Gold Reacts To The Fed – Direxion Daily Gold Miners Index Bull 3x Shares ETF (NYSEARCA:NUGT)

[ad_1]

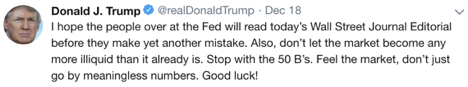

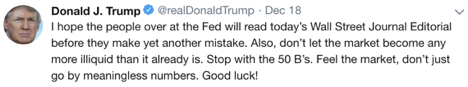

The markets have been optimistic going into the ultimate Fed assembly of the yr on Wednesday, December 19. Volatility within the stock market, an ongoing commerce dispute with China, sluggish financial development in Europe, and the latest inversion of the yield curve brought about many market members to hope that the Fed would pause fairly than hike the Fed Funds price. President Trump has been a constant critic of the central financial institution and his appointee, Chairman Jerome Powell. In the times earlier than the ultimate FOMC assembly, the President tweeted:

With rising requires the Fed to go away charges unchanged, the worth of gold rallied, and shares started to maneuver to the upside on Wednesday. However, the Fed is an apolitical physique and determined that the present surroundings with regards to GDP development and employment information referred to as for one more price hike and elevated the Fed Funds price to 2.25-2.50%.

While the market anticipated the speed improve, which the Fed had promised in June, most members regarded for a dovish assertion and press convention that acknowledged the present market volatility and dangers to the economic system. The Fed lowered their steering for 2019 slicing the variety of will increase within the Fed Funds price from three to 2, however it was not sufficient to fulfill a upset market. The greenback rallied within the aftermath of the Fed announcement, assertion, and Chairman Powell’s press convention. Stocks and gold fell because the market voted that tightening credit score is poisonous within the present surroundings. A mix of weak point in equities and the valuable metallic despatched the gold mining shares decrease, and each the broadly traded VanEck Vectors Gold Miners ETF product (GDX) and the VanEck Vectors Junior Gold Miners ETF product (GDXJ) put in bearish reversals.

However, the next day, gold turned larger and the greenback decrease as concern and uncertainty gripped markets. The gold mining shares didn’t comply with the yellow metallic to new highs.

Gold moved near the 50% retracement stage on the February futures contract

In a reversal of fortune for the gold market following the Fed price hike, the worth approached the 50% retracement stage of its fall from the April excessive to the mid-August low on December 20.

Source: CQG

As the weekly chart highlights, gold fell from $1365.40 through the week of April 9 to a low of $1161.40 through the week of August 13. The quickly to run out December contract traded to a excessive at $1261.30 on December 21. Both worth momentum and relative strength indicators are rising in overbought territory, and open curiosity has begun to rise from lows at below 390,000 contracts which have been the bottom stage since early 2016. The 50% retracement stage stands at $1263.40, simply $2.10 above the excessive on Friday. Meanwhile, the transfer on the February futures contract on December 20 took the worth of the yellow metallic to a excessive at $1270.30 per ounce.

Gold bucks the pattern in December 2018

The weekly chart exhibits that gold had made seasonal lows through the last month of the yr in 2015, 2016, and 2017. In 2015, the worth declined to a low at $1046.20 and rose to a peak at $1377.50 in July 2016 following the Brexit shock. In 2016, the low through the last month of the yr was at $1123.90, and the worth rose to a excessive of $1358.50 in early September 2017 earlier than falling to a backside at $1236.50 final December. This yr, the height for gold was in January and April when the market put in a double-prime at $1365.40 earlier than declining to a backside at $1161.40 in August. The lows for gold got here early in 2018 because the yellow metallic bucked the pattern over the previous three years. In December 2018, the gold market continued to make larger highs in a sample that started in August.

A bullish pattern since August

Gold adopted the greenback because it fell to its backside for the yr. The greenback index rose to a brand new excessive for 2018 in mid-August when it traded to 96.865. The inverse relationship between gold and the dollar led to the decline to the bottom stage of the yr. However, in an indication of strength for the gold market, the worth restoration has been gradual and regular since August though the greenback has moved to larger highs over the interval. The most up-to-date peak at 97.705 within the greenback index did little to discourage the transfer to the upside within the gold futures market.

Source: CQG

As the daily chart illustrates, after reaching a low at $1173.20 in mid-August, gold has made larger lows and better highs because it reached its most up-to-date peak at $1270.30 on December 20, an increase of $97.10 or 8.3%. While worth momentum and relative strength are in overbought territory, the pattern stays intact as we head into the ultimate buying and selling classes of 2018.

Gold has been a beneficiary of the concern and uncertainty that’s gripping the stock market today. While different commodities together with crude oil and copper have skilled important worth declines, the yellow metallic is at its highest stage since mid-July because the bullish pattern continued on the finish of this yr.

2019 shall be a extra risky yr in markets

All the indicators level to a continuation of volatility in markets throughout all asset courses in 2019. The commerce dispute between the U.S. and China continues to threaten the worldwide economic system. The Fed continued on its hawkish path with a price hike at its December assembly final week and the rote QT coverage that continues to tighten credit score. Meanwhile, the ECB stays accommodative with regards to financial coverage. At their last assembly of 2018, the European central financial institution ended QE, however reserve the suitable to make use of it as a instrument for stimulus. Moreover, charges in Europe stay at detrimental forty foundation factors, and there aren’t any plans to scale back the ECB’s swollen steadiness sheet that has grown to over $3 trillion on account of asset purchases.

The potential for points on the geopolitical panorama stays excessive going into 2019. Brexit will come to a head with a deadline of March 29, 2019, and the European Union faces a myriad of political and financial issues with their membership. Russia, China, and North Korea may change into problematic over the approaching yr. At the identical time, the Democratic majority within the House of Representatives guarantees to create numerous friction between the branches of presidency within the U.S. As of the top of final week, the U.S. confronted a authorities shutdown over the border safety situation.

Markets replicate political and financial occasions, and as we transfer into 2019, there are various points which are more likely to hold worth variance excessive in markets throughout all asset courses. Gold’s latest worth motion has been a response to the risky yr that lies forward.

A scary sample in gold mining shares- The metallic is the magnet

The worth of gold moved decrease in a kneejerk response to the Fed price hike on December 19, however the worth recovered and made a brand new excessive the next day. However, gold mining shares have been hit with a double-whammy of promoting within the yellow metallic on the day of the assembly and a cascade of promoting within the stock market on December 19 and 20. Gold mining shares fell within the aftermath of the information from the Fed, and whereas they rallied on December 20, they remained under their highs from the day past.

Source: Barchart

As the chart of the GDX exhibits, the worth of the main gold mining shares rose to a excessive at $21.47 on December 19 and fell to a low at $19.90 placing in a bearish key reversal buying and selling sample on the session. The following day, whereas gold moved to new and better highs, the GDX solely made it to a peak at $20.84 per share.

Source: Barchart

The ETF that represents the junior gold mining shares (GDXJ) displayed the identical reversal sample on December 19 because it fell from $30.29 to $28.03, and it solely made it to a excessive at $29.35 on Thursday within the face of recent highs within the gold futures market.

For those that imagine that the worth of gold will proceed its bullish worth sample that started in mid-August, the shortage of bullish worth motion within the gold mining shares may present a chance if the shares play catchup with the metallic over the approaching days and week.

The Direxion Daily Gold Miners Bull 3X ETF product (NUGT) is a turbocharged instrument for these on the lookout for a delayed response within the gold mining shares. The fund abstract states:

“The funding seeks daily funding outcomes, earlier than charges and bills, of 300% of the daily efficiency of the NYSE Arca Gold Miners Index. The fund invests at the least 80% of its internet belongings (plus borrowing for funding functions) in securities of the index, ETFs that monitor the index and different monetary devices that present daily leveraged publicity to the index or ETFs that monitor the index. The index is a modified market capitalization weighted index comprised of publicly traded firms that function globally in each developed and rising markets, and are concerned primarily in mining for gold and, in mining for silver. It is non-diversified.”

NUGT is just applicable for brief-time period forays into the gold mining shares on the lengthy aspect. The Direxion Daily Gold Miners Bear 3X ETF product (DUST) is the complimentary bearish product within the gold mining sector. Leverage comes at a worth which is time decay. Therefore, time is essential when using these instruments as they undergo from reverse splits which destroy their values over time. On December 19, the GDX and GDXJ fell by 7.3% and 7.5% from their highs to their lows through the risky session.

Source: Barchart

On the identical day, DUST moved from a low of $23.00 to a excessive of $28.37 or 23.3%.

Source: Barchart

NUGT moved from $18.64 to $14.75 on December 19 or 20.9% on the session. Meanwhile, on December 19 gold’s vary was from $1245.30 to $1262.20 which was 1.34%.

Time will inform if the rally in gold can flip the worth of gold mining shares round and reverse the affect of the falling stock market. NUGT and DUST are unimaginable buying and selling devices that provide market members the chance to turbocharge their ends in the gold mining shares. NUGT and DUST commerce a median of 10.133 and 2.374 million shares every day making them extremely liquid instruments when approaching the gold mining shares.

Gold’s kneejerk response to the Fed’s rate of interest hike was bearish, however it asserted itself the next day because the market of alternative during times of concern and uncertainty. Time will inform if the gold mining shares meet up with gold or lead the worth of the valuable metallic decrease over the approaching days and weeks. The gold mining shares are likely to enlarge the worth motion within the gold futures market on a share foundation. The firms that extract gold from the crust of the earth are in danger for the gold worth, and their earnings are likely to rise and fall with the worth of the yellow metallic. The rising worth of gold is just not bearish for these firms as we head into 2019.

The Hecht Commodity Report is the most complete commodities stories out there right now from the highest-ranked ranked writer in each commodities, foreign exchange, and treasured metals. My weekly report covers the market actions of over 25 totally different commodities and gives bullish, bearish and impartial calls; directional buying and selling suggestions, and actionable concepts for merchants and buyers.

For the remainder of 2018, I’m providing a one-time sale worth. Anyone who indicators up for a one-yr subscription will obtain a 30% low cost ($490 per yr) off the present price and can by no means expertise a rise so long as they continue to be a subscriber.

Disclosure: I/we now have no positions in any shares talked about, and no plans to provoke any positions throughout the subsequent 72 hours. I wrote this text myself, and it expresses my very own opinions. I’m not receiving compensation for it (aside from from Seeking Alpha). I’ve no enterprise relationship with any firm whose stock is talked about on this article.

Additional disclosure: The writer all the time has positions in commodities markets in futures, choices, ETF/ETN merchandise, and commodity equities. These lengthy and brief positions have a tendency to alter on an intraday foundation.

[ad_2]