Hearst Ups Its Bid: Why DallasNews Is Suddenly Hot Property

DallasNews Corporation (NASDAQ:DALN) is back in the spotlight following a significant revision to its acquisition offer from media giant Hearst. Just weeks after recommending shareholders approve a $15 per share cash acquisition, DallasNews’ board has successfully negotiated a higher offer—now at $16.50 per share. The stock price has already crossed the $15 mark, spurred by growing consensus that the Hearst deal may be the most viable exit. Proxy advisors ISS and Glass Lewis have both endorsed the merger, and Robert W. Decherd—DALN’s largest shareholder—has come out in favor. This revised bid follows the management’s rejection of an unsolicited $18.50 per share all-cash offer from MNG Enterprises, an Alden Global Capital affiliate. With a shareholder vote scheduled before September 22, the Hearst proposal is shaping up to be a watershed moment for the storied Texas-based media company.

Strong Balance Sheet & Deleveraging Catalysts Post-Asset Sales

One of the most compelling reasons Hearst could be interested in acquiring DallasNews is the latter’s balance sheet transformation following the monetization of its real estate. The $36.2 million sale of the company’s Plano printing facility was completed in Q1 2025 and fully recognized as a gain on the income statement. The cash proceeds allowed DallasNews to eliminate its pension obligations entirely—injecting $10 million in cash into the fund and purchasing an annuity to cover all future liabilities. This move not only strengthens DALN’s liquidity but also wipes away its last source of long-term debt, providing Hearst with a cleaner acquisition target. As of April 25, DallasNews reported cash and cash equivalents of $36 million. From an M&A standpoint, this de-risked balance sheet is attractive because it allows an acquirer to avoid integration headaches tied to legacy financial liabilities. It also offers optionality in terms of capital allocation—either via reinvestment into digital growth or future dividend payouts. Moreover, DALN’s asset-light transition, including a move to a leased printing facility, is expected to generate $5 million in annualized expense savings starting in Q2 2025. For Hearst, acquiring a legacy media brand that is in the middle of a cost-structure reset with a fully funded pension and no debt obligations creates an opportunity for clean synergies and margin accretion without the burden of legacy liabilities.

Undervalued Digital Asset With Proprietary Audience Insights

Despite challenges in legacy print, DallasNews has made noteworthy progress in digital transformation—an area that may hold particular appeal for Hearst. As of Q1 2025, digital-only subscriptions rose 4.2% year-over-year to 65,028, making up more than half of total memberships. The company recently deployed an AI-driven dynamic paywall, which has resulted in a 16% increase in subscription starts compared to its previous rules-based meter system. This behavioral data, tied directly to user engagement, can be a valuable source of proprietary insight that complements Hearst’s existing digital infrastructure. DallasNews has also rolled out tools like video players and commenting systems designed to enhance time-on-site and monetizable ad inventory. While overall membership growth remains slower than desired, DALN’s concentrated local audience base provides a foundation for targeted advertising, events, and subscription bundling. For a buyer like Hearst, which has deep content creation capabilities and national distribution, this local engagement could act as a testbed for deeper personalization models. Additionally, owning a data-rich property like The Dallas Morning News allows for refined programmatic advertising strategies, especially within local markets underserved by broader national players. In short, while DALN’s digital revenues have yet to scale meaningfully, the underlying architecture and audience loyalty offer high-margin digital growth potential for a scaled acquirer.

Agency Division Offers Scalable Margin Expansion Platform

Beyond its core publishing business, DallasNews operates Medium Giant—a marketing and media services agency that posted a $600,000 year-over-year increase in operating income in Q1 2025 despite a challenging ad environment. Medium Giant has been strategically repositioned by cutting ties with low-margin clients and focusing on higher-value engagements. With new large clients onboarded and a disciplined cost base, the agency is now operating at a margin that the company aims to grow into double digits. Hearst, which owns a range of content-driven and marketing subsidiaries, could leverage Medium Giant to expand its B2B offerings across regional and national client bases. Given Medium Giant’s specialty in academic and tourism verticals—two segments with multi-channel advertising potential—there are real cross-sell opportunities within Hearst’s broader advertising ecosystem. In addition, the agency model adds a layer of non-subscription revenue, diversifying the top line and potentially stabilizing earnings. The agency’s ability to operate independently of the cyclical print business makes it an appealing asset within a post-merger structure. As Hearst looks to future-proof its portfolio, owning an agency with proven scalability and integrated operations could serve as a backbone for servicing not just DallasNews’ media properties, but also Hearst’s broader network of regional and local brands.

Attractive Entry Multiple For A Strategic Or Financial Buyer

From a valuation standpoint, DallasNews trades at what can only be described as distressed levels relative to its fundamentals and the broader media industry. As of mid-September 2025, its trailing price-to-sales ratio stood at just 0.63x, while its trailing EV/EBITDA was (1.72x)—deeply depressed even accounting for asset sales and non-operating items. The latest forward metrics suggest a multiple rebound, with NTM EV/EBITDA at 3.10x and price-to-sales at 0.29x, though this still reflects a steep discount to media peers. The depressed valuation likely reflects a mix of factors including print advertising decline, modest digital revenue ramp, and uncertainty around macroeconomic effects on local advertising spend. However, this undervaluation provides an entry point for strategic acquirers like Hearst who are in a position to rationalize operations and drive cash flow from an already lean cost base. The discounted multiple could allow Hearst to realize substantial internal rate of return (IRR) post-acquisition, especially as synergies are extracted through shared content networks, consolidated vendor relationships, and digital product cross-promotion. Moreover, the cash-heavy nature of the $16.50/share bid means DALN shareholders are not bearing future execution risk, while Hearst retains the long-term upside from operational turnaround. In short, Hearst’s revised bid reflects both recognition of undervaluation and strategic interest in locking in synergies before rival bidders like MNG Enterprises sweeten their own proposals.

Final Thoughts

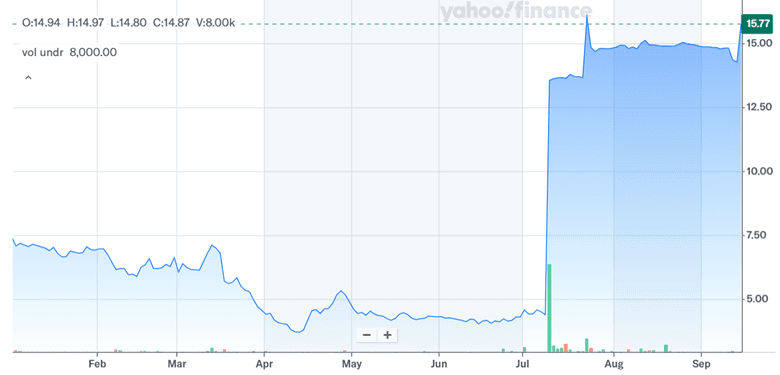

Source: Yahoo Finance

It is hard to believe that barely a couple of months ago, DallasNews was trading below $5 per share and is a classic case how smart investments in small-caps that can potentially become M&A targets can lead to multi-bagger returns. Today, DallasNews presents a mix of stabilized legacy operations, digital growth potential, and operational deleveraging that could be attractive to a scaled media operator like Hearst. The recent sale of legacy real estate and elimination of pension obligations have created a cleaner financial profile with no long-term debt and over $36 million in cash on hand. Its trailing valuation multiples—such as EV/EBITDA at (1.72x) and P/S at 0.63x—reflect both skepticism and opportunity. Whether Hearst can translate these conditions into lasting value depends on post-deal execution and integration. Shareholder approval remains the immediate next step, with potential deal closure hinging on upcoming voting outcomes before September 22.