HNI’s Bold $2.2 Billion Steelcase Gambit: A New Chapter In The Office Furniture Market?

HNI Corporation’s (NYSE:HNI) blockbuster announcement on August 4, 2025 that it will acquire Steelcase in a $2.2 billion cash-and-stock deal has catalyzed intense debate among investors and industry watchers. The transaction—valuing Steelcase at approximately $18.30 per share and representing an 80 percent premium—aims to create a combined enterprise with pro forma revenue near $5.8 billion and annual run-rate cost synergies of $120 million. With Steelcase shareholders receiving $7.20 cash plus 0.2192 shares of HNI, the merger implies an initial net leverage of about 2.1x that is projected to revert to pre-deal levels within 18–24 months. As stakeholders weigh immediate accretion—an expected $0.50–$0.60 per share in 2027—against the transaction risks, it is crucial to understand the biggest factors that underpin the promise of this transformative union.

Expanded Global Distribution & Dealer Excellence

The marriage of HNI’s robust North American dealer network—particularly its leadership in small- and medium-business (SMB) markets—with Steelcase’s nearly 800 dealer locations across more than 80 countries unlocks unparalleled distribution scale. By deliberately preserving existing dealer partnerships and brand exclusivity, both firms avoid channel conflicts while enabling dealers to offer a wider product spectrum, from cost-efficient SMB solutions to high-end contract furnishings. This cross-pollination empowers dealers to address entire project lifecycles, whether outfitting a boutique startup or a Fortune 500 headquarters, and facilitates entry into verticals where one partner is underrepresented: HNI’s residential and hospitality channels meet Steelcase’s strong foothold in healthcare and education. Geographic diversification also hedges against regional economic slowdowns that have recently pressured Steelcase’s international sales, especially in Europe. Furthermore, HNI’s Mexico seating production facility—already delivering margin expansion—can serve Steelcase brands, shortening lead times and reducing freight costs. By integrating automated order-management systems and data-driven demand forecasting, the enlarged network can optimize inventory levels, improve fill rates and deliver a seamless dealer experience that fuels both top-line growth and customer loyalty in an increasingly competitive office-furnishings landscape.

Procurement Scale & Manufacturing Optimization

Central to the $120 million synergy target is the procurement of raw materials and components at scale. HNI’s established relationships with steel, laminates, textiles and hardware suppliers can be renegotiated to encompass Steelcase’s annual $3.2 billion purchasing volume, yielding lower per-unit costs through bulk discounts and supplier consolidation. Conversely, Steelcase’s deep ties to low-cost manufacturing hubs in Asia—along with its tariff-mitigating strategies—can inform HNI’s own production network, driving leaner operations and enhanced supplier lead-time visibility. Joint supply-chain digitization initiatives, such as AI-powered demand sensing and automated replenishment, will reduce working-capital intensity and minimize stockouts. On the factory floor, co-locating overlapping product lines—particularly seating—in Mexico and selectively consolidating underutilized European facilities will streamline capacity utilization and cut fixed overhead. Additionally, shared back-office functions, from procurement to quality assurance, combined with a unified ERP platform, will compress SG&A ratios and standardize best practices. By deploying cross-functional integration “tiger teams” modeled on the Kimball International playbook, HNI can accelerate cost take-out while safeguarding product quality and dealer flexibility, ultimately enhancing margins across both the Workplace Furnishings and Residential Building Products segments.

Cross-Selling Arsenal & Revenue Expansion

While the deal’s initial accretion model does not factor in revenue synergies, the commercial logic suggests material upside from cross-selling. HNI’s sterling performance in its Workplace Furnishings segment—organic net-sales up more than 8 percent in Q2 2025—can be amplified by introducing Steelcase’s premium, design-led brands into HNI’s SMB and contract channels. Dealers will gain the ability to bundle broad price-point offerings, catering to hybrid-work arrangements where clients mix economical lines with high-performance solutions. Meanwhile, Steelcase’s global corporate accounts and healthcare relationships represent new openings for HNI’s residential-grade products, especially in hospitality and multi-family developments. Jointly, the salesforce can pursue large, multi-region RFPs by leveraging integrated solution suites that include space-planning services, ergonomic consulting and post-sale lifecycle management. Over time, the combined company can explore subscription-based furniture-as-a-service models—monetizing refurbishment, redeployment and digital asset tracking—to secure recurring revenue streams. In addition, unified customer-insights platforms will enable personalized account strategies, increasing wallet share and deepening dealer loyalty. Collectively, such revenue-synergy initiatives could materially exceed the $120 million cost-synergy baseline, driving significant long-term EBITDA growth.

Innovation Fusion & Product Portfolio Enrichment

A powerful synergy emerges from fusing Steelcase’s research-led design ethos with HNI’s rapid-iteration product development capabilities. Steelcase’s human-centric workplace studies and design studios can be leveraged to accelerate HNI’s cycle times for next-generation workstations, modular collaboration hubs and integrated technology-enabled furniture. In parallel, HNI’s successful introduction of gas-insert and electric-fireplace offerings in its Residential Building Products division can benefit from Steelcase’s prototyping and user-experience expertise, yielding hybrid solutions for hospitality and wellness-focused environments. Cross-pollinated R&D teams will standardize component architectures—power modules, wireless charging surfaces, sensor arrays—to reduce engineering redundancies and lower unit costs. The joint innovation pipeline can incorporate AI-driven customization platforms, enabling on-demand fabrication and mass personalization, while digital twin simulations optimize interior layouts for new hybrid-work patterns. By diversifying the combined brand portfolio across budget, mid-range and premium tiers, dealers can address the full spectrum of client budgets and project scopes. This innovation acceleration not only enhances product differentiation but also creates potential for new service revenues—analytics subscriptions, space-utilization dashboards and sustainability certifications—solidifying the enlarged company’s leadership in post-pandemic office and residential solutions.

Final Thoughts

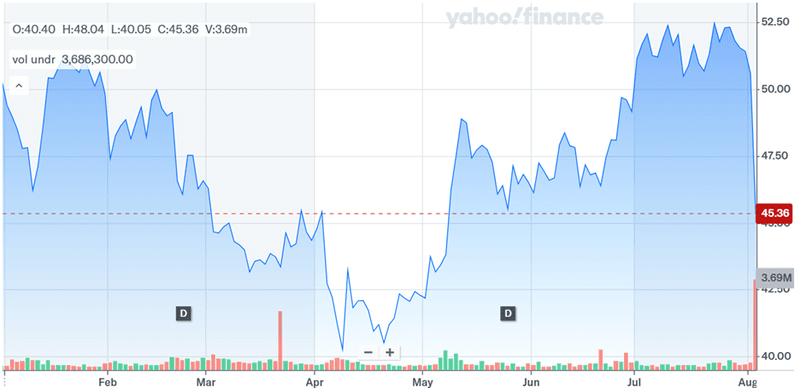

Source: Yahoo Finance

HNI’s stock has been volatile over the past months and the proposed Steelcase acquisition actually resulted in the stock plummeting, largely due to the massive dilution. This is the reason why HNI is trading at a trailing EV/EBITDA of 8.23x, EV/EBIT of 11.23x and a P/E of 14.72x as of August 4, 2025—significantly below recent peaks but above historical troughs. While the transaction offers a compelling array of strategic synergies—from distribution scale and procurement leverage to cross-selling expansion and innovation acceleration, realizing these benefits hinges on flawless integration: aligning 1,100 dealer networks, merging ERP systems, and preserving the distinct brand identities that underpin each company’s customer loyalty. Also, it is evident that the market has priced in modest growth but is not perceiving the deal as a transformative merger. Overall, we believe that the the deal may prove a double-edged sword for HNI shareholders: a catalyst for accelerated expansion if synergies materialize, or a dilation of returns if integration proves more complex than anticipated.