Green Dot’s Strategic Review Heats Up: Why PE Giants & Tech Titans Are Circling!

Green Dot Corporation (NYSE:GDOT), a pioneer in banking-as-a-service and embedded finance, has found itself at the center of growing acquisition interest. Following a formal strategic review initiated in March 2025 and advised by Citigroup, the company has attracted attention from both private equity firms and strategic acquirers, despite a generally subdued M&A market. The sale process has gained traction with first-round bids recently submitted. However, regulatory restrictions—particularly federal limits on private equity ownership in banks—could necessitate the breakup of the business into distinct parts. Green Dot owns Green Dot Bank, a regulated entity supporting major programs like Apple Cash and Walmart’s MoneyCard. Together, Apple and Walmart accounted for 65% of Green Dot’s FY2024 revenue, making them central to its enterprise value. Recent renewals, such as a long-term extension with Walmart through 2033, and new partnerships with Samsung and Crypto.com, demonstrate that Green Dot’s momentum is real and timely. Let us analyze the biggest elements that underscore its acquisition appeal to both financial sponsors and strategic players.

Established Partnerships With High-Value Clients

Green Dot’s long-standing relationships with Apple and Walmart are foundational to its strategic value. Apple alone accounted for $948 million of revenue in 2024, while Walmart contributed $171 million—together representing 65% of the company’s total income. The recent renewal of Walmart’s MoneyCard agreement through 2033 signals a long-term commitment that enhances predictability of future revenues. Moreover, Walmart and Green Dot jointly manage the TailFin JV, which has committed $70 million to product enhancements. These relationships validate the firm’s reliability as a banking partner and program manager. Additionally, Green Dot has expanded its client roster with high-profile partnerships like Samsung and Crypto.com. Samsung has chosen Green Dot’s Arc platform to power new wallet features, including Tap to Transfer. Crypto.com will use Arc as an on/off-ramp for U.S. cash transactions and to launch an interest-bearing savings vault. These signings not only diversify Green Dot’s client base but also reflect the company’s growing brand equity and reliability among global enterprises. For potential acquirers, such embedded relationships reduce the cost of customer acquisition and ensure an ongoing revenue stream backed by long-term contracts. The mix of blue-chip customers and new-age fintechs positions Green Dot as a mission-critical partner for high-volume financial operations—making it a strategic acquisition target for firms looking to gain rapid scale in embedded finance.

Scalable Embedded Finance Platform (Arc) With Proven Traction

Green Dot’s Arc platform has evolved into a comprehensive and configurable embedded finance engine, and it is increasingly central to the company’s growth narrative. Arc powers a majority of Green Dot’s business-to-business (B2B) operations, which saw over 40% year-over-year revenue growth in Q1 2025. It also serves as the technological foundation for recent partnerships with Samsung and Crypto.com. Arc integrates banking, program management, compliance, and payment infrastructure—delivering a vertically integrated solution that distinguishes it from point-solution competitors. Over the past year, the Arc brand has gained significant market recognition, which is further supported by Green Dot’s ability to offer risk and compliance infrastructure—critical in a market increasingly focused on regulatory scrutiny. The business development pipeline remains strong, with year-to-date signings nearly matching all of FY2024. The company has also integrated the Money Processing division into the Arc-led BaaS segment, creating synergies in onboarding, risk management, and scalability. With the Arc platform positioned to support rapid partner launches and higher transaction volumes, it offers immediate plug-and-play capabilities for acquirers seeking to deepen their exposure to embedded finance without building an in-house stack from scratch. For PE buyers, Arc’s profitability and growth momentum in B2B offer a clear value creation lever post-acquisition. For strategics, acquiring Arc means owning a proven, scalable infrastructure with cross-sell potential across existing product portfolios.

Improving Financials & Multi-Segment Momentum

Green Dot has reported a significant financial turnaround in early 2025, with non-GAAP revenue rising 24% and adjusted EBITDA increasing by 53% in Q1. All three operating segments—B2B, Money Movement, and Consumer—delivered segment-level profit growth for the first time in years. The B2B segment, led by Arc and rapid! employer services, grew over 40% in revenue and saw meaningful margin expansion due to renewed contracts and reduced fraud losses. The Money Movement segment, encompassing Tax and Money Processing businesses, posted a 10% increase in Tax revenue and a fourth consecutive quarter of growth in third-party cash transfers. Margins improved by nearly 600 basis points across the segment. Even the Consumer division, historically under pressure, is seeing slower revenue declines due to retention efforts and strategic partnerships like PLS. These multi-pronged improvements suggest that Green Dot’s operational overhaul—focused on cost control, partner retention, and platform modernization—is paying off. Additionally, renewed guidance now expects FY2025 revenue of $2.0–$2.1 billion, adjusted EBITDA of $150–$160 million, and non-GAAP EPS of $1.14–$1.28. This creates a stronger earnings base for valuation and reduces the perception of risk tied to any single underperforming segment. For acquirers, this implies greater optionality in carve-outs or integrated scale-ups, with each division showing a path to standalone profitability or accretive synergy.

Divestment Flexibility & Regulatory Readiness

Green Dot’s corporate structure and technology stack provide flexibility for divestment or partial acquisitions—a crucial consideration given federal rules limiting private equity ownership in banks to under 25%. The Tax Processing and PayCard divisions operate on largely independent tech stacks, making them easier to spin off or divest. Green Dot’s leadership confirmed this modularity, noting that the strategic review encompasses potential partial sales depending on buyer interest and regulatory feasibility. The company’s willingness to entertain such carve-outs increases its attractiveness to private equity firms looking to bypass bank charter constraints. Furthermore, Green Dot has invested heavily in strengthening its compliance and risk management frameworks, hiring seasoned executives such as Kim Olson as Chief Risk Officer. These steps align with the current regulatory climate and make the business more “deal-ready” from a due diligence standpoint. On the strategic side, banks or fintechs already possessing a charter could acquire the platform or select business units to immediately expand capabilities in prepaid cards, embedded finance, or direct-to-consumer banking. Regulatory pressure on debit interchange fees remains a concern, but recent signs of relaxed scrutiny under the current administration have revived optimism around BaaS models. In this context, Green Dot offers an unusually clean asset with strong internal controls, clearly defined business lines, and pre-existing infrastructure to satisfy both compliance and growth objectives for acquirers.

Final Thoughts

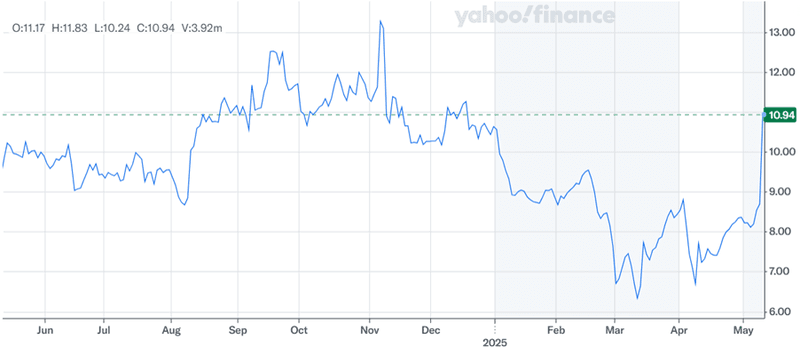

Source: Yahoo Finance

Green Dot’s ongoing strategic review has resulted in a massive spike in its stock price given the fact that the company has unlocked significant interest from both financial sponsors and strategic buyers. From a valuation standpoint, the company is trading at a Price/ Book multiple of 0.63x which appears to be very reasonable. Moreover, its proven partnerships, scalable platform, improved financials, and carve-out readiness also augment Green Dot’s attractiveness. While regulatory constraints and customer concentration remain key risks, the company’s progress across multiple segments and long-term contracts with partners like Walmart offer a compelling value proposition. The coming weeks will reveal whether this strategic momentum translates into a full or partial sale, a value-unlocking restructuring, or a renewed path as a standalone embedded finance player.