In a surprising turn of events, GoHealth (NASDAQ:GOCO) finds itself at the crossroads of investor sentiment as an ambitious takeover offer takes a U-turn. The health insurance marketplace company witnessed a staggering drop in its stock price following the withdrawal of a $20 per share takeover proposal by an investor group, including established stakeholders and Centerbridge Partners. This unforeseen twist comes after the GoHealth board's special committee declined the takeover bid earlier this month, leaving investors questioning the next move for this industry player. Is it worth investing in this small-cap at the current stage? Let us have a closer look and find out.

What Does GoHealth Do?

GoHealth, Inc is a prominent player in the health insurance marketplace and the digital health sector with a primary focus on Medicare services within the United States. The company operates across four distinct segments: Medicare—Internal, Medicare—External, Individual and Family Plans (IFP) and Other—Internal, and IFP and Other—External. At its core, GoHealth runs a sophisticated technology platform that harnesses the power of machine-learning algorithms fueled by comprehensive insurance behavioral data. This innovative approach streamlines and optimizes the process of assisting individuals in their search for the most suitable health insurance plan tailored to their specific requirements. The company's diverse range of offerings spans Medicare-related services like Medicare Advantage, Medicare Supplement, Medicare prescription drug plans, and Medicare Special Needs Plans. Furthermore, GoHealth extends its portfolio to encompass Individual and Family Plans (IFP), along with dental plans, vision plans, and other supplementary plans aimed at individuals. Leveraging a multi-channel distribution strategy, the company distributes its products through carriers, an online platform, as well as through independent and external agencies. Established in 2001, GoHealth has maintained its position at the forefront of the industry, continuously adapting its strategies to the evolving landscape of healthcare and insurance. With a core emphasis on leveraging technology to provide personalized and optimized solutions, GoHealth remains an intriguing entity to watch in the dynamic and ever-evolving domain of health insurance and digital health services.

Recent Financial Performance & Achievements

GoHealth, Inc., in collaboration with its external partners, assisted over 162,000 Medicare consumers in evaluating coverage options, exploring potential Medicare plans, and successfully enrolling in suitable plans. Setting itself apart from traditional brokers, GoHealth's marketplace model shines with a consumer-centric focus and an unwavering commitment to impartiality. The company's financial performance reflects these principles, with achievements including $140 million in revenue, nearly $1 million in adjusted EBITDA, and an impressive positive cash flow of nearly $11 million.

It is important to note the company's pivotal turnaround, evident from the remarkable improvement in profitability. GoHealth evolved from a loss of just under $32 million in Q2 of 2022 to a positive adjusted EBITDA in the same quarter of 2023. This transformation underscores the strategic resizing decisions made in the previous year, positioning GoHealth on a trajectory of enhanced profitability. Automation and technology deployment played a vital role in this turnaround, optimizing operations and fueling prudent growth on a year-over-year basis.

This exceptional performance emboldened GoHealth's management to revise its financial guidance upwards for the remainder of the year. Anticipating a total net revenue between $800 million and $850 million, the company's projection signals a strong surge compared to the initial lower bound of $750 million. Furthermore, the anticipated adjusted EBITDA range, set to reach between $120 million and $140 million, exceeds the earlier lower bound of $100 million.

Strategic Changes

It is important to note that GoHealth's strategic exit from non-Encompass BPO Services has been a major factor responsible for its evolution. This is a move that marks the transition to a phase of profitable growth and improved cash flow generation. This strategic shift is a cornerstone of the company's holistic approach to operational efficiency and long-term relationship building. GoHealth's strategy is focused on the enhancement of the consumer experience. The Encompass transformation, which is grounded in personalized, unbiased, and pressure-free shopping experiences, positions the company to be the preferred destination for consumers seeking Medicare plans. By implementing the Plan Fit Checkup and investing in technology, GoHealth ensures consumers receive tailor-made solutions while building trust and credibility. The company's commitment to guiding consumers through their options aligns with its mission to foster enduring relationships and deliver excellence in the consumer experience. Innovations like the unified agent experience, Plan Fit tool, and transformative data initiative, Customer 360, further fortify GoHealth's position as a futuristic player within its domain.

Final thoughts – The Impact Of The Offer Withdrawal

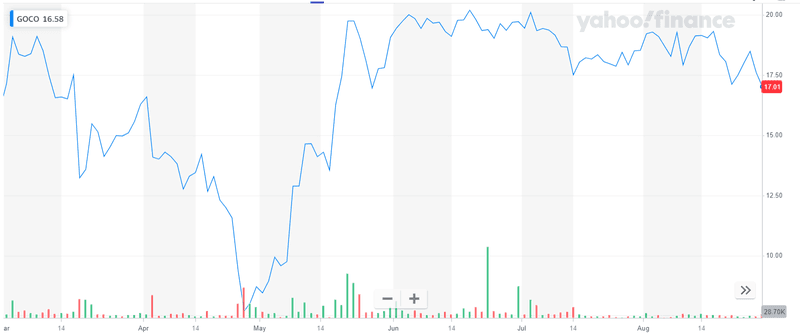

Source: Yahoo Finance

We see the steep drop in GoHealth's stock price post the rejection of the offer. It is important to highlight that the investor group had initially extended its $20 per share offer back in May 2023, prompting GoHealth to establish a dedicated special committee to assess the buyout proposition, an indication of the offer's significance. However, the tables turned when the same committee rejected the takeover bid, leading to the investor group's withdrawal. This intriguing development has not only ignited a market buzz but also triggered speculation about GoHealth's internal dynamics and strategic direction. Currently, GoHealth carries a slightly high short interest of above 9%, further fanning the flames of interest from investors and industry watchers alike. As the company navigates this unexpected juncture, questions are being raised regarding its growth prospects, market positioning, and the strategic vision. The rejection of the offer appears to be a questionable decision and we believe that the stock is best avoided at current levels.