Hillenbrand Surges On Strategic Sale Buzz—What’s Next For The Industrial Giant?

Hillenbrand Inc. (NYSE:HI) has recently caught the attention of investors after Bloomberg reported that the company is actively evaluating strategic options, including a potential sale. Shares surged over 12% on the news as the company, known for its engineered industrial equipment and systems, explores avenues to unlock shareholder value. Hillenbrand is reportedly working with advisers to assess takeover interest, though deliberations are still in early stages with no certainty of a transaction. The development comes after Hillenbrand successfully executed several divestitures, including its Milacron Injection Molding & Extrusion (MIME) business and its minority stake in TerraSource, resulting in over $300 million in debt reduction. But does this make it an attractive acquisition target? Let us find out!

Strategic Sale Potential: Portfolio Simplification, Synergy Capture, & Financial Flexibility

Hillenbrand has made tangible progress in aligning its portfolio toward high-margin, high-growth segments, particularly within Food, Health & Nutrition (FHN) and Advanced Process Solutions (APS). Its recent divestitures, including the sale of the MIME business for $265 million and its TerraSource stake for $115 million, reflect a conscious pivot toward focusing on performance materials and system-oriented solutions. These transactions allowed the company to reduce debt by more than $300 million in fiscal 2025, pushing net leverage to an implied 3.7x immediately after the TerraSource sale. This cleaner balance sheet and narrower business focus significantly enhance Hillenbrand’s attractiveness to potential acquirers. Moreover, the $30 million in run-rate cost synergies achieved from the Linxis and FPM acquisitions—accomplished in just 20 months instead of the projected 3–5 years—highlight management’s operational efficiency. With integration now shifting toward commercial synergies, especially cross-selling across Coperion’s global footprint, there is clear upside for any buyer to harness. In particular, Hillenbrand’s ability to serve the global FHN market with complete system solutions stands out as a differentiated offering. The company’s “in-region, for-region” manufacturing footprint adds further value, providing resilience to tariffs and global trade shifts. In light of these structural improvements, strategic buyers could view Hillenbrand as a platform investment to deepen vertical integration, while financial buyers may target margin expansion and EBITDA growth through commercial leverage and further portfolio optimization.

Earnings Beat & Market Potential: Stabilizing Demand & High-Value Orders

Despite macroeconomic headwinds and cautious customer behavior, Hillenbrand delivered a fiscal Q3 2025 revenue of $599 million, exceeding internal expectations. Adjusted EPS of $0.51 aligned with forecasts, driven by productivity gains and favorable pricing, even as EBITDA declined year-over-year due to lower volume and unfavorable mix. Critically, the company reported an uptick in APS orders after the quarter ended, especially in polyolefins and engineering plastics from geographies like the U.S. and Asia. The FHN segment also remains stable and continues to contribute over 25% of total revenue, highlighting Hillenbrand’s pivot toward less cyclical, recurring revenue streams. The completion of cross-functional sales integration now allows the combined Linxis-FPM-Coperion organization to offer bundled solutions across bakery, nutrition, and health sectors. With quoting pipelines robust and customer test facilities operating at high capacity, forward visibility is improving. Moreover, signs of demand recovery in the MTS segment, including hot runner orders and quoting from both existing and new clients in China and India, indicate a broader market stabilization. The short-cycle nature of the MTS business positions it well for rapid earnings rebound when volumes recover. While customer order decisions have been delayed due to tariff uncertainty, Hillenbrand’s local supply chain and contract structures are optimized to respond quickly. The near-term forecast, underpinned by recent large orders in July and an updated revenue guidance of $2.59–$2.63 billion, suggests that Hillenbrand has navigated the downturn effectively and is positioned to benefit from any cyclical upswing.

Stock Underperformance: Weak YTD Returns Despite Operational Progress

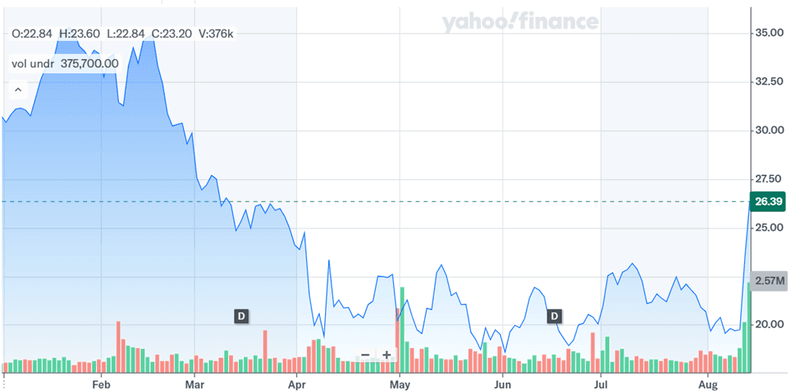

Hillenbrand’s stock has declined 24% year-to-date through August 12, underperforming both the broader market and industrial sector indices. This divergence in performance has occurred despite the company meeting or exceeding key financial milestones, such as achieving synergy targets ahead of schedule and delivering above-consensus revenue. Investor caution appears rooted in several factors: delayed capital orders due to macroeconomic uncertainty and trade policy ambiguity, muted free cash flow generation in Q3, and a net debt/EBITDA ratio of 3.7x that remains elevated despite recent deleveraging. While Hillenbrand’s backlog declined 10% year-over-year to $1.57 billion, the company attributes this to temporary order deferrals rather than cancellations. Nonetheless, the decline reflects investor concerns around demand softness and operating leverage pressure. Additionally, the muted cash flow from operations in Q3—driven by lower customer advances—raises questions about near-term liquidity generation. With adjusted EBITDA margin down 360 basis points and adjusted EPS falling 40% year-over-year, market participants may be waiting for sustained margin expansion and improved free cash conversion before re-rating the stock. Despite management’s reaffirmation of cash-positive contract structures and near-term payment schedules tied to project milestones, the timing of order inflows remains uncertain. Consequently, this underperformance presents both a risk and an opportunity: potential acquirers might see the depressed valuation as an entry point, while existing shareholders may seek clarity on strategic outcomes before revisiting the stock’s investment case.

Final Thoughts

Source: Yahoo Finance

We see a marked spike in Hillenbrand’s stock price after the announcement of the company exploring the possibility of a strategic sale. With a simplified portfolio, lowered leverage, early synergy realization, and positive indicators in order pipelines, Hillenbrand is structurally stronger than a year ago. However, the company continues to face execution risk related to volume recovery, tariff impacts, and muted cash flow performance. From a valuation standpoint, Hillenbrand is trading at a last-twelve-month (LTM) EV/EBITDA multiple of 8.4x and an LTM EV/Revenue of 1.23x—figures that suggest it is modestly undervalued compared to diversified industrial peers, particularly when factoring in the quality of its margin profile and the defensiveness of its FHN exposure. Yet, with an LTM P/E of -90.68x due to prior-year impairments, the market may be hesitant to fully price in forward potential without more consistent earnings performance. The low valuation does indicate that the company could attract suitors but whether a deal actually goes through or not, is to be seen.