Here’s how ugly 2018 was for stocks and other assets

[ad_1]

A little bit post-Christmas love from Santa Claus to finish 2018 gained’t be sufficient to show the tide for an ugly December and a brutal 2018 that lower throughout a broad swath of Wall Street, starting from stocks to commodities.

Indeed, whereas traders had spent a lot of the long-running bull market in stocks arguing that “there was no alternative” to equities, the previous 12 months noticed traders lament that there was “nowhere to hide” as asset lessons throughout the board got here underneath stress.

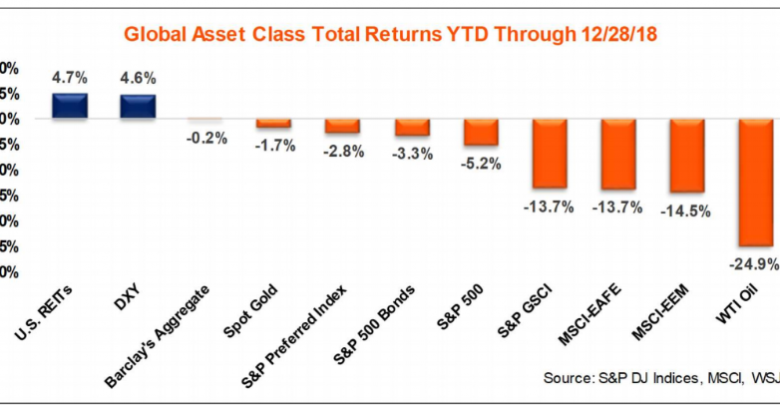

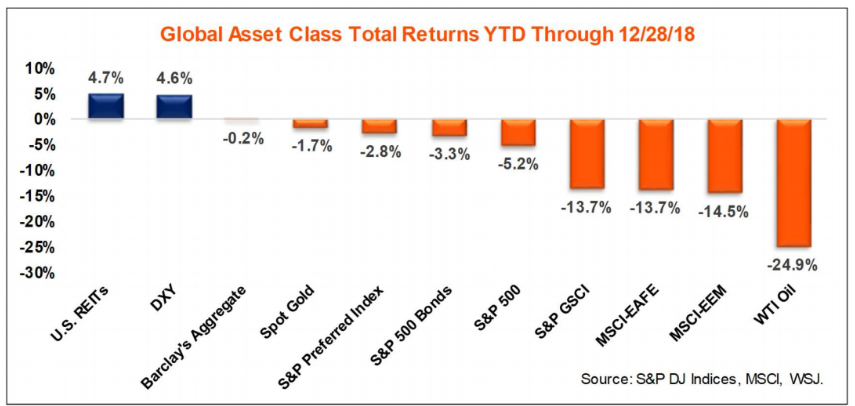

The desk under from CFRA, utilizing knowledge via Friday’s shut, illustrates the carnage:

CFRA

CFRA

No matter the funding, “investors likely experienced declines in annual returns. Indeed, even though U.S. REITs and the dollar recorded total returns in excess of 4.5%, declines were seen in bonds, gold, oil, preferred stocks and U.S. equities, along with developed international and emerging market indices,” mentioned Sam Stovall, chief funding strategist at CFRA, in a Monday notice.

Opinion: Every investor was humbled in 2018, so it’s wise to figure out what happened and why

U.S. stocks had been moving to the upside on Monday, seeking to construct on a rebound that noticed main indexes on Friday put up their first weekly rises of the month. But the S&P 500

SPX, +0.47%

and Dow Jones Industrial Average

DJIA, +0.83%

had been on monitor to log their worst December efficiency since 1931, whereas the Nasdaq Composite

RUT, -0.13%

which fell into bear-market territory earlier this month, is ready for its worst December efficiency ever. That’s left all three indexes set for their greatest annual declines since 2008.

For an in depth breakdown of 2018 U.S. stock market efficiency, try: Dow industrials and S&P 500: The best- and worst-performing stocks of 2018

Major fairness markets exterior the U.S. largely suffered much more. China’s Shanghai

SHCOMP, +0.44%

fell 24.6% in 2018, the most important annual fall since 2008, whereas Hong Kong’s Hang Seng Index

HSI, +1.34%

shed 13.6% for its greatest fall since 2011, in line with knowledge compiled by Dow Jones Market Data.

In Europe, the Stoxx 600

SXXP, +0.42%

fell 13.2% for 2018, its greatest decline since 2008.

Emerging-market stocks had been punished partially by a stronger greenback, with the iShares MSCI Emerging Markets ETF headed for a 17% 2018 decline.

As famous, a down 12 months for stocks was uncharacteristically additionally a down 12 months for bonds. The yield on the 10-year U.S. Treasury notice

TMUBMUSD10Y, -3.20%

rose 33.1 foundation factors via Friday, on monitor for its largest annual rise since 2013. Yields and debt costs transfer in reverse instructions. The iShares Core U.S. Aggregate Bond ETF

AGG, +0.23%

was headed for a 2.7% annual fall, in line with FactSet knowledge.

On the commodity entrance, gold futures

GCG9, +0.11%

had been ending the 12 months on a robust notice however had been nonetheless poised to log a 2% annual loss, whereas crude futures tumbled sharply within the fourth quarter, slumping right into a bear market after hitting almost four-year highs in early October. The U.S. benchmark, West Texas Intermediate crude was down almost 40% from its excessive and on monitor for a 2018 fall of round 25%.

As for the greenback, the ICE U.S. Dollar Index

DXY, -0.30%

which tracks the forex in opposition to a basket of six main rivals, was down 1.1% in December, trimming its 2018 achieve to 4.4%.

Providing important info for the U.S. buying and selling day. Subscribe to MarketWatch’s free Need to Know publication. Sign up here.

[ad_2]