinforcing Gigacloud’s reputation as an adaptable, full-stack enabler of global trade.

Final Thoughts

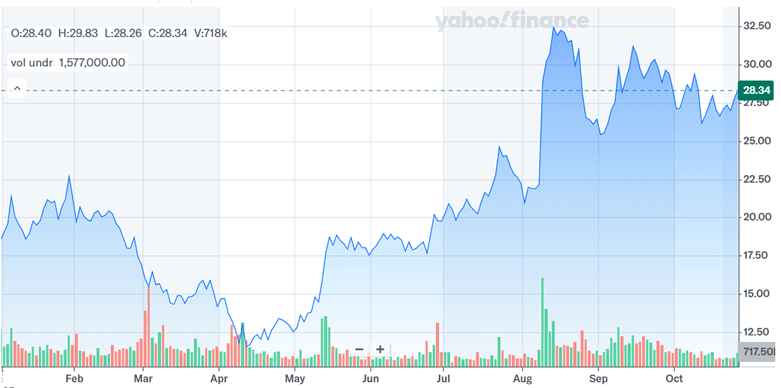

Source: Yahoo Finance

Gigacloud’s stock trajectory has been more or less flat over the past few months and the stock is still trading at relatively modest levels for a small-cap tech logistics play. Its LTM EV/EBITDA stands at 8.7x and EV/Gross Profit at 4.4x, while price-to-sales sits below 1x. That could mean the market’s cautious—or that there’s untapped upside if these moves deliver. On the surface, buying New Classic Home Furnishing seems like a pretty smart move. You’re getting a company that’s already pulling in $70 million a year, has over 2,000 SKUs in circulation, and works with more than 1,000 retailer customers. That’s a solid boost to both product depth and customer access. And let’s not overlook the sourcing angle—New Classic’s supply chain is already heavily diversified outside China, with strong roots in Southeast Asia and the U.S. That could be a huge advantage as trade policies continue to shift. Operationally, this could sync up nicely with Gigacloud’s own marketplace and Supplier Fulfilled Retailing model, especially given the company’s recent success streamlining Noble House’s bloated SKU count into a lean, profitable portfolio. Overall, we believe that it is a wait-and-watch situation. Whether this turns out to be a breakout moment or just another step in Gigacloud’s expansion journey depends on execution from here.